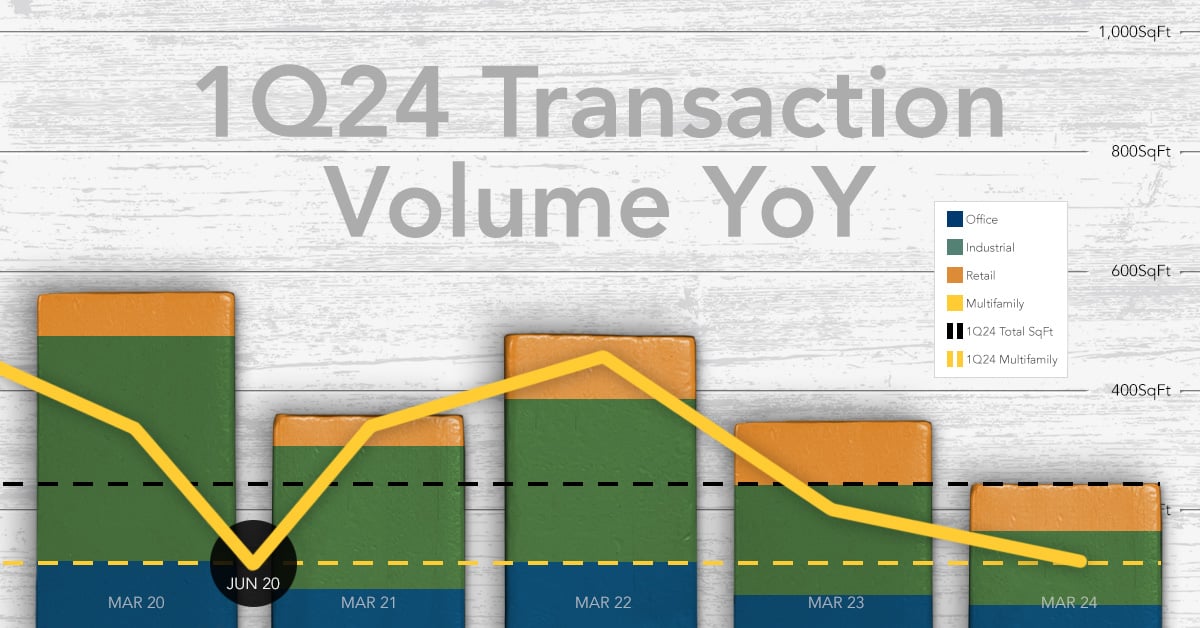

Commercial Real Estate (CRE) transaction volume is usually measured in terms of nominal dollars. “Nominal” just means that these dollars aren’t inflation adjusted. Of course, inflation surged to levels not seen since the early 1980s in 2022. But standard inflation adjustments leave something to be desired in the case of CRE transaction volume, as ...

Read More ›Analyzing CRE Transaction Volume – Retail a Relative Bright Spot in Bleak Q1

CRE X-Factor - Renters May Gain Some Temporary Leverage as Flood of New Apartment Supply Comes to Market

Similar to the for-sale housing market, apartment leasing trends are seasonal. Typically, both renters and home buyers are more likely to move in the spring than in the winter. After all, while people in warm-weather climates might have an easier time moving year-round, for many it’s hard to move when there’s snow on the ground or other inclement ...

Read More ›CRE X-Factor - The Link Between CRE Mortgage Maturities and Transactions

