Why the Student Loan Debt Burden is Overstated

By

Odeta Kushi on November 19, 2020

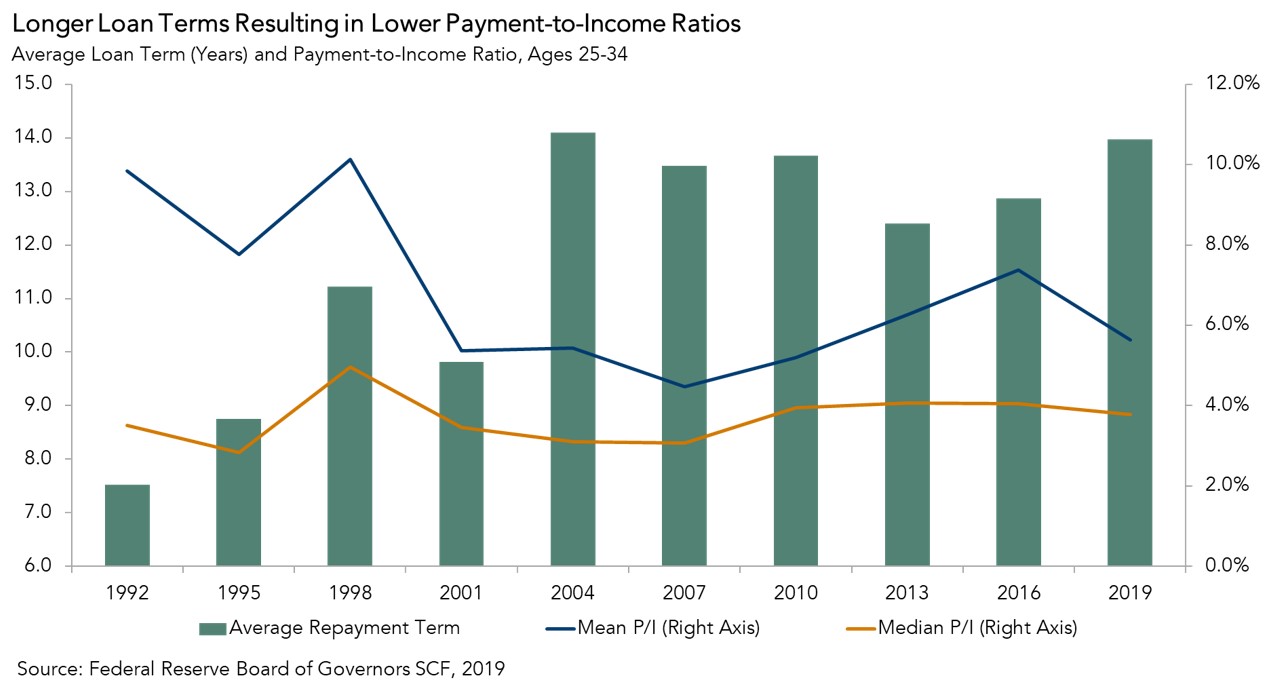

Student loans are often cited as an insurmountable barrier to homeownership for young home buyers. It is true that student loan debt levels are higher today than a generation ago, but is it preventing potential home buyers from saving for a down payment? The recently released 2019 Survey of Consumer Finances data highlights some important trends ...

