How Wage Growth Reduced the Sting of Rising Rates on Affordability

By

Mark Fleming on October 29, 2018

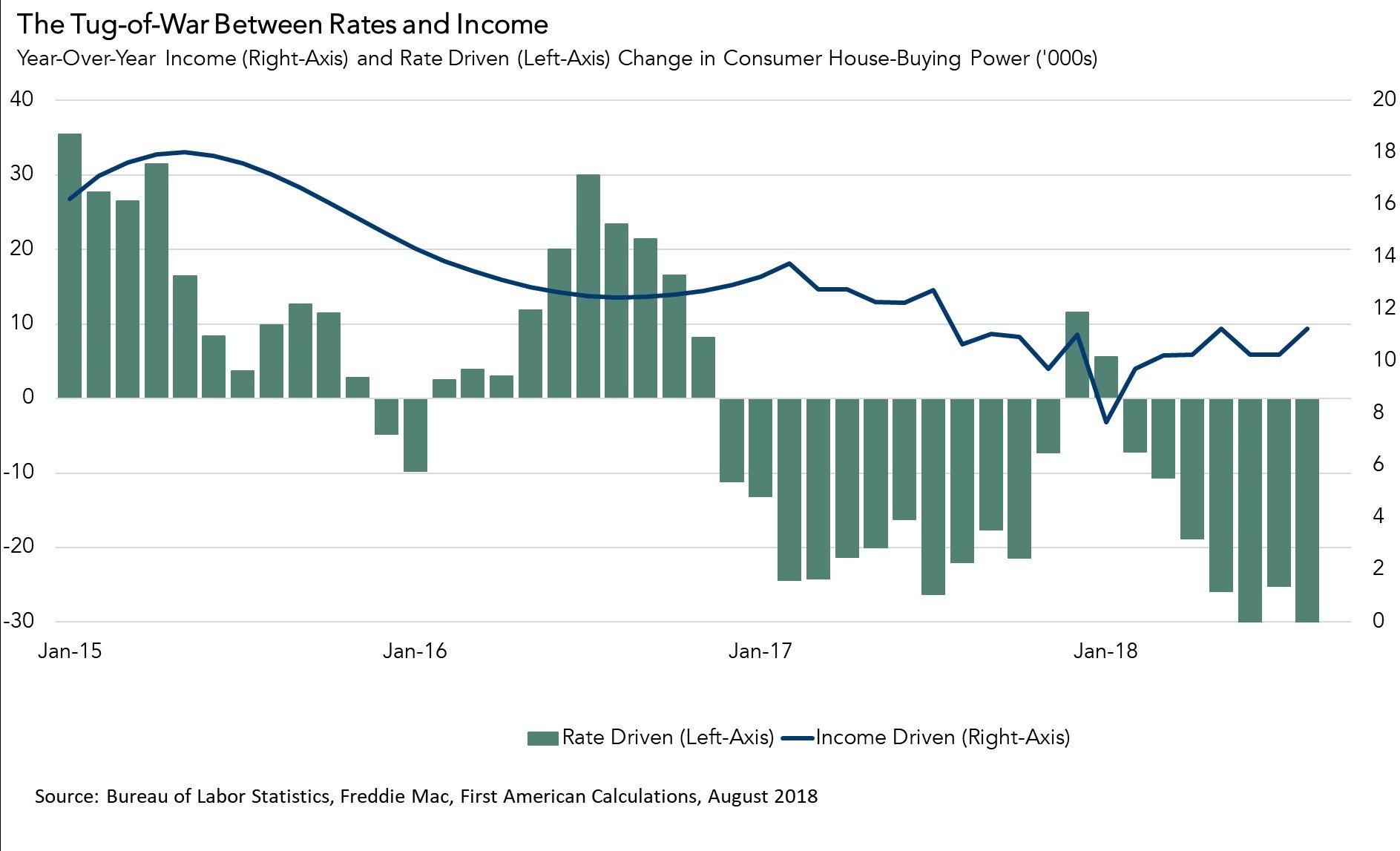

Understanding the dynamics that influence consumer house-buying power, how much home one can buy based on changes in income and interest rates, provides helpful perspective on the housing market. When incomes rise, consumer house-buying power increases. When mortgage rates or nominal house prices rise, consumer house-buying power declines. Our ...

