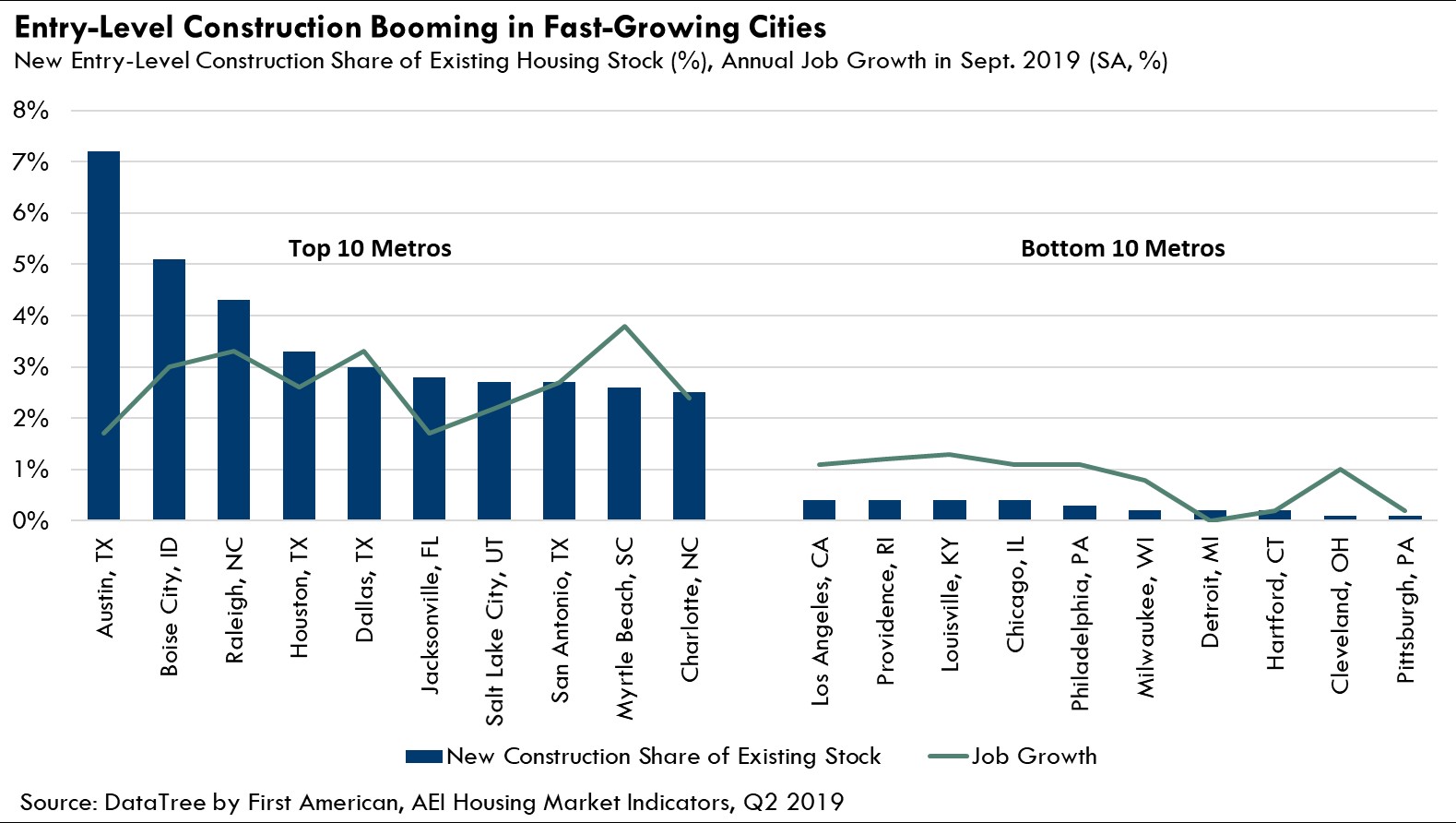

What Do the Top 10 Cities for Entry-Level New Home Construction Have in Common?

