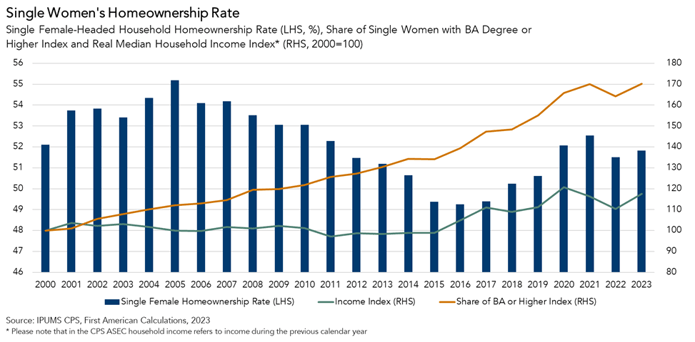

As we commemorate International Women’s Day and Women’s History Month, it’s an opportune time to celebrate the progress that single women have made in pursuit of the American Dream of homeownership. According to an analysis of anonymized household-level survey data, the homeownership rate among single, female-headed households (including widowed, separated, or divorced) increased to 51.8 percent in 2023, up from 51.5 percent a year ago and recovering from the most recent low of 49.3 percent in 2016.

In total, there were nearly 20 million single, female-headed homeowner households in 2023, outpacing single, male-headed households both in sheer number and homeownership rate. With the newly released 2023 data, the impact of the pandemic on women’s wealth and homeownership comes into focus, and single, female homeownership remains on an upward trajectory.

“Despite the ‘she-cession,’ single women are increasingly pursuing homeownership and reaping its wealth creation benefits.”

Pandemic Challenges Did Not Deter Wealth Creation

The pandemic took a disproportionate toll on women’s economic outlook, leading many to refer to the time period as a ‘she-cession.’ Women faced higher unemployment and dropped out of the labor force in greater numbers, while taking on more domestic work, such as housework and childcare. For single women in particular, this led to a decline in financial confidence in home buying, including concerns about gathering a down payment or affording a monthly mortgage. According to a Freddie Mac 2021 survey, 60 percent of head-of-household renters that were single women felt that homeownership was indefinitely out of reach.

Despite the challenges of the pandemic, wealth among single women has increased over the last several years. The median net worth of single, female-headed households increased from $54,400 in 2019 to $74,500 in 2022, according to the Survey of Consumer Finances (SCF), a triennial survey that collects detailed accounts of household finances. For single women who are also homeowners, median net worth increased from $199,400 to $266,500 in the same period. In fact, a primary residence is the single largest asset most homeowning households own, and for single women on average the value of the primary residence made up 66 percent of all assets in 2022. Homeownership remains an important driver of wealth creation, and women, especially single women, are taking note.

Women’s Homeownership Rate Poised to Increase Further

The fundamentals that have fueled the surge in homeownership among women show no signs of slowing. Women have increasingly pursued higher education, which is linked to higher household income, and higher income improves the likelihood of homeownership. The share of single women with a bachelor’s degree or higher has increased from 20 percent in the year 2000 to 34 percent in 2023. The share of single women with a graduate degree has more than doubled in the same timeframe. Similarly, real median household income for single women has increased approximately 15 percent from 2000 to 2022, resulting in greater house-buying power.

Single women are increasingly flexing that buying power to purchase homes, consistently outpacing single men two to one for the past several years. As educational attainment and household income for women continue to rise, it’s reasonable to expect increased homeownership to follow suit. Despite the ‘she-cession,’ single women are increasingly pursuing homeownership and reaping its wealth creation benefits.