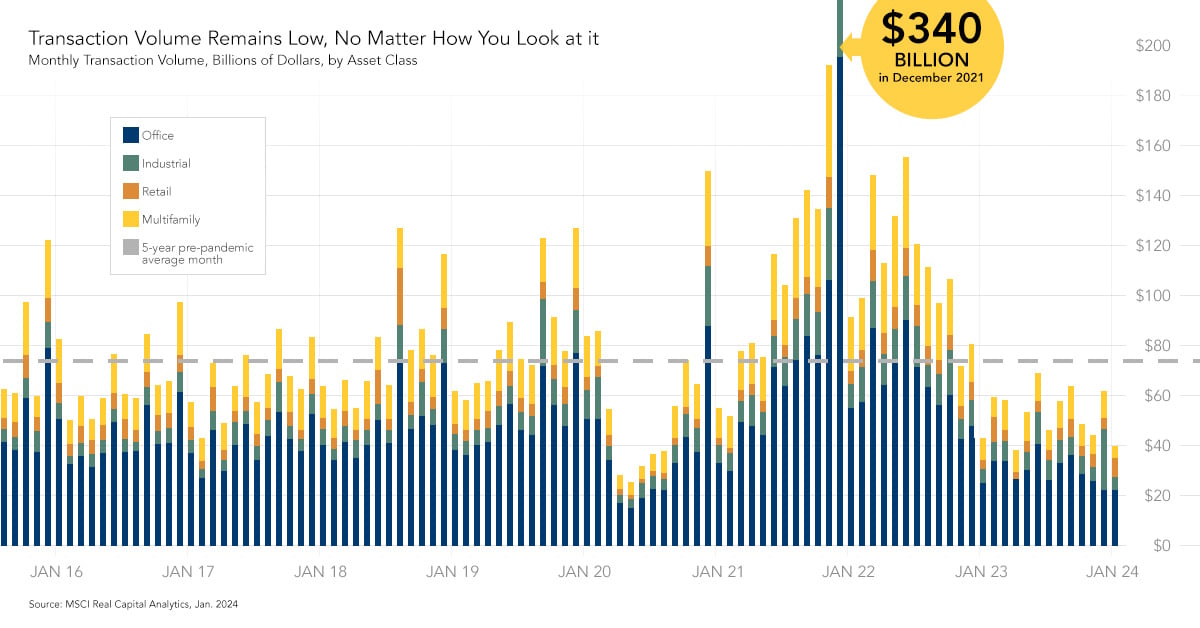

Over the last two years, commercial real estate (CRE) transaction volume has declined precipitously as interest rates soared. Currently, the market is at a multi-year trough in transaction activity, and many are wondering when it may pick back up. Though it’s hard to say with certainty, one factor that will invariably play a role in the recovery ...

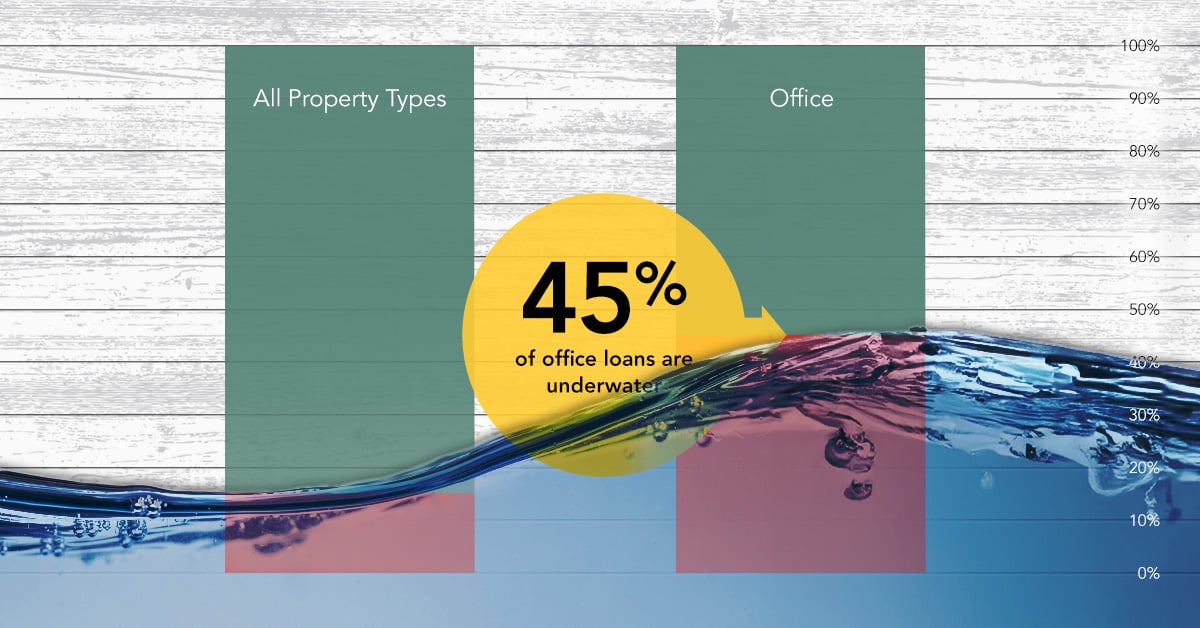

Read More ›Measuring the Foreclosure Risk in Commercial Real Estate Assets

While there is a substantial quantity of commercial real estate (CRE) debt maturing this year, there’s nothing inherently dangerous about a mortgage coming due. Challenges arise when maturities occur simultaneously with one of two other challenges. The first is when a building is not generating sufficient income to cover its expenses, which is ...

