In a recent article, we juxtaposed the Federal Reserve’s projections with the “wisdom of the crowd” to consider possible interest rate outcomes in 2024. In this X-Factor, we explore the uncertainty surrounding interest rate expectations more broadly. For example, if there is a soft landing, there’s still a chance, according to the Fed’s own projections, that the Fed may decide that short-term interest rates are sufficiently accommodative of moderate long-term growth and, therefore, not cut rates at all. While neither the Fed nor the market think this is the most likely outcome this year, their expectations seesawed throughout 2023. Today, we’ll look at how these expectations have changed over the last year, and what these recent changes tell us about this year’s rate outcomes.

“Such varied rate expectations indicate that, despite the Fed’s seeming pivot, much remains uncertain about rate outcomes this year.”

How the Fed Changed Its Mind in 2023

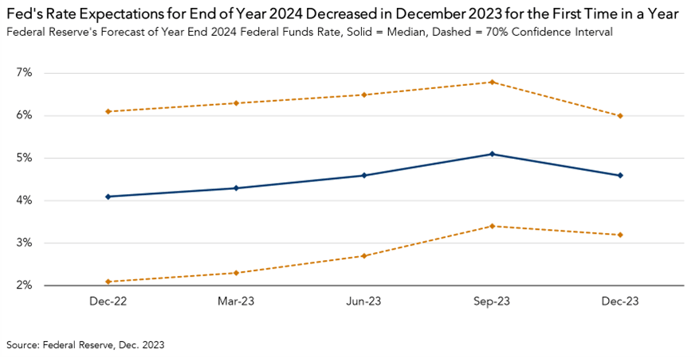

Why even game out this ‘no rate cut’ scenario, if both the market and the Fed expect rate cuts this year? The shortcoming with snapshots of expectations is that they aren’t static – expectations change over time. The economy burned hotter than expected throughout 2023, and, as such, the Fed became increasingly convinced that rates may need to be higher for longer. From December 2022 to September 2023, the median estimate of the federal funds rate at year-end 2024 repeatedly increased, by a full percentage point in total. However, in its December Summary Economic Projections, the Fed revised downwards its year-end 2024 expectation from 5.1 percent to 4.6 percent, the first downward revision in a year.

In addition to these median estimates, the Fed also provides probability bands – ranges in which the Fed is 70 percent confident that the actual federal funds (fed funds) rate will be within. These bands have narrowed throughout 2023, indicating that the Fed is more confident of its year-end 2024 forecast than at the start of 2023. This is due, in part, to the shorter forecast period but it also reflects stabilizing market conditions. But, as the confidence interval shows, there remains a chance that the fed funds rate increases to 6 percent by the end of the year. So, not just no rate cuts, but rate increases.

Shape Up

For approximately the last year and a half, short-term Treasury rates have exceeded long-term Treasury rates, a phenomenon known as “yield curve inversion.” Yield curve inversion has traditionally been a dependable leading indicator of recessions, and the last time the yield curve inverted without a recession occurring (a “false positive”) was in the late 1960s. A yield curve inversion has preceded every recession since then.

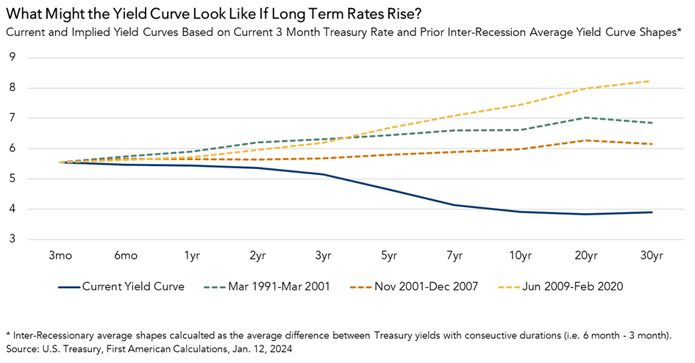

Could the aftershocks from a once-in-a-century pandemic give us another false positive? If short-term rates remain where they are, then an inverted yield curve can only “un-invert” (or normalize) if long-term rates rise. In this scenario, the cost to finance property purchases would remain high, and higher long-term Treasuries would continue to provide CRE investors with longer-term Treasury yields as an investment substitute to CRE.