Read More ›

Why Homeowners Staying in their Homes Dampens the Housing Market

By

Mark Fleming on October 18, 2018

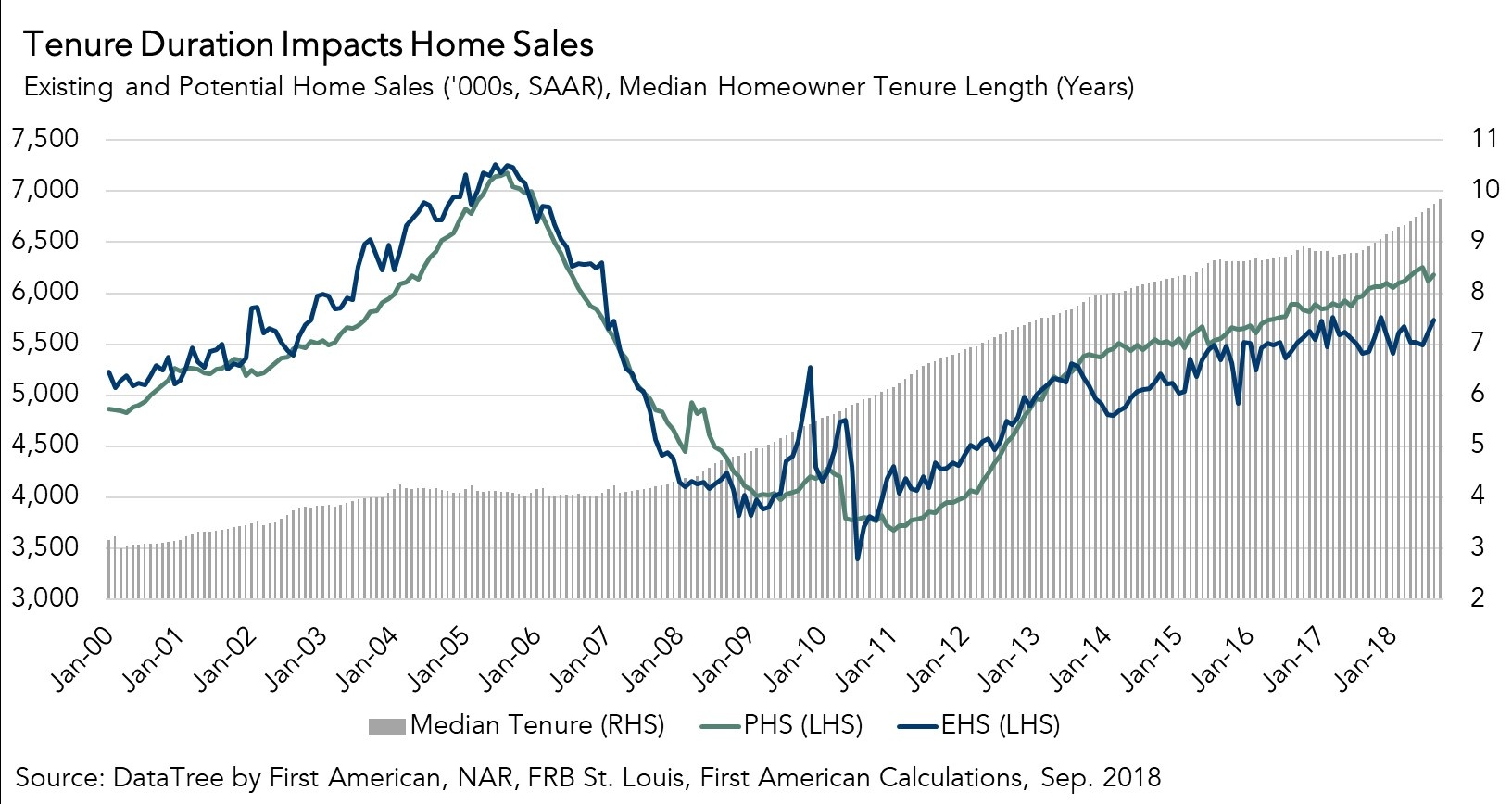

While the housing market continues to underperform its potential by 7.2 percent, the gap between actual existing home sales and the market potential for home sales narrowed by 1 percent in September compared with August, according to our Potential Homes Sales model. However, even though the performance gap narrowed a bit, the housing market still ...

