In November 2021, housing market potential decreased modestly month-over-month to a 6.26 million seasonally adjusted annualized rate (SAAR), according to our Potential Home Sales (PHS) model. Housing market potential in November increased 7.2 percent compared with one year ago and remains significantly higher than the pre-pandemic level. Demand for homes was strong prior to the pandemic and then housing demand accelerated amid the pandemic as buyers wanted more space, enjoyed more geographic flexibility in where they could live, and benefitted from increased house-buying power driven by record-low mortgage rates. While many of these factors will remain consistent in 2022, mortgage rates are widely expected to rise, so how will that impact home sales?

“Rising mortgage rates don’t change the other key housing market fundamental -- strong millennial home buyer demand, which will continue to underpin the 2022 housing market.”

What Can We Learn from Previous Rising-Rate Eras?

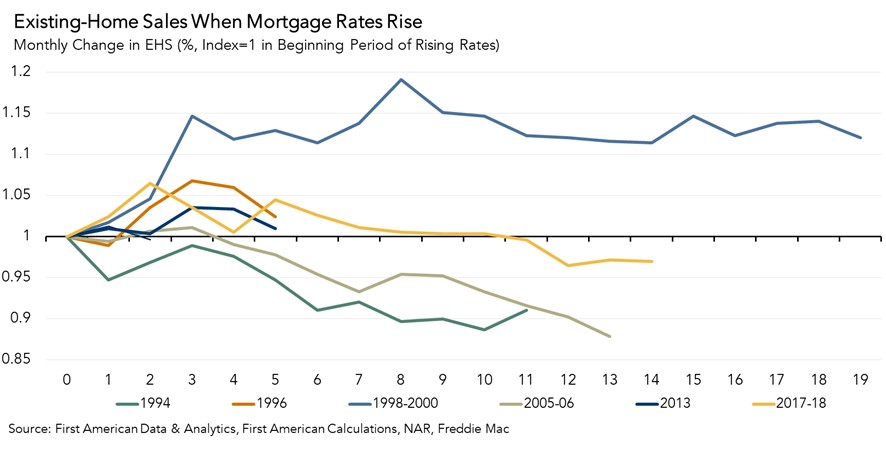

Existing-home sales don’t always slow down when mortgage rates rise and are often more influenced by why mortgage rates are rising. Looking back over almost 30 years, there have been six significant rising-mortgage rate eras. Rising mortgage rates led to declining existing-home sales in two of the six rising-rate eras.

The 2005-2006 rising-rate era preceding the 2008 housing crisis stands out because sales fell dramatically. Rising mortgage rates in that period were driven by the Federal Reserve’s efforts to tame above-target inflation. The Fed’s moves worked, as existing-home sales declined by more than 12 percent in approximately one year. Existing-home sales also decreased in the 1994 rising-rate era, as the Fed increased the federal funds rate to prevent strong economic growth from feeding inflation.

However, other than these two examples, existing-home sales have demonstrated resilience to rising-rate environments. For example, mortgage rates spiked in the summer of 2013 when the Fed indicated it would taper its quantitative easing policy of buying Treasury bonds and mortgage-backed securities. But this ‘taper tantrum’ had no negative impact on existing-home sales.

Most recently, in 2017, it took almost a year of rising rates, before the pace of existing-home sales declined below the pace of sales seen before rates started to rise. Context matters and each rising-rate era is different. The housing market’s response to rising rates depends on the reason why rates are rising.

Growing Economy, Millennial Demand Mitigate Impact of Rising Mortgage Rates

Our Potential Home Sales model indicates household formation, higher house-buying power, and looser credit conditions continued to drive housing market potential relative to one year ago. However, limited inventory continued to dampen housing market potential, a dynamic we expect to persist in 2022. While rising mortgage rates may reduce affordability in 2022, it’s important to note that each rising-rate environment is different and influenced by a variety of economic trends, and the rising rates we see today are driven by a recovering economy. Rising mortgage rates don’t change the other key housing market fundamental – strong millennial home buyer demand, which will continue to underpin the 2022 housing market.

November 2021 Potential Home Sales

For the month of November, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales decreased to a 6.26 million seasonally adjusted annualized rate (SAAR), a 0.3 percent month-over-month decrease.

- This represents a 79.5 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales increased 7.2 percent compared with a year ago, a gain of 422,000 (SAAR) sales.

- Currently, potential existing-home sales is 533,000 (SAAR), or 7.9 percent below the pre-recession peak of market potential, which occurred in April 2006.

Market Performance Gap

- The market for existing-home sales outperformed its potential by 9.4 percent or an estimated 586,000 (SAAR) sales.

- The market performance gap increased by an estimated 87,000 (SAAR) sales between October 2021 and November 2021.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.