Read More ›

What a Pandemic-Driven Shift in the Labor Market Could Mean for Housing

By

Mark Fleming on November 12, 2020

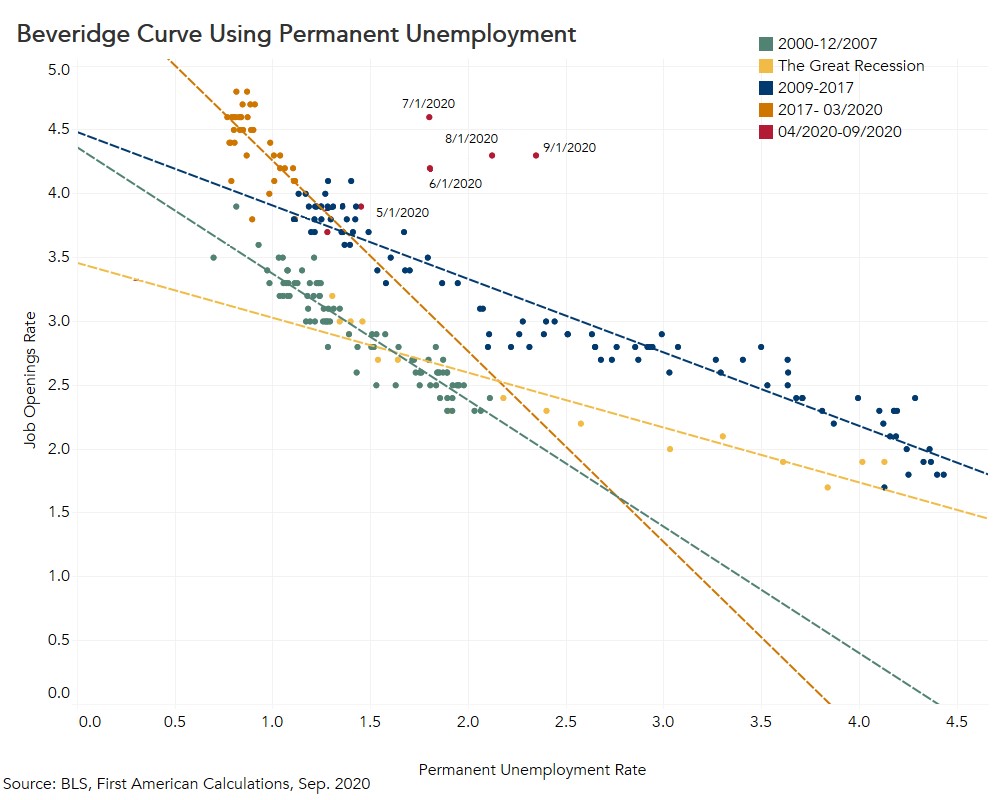

The October jobs report exceeded consensus expectations for job growth, yet the labor market’s rebound continues to slow. Higher frequency data from weekly jobless claims confirm the slowdown, as the level of new jobless filings is not falling as quickly in recent months. COVID-19 cases are on the rise and there is increasing likelihood of a ...

Read More ›

Homeownership Remains Strongly Linked to Wealth-Building

By

Odeta Kushi on November 5, 2020

Economists study homeownership and policymakers often emphasize it because homeownership is an effective way to build wealth, especially for low-income households. In fact, quantifying the wealth-building power of homeownership shows that home is not only where your heart is, but also where your wealth is.

