The recent rise in long-term interest rates suppresses commercial real estate (CRE) transaction volume in two primary ways. First, higher long-term interest rates typically lead to higher CRE mortgage rates, which make CRE deals less profitable. Lower prospective returns on CRE deals incentivize buyers to wait on the sidelines until prices fall ...

Read More ›CRE X-Factor – Lower Prospective CRE Returns Contribute to Depressed Transaction Volume

CRE X-Factor - Consumers Face Headwinds Heading into 2024

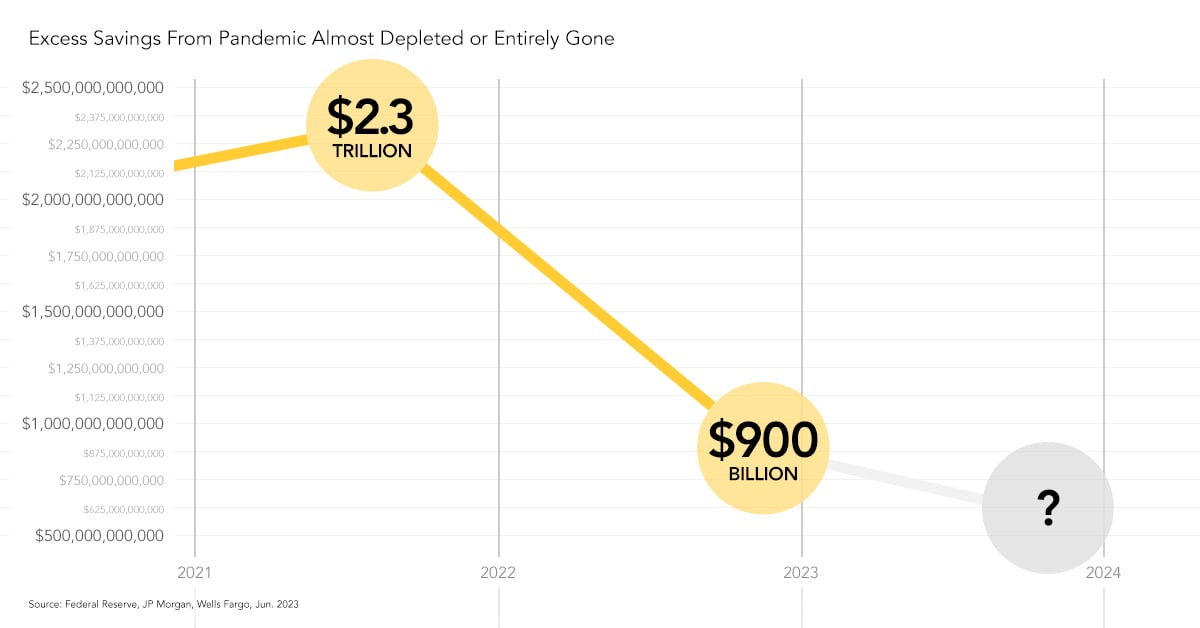

As pandemic-era restrictions and precautions eased, consumers began to spend the money that they had saved during the early parts of the pandemic. The resulting surge in consumer spending contributed, at least in part, to the runaway inflation that eventually triggered the Federal Reserve to hike interest rates at the fastest pace in decades. ...

Read More ›CRE X-Factor – The End of the Beginning for the CRE Adjustment?

With interest rates high, transaction volumes low, and property prices generally on the decline, it’s safe to say that the commercial real estate (CRE) market is undergoing an adjustment period. The market adjustment has triggered a process referred to as “price discovery,” in which many buyers are sitting on the sidelines waiting for lower entry ...

