As nominal house prices have soared over the last year, many potential first-time home buyers may be reconsidering whether to buy or to continue renting. Weighing the monthly cost of renting versus owning a home is a key factor in determining if it makes financial sense to buy a home. This update to a 2019 analysis, which found that owning was cheaper than renting in all but four markets in California, uses data from 2020 to see how the surge in house prices may have shifted the balance of owning versus renting.

“Once you include the equity benefit of price appreciation, owning made more financial sense than renting in 48 out of the 50 top markets, with the only exceptions being San Francisco and San Jose, Calif.”

Rapid House Price Appreciation – Better to Rent?

In 2020, growing demand for homes against limited supply fueled rapid house price appreciation, which reached 10.9 percent in October relative to the year before. Meanwhile, annual rent growth slowed to 0.7 percent in October 2020, compared with 3.4 percent last October. Surely this must imply that renting was the better financial choice in 2020, right?

The answer is ‘yes’ if you simply compare median rent to the monthly costs of owning a home. There are a number of monthly costs homeowners have to pay that renters do not, including taxes, repairs, homeowner’s insurance and the monthly mortgage payment. The analysis creates a monthly cost profile for a hypothetical first-time home buyer, using the average 30-year, fixed-rate mortgage in 2020 and assuming a 5 percent down payment on a house at the 25th percentile sale price. Why 25th percentile? A first-time home buyer is more likely to buy a less expensive home. After accounting for total monthly homeownership costs for a hypothetical first-time home buyer and comparing it with the median rent by market, renting was a better financial choice in 32 of the top 50 markets. However, this comparison leaves out a key financial benefit of homeownership.

Don’t Forget the Equity

Monthly homeownership costs ignore a major financial advantage of homeownership–the accumulation of equity from house price appreciation. To factor in the equity benefit, the analysis splits annual house price appreciation in each market across 12 months to create a monthly equity gain from appreciation and then subtracts the gain from the total monthly cost of homeownership. In some markets, the monthly equity gain was greater than all the combined costs, resulting in a negative monthly homeownership cost. This effectively means that the home was paying the homeowner in these markets, which include Phoenix, Salt Lake City, Providence, R.I., Tampa, Fla., and Columbus, Ohio.

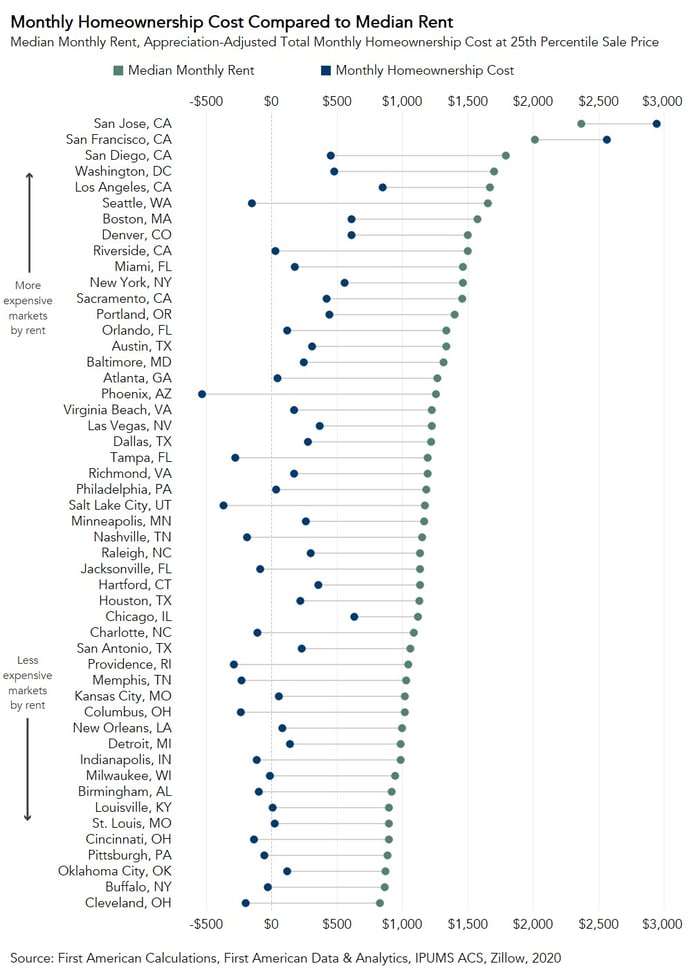

Once you include the equity benefit of price appreciation, owning made more financial sense than renting in 48 out of the 50 top markets, with the only exceptions being San Francisco and San Jose, Calif. The graph below shows the cost of renting versus house price appreciation-adjusted owning by market. The wider the gap between the two points, the more financially advantageous it was to own rather than rent.

Consider a potential first-time home buyer in Phoenix, the most advantageous market to own rather than rent. If the home buyer put a 5 percent down payment on a $235,000 home with a mortgage rate of 3 percent, the home buyer would have paid roughly $950 monthly in principal and interest, and an estimated $510 in taxes, repairs, private mortgage insurance, and homeowner’s insurance costs. The home buyer’s total monthly cost of ownership was $1,470. Between 2019 and 2020, the average house price in Phoenix increased 10.2 percent, which equates to a monthly equity benefit of nearly $2,000 each month, making the total monthly cost was -$530, or a net gain. Compared with the median monthly cost of rent in Phoenix, $1,260, it made much more financial sense to buy rather than to rent in 2020.

Once you a purchase a home, the equity benefit of house price appreciation makes owning a home a better financial decision than renting in most markets. Of course, the decision to own or to rent includes many other factors, especially the timing of other key lifestyle decisions, such as marriage and family formation. As millennials continue to age into their prime home-buying years, a home will not only be a smart financial choice, but a necessary lifestyle choice for many.

Methodology

The rent-versus-buy analysis compares rent with the cost of ownership in the 50 largest U.S. metropolitan areas. Median rent is derived from the 2019 American Community Survey microdata, the latest year available, and extrapolated to 2020 using the Zillow Observed Rent Index. Home sale prices, property tax rates, and house price appreciation by market are derived from First American Data & Analytics data. All data for 2020 reflects the time period from January through October 2020. The monthly cost of ownership is calculated for payment, interest, taxes and insurance (PITI), assuming a down payment of 5 percent and an interest rate of 3.11 percent (the average for a 30-year, fixed-rate mortgage in 2020). Because the down payment assumed is less than 20 percent, private mortgage insurance is added to the cost of ownership at a rate of 0.75 percent of the home value. Annual homeowner’s insurance is assumed to be 0.4 percent of the home value, and annual repair costs are assumed to be 1 percent of the home value. To account for the accumulation of equity, the average rate of house price appreciation between 2019 and 2020 is multiplied by the sale price. The amount is then divided by 12 and subtracted from the monthly cost of homeownership, resulting in the house price appreciation-adjusted monthly homeownership cost.

Ksenia Potapov contributed to this blog post.