By

Odeta Kushi on November 22, 2019

The dominant theme in the housing market nationally in 2019 has been the ongoing challenge of a dearth of housing supply amid rising demand. A natural solution to the challenge is to build more homes. Yet, nationally, supply headwinds still make it hard for builders to ramp up new construction, especially at the entry-level, where first-time home ...

Read More ›

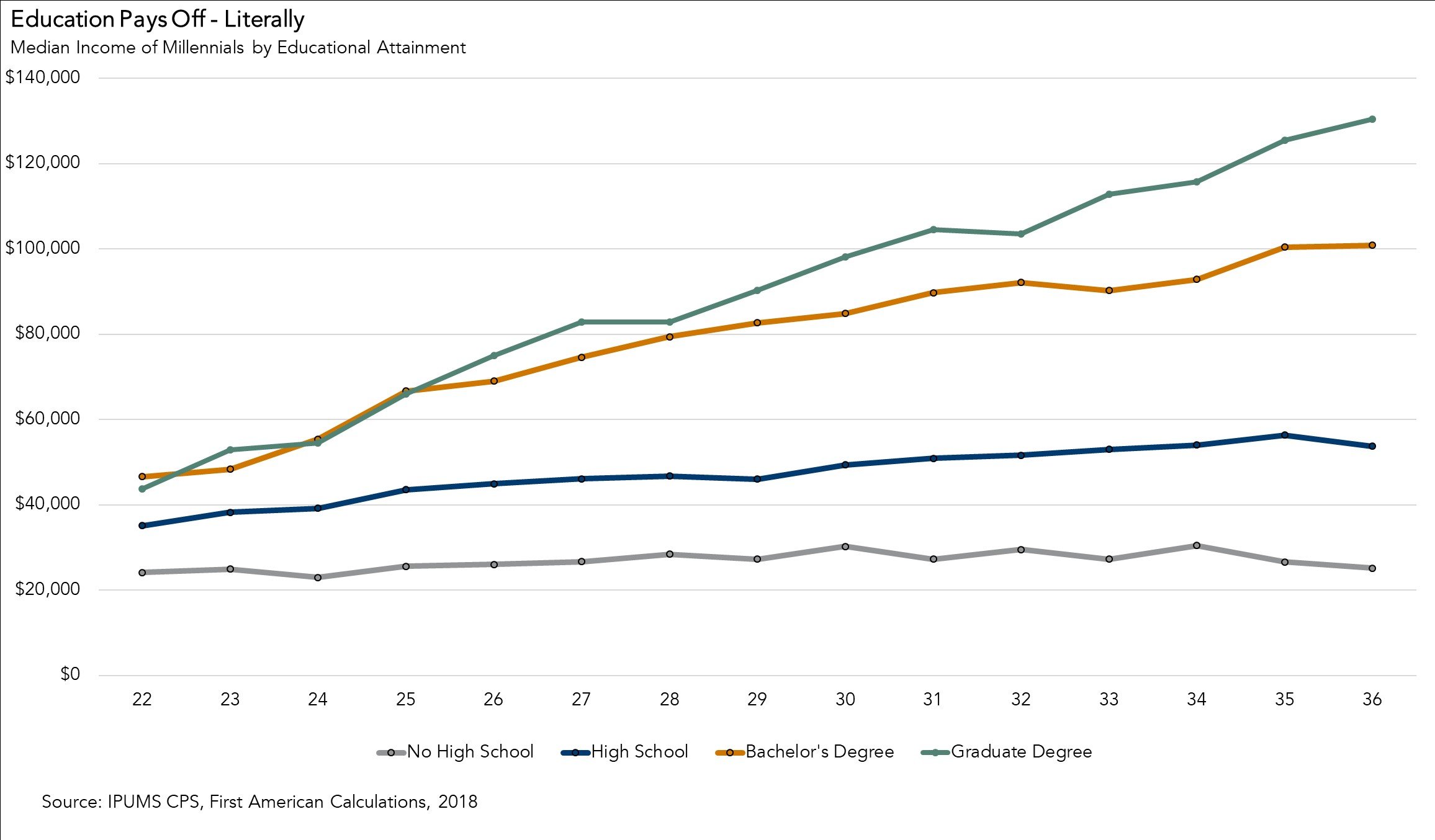

