What Do Previous Rising Mortgage Rate Eras Tell Us About Today's Housing Market?

By

Mark Fleming on December 17, 2018

In November, the housing market underperformed its potential by 7.4 percent, marking 40 straight months the market remained below its potential, according to our Potential Homes Sales Model. Month over month, the gap between actual existing-home sales and the market potential for home sales narrowed by 1.2 percent, but the housing market still has ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

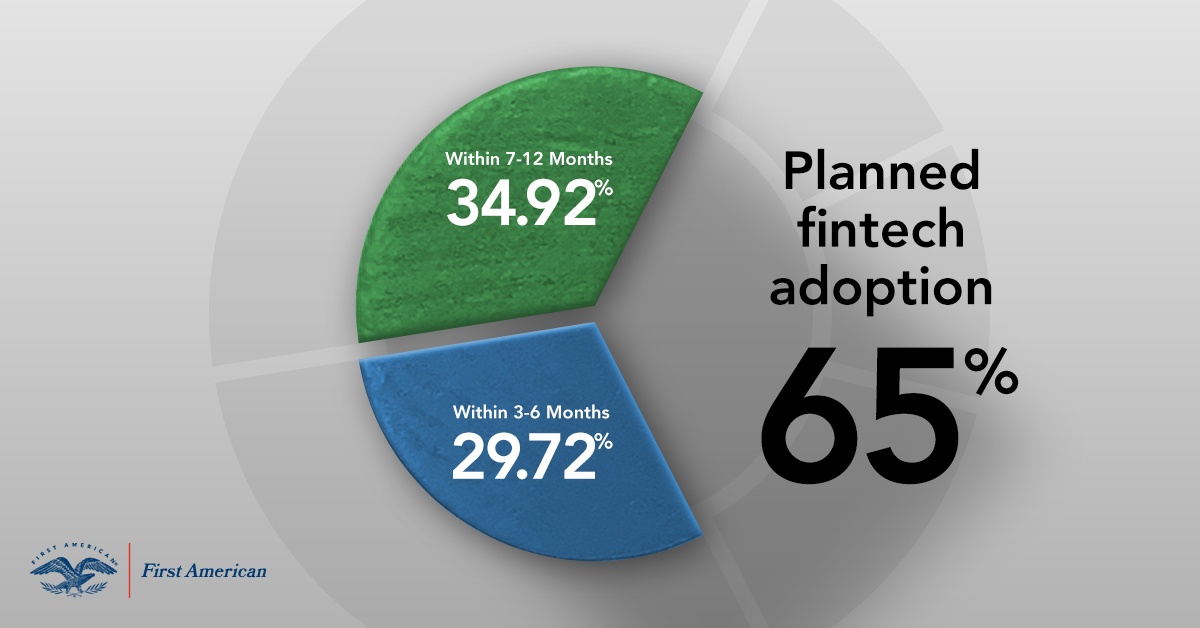

Will Fintech Adoption Among Real Estate Professionals Accelerate in 2019?

By

Mark Fleming on November 27, 2018

Throughout 2018, we’ve seen many trends that set the groundwork for the acceleration of financial technology (fintech) adoption. It has been a strong seller’s market across the top U.S. metropolitan areas. With inventory low and house prices at historic highs, prospective home buyers felt pressured to settle deals quickly before opportunities fade ...