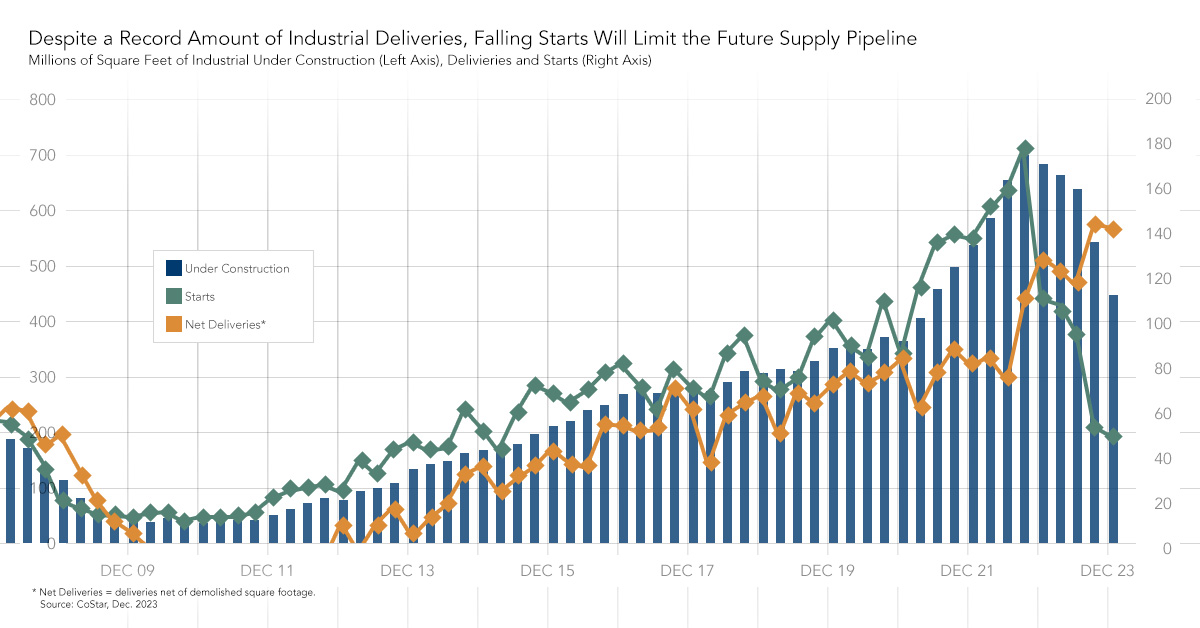

Read More ›What’s Behind the Surge in Industrial Cap Rates?

Though the industrial market is softening compared to the pandemic days of double-digit rent growth and record-low vacancy, it is far from weak. Despite slowing rent growth and modestly rising vacancies, demand to lease industrial space remains strong, driven by long-term trends such as rising eCommerce sales, retailers’ need for modern logistics ...

Read More ›Commercial Real Estate Industrial Real Estate Potential Cap Rate Model

CRE X-Factor - Will the Post-Valentine’s Day Retail Sales Report Come up Roses?

This Valentine’s Day, while couples nationwide enjoy romantic dinners, exchange chocolates and flowers, or cozy up at home with a nicer-than-average bottle of wine, economists will instead be focusing on something slightly less romantic: how much money people are spending on retail goods and services. While the retail sales report that comes out ...

Read More ›Why Apartment Rents are Poised to Decline in Former Pandemic Hot Spots

Nationally, a substantial amount of new apartment supply will be delivered in 2024. Increased supply empowers renters with more choices, prompting landlords to compete through pricing. Some cities have a lot more supply coming to market than others, and each market’s ability to absorb new units, as well as how many vacant units are left over after ...

Read More ›CRE X-Factor - Great Rate Expectations for 2024

In a recent article, we juxtaposed the Federal Reserve’s projections with the “wisdom of the crowd” to consider possible interest rate outcomes in 2024. In this X-Factor, we explore the uncertainty surrounding interest rate expectations more broadly. For example, if there is a soft landing, there’s still a chance, according to the Fed’s own ...

Read More ›2024 Will be a Year of Transition in Commercial Real Estate

A new, albeit not particularly comforting refrain has become popular in the commercial real estate (CRE) world -- stay alive until 2025. Many are hoping that by 2025 inflation will be demonstrably tamed and the Federal Reserve will have lowered interest rates. But getting to 2025, as the catchphrase suggests, means that 2024 will be a year of ...

Read More ›CRE X-Factor – Lower Prospective CRE Returns Contribute to Depressed Transaction Volume

The recent rise in long-term interest rates suppresses commercial real estate (CRE) transaction volume in two primary ways. First, higher long-term interest rates typically lead to higher CRE mortgage rates, which make CRE deals less profitable. Lower prospective returns on CRE deals incentivize buyers to wait on the sidelines until prices fall ...

Read More ›