Homeownership is often touted as one of the most effective ways to build wealth, especially for lower income households, for several reasons. Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners. Equity gains can make the cost of owning a home cheaper than renting one. Additionally, a 30-year, fixed-rate mortgage, especially for those who locked in a historically low rate, can be a great inflation hedge. But just how influential a role does homeownership play in wealth creation?

“Despite the risk of volatility in the housing market, homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.”

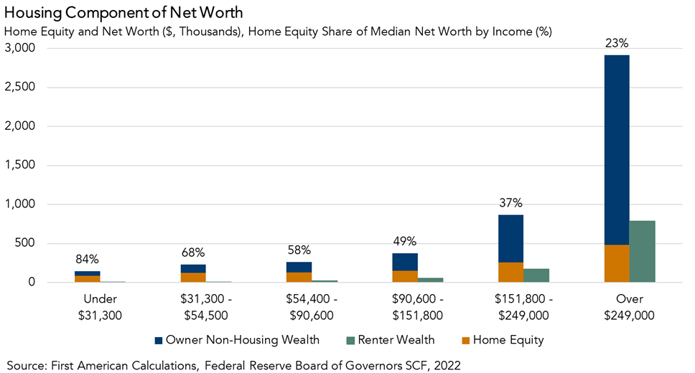

For Most, Housing is the Largest Component of Net Worth

According to the 2022 Survey of Consumer Finances (SCF), a triennial survey that collects detailed accounts of households’ finances, the median homeowner has 38 times the household wealth of a renter. Homeowners are wealthier than renters at every income level. For families in the bottom 20 percent of incomes, median net worth was nearly $147,000 for homeowners, and only $3,400 for renters.

More importantly, housing is the single largest component of net worth for most households. The lower the income of a homeowning household, the greater the share of its wealth that comes from homeownership. This pattern has remained consistent over the last three decades, according to historical SCF data. In 2022, home equity (the value of a home less home-secured debt) accounted for approximately 84 percent of the total net worth of the lowest income households. For households in the middle of the income distribution, home equity represented between 68 and 37 percent of net worth, but for households in the top 10 percent of the income distribution that share was only 23 percent. While the wealth of lower income homeowning households is primarily tied to a home, households further up the income distribution tend to own a greater variety of financial assets and non-financial assets other than residential property.

Home Equity Increases Over Time

The difference in the composition of wealth means that fluctuations in home prices will have a much bigger impact on the wealth of lower income families than of those that have a mix of other assets. However, historically housing has steadily appreciated over time and rarely experiences major declines. On average, homeowners experience equity gains of 3 to 4 percent per year in the long run.

House price appreciation between 2019 and 2022, however, was well above average. Median home equity increased 44 percent between 2019 and 2022, from $139,000 to $201,000. The increase was the largest on record over the history of the modern SCF, dating back to 1989.

It’s possible that what went up so quickly, must come down at some point. There are certainly risks from homeownership, and its benefits are not uniform across all markets. Real estate is local, and some markets may experience strong price growth, while others experience price declines. But, despite the risk of volatility in the housing market, homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.