Why the Yield Curve May Have Fooled Some Experts

By

Mark Fleming on April 5, 2019

April Fools’ may be over, but that hasn’t dampened recession fears from generating headlines. Broadly speaking, the U.S. economy is performing well. Wages are increasing and we’re near full employment. So, why are some experts raising recession concerns?

Read More ›

Interview on CNBC: Discussing the Impact of Declining Mortgage Rates and Limited Supply on the Housing Market

By

FirstAm Editor on March 27, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC on Tuesday and discussed how the decline in mortgage rates over the last few months and continued tight housing supply are likely to impact the housing market.

Read More ›

Housing New Home Buying In The News Interest Rates Affordability

Three Reasons Home Buyers Have More Power This Spring

By

Mark Fleming on March 25, 2019

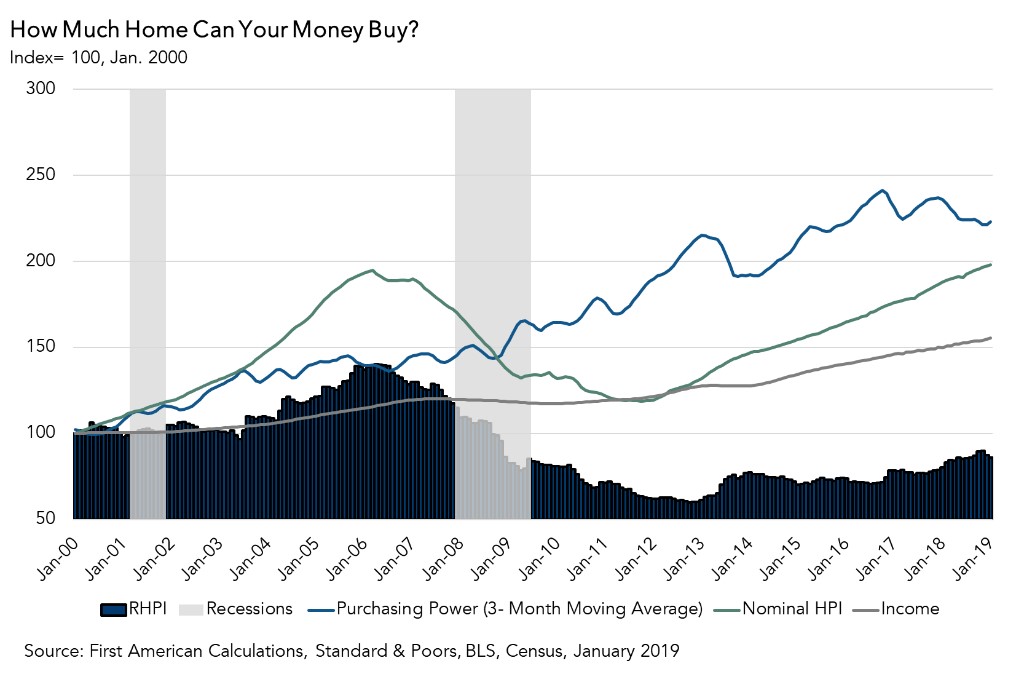

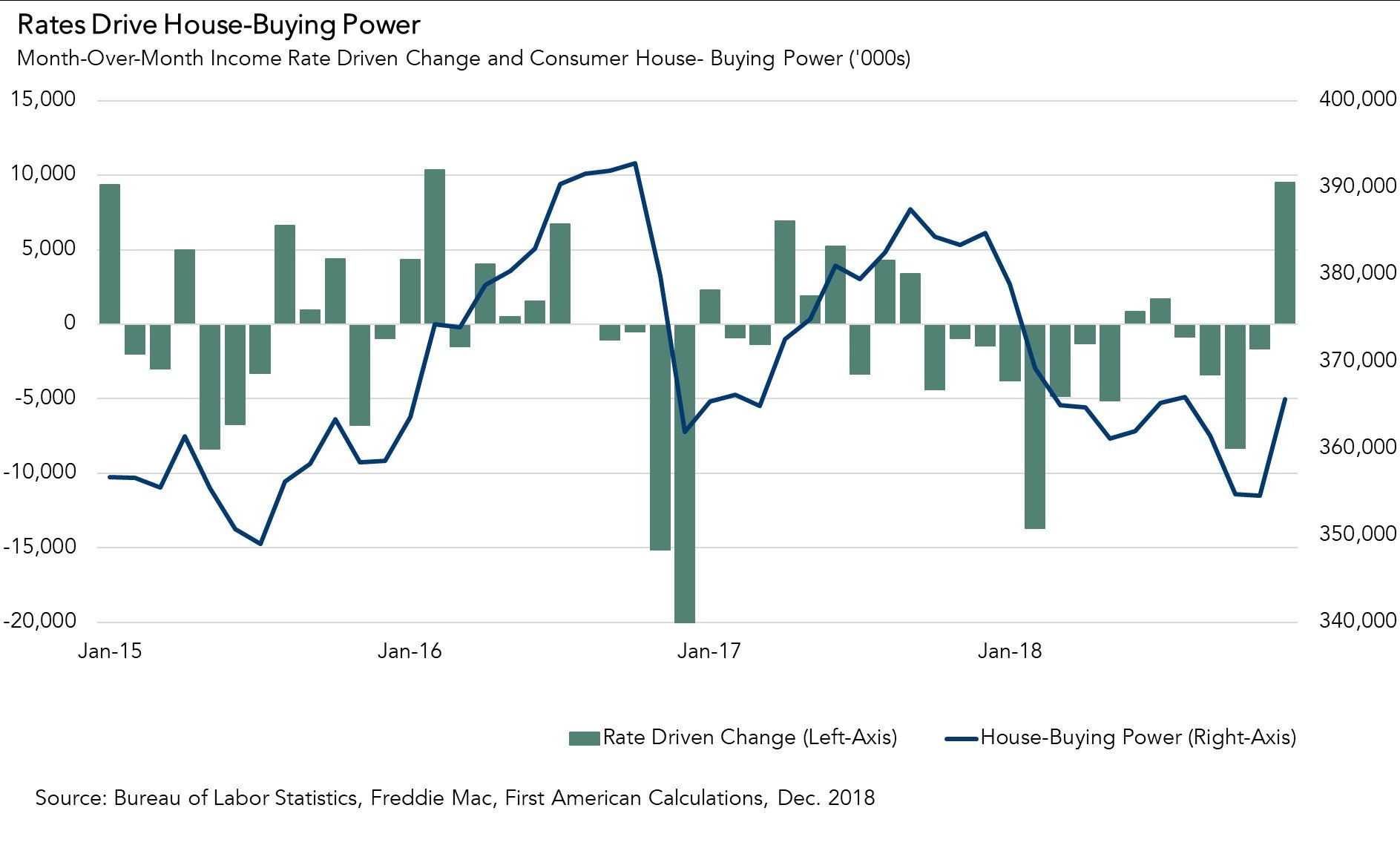

While 2018 was largely characterized by declining affordability, ending the year with a five percent yearly decline in house-buying power, this trend reversed sharply in early 2019. Moderating home prices, in conjunction with gains in household income and declining mortgage rates, boosted affordability for potential home buyers.