One way to determine the overall shape of a yield curve is with spreads between consecutive rates – tracking the difference between the six-month Treasury rate and the three-month Treasury rate, for example. Using the average shape of the yield curve in inter-recessionary time periods, we can get a sense of what our own yield curve would look like if short-term rates remained fixed and long-term rates rose to differing degrees. For example, if short-term rates do not decline this year and long-term rates revert to the average shape from between the Great Financial Crisis and COVID-19 recessions, the 10-year yield would be around 7.5 percent and the 30-year yield would be over 8 percent.

The Market Disagrees with the Fed, but not Entirely

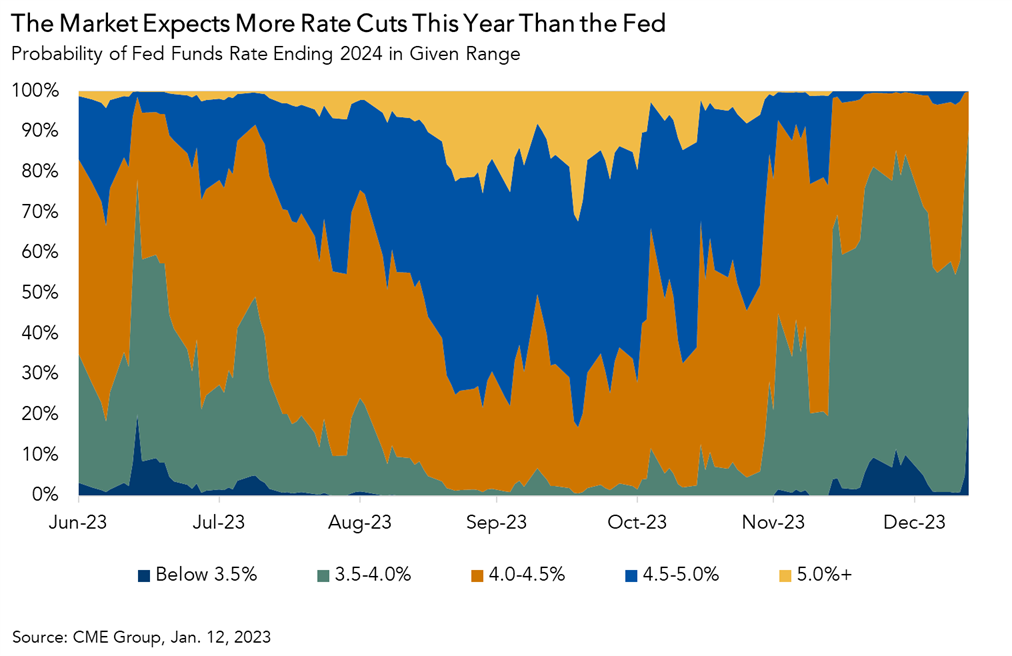

While the Fed revised its forecasts of year-end 2024 interest rates upwards through most of 2023, the market has been expecting more rate cuts in 2024 than the Fed for some time. At the end of the second quarter, according to data from CME Group’s FedWatch Tool, a little more than one-third of the market expected the fed funds rate to drop below 4.0 percent by the end of 2024. At that time, slightly less than two-thirds of the market expected a 2024 terminal rate of between 4 percent and 5 percent, and only 1 percent expected one rate cut or none at all.

Following the Federal Open Market Committee’s December 13 press release, these probabilities flipped. Now, an overwhelming 90 percent of the market expects rates to fall below 4 percent by the end of the year, and the remaining 10 percent expects rates to be between 4 and 5 percent. The market is convinced that there will be at least two rates cuts this year, but that more are far more likely. The market seems to disagree with the Fed over just how many rate cuts will occur this year, but they both agree that rate cuts will happen.

