Why the Housing Market Can Thrive if a New Rising-Rate Era Begins

By

Mark Fleming on January 26, 2021

Even though nominal house prices continued to surge, affordability improved in November as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability. Real house prices declined by 6.2 percent relative to one year ago, thanks to the benefit of increased buying ...

Read More ›

Will the Super-Sellers' Market Continue to Impact Affordability in 2021?

By

Mark Fleming on December 28, 2020

The housing market prior to the pandemic could have been characterized as a sellers’ market, with a shortage of supply relative to demand. With the current supply of homes for sale even tighter relative to demand, it can only be characterized as a super-sellers’ market today. The pandemic has intensified a sense of home as refuge and falling ...

Read More ›

Why the Big Short in Housing Supply Will Remain in 2021

By

Mark Fleming on December 3, 2020

As the housing market has recovered from the initial impacts of the pandemic, nominal house price appreciation has soared, but affordability actually improved until recently due to the house-buying power benefit from historically low mortgage rates. However, for the second month in a row, the Real House Price Index (RHPI) increased, indicating ...

Read More ›

Interest Rates Real House Price Index Affordability Housing supply

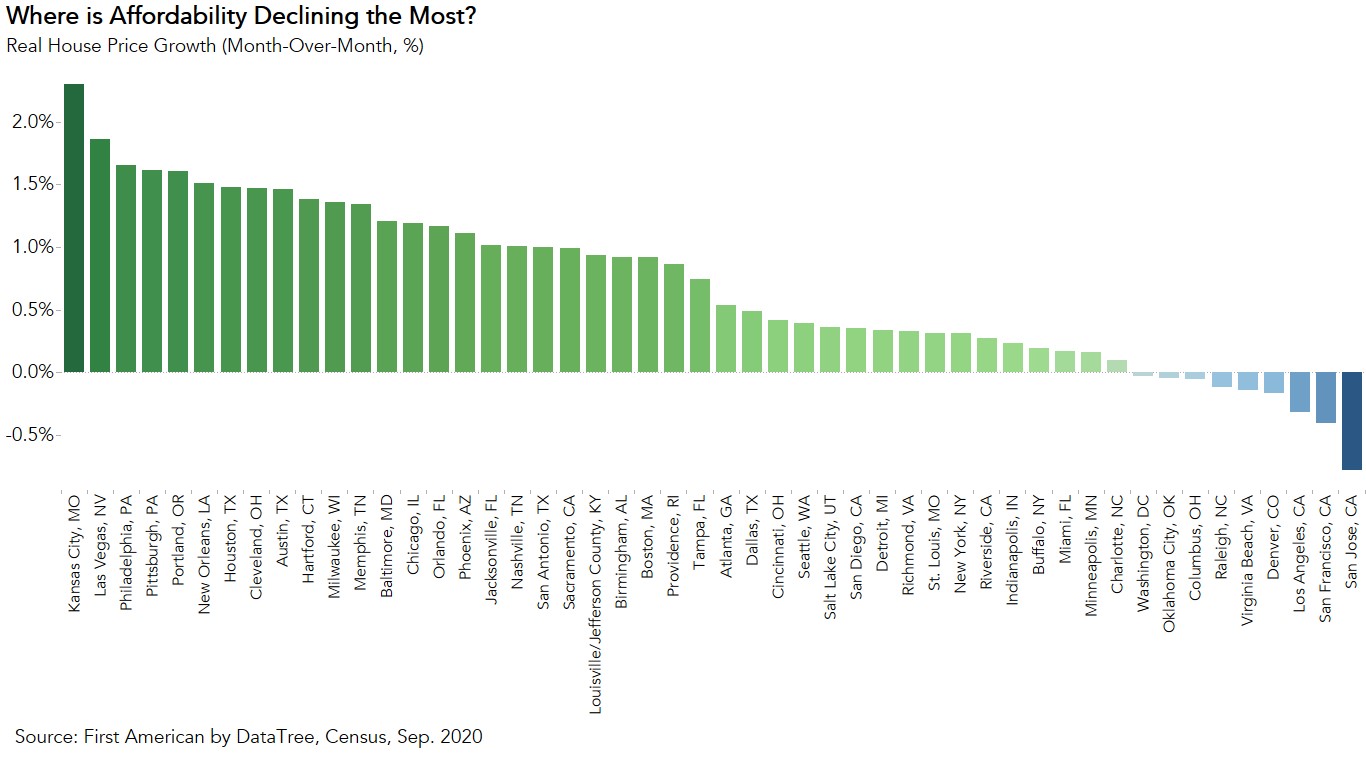

The Five Cities Where Affordability Declined the Most

By

Mark Fleming on November 23, 2020

Affordability declined month over month in September for the second month in a row, even as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability. The 30-year, fixed-rate mortgage fell by 0.05 percentage points and household income increased 0.2 percent ...

Read More ›

Has the Affordability Boost From Falling Mortgage Rates Run its Course?

By

Mark Fleming on October 27, 2020

Throughout 2020, falling mortgage rates have been the strongest influence on housing affordability trends, even helping fuel the housing market’s impressive recovery and resilience to the continuing economic fallout from the coronavirus pandemic. Mortgage rates began declining in January 2020 and even dropped below 3 percent for the first time ...

Read More ›

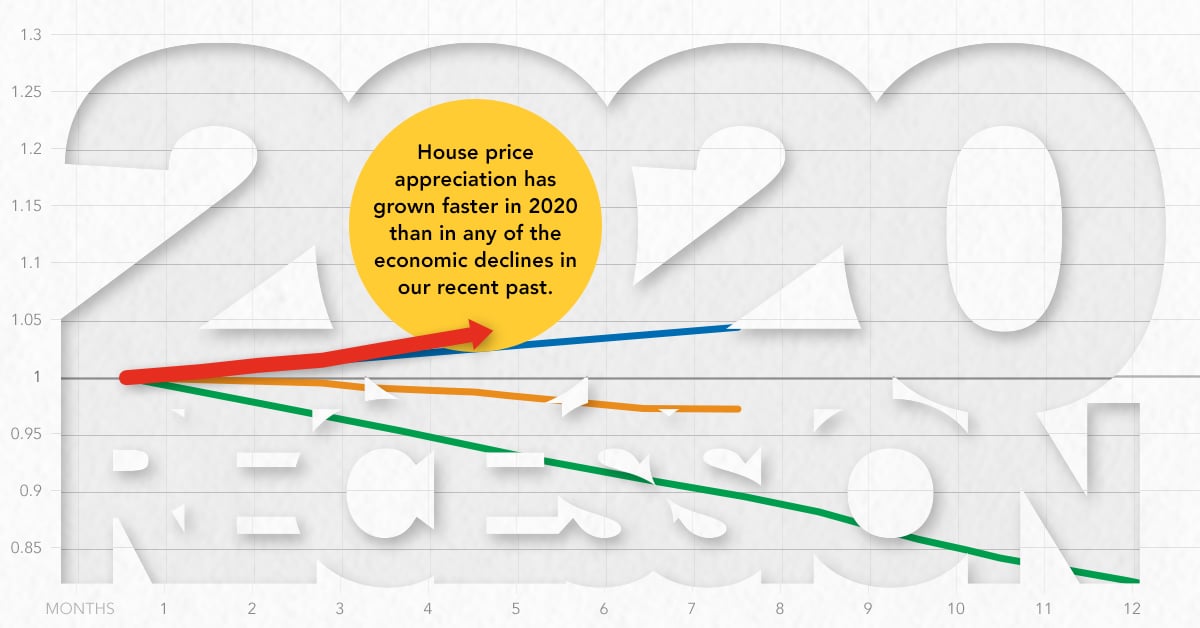

How Can Housing Affordability Improve During Periods of Economic Decline When House Prices Rise

By

Mark Fleming on September 28, 2020

Affordability improved in July as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability, outpacing the rise in nominal house price appreciation. The average 30-year, fixed mortgage rate fell by 0.75 percentage points and household income increased 5.5 ...

Read More ›