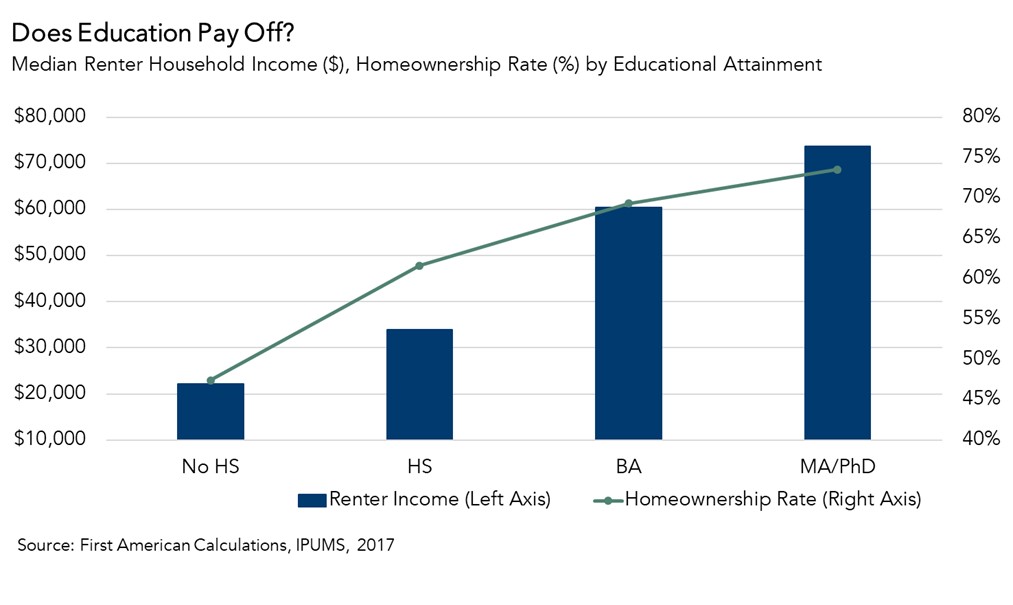

Does Education Really Lead to Greater Earning Power?

By

Odeta Kushi on September 13, 2019

Whether it’s parents shuttling their children off to elementary school or students starting their final year of college, back-to-school season is here. We generally spend a minimum of 12 years as a student, more if you pursue a college degree. Along the way, we’re told that education is critical to your ability to earn a decent living.