Read More ›

Why ARMs Today are Different

By

Odeta Kushi on October 10, 2018

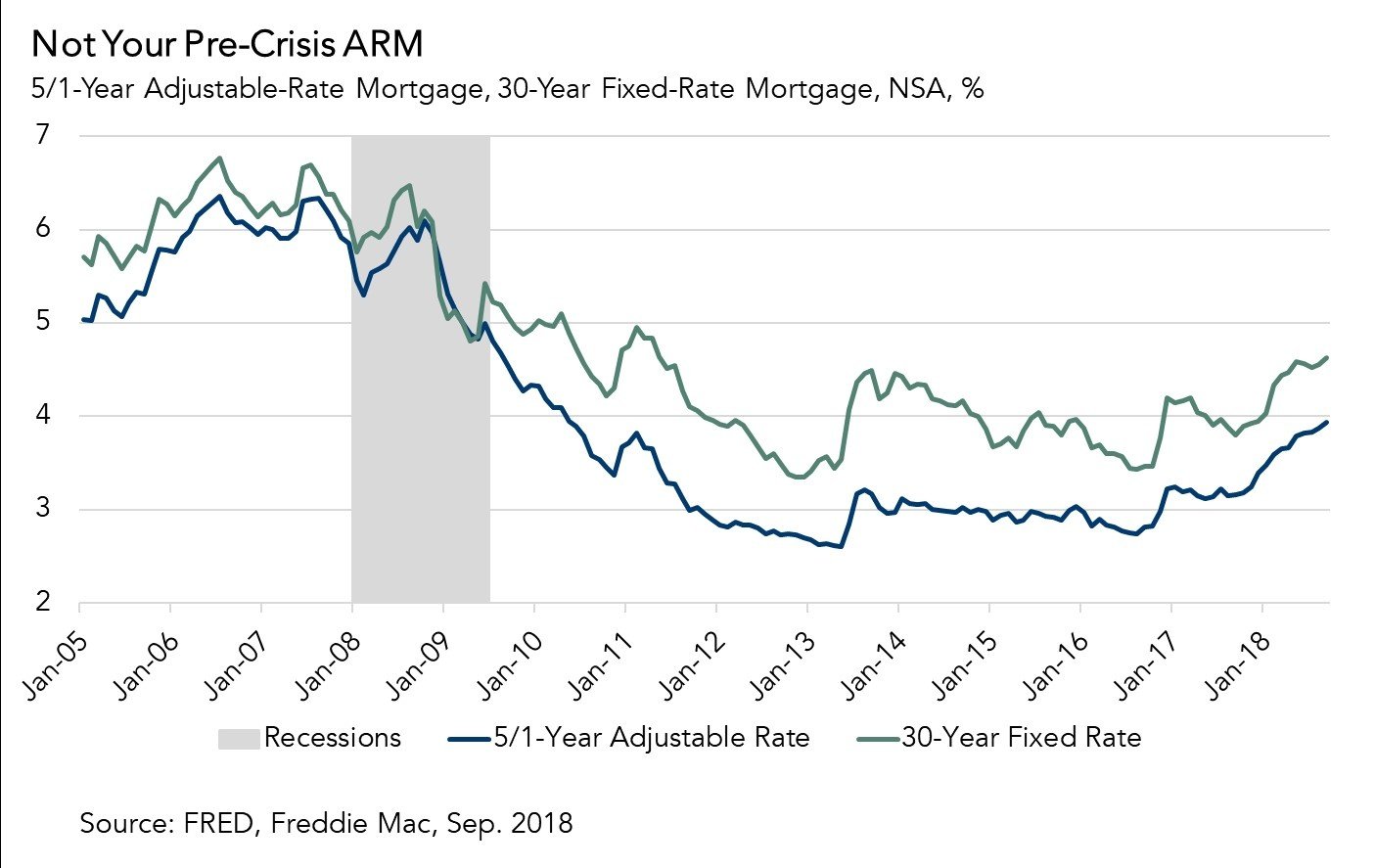

Adjustable-rate mortgages (ARMs), a symbol of the housing market crash, are making a comeback, but their resurgence is not an indicator of a potential negative turn in the housing market. An ARM is a mortgage that typically has a 30-year repayment term, but the interest rate is fixed for the first few years of the loan. Once the fixed period ends, ...

Read More ›

Interview on CNBC: Discussing the impact of rising rates on affordability and home-buying demand

By

FirstAm Editor on October 5, 2018

First American Chief Economist Mark Fleming was interviewed on CNBC yesterday and discussed the impact of rising interest rates on affordability and home-buying demand.

