Top Five Cities for Lower-Income Renters to Pursue the Dream of Homeownership

By

Odeta Kushi on April 14, 2021

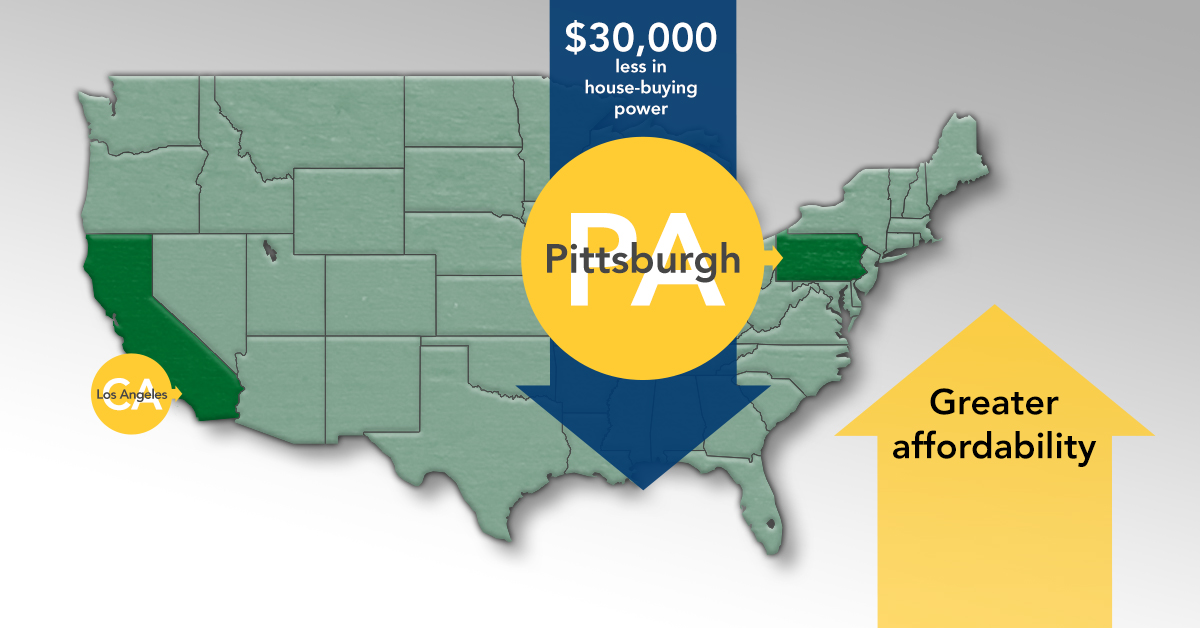

In the fourth quarter of 2020, the median renter experienced a 10 percent boost to their house-buying power relative to one year ago, but the share of homes they could afford to buy declined by 4 percentage points due to rising house prices, according to the First-Time Home Buyer Outlook Report. However, while we recently examined affordability ...

Read More ›

Homeownership First-Time Home Buyer Outlook Report Renter Affordability

The Good, the Bad and the Maybe Ahead of Spring Home Buying

By

Mark Fleming on March 19, 2021

In February 2021, housing market potential increased to its highest level since 2007, despite the largest month-over-month jump in mortgage rates since October 2019. Housing market potential rose 1.3 percent in February relative to the previous month, and 12.2 percent year-over-year. While rising average tenure length was the largest drag on ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

Will the Pandemic “She-cession” Derail Growth in Homeownership Among Single Women?