Read More ›

Myth or Reality? The Pandemic-Driven Acceleration to the Suburbs

By

Odeta Kushi on October 15, 2020

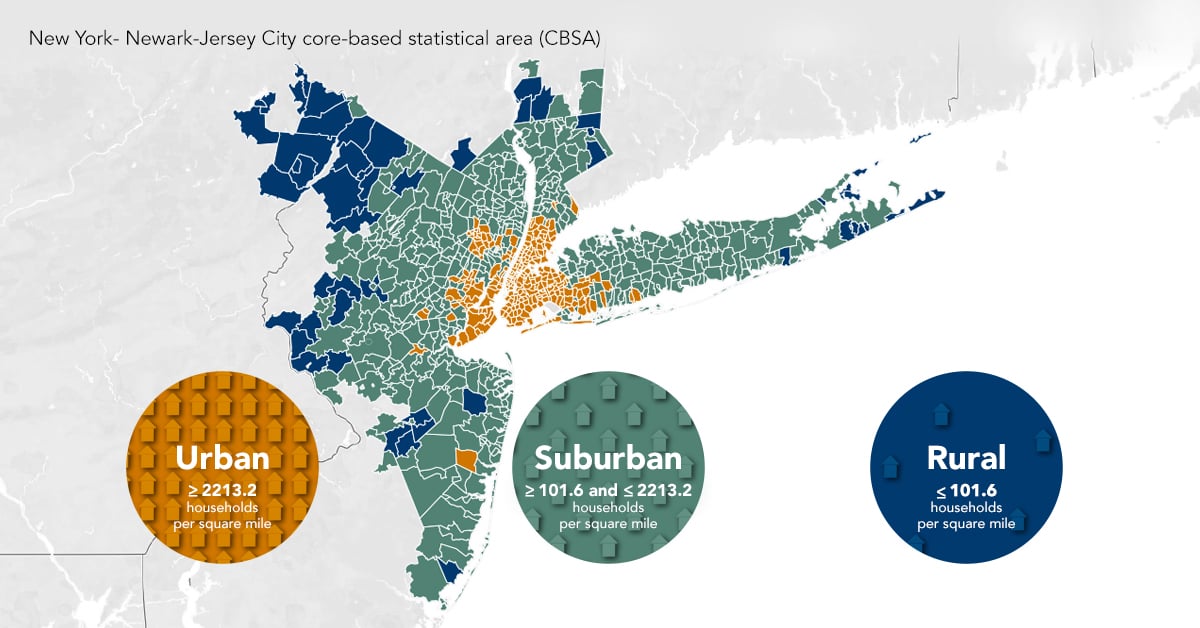

Several reports indicate that the pandemic has triggered a mass flight from urban centers to the suburbs. It’s true that a move to the suburbs usually offers more space for telework and stay-at-home activities. But, as millennials have been aging into the key lifestyle decisions associated with a greater likelihood of purchasing a home (marriage ...

