Millennials Remain Driving Force in Housing Market Potential

By

Mark Fleming on January 19, 2022

The final Potential Home Sales Model report of 2021 revealed that market potential ended the year on a strong note. While the winter months are traditionally real estate’s slow season, our measure of the market potential for existing-home sales showed the housing market again broke with traditional seasonal patterns by ending the year strong. In ...

Read More ›

Affordability Falls to its Lowest Level Since 2008

By

Mark Fleming on December 27, 2021

Affordability sank to its lowest level since 2008 in October, as two of the three key drivers of the Real House Price Index (RHPI) swung in favor of reduced affordability relative to one year ago. Higher mortgage rates and record year-over-year nominal house price growth triggered a nearly 20 percent jump in the RHPI (rising RHPI values indicate ...

Read More ›

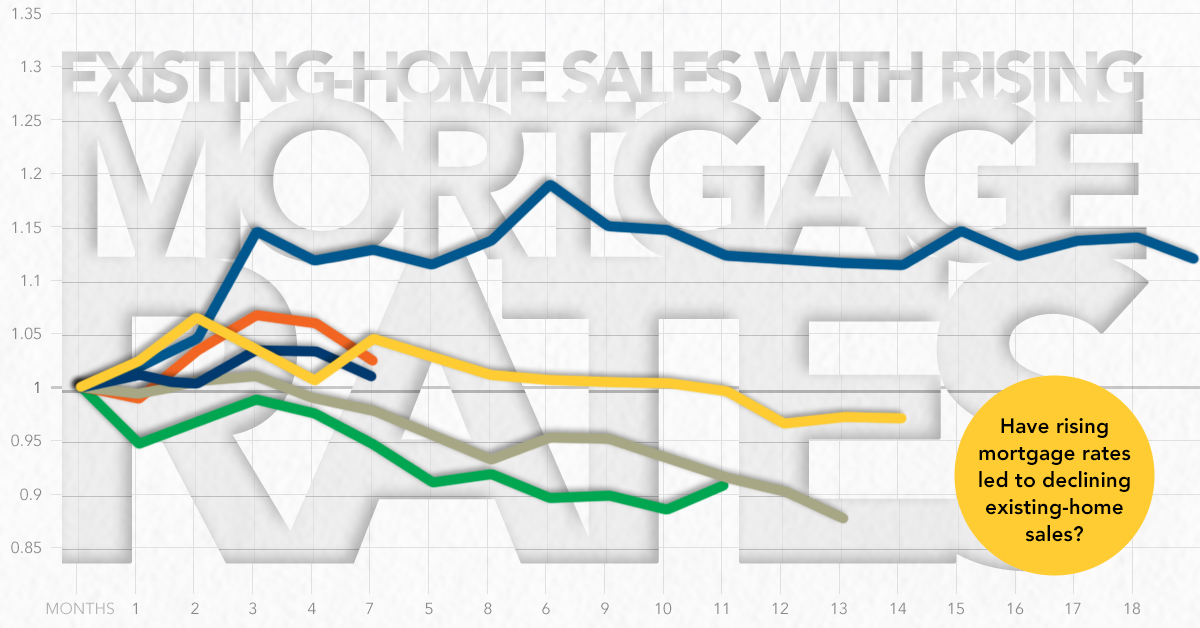

Will Rising Mortgage Rates Slow Sales?

By

Mark Fleming on December 22, 2021

In November 2021, housing market potential decreased modestly month-over-month to a 6.26 million seasonally adjusted annualized rate (SAAR), according to our Potential Home Sales (PHS) model. Housing market potential in November increased 7.2 percent compared with one year ago and remains significantly higher than the pre-pandemic level. Demand ...

Read More ›

What’s the Outlook for the Housing Market in 2022?

By

Odeta Kushi on December 20, 2021

At first glance, the outlook for the 2022 housing market is a familiar one – strong millennial demand for homes constrained by an ongoing, historic housing supply shortage. This supply-demand imbalance generated the record house price appreciation seen in 2021 and, given this dynamic shows few signs of changing, we expect house price appreciation ...

Read More ›

Why House Prices Still Have Room to Run

By

Mark Fleming on November 30, 2021

According to the Real House Price Index (RHPI), which measures housing affordability in the context of changes in consumer house-buying power, affordability in September declined to its lowest level since 2008. Two of the three components of consumer house-buying power swung toward declining affordability. Record nominal house price growth and ...

Read More ›

Why Housing Market Potential Keeps Rising

By

Mark Fleming on November 22, 2021

In September 2021, existing-home sales increased to a 6.29 million seasonally adjusted annualized rate (SAAR). Prior to the pandemic, the housing market had not reached this sales pace since 2006. We may see another strong month in October, as housing market potential increased 10.3 percent compared with one year ago to 6.27 million (SAAR), ...

Read More ›