Millennials, Walking Around Like They Own the Place

By

Ksenia Potapov on June 22, 2023

Amid the roller coaster housing market of the past few years, National Homeownership Month presents an opportunity to examine a fundamental driver of homeownership and housing demand—demographics. In fact, there’s one generation in particular that will remain a driving force of homeownership demand for years to come—the millennials.

Read More ›

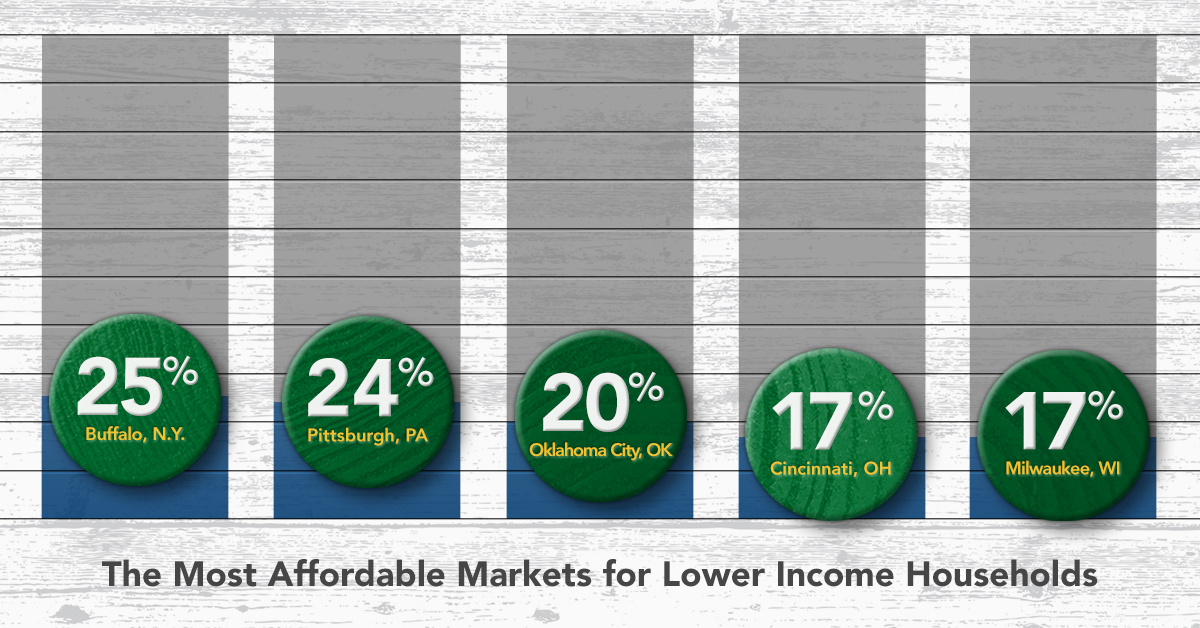

Outlook for First-Time Home Buyer Affordability is Mixed, but Affordable Markets Remain

By

Ksenia Potapov on May 30, 2023

National housing affordability has broadly declined compared with one year ago, especially for potential first-time home buyers. The median renter, who can also be considered the median first-time home buyer, could afford 34 percent of the homes for sale nationally in the first quarter of 2023, down from 45 percent a year earlier. The decline is ...

Read More ›

Homeownership First-Time Home Buyer Outlook Report Renter Affordability

For Single Women, Housing Remains Largest Component of Wealth Creation

By

Ksenia Potapov on March 10, 2023

As we celebrate International Women’s Day and Women’s History Month, it’s important to reflect on the progress that women, and single women in particular, have made in achieving one of the main tenets of the American Dream – homeownership. Since 2019, the number of single, female-headed households (including widowed, separated, or divorced) has ...

Read More ›

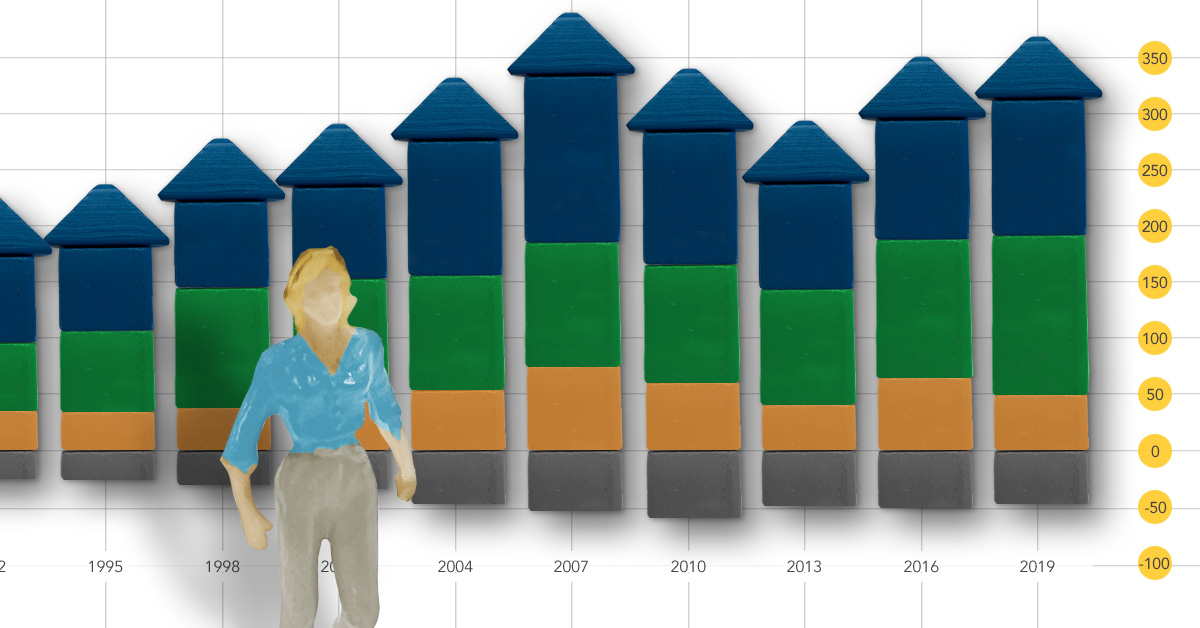

Will Foreclosures Rise as the Housing and Labor Markets Cool?

By

Ksenia Potapov on November 15, 2022

The pandemic brought about both policies to protect homeowners from losing their homes – foreclosure moratoriums and forbearance programs – and concerns that a wave of foreclosures would crash upon the housing market once the protections ended. The wave did not materialize, and foreclosures remain near historic lows. Now, the Federal Reserve is ...

Read More ›

Why Educated Millennials Still Hold the Key to Future Homeownership Demand

By

Odeta Kushi on October 10, 2022

The fall usually marks the beginning of the school year, seasonally cooler weather and a seasonally cooler housing market. But, this year, the housing market’s typical autumn slowdown is more pronounced as rapidly rising interest rates discourage buyers and sellers from entering the market. The housing market is not immune to business cycles, and ...

Read More ›

Fewer Affordable Options for Potential First-Time Home Buyers as Mortgage Rates Rise

By

Ksenia Potapov on October 5, 2022

As mortgage rates have steadily risen, affordability has decreased significantly for home buyers across income levels. However, affordability for the potential first-time home buyer – those currently renting – has faced the most pressure. Nationally, affordability for potential first-time home buyers declined 19 percentage points in June 2022 ...

Read More ›

Homeownership First-Time Home Buyer Outlook Report Renter Affordability