After hitting a low point in the spring, the housing market has rebounded strongly during the pandemic. Historically low mortgage rates have fueled demand and increased home buyers’ purchasing power amid an ongoing housing supply shortage. The widening imbalance between housing supply and demand has pushed house prices higher. Some now fear that the rise in home prices is keeping first-time home buyers on the sidelines by increasing the largest upfront cost for a home – namely, the down payment.

“For those who were already planning to buy and had a down payment lined up, the additional down payment burden from rising house prices may be a lot less than many expect.”

Down Payment Myths

As home prices rise, the amount needed for a down payment, a fixed percentage of the home’s purchase price, will also increase. The question is whether that increase is large enough to constitute a real hurdle for home buyers. Several myths surround the down payment and chief among them is the misconception that the down payment needs to be at least 20 percent of the price of the home. In reality, home buyers can put down as little as 3 percent and, increasingly, more home buyers have taken advantage of that option, specifically first-time buyers.

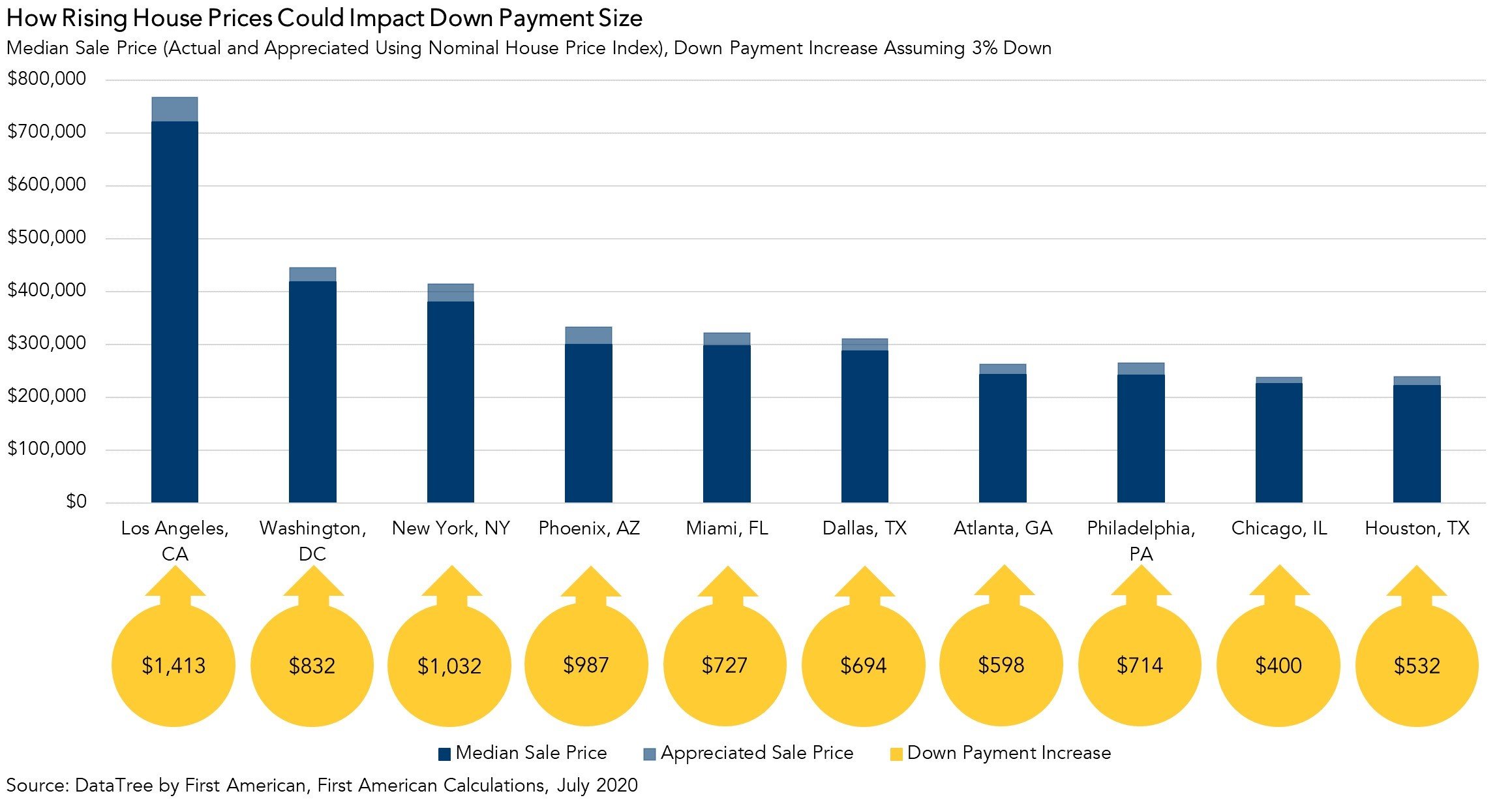

Comparing how house price appreciation impacts the amount needed for a down payment can help dispel the notion that price appreciation is pushing down payments out of reach for home buyers. Given the median home price for the top 10 most populous U.S. markets and assuming a 3 percent down payment, the amount by which the down payment would increase if annual house price appreciation in each market remained at July’s pace, varying from 6 to 11 percent, ranges from $400 to as much as $1,400.

According to data from DataTree by First American, a home buyer in Phoenix purchasing the median-priced home of $300,000 in July, would need a down payment of $9,000 at 3 percent down. If the home appreciates by 11 percent (July’s house price growth rate in Phoenix) to a new sales price of just over $332,900, the down payment amount would increase to $9,987 – a relatively small increase of $987 compared with the cost of the house. However, if the first-time home buyer plans to put down 20 percent, the down payment amount would increase by $6,580 – from $60,000 to $66,580. The low down payment loan reduces the increased down payment burden by over $5,500.

A down payment below 20 percent also incurs private mortgage insurance (PMI), usually between 0.5 and 1 percent of the loan amount. However, the PMI is a monthly cost, rather than an upfront one, and was likely already considered by a home buyer planning to put down the minimum amount.

Bottom Line

Potential first-time home buyers tend to be younger and do not have the equity from the sale of an existing home to bring to the closing table. The most significant impediment for first-time home buyers has always been and remains the challenge of saving the money for a down payment. However, first-time home buyers have a variety of low down payment options, so for those who were already planning to buy and had a down payment lined up, the additional down payment burden from rising house prices may be a lot less than many expect.

Ksenia Potapov contributed to this blog post.