Read More ›

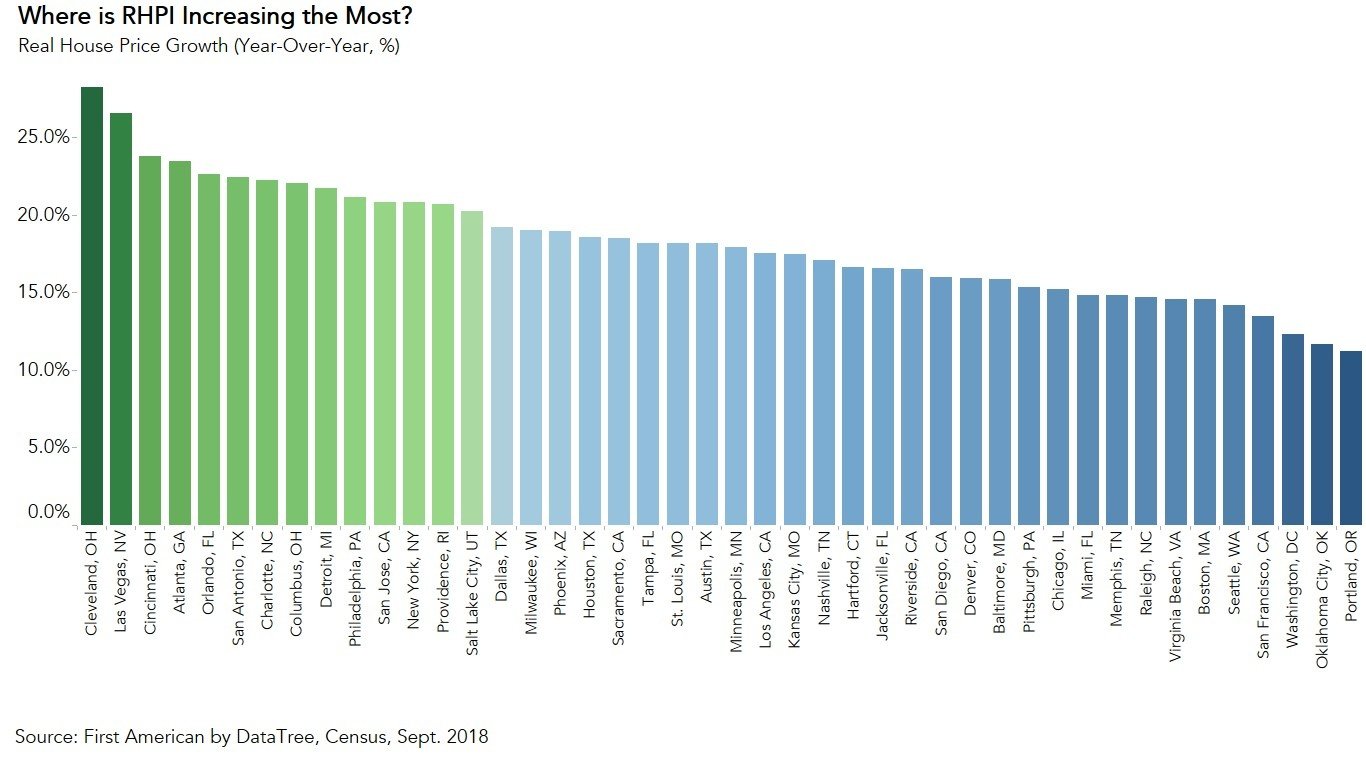

Why is Real House Price Appreciation Accelerating?

By

Mark Fleming on November 26, 2018

In September, all three of the key drivers of the Real House Price Index (RHPI), household income, mortgage rates, and an unadjusted house price index, increased compared with a year ago. When household income rises, consumer house-buying power increases. When mortgage rates and house prices increase, consumer house-buying power decreases. The ...

Read More ›

Interview on CNBC: Discussing the New Normal for the Housing Market

By

FirstAm Editor on November 23, 2018

First American Chief Economist Mark Fleming was interviewed on CNBC earlier this week and discussed the current dynamics at play in the housing market where rising mortgage rates have impacted both supply and demand.

Read More ›

Housing In The News Interest Rates Millennials Affordability

Do Rising Rates Outweigh the Impact of the Strong Economy on Housing Market Potential?