Is Some Relief in Sight for Cash-Strapped Borrowers?

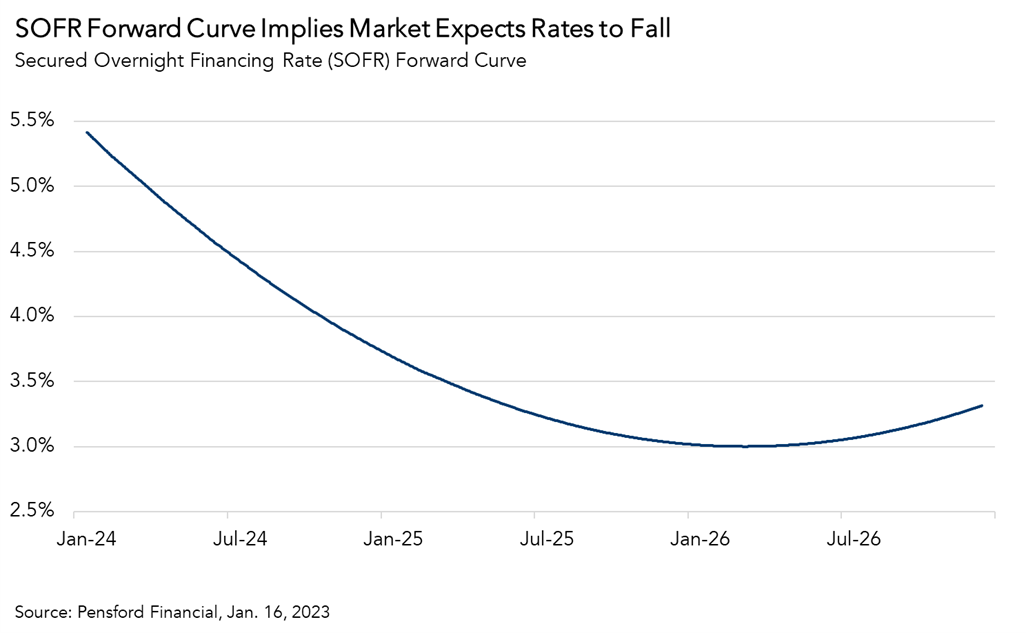

Most variable-rate commercial real estate (CRE) loans use the Secured Overnight Funding Rate (SOFR), a short-term interest rate, as their benchmark rate[1]. CRE borrowers pay some spread based on their credit risk over a one-month SOFR rate. Therefore, while Treasury rates and the fed funds rate indirectly impact CRE mortgage rates, SOFR impacts many of them directly.

The market overwhelmingly expects fed funds rate cuts this year, and it is expecting similar declines in SOFR as well. One way to measure the market’s expectations of the SOFR at a given moment is with the SOFR forward curve. The forward curve represents current market expectations of the SOFR at different points in the future (the curve itself is derived using SOFR futures contracts). Currently, the one-month SOFR sits at about 5.3 percent, and the market is expecting it to decrease by over a full percentage point to 3.7 percent at the end of 2024. Were this to occur, some cash strapped owners that are struggling to meet debt service now could become cash flow positive, which would somewhat limit the quantity of distress that occurs in 2024.

Conclusion

The market, it seems, is somewhat at odds with the Fed in terms of its outlook for 2024. Though both expect rate cuts in 2024, the market overwhelmingly believes there will be more than the Fed implies in their forecasts. On the other hand, if the Fed does not cut rates, the yield curve would have to revert through increasing long-term rates, which would continue to stymie CRE transaction volume. Such varied rate expectations indicate that, despite the Fed’s seeming pivot, much remains uncertain about rate outcomes this year.

[1] Until recently, CRE rate benchmarks were typically LIBOR, which is being phased out.