Read More ›CRE X-Factor – Why Operating Costs for Commercial Properties have Soared

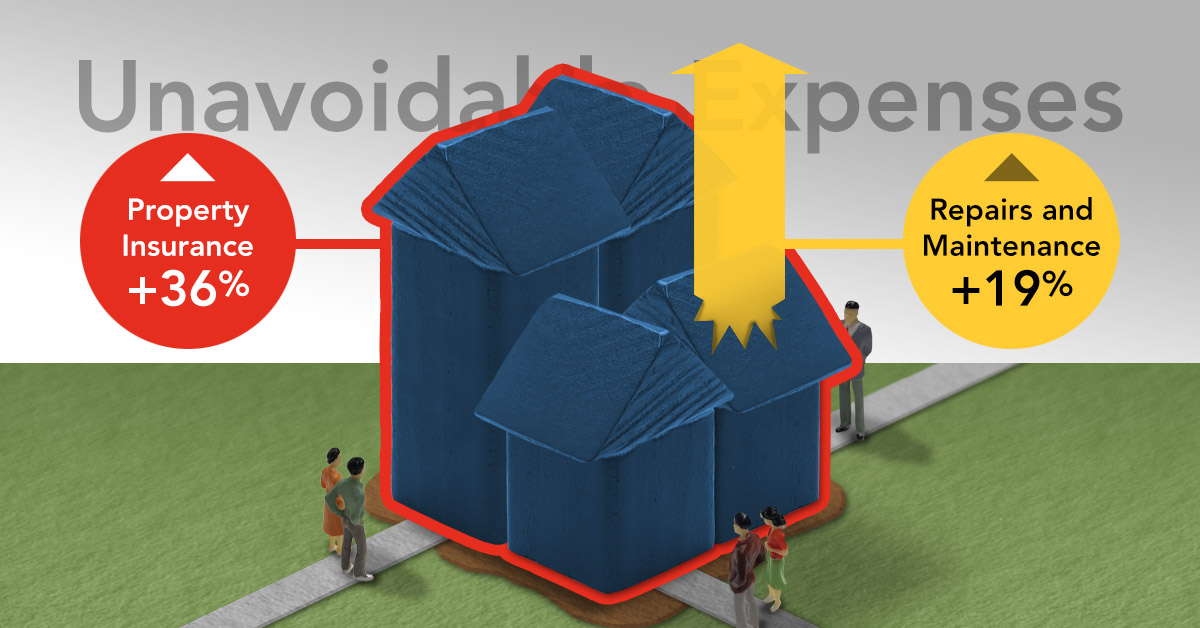

As rent growth has softened across all asset classes, property owners and operators have increased their focus on limiting expense growth. However, this has proven difficult for some line items, as both property insurance, and repairs and maintenance (R&M) expenses have increased significantly over the last three years. In this edition of the ...

Read More ›CRE X-Factor – Assessing the State of the CRE Reset

The commercial real estate (CRE) market is in a reset. Deal activity is down, and property prices are declining. We recently examined what clues history can provide about the potential length and depth of CRE price declines. Today, let’s examine what current CRE fundamentals can tell us about where we are in the process of resetting.

Read More ›CRE X-Factor: For Commercial Real Estate, Banks Aren’t the Only Lender in Town