Read More ›

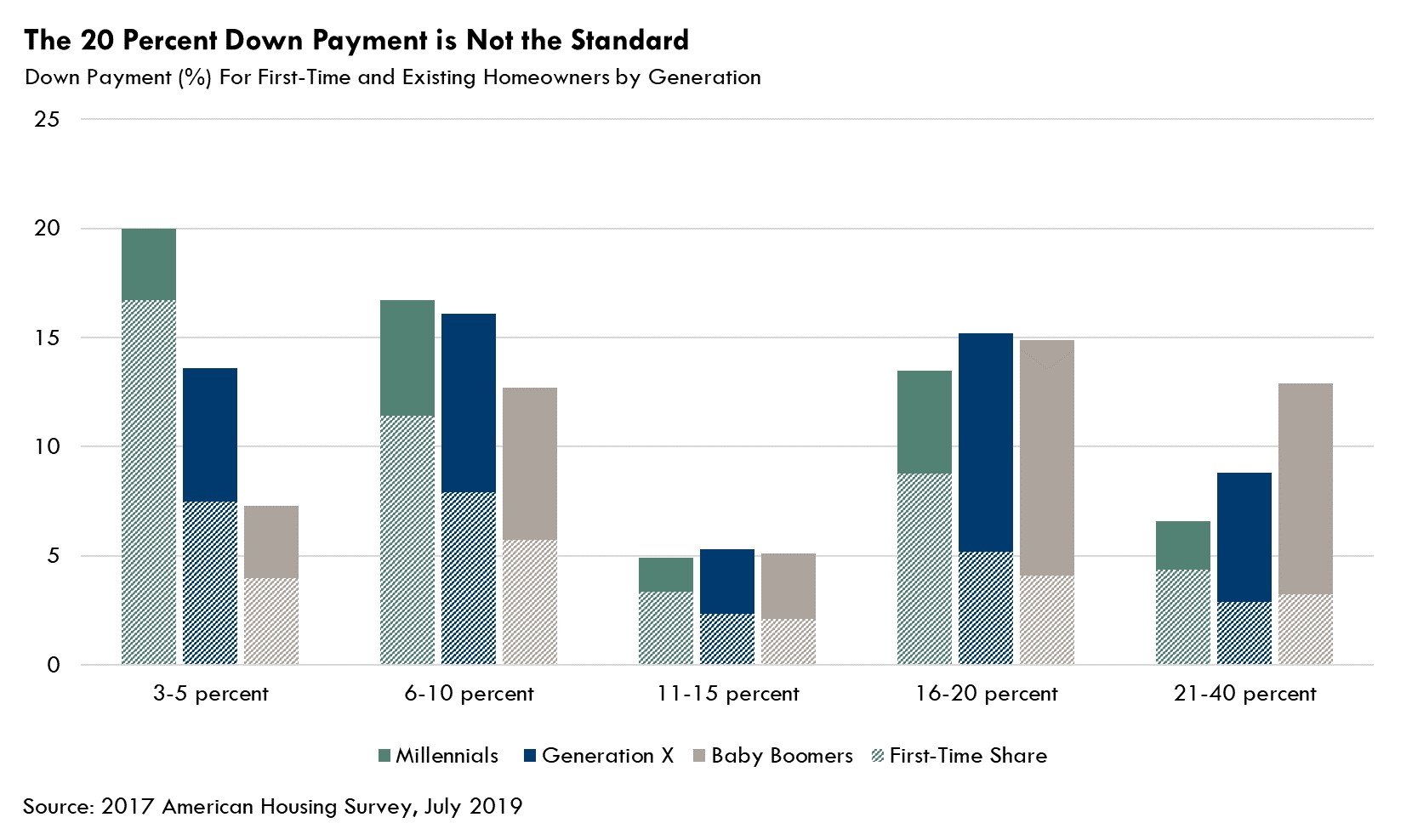

Dispelling the Myth of the 20 Percent Down Payment

By

Odeta Kushi on August 6, 2019

Since hitting a low point of 63 percent in 2016, the homeownership rate has rebounded, largely driven by millennial households purchasing their first homes. Many surveys, like one by Bank of the West, indicate that millennials are no different from previous generations – they view homeownership as a main tenet of the American Dream.