Read More ›

Why The Stage Is Set For A Stronger Spring Home-Buying Season

By

Mark Fleming on March 21, 2019

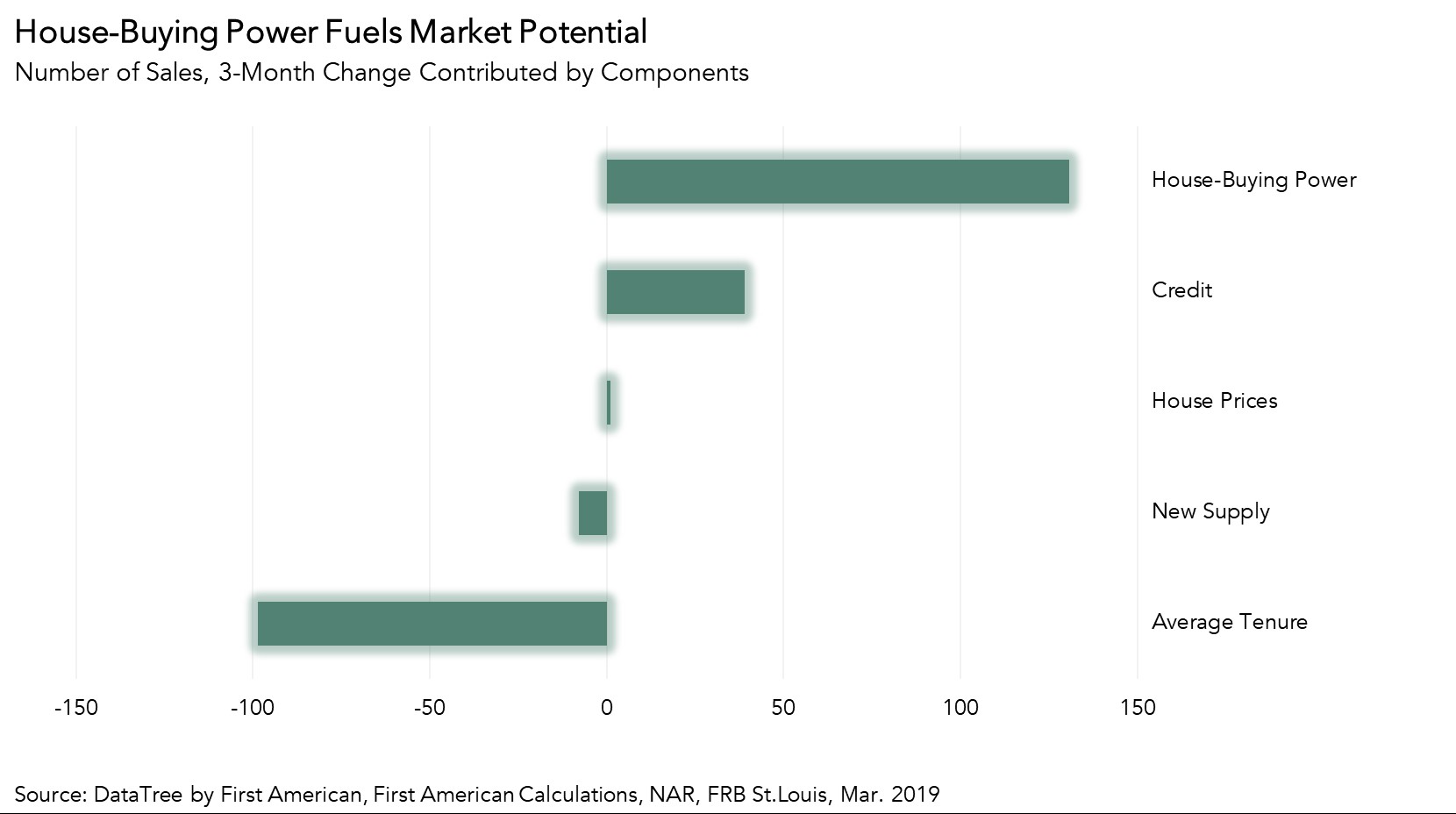

In February 2019, the housing market continued to underperform its potential, but showed signs of promise leading into the spring home-buying season. Actual existing-home sales are 2.5 percent below the market’s potential, according to our Potential Home Sales model. That means the market has the potential to support 127,000 more home sales at a ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

What Triggered the Biggest Increase in House-Buying Power in Five Years?

By

Mark Fleming on February 25, 2019

Housing affordability is a function of three economic drivers: nominal house prices, household income and mortgage rates. When incomes rise, consumer house-buying power increases. Declining mortgage rates or declining nominal house prices also increase consumer house-buying power. Our Real House Price Index (RHPI) uses consumer house-buying power ...