By

Mark Fleming on November 19, 2018

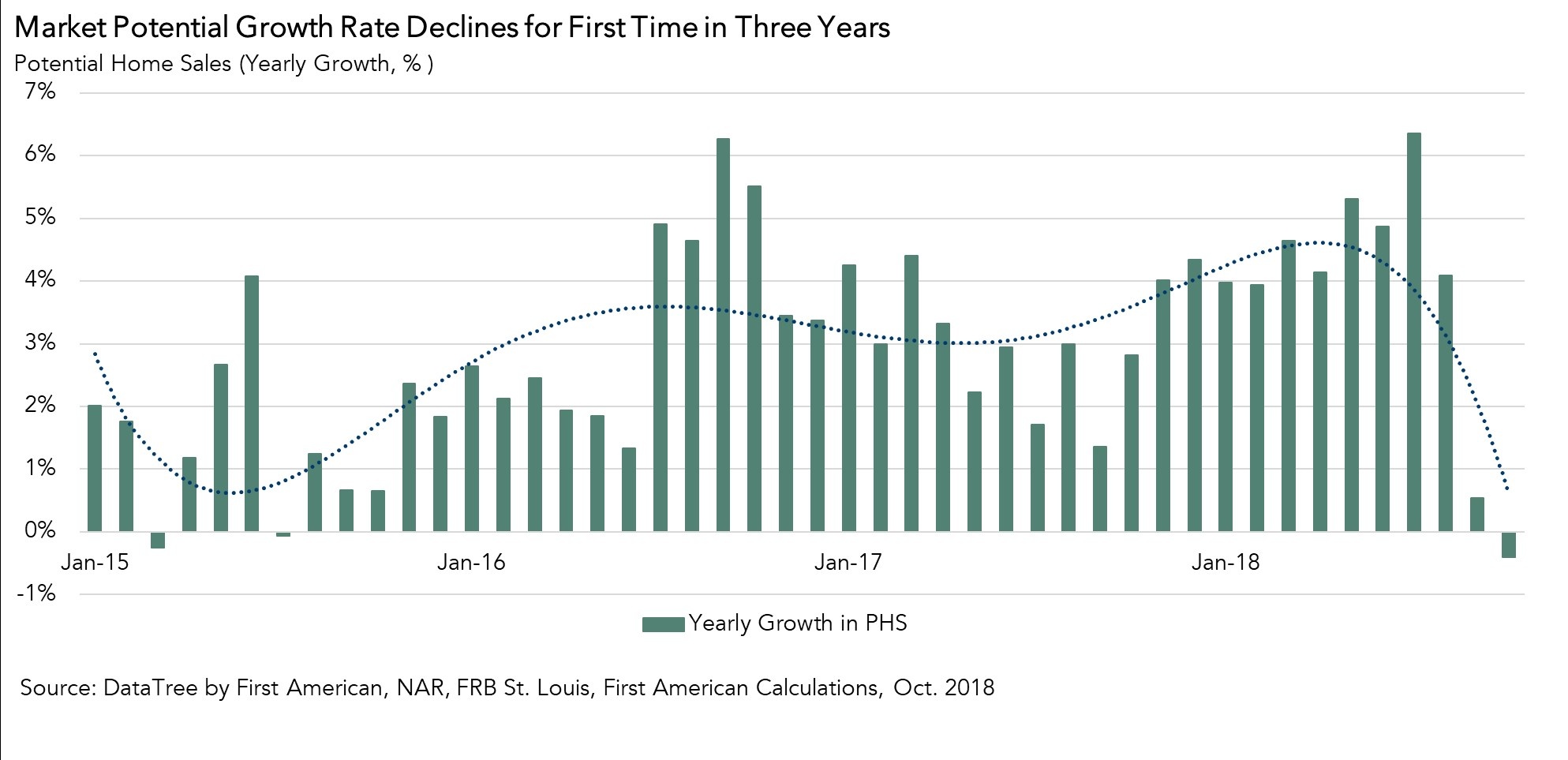

While the housing market continues to underperform its potential by 6.5 percent, the gap between actual existing home sales and the market potential for home sales narrowed by 1 percent in October compared with September, according to our Potential Homes Sales model. The housing market has the potential to support more than 391,000 additional home ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