By

Odeta Kushi on March 11, 2021

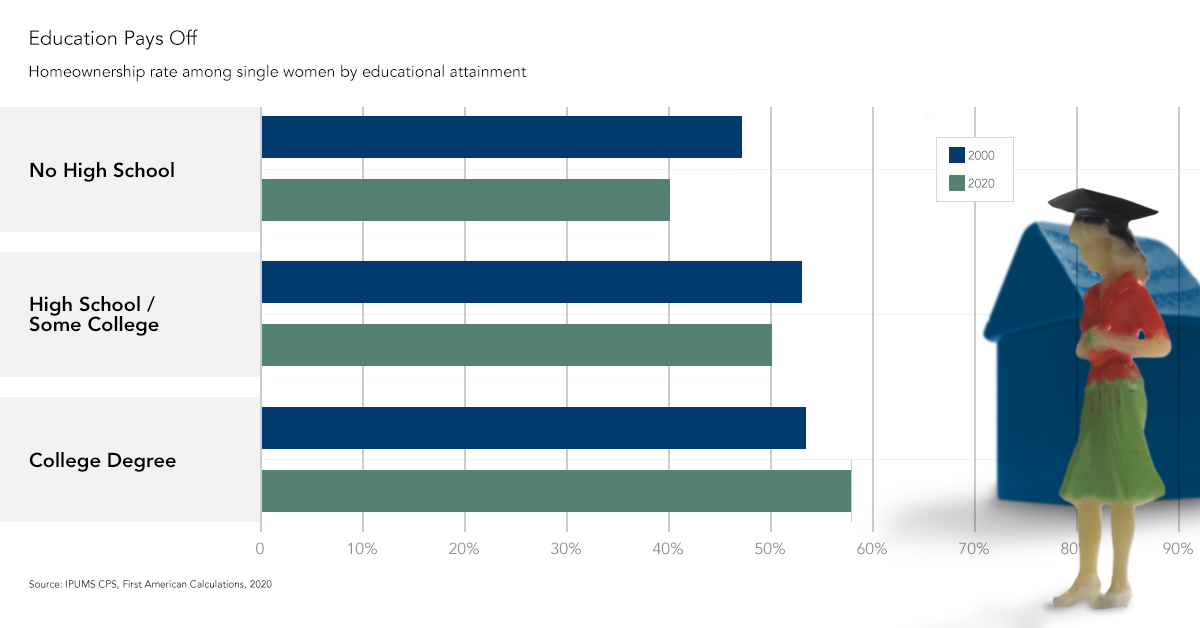

During Women’s History Month, it’s important to reflect on the progress that single women have made in achieving one of the main tenets of the American Dream - homeownership. According to our analysis of anonymized household-level survey data, following an overall decline in the homeownership rate among single women in the aftermath of the Great ...

Read More ›

Interview with Yahoo! Finance: “Single Women are Clearly Embracing Wealth Creation Through Home Buying”

By

FirstAm Editor on March 8, 2021

First American Deputy Chief Economist Odeta Kushi was interviewed on Yahoo! Finance earlier this month, explaining why women homeownership rates are on the rise and the outlook for the housing market in the year ahead.

Read More ›

Housing In The News Interest Rates Affordability Homeownership

Don’t Overlook the Benefit of Equity When Considering Whether to Rent or Own

By

Odeta Kushi on January 25, 2021

As nominal house prices have soared over the last year, many potential first-time home buyers may be reconsidering whether to buy or to continue renting. Weighing the monthly cost of renting versus owning a home is a key factor in determining if it makes financial sense to buy a home. This update to a 2019 analysis, which found that owning was ...

Read More ›

Will Record Equity Levels Prevent a Foreclosure Tsunami?

By

Odeta Kushi on December 23, 2020

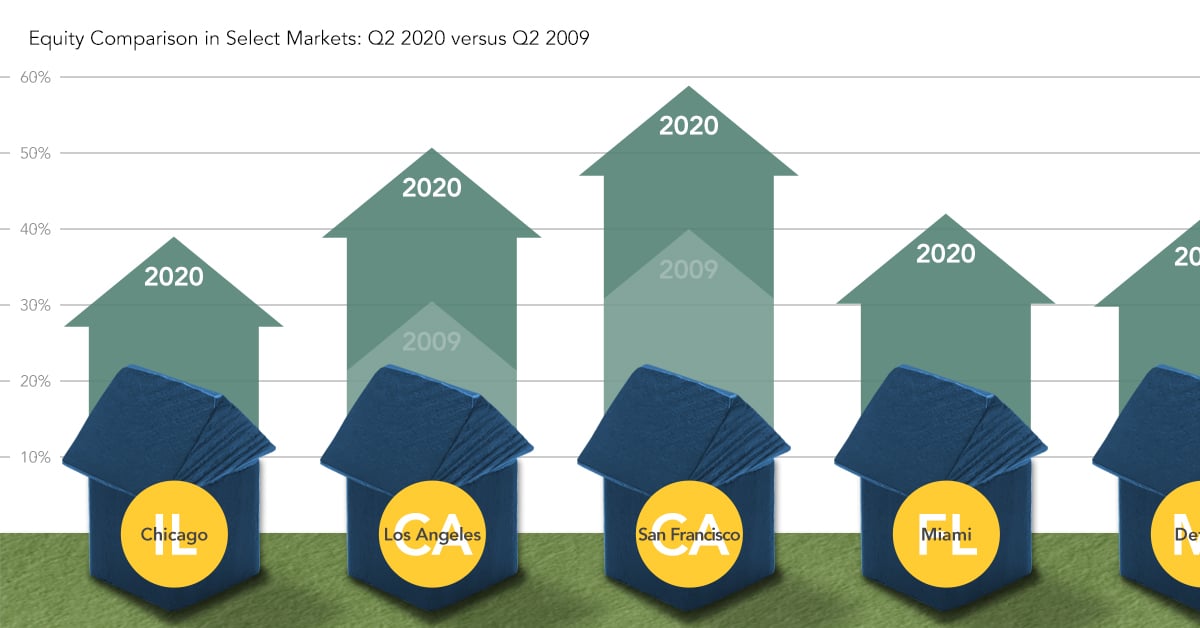

In spite of the record-setting spike in unemployment at the outset of the pandemic, foreclosure activity in 2020 has plunged to an all-time low. The fiscal stimulus and foreclosure moratorium clearly made a difference, helping thousands of homeowners keep their homes. At the peak in early June, 8.6 percent of all mortgage loans were in ...

Read More ›