Nationally, a substantial amount of new apartment supply will be delivered in 2024. Increased supply empowers renters with more choices, prompting landlords to compete through pricing. Some cities have a lot more supply coming to market than others, and each market’s ability to absorb new units, as well as how many vacant units are left over after absorption will shape the path that apartment rent trends take in different cities this year. Cities with new supply that far exceeds existing demand will face more downward pressure on rents.

“Apartment rents are already declining in many cities, and those with more construction underway that lack the demand to absorb new deliveries will see rents fall further in 2024. “

Where Rents Face Most Downward Pressure

One way to measure whether a market is over- or under-supplied is with new excess stock. New excess stock is the quantity of vacant new supply that is left over after all demand is accounted for. New excess stock is calculated as the difference between new apartment deliveries, a measure of supply, and net apartment absorption, a measure of demand. Net absorption is the change in leased apartment units (new and existing) after accounting for both recently vacated and leased units. A landlord in a city with a lot of new excess stock has more competition and must compete for renters with lower rents.

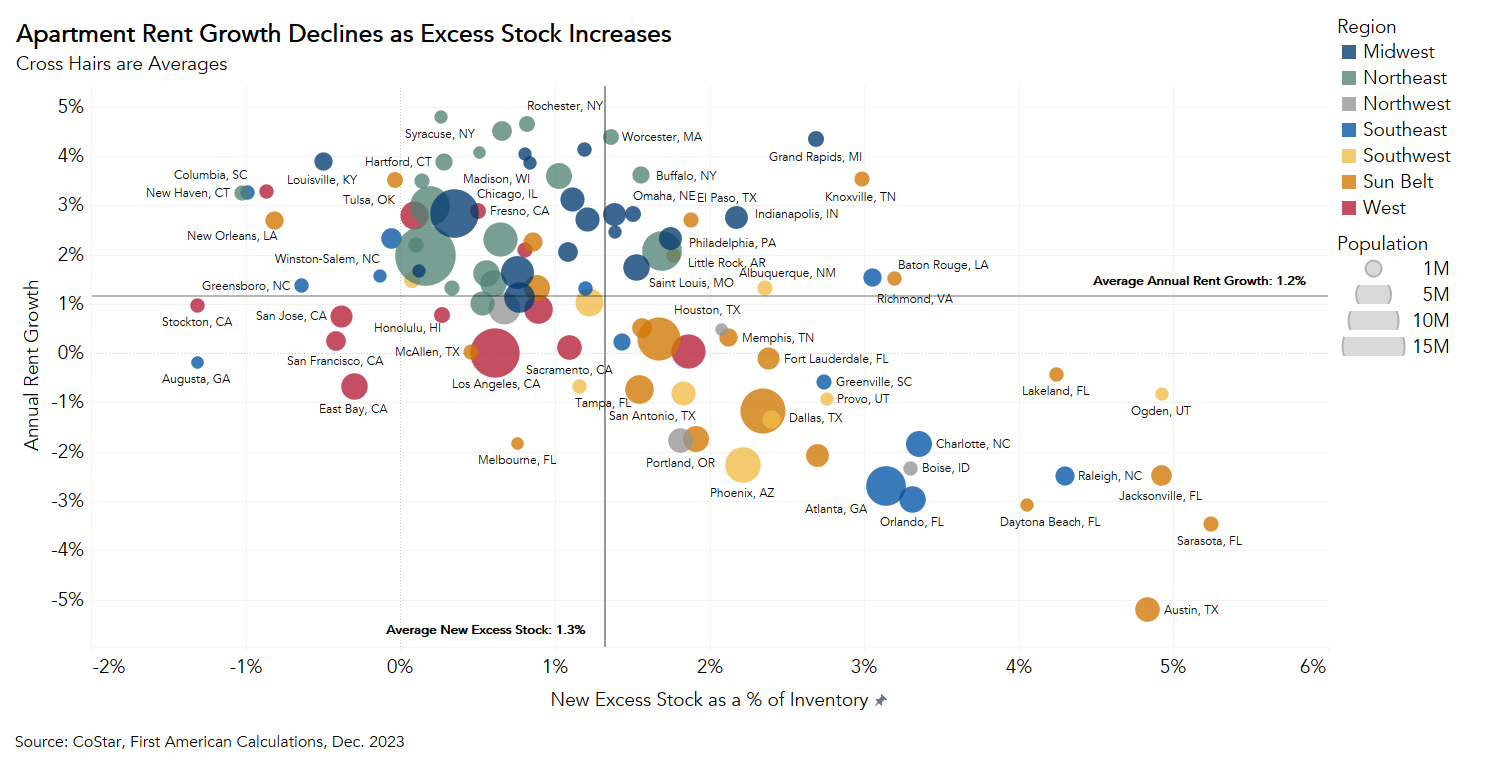

The following chart shows the relationship between new excess stock and rent growth in 2023 (click here for an interactive version). To account for different city sizes, new excess stock is shown relative to the existing inventory of apartments in each city one year ago, before the latest deliveries occurred. The grey cross hairs show the average level of new excess stock and rent growth, respectively, for all cities in the chart.

Over the last year, cities with higher levels of new excess stock have typically seen low rent growth or declining rents. In the chart, those cities fall within the bottom-right quadrant, indicating higher than average excess stock and lower-than-average rent growth. Conversely, those with lower levels of new excess stock have typically seen higher-than-average rent growth, as seen in the top-left quadrant of the chart.

Flood of New Apartments Dampened Rent Growth in Sunbelt, Southwest and Southeast

Regionally, at the end of last year there was a greater quantity of new excess stock in Sunbelt, Southwest, and Southeastern cities. By contrast, Midwestern and Northeastern cities had less new excess stock come to market. As a result, rent growth was higher in markets such as Chicago, Boston, and Washington D.C. than in cities like Austin, Atlanta or Phoenix.

New excess stock in some cities declined, indicating that apartment demand outpaced the new supply of apartments that came to market. In fact, cities like Los Angeles, San Francisco and San Jose had new excess stock declines, but rents still declined or rent growth was below average.

One possible explanation for these Western markets’ low rent growth is the difference in affordability. Cities in the West have some of the highest rent-to-income ratios in the country, meaning people use a greater portion of their income to cover their rent expense. Rent hikes may have been limited in some Western cities simply because renters couldn’t afford to pay much more.

Rent Declines Not Over Yet

Apartment rents are already declining in many cities, and those with more construction underway that lack the demand to absorb new deliveries will see rents fall further in 2024. The pandemic, which drove geographic shifts in the demand for apartments, as well as the low interest rate period that immediately followed, created a multifamily construction boom that is now slowing. That boom will soon result in a large increase in apartment supply in popular pandemic relocation destinations that will take time to be absorbed.

In cities where the absorption of the new excess stock of apartments is slow, rents will fall as landlords try to fill more units. This oversupply won’t last forever, but it may well force some landlords to revisit their pro forma assumptions as they work through this period of rent moderation.