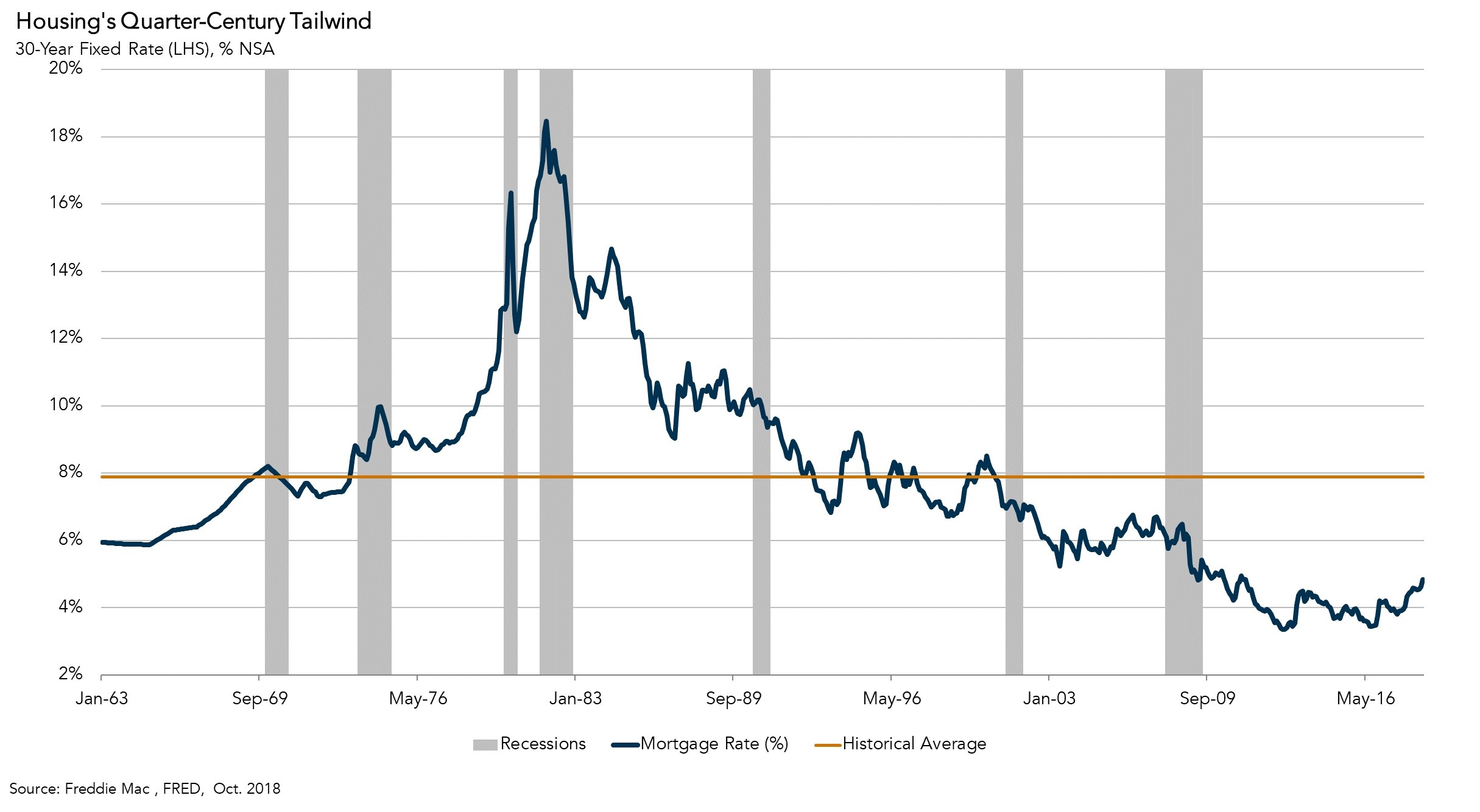

Why the Housing Market Can Thrive at 5 Percent Mortgage Rates

By

Mark Fleming on November 12, 2018

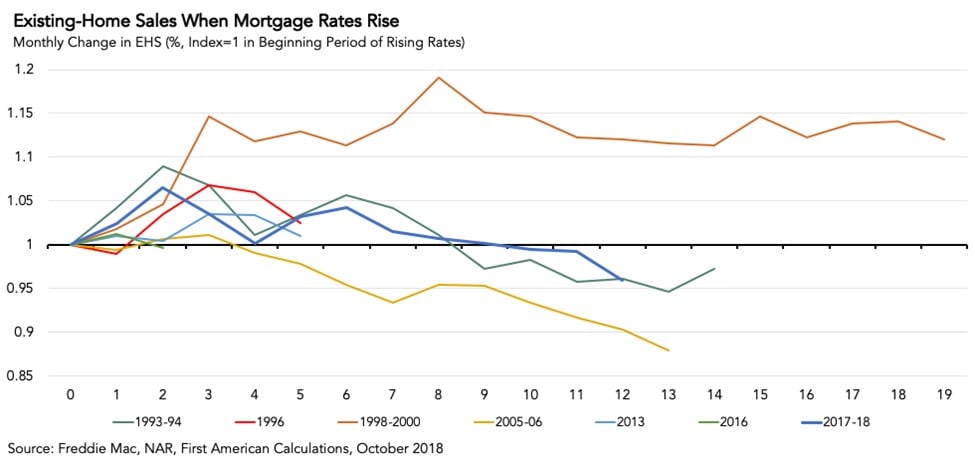

Last week, the 30-year, fixed mortgage rate hit a seven-and-a-half-year high of 4.86 percent. Most experts believe mortgage rates will continue to rise, reaching 5 percent in 2019.

Read More ›