Read More ›

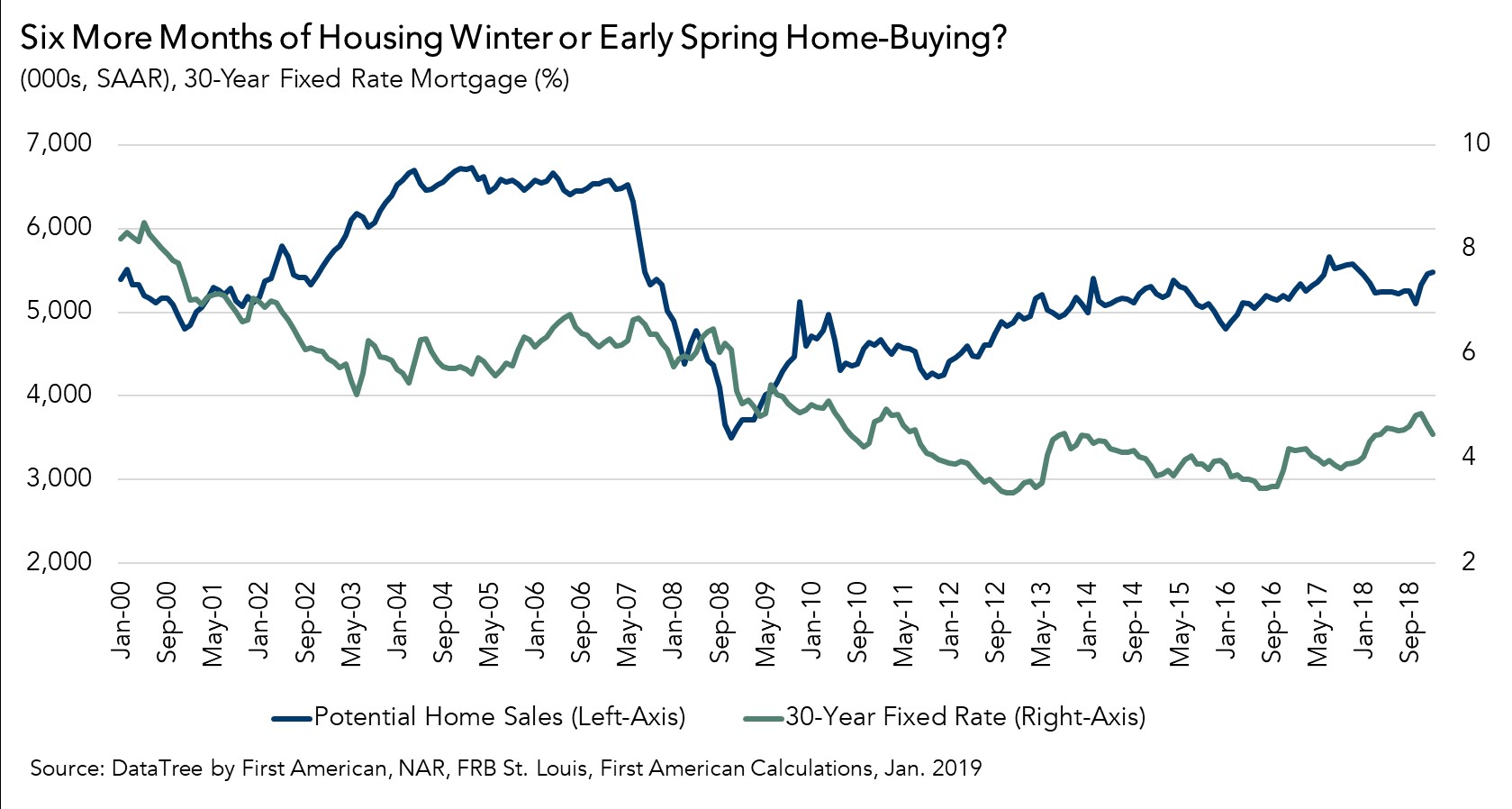

Six More Months of Housing Winter or Early Spring Home-Buying Season?

By

Mark Fleming on February 20, 2019

In the first month of the new year, the housing market continued to underperform its potential, but gave us signs of promise for the future. Actual existing-home sales are 5.3 percent below the market’s potential, according to our Potential Home Sales model. That means the market has the potential to support 293,000 more home sales than the ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales