A new, albeit not particularly comforting refrain has become popular in the commercial real estate (CRE) world -- stay alive until 2025. Many are hoping that by 2025 inflation will be demonstrably tamed and the Federal Reserve will have lowered interest rates. But getting to 2025, as the catchphrase suggests, means that 2024 will be a year of transition. Though supply and demand fundamentals differ meaningfully across asset classes, all CRE will be impacted by what happens to interest rates next year. The quantity of distress, the pace of price discovery and the resumption of deal activity will all depend, in part, on whether interest rates continue to rise, stabilize, or decline.

“Either way you cut it, while the industry is busy staying alive until 2025, you can bet it won’t be a bore in 2024.“

The “Wisdom of the Crowd” Does Battle With “Consensus Expert Opinion”

Of course, forecasting interest rates is easier said than done. One way to navigate the grand uncertainty of the future price of money is to look at the Federal Reserve’s own expectations of where the fed funds rate will be at the end of next year. Afterall, as this reasoning goes, who best to judge how the fed funds rate will move than the people who set the rate themselves? Every quarter the Federal Reserve releases its “Summary of Economic Projections” (SEP), which surveys each member of the Federal Reserve about their expectations of a number for economic measures over the next several years. Though estimates between board members vary, the median response of all Fed members is a “consensus of expert opinion” on movements in the fed funds rate next year.

Another way to go about the uncertainty associated with forecasting interest rates is to use the ”wisdom of the crowd”, that is, the market’s expectations of what will happen to rates. The wisdom of the crowd is a well-studied economic phenomenon that describes how the collective opinion of a group of people can be more accurate than the judgement of a single or few experts. However, other research suggests that an aggregate of expert forecasts, our “consensus expert opinion”, can do even better than the broader crowd’s average, in some circumstances.

Some Cautious Optimism Warranted

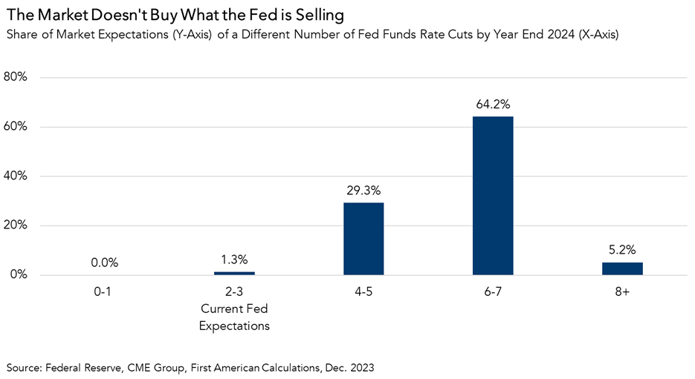

So, with 2023 nearly behind us and 2024 ahead, how does expert opinion compare to market expectations about next year? The latest release of the SEP, from December, provides some fuel for cautious optimism. The latest projection implies that the Fed will cut rates by almost 75 basis points by the end of 2024 – three rate cuts. Many in the real estate industry are eagerly awaiting these rate cuts to begin, as lower rates and less-constrained markets would make it easier to buy buildings.

The market is possibly even more optimistic. According to data from CME’s FedWatch Tool, the market overwhelmingly expects there to be between 6 to 7 rate cuts next year. Multiple rate cuts in 2024 would certainly be welcome, but the economic environment that would warrant so many of them would likely be a recessionary one.

Is Something Missing?

A soft landing accompanied by rate cuts would be the best possible outcome for CRE in 2024. So far, the labor market and economy remain strong, so the soft landing scenario is possible. Lower rates would provide property owners with cheaper refinancing alternatives, which would decrease the quantity of distress that hits the market next year. Lower rates would also provide acquirers with cheaper cost of debt and, therefore, more deals that “pencil out.” With greater deal volume, more buyers and sellers will be able to agree on price, and with more price agreement comes more certainty for assets that have recently been difficult to value.

Of course, a soft landing with rate cuts is not the only possible outcome for next year. In the next X-Factor, we’ll discuss another economic and interest rate scenario in 2024, and what it could mean for CRE.

Either way you cut it, while the industry is busy staying alive until 2025, you can bet it won’t be a bore in 2024.