Similar to the for-sale housing market, apartment leasing trends are seasonal. Typically, both renters and home buyers are more likely to move in the spring than in the winter. After all, while people in warm-weather climates might have an easier time moving year-round, for many it’s hard to move when there’s snow on the ground or other inclement weather gets in the way.

While the purchase market gets most of the spring attention, in this X-Factor, we’ll explore supply and demand trends unfolding in the apartment market, and how renters may benefit from an abundance of options this year, at least in some markets.

“An oversupply of apartments will provide renters with greater options this spring and for the remainder of the year. However, the long-term housing shortage will limit the decline in rent growth. Based on current trends, it looks like demand may catch back up to supply in late 2025 or in early 2026.”

Renter Demographics

Typically, renters are younger than home buyers for a myriad of reasons ranging from lifestyle to financial. For example, younger individuals might not have the down payment required to purchase a home, and they may prefer the flexibility of renting as they decide where to go to school or where they may need to relocate for a job. As a result, first-time households, such as young adults moving out of their parents’ house or graduating from college and getting a first place on their own, tend to be renters.

Of the roughly 146 million households in the U.S., approximately 45 million, roughly one third, are renters, leasing apartments or single-family homes. Of these 45 million rental households, approximately 23 million live in apartment buildings with five or more units. Of the remaining 22 million renter households, 14.5 million live in single-family homes and the rest live in smaller buildings with two-to-four units.

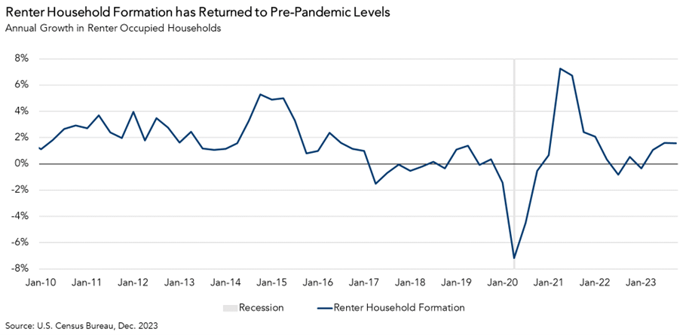

In the early stages of the pandemic, renter household formation plunged as many Americans moved back in with parents. As time went on, people sought out greener pastures and more space to ride out the rest of the pandemic, which resulted in a rebound in renter household formation that lasted until late 2021. Throughout 2022 and the first half of 2023, with inflation and macroeconomic uncertainty high, renter household formation declined as more people stayed put. As of the fourth quarter of 2023, renter household formation had returned to roughly pre-pandemic levels, indicating that renter household growth may finally be stabilizing.

Renters Will Have More Options this Spring

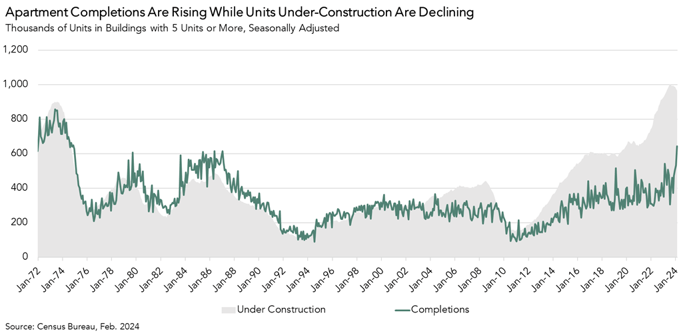

Renters this spring will have more options than they did last year, as a lot of new apartments have been delivered since then. According to data from CoStar, the stock of apartments in the U.S. increased by approximately 600,000 over the last year, and there’s more coming soon. The number of apartments under construction nationwide peaked last summer, but is still near an all-time peak, with just under 1 million units currently being built. Many of these apartments are coming to market now. As a result, we can expect the surge in new apartment supply to continue throughout this year and into the first half of 2025.

Surging Supply of New High-End Apartments Will Impact Rents for Lower-Priced Units

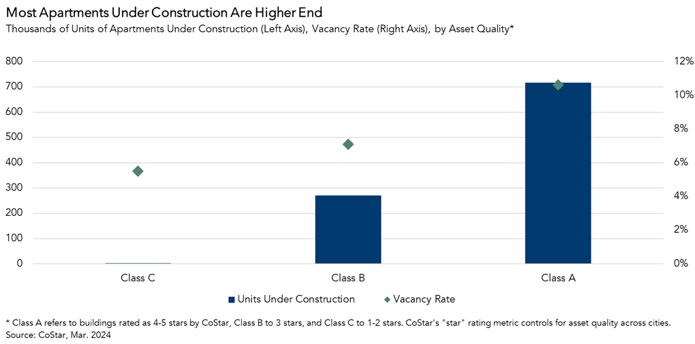

More apartments available to rent means landlords have to compete harder to attract tenants, leading many to lower rents or at least slow the pace of rent increases. Approximately 70 percent of apartments currently under construction are higher end, “Class A” apartments, even though the demand for mid- and lower-tier apartments is higher, as demonstrated by lower vacancy rates. However, recent research suggests that large additions in Class A stock are not only dragging Class A rents down but also weighing on Class B rents, especially in high-supply cities.

What’s the Over-Under (Supply)?

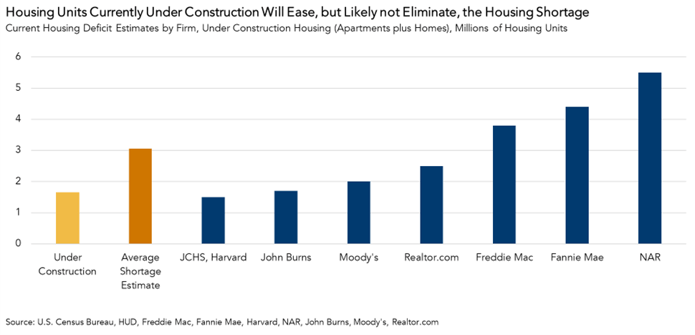

While renters will have more choices this year, the future supply pipeline of apartments (as measured by apartment starts) is now also falling, and in the long run there is still a national housing shortage. Estimates of this shortfall vary, but the average estimate is about 3 million units of housing undersupply. Currently, there are approximately 1.7 million units of housing under construction (apartments and homes). If all of those units came to market tomorrow ready to sell or lease, we’d still likely have a housing shortage. Of course, all real estate is local, so this shortfall varies considerably by market.

So, What’s the X-Factor?

An oversupply of apartments will provide renters with greater options this spring and for the remainder of the year. However, the long-term housing shortage will limit the decline in rent growth. Based on current trends, it looks like demand may catch back up to supply in late 2025 or in early 2026.