Read More ›

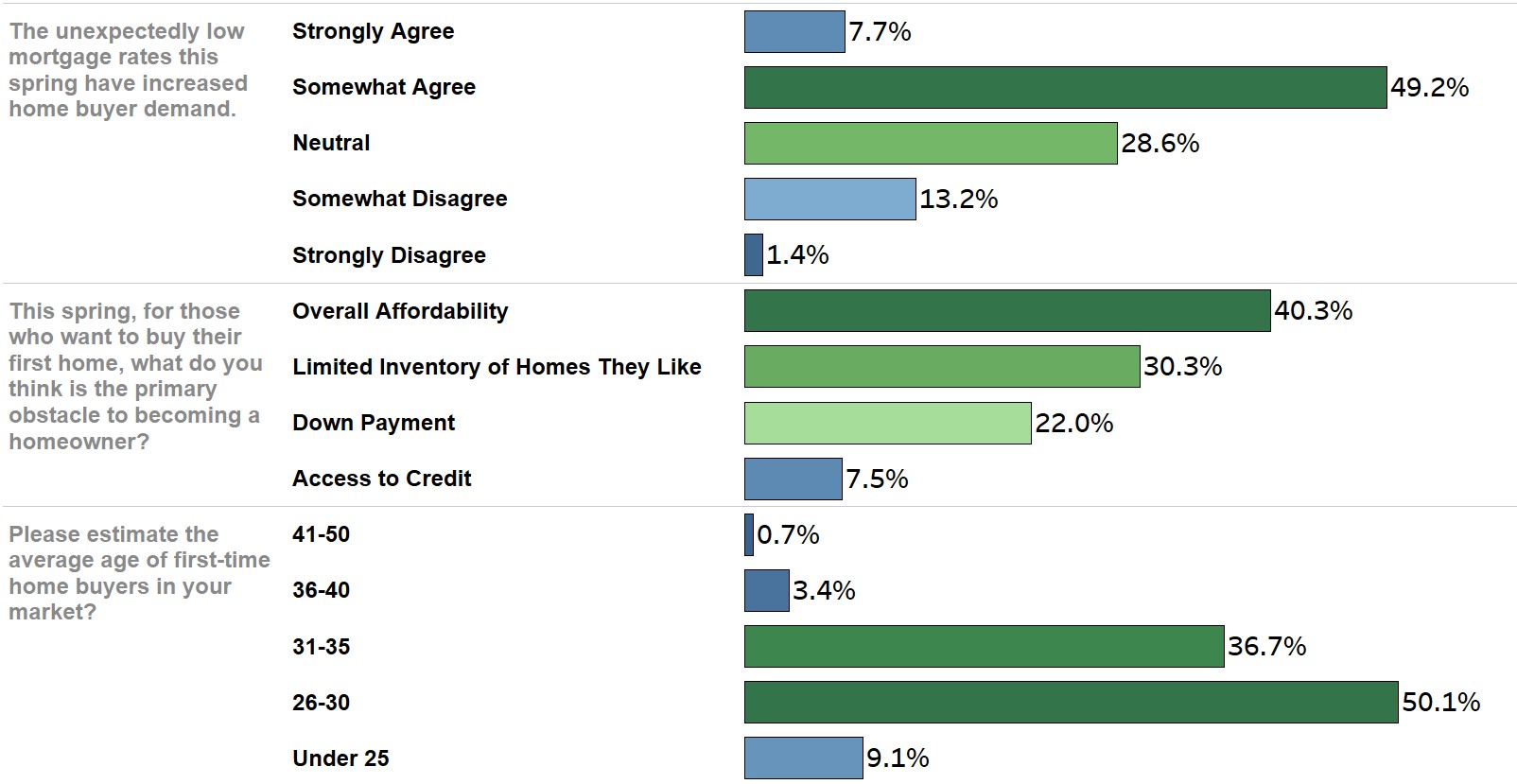

The Unexpected Surprise Boosting Demand and Supply in 2019

By

Mark Fleming on June 18, 2019

In late 2018, many experts believed the housing market in 2019 would behave very similar to the 2018 housing market, characterized by rising demand for homes and limited supply driving house price appreciation, while mortgage rates continued their steady ascent. Then, December 2018 brought a sudden drop in mortgage rates, a decline which has ...

Read More ›

Housing Interest Rates Millennials Real Estate Sentiment Index

What is the Impact of Student Loan Debt on House-Buying Power?

By

Odeta Kushi on February 15, 2019

Contrary to many reports, student loan debt is not an insurmountable barrier to homeownership for millennials. Student loan debt is more likely to delay the timing of homeownership, but it does not necessarily prevent homeownership. But, this begs the questions, how does student loan debt impact house-buying power? And, is higher education a ...

Read More ›

Millennials Education Homeownership Progress Index Homeownership

Interviews on NPR and Forbes.com: Discussing Millennial Homeownership and the 2019 Spring Home Buying Season

By

FirstAm Editor on February 6, 2019

First American Deputy Chief Economist Odeta Kushi provided perspective on millennial homeownership in an interview with National Public Radio and Chief Economist Mark Fleming’s expectations for the spring home buying season were featured in a Forbes.com article earlier this month.

Read More ›

Housing In The News Interest Rates Millennials Affordability