Read More ›

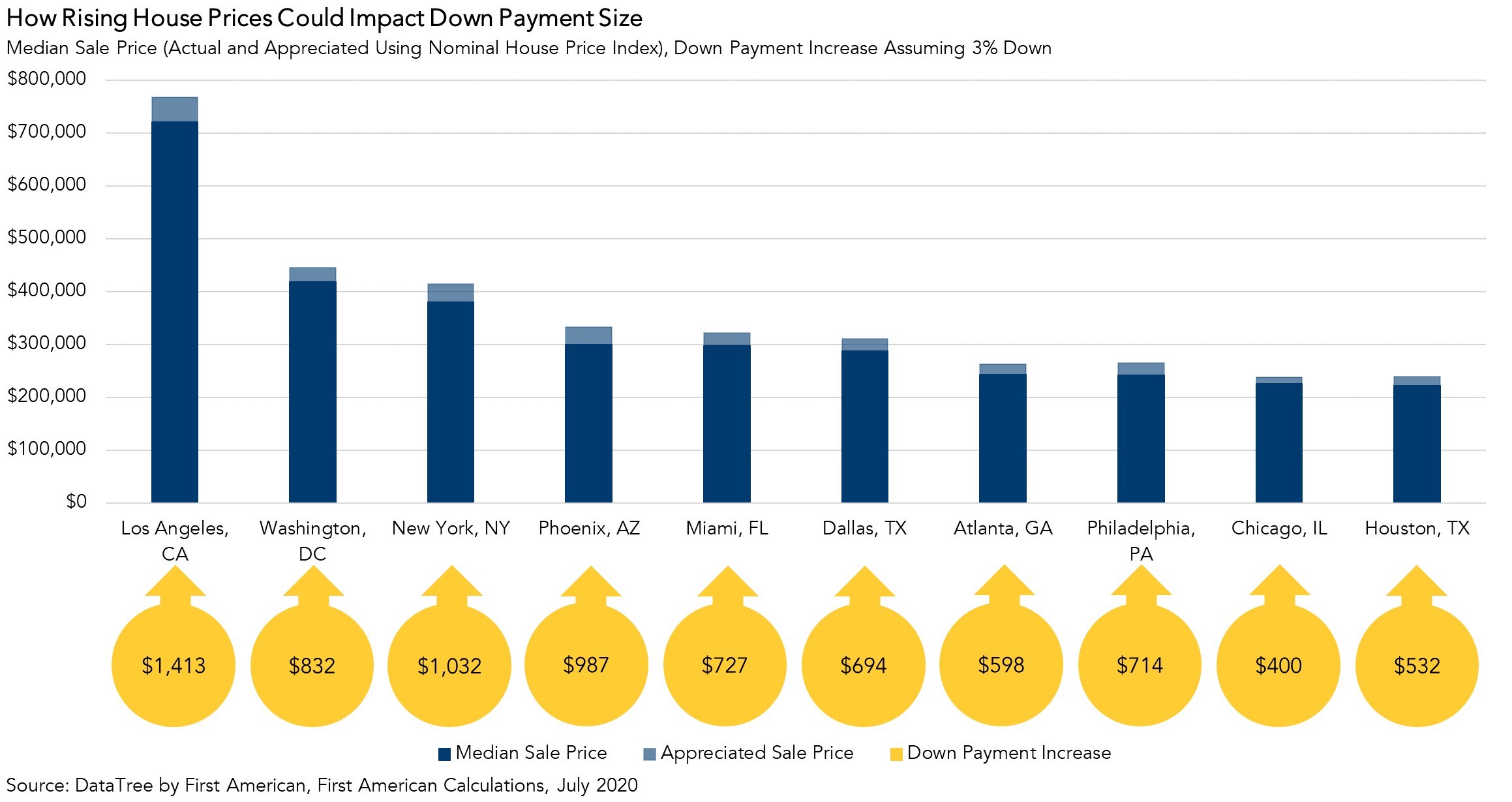

How Rising House Prices Could Impact Down Payment Size

By

Odeta Kushi on September 17, 2020

After hitting a low point in the spring, the housing market has rebounded strongly during the pandemic. Historically low mortgage rates have fueled demand and increased home buyers’ purchasing power amid an ongoing housing supply shortage. The widening imbalance between housing supply and demand has pushed house prices higher. Some now fear that ...

Read More ›

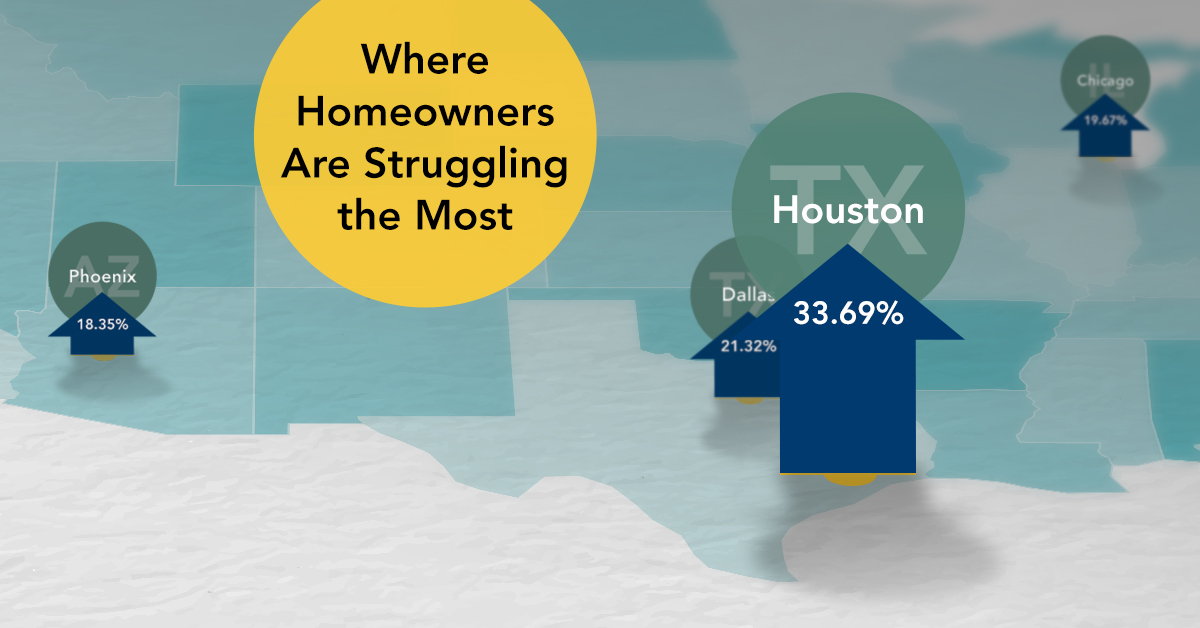

The Silver Lining for Cities with the Most Homeowner Distress

By

Odeta Kushi on September 3, 2020

Based on our analysis last month, a wave of foreclosures similar to levels seen during the Great Recession is unlikely to occur despite the continuing economic hardship caused by the COVID-19 pandemic. Homeowners are in a much better position to weather this crisis, in part because household equity is near a three-decade high, negating one of the ...

Read More ›