Demographic trends are a fundamental driver of housing demand and supply and analyzing them can help us anticipate how many people will need housing, as well as roughly when, where and what kind of housing. During the pandemic, the peak of millennial demand for homeownership coincided with record-low mortgage rates and a shortage of homes for sale, creating a perfect storm that resulted in double-digit annual house price growth. As millennials continue to age into their prime home-buying years, while baby boomers begin to age out, the question is, how will demographics shape housing demand and supply dynamics in the coming years?

“Demographic trends dictate demand and supply in the housing market and, though they may move slowly, they are hard to outrun.”

30s are the New 20s

The homeownership rate for millennials lags behind their generational predecessors. At age 30, the millennial homeownership rate is approximately 6 percentage points lower than that of their generational predecessors, Generation X, at the same age. That’s largely because millennials have prioritized their education, which takes time and money, and have delayed marriage and family formation, which are motivators for and are correlated with homeownership. Previous generations made these lifestyle choices in their 20s, millennials are making them in their early-to-mid 30s. As evidence of this trend, the homeownership rate gap between 40-year-old millennials and Generation X is significantly narrower, at just 2 percentage points.

Today, millennials, the largest generation to date, are aging into their 30s. The population of 30-to-39-year-olds will continue increasing through at least 2030, according to Census Bureau population projections. Additionally, millennials’ higher educational attainment is translating into higher earning power, a strong determinant of homeownership. As of 2022, over half of millennial households were homeowners, which still leaves many more young households who want to make the same transition. In the short term, high mortgage rates and reduced affordability may lead them to delay, but not forego, their transition into homeownership.

The Ageing-Out Transition

Just as younger generations have been transitioning into homeownership later and later compared with their predecessors, today’s seniors have been living longer and increasingly aging in place, which increases housing demand relative to previous generations. However, this transition, much like millennials’ transition into homeownership, is delayed but not forgone.

The number of people 80 years of age or older is expected to more than double between 2022 and 2040, increasing from 13 million to 28 million. As the baby boomer generation ages into their 80s, starting slowly in the late 2020s and picking up speed in the 2030s, they will likely begin downsizing and selling their homes, putting more housing supply on the market.

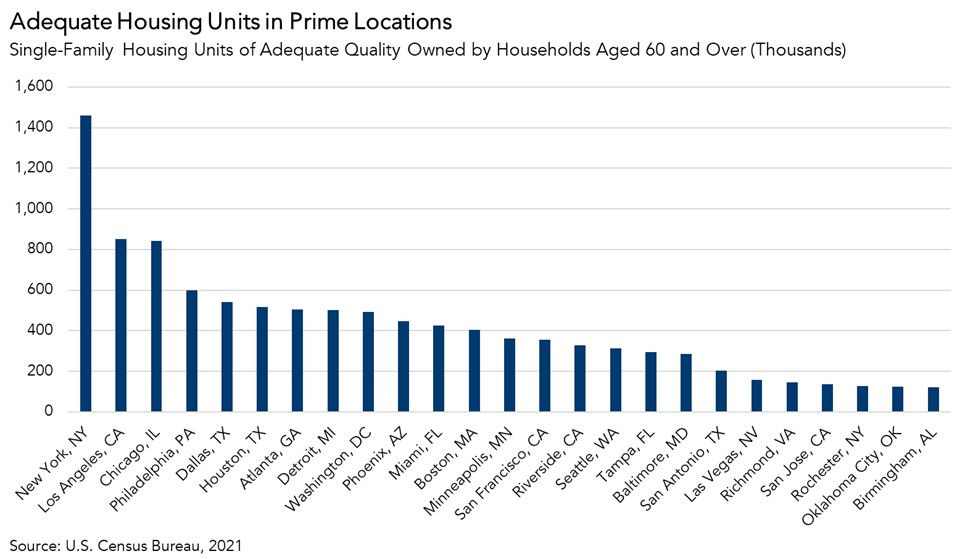

However, many of the homes being sold by baby boomers will need some work. Approximately 942,000 single-family homes owned by a head of household that is over the age of 60 are considered “inadequate” dwellings, according to the 2021 American Housing Survey (AHS). The AHS definition for an “inadequate” dwelling includes units with severe defects such as a lack of electricity or hot water, insufficient heating during the winter, or water leaks. That still leaves approximately 32 million single-family homes considered “adequate” in 2021. Of those, approximately 11 million were in the top 25 U.S. metropolitan areas, including 1.5 million units in New York, 852,000 in Los Angeles, and 490,000 in Washington, D.C.

Even so, many of the structures considered adequate would still likely need updating and remodeling to be brought up to date and be attractive to potential buyers. Given the highly sought-after locations of these housing units, there will likely be buyers willing to spend the money needed for updating and remodeling. Somewhat by default, the fixer-upper will be popular again.

Demographic Forces are Hard to Outrun

The demographics for home buying will remain very favorable in the coming years. Today, the housing market suffers from a shortage of housing inventory—a deficit of approximately 2 million housing units in early 2023—due to a combination of decade-long underbuilding and a demographic wave of demand from millennial home buyers. However, the generation behind the millennials, Generation Z, is smaller in size and will likely require fewer housing units. Over the next decade, as baby boomers age out of homeownership, the housing shortage may narrow and eventually disappear. Demographic trends dictate long-run demand and supply in the housing market and, though they may move slowly, they are hard to outrun.