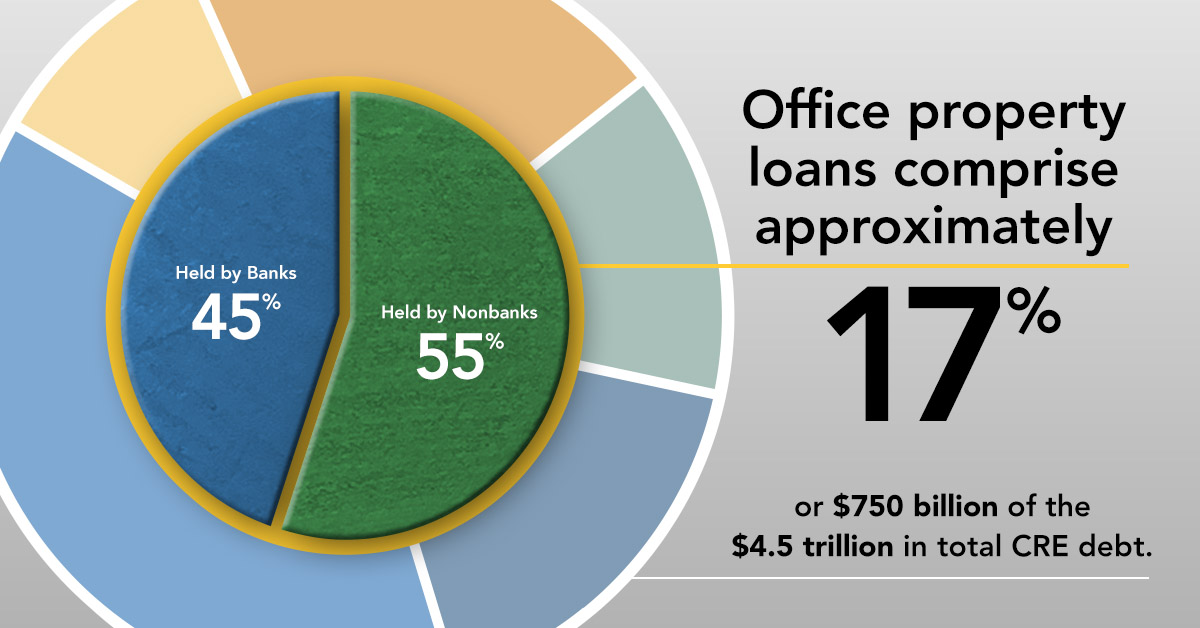

When most people think of a loan, they think of a bank. Banks take deposits from customers in return for interest payments or other services. The bank then invests those deposits in loans, such as commercial real estate (CRE) loans, and securities that pay a higher interest rate than the bank is paying on the deposits. However, a bank is not the ...

Read More ›CRE X-Factor: Analyzing the Commercial Real Estate Market Slowdown

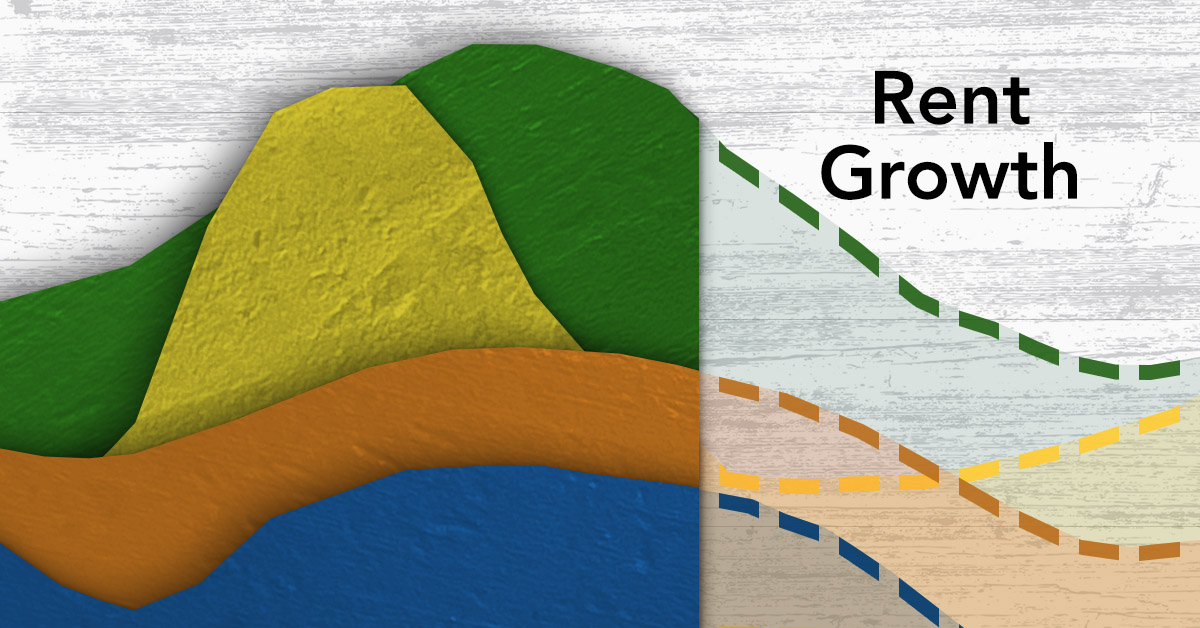

Several indicators now point firmly to a broad cooling in commercial real estate (CRE) markets. The extent of the cooling, however, varies meaningfully by asset class and geography.

Read More ›CRE X-Factor: Where is Commercial Real Estate Deal Activity Heading in 2023?

Several commercial real estate (CRE) fundamentals continued to soften in October. It was the second consecutive month where prices for multifamily, retail, and central business district (CBD) office sectors all declined on a month-over-month basis, though prices remain higher for all asset classes compared to October 2021.

Read More ›