Read More ›

Housing In The News Interest Rates Millennials Affordability

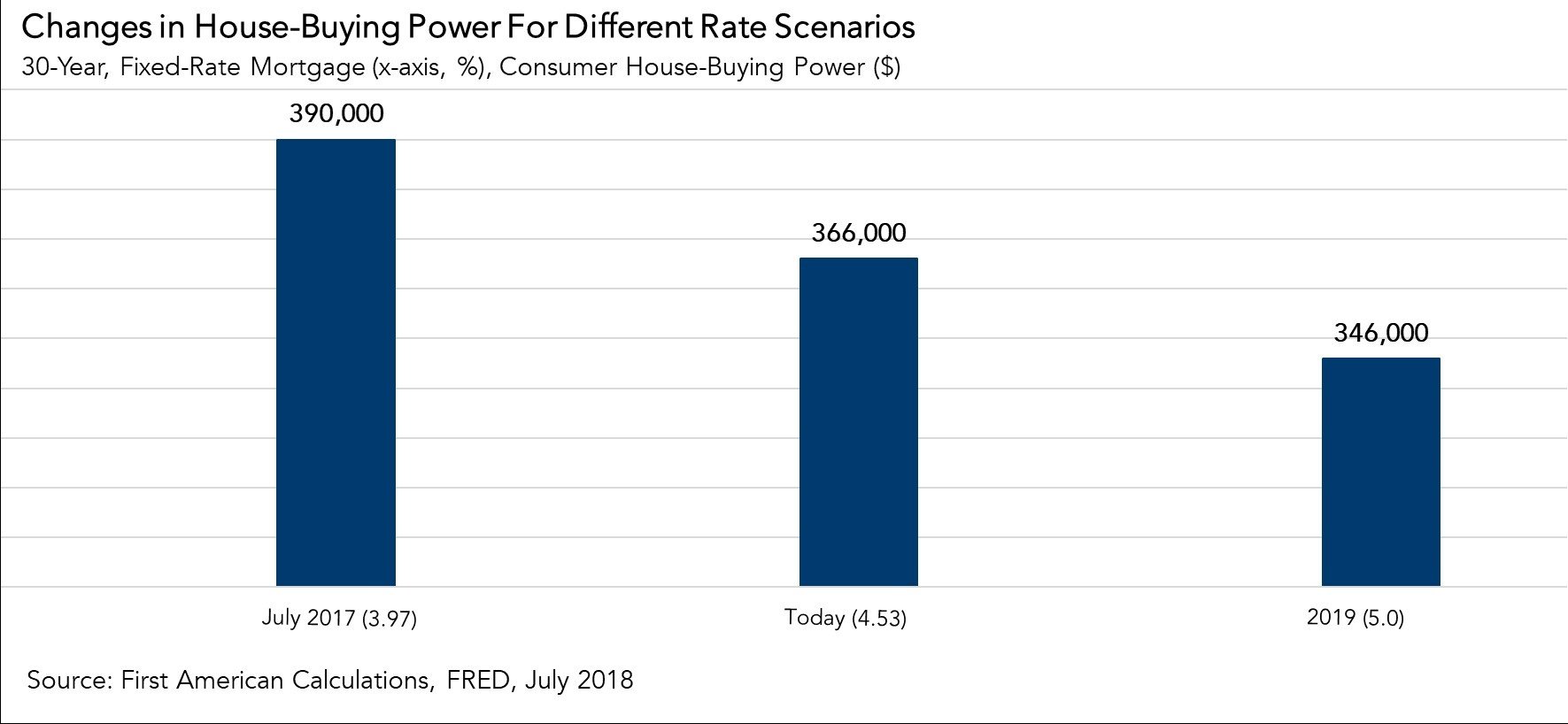

How Will Rising Mortgage Rates Impact Housing Affordability in 2019?

By

Mark Fleming on September 24, 2018

The Federal Open Market Committee (FOMC) meeting is just around the corner and a rate hike is almost certain, according to experts, which will trigger conversations about rising mortgage rates across the housing industry. While changes to the federal funds rate won’t necessarily spur further increases in mortgage rates, mortgage rates are expected ...

Read More ›

Interview on CNBC: Discussing the housing market’s potential shift toward a buyer’s market

By

FirstAm Editor on September 21, 2018

First American Chief Economist Mark Fleming was interviewed on CNBC earlier this week and discussed the housing market’s potential shift toward a buyer’s market and the challenges facing the market: affordability and interest rates.

Read More ›

Housing In The News Interest Rates Millennials Affordability