How Will Rising Mortgage Rates Impact Housing Affordability in 2019?

By

Mark Fleming on September 24, 2018

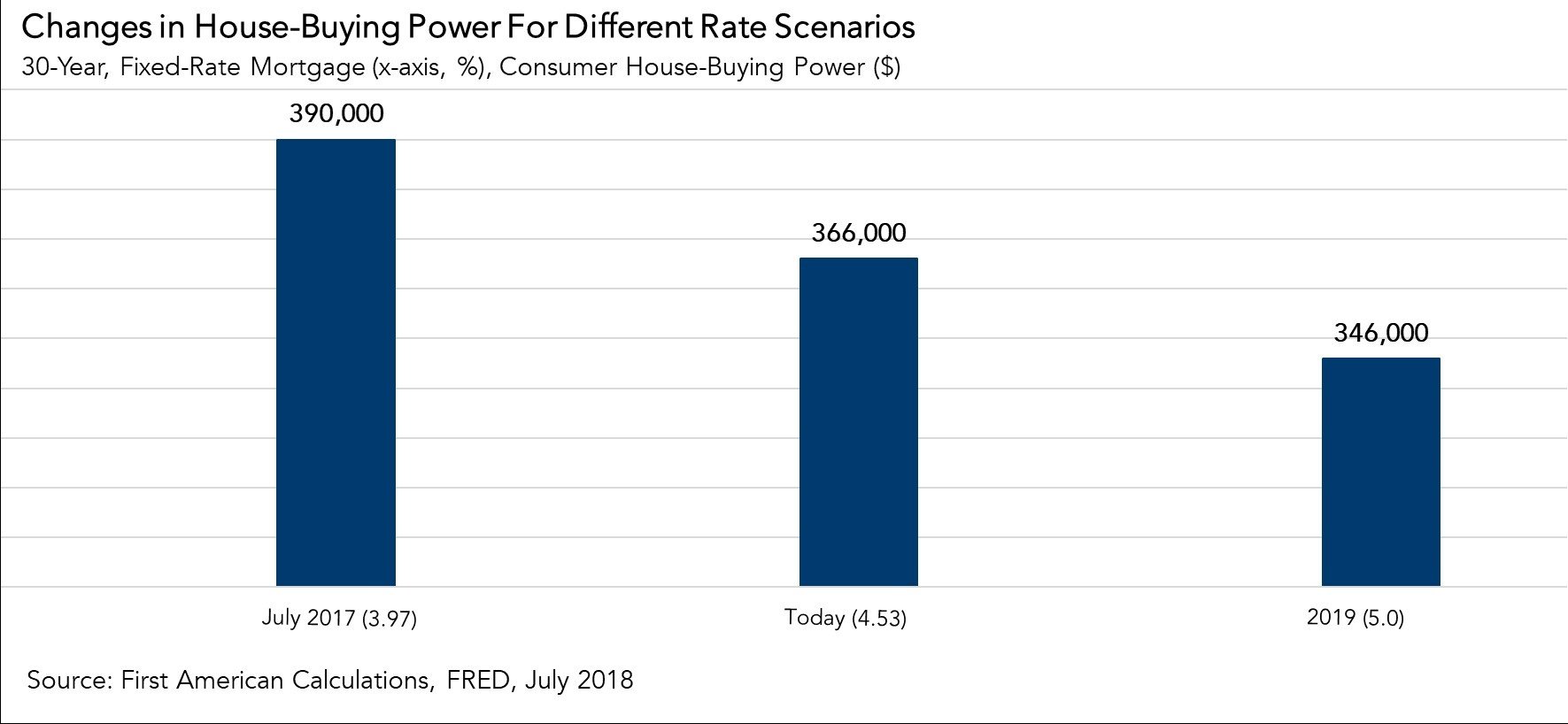

The Federal Open Market Committee (FOMC) meeting is just around the corner and a rate hike is almost certain, according to experts, which will trigger conversations about rising mortgage rates across the housing industry. While changes to the federal funds rate won’t necessarily spur further increases in mortgage rates, mortgage rates are expected ...

Read More ›

Interview on CNBC: Discussing the housing market’s potential shift toward a buyer’s market

By

FirstAm Editor on September 21, 2018

First American Chief Economist Mark Fleming was interviewed on CNBC earlier this week and discussed the housing market’s potential shift toward a buyer’s market and the challenges facing the market: affordability and interest rates.

Read More ›

Housing In The News Interest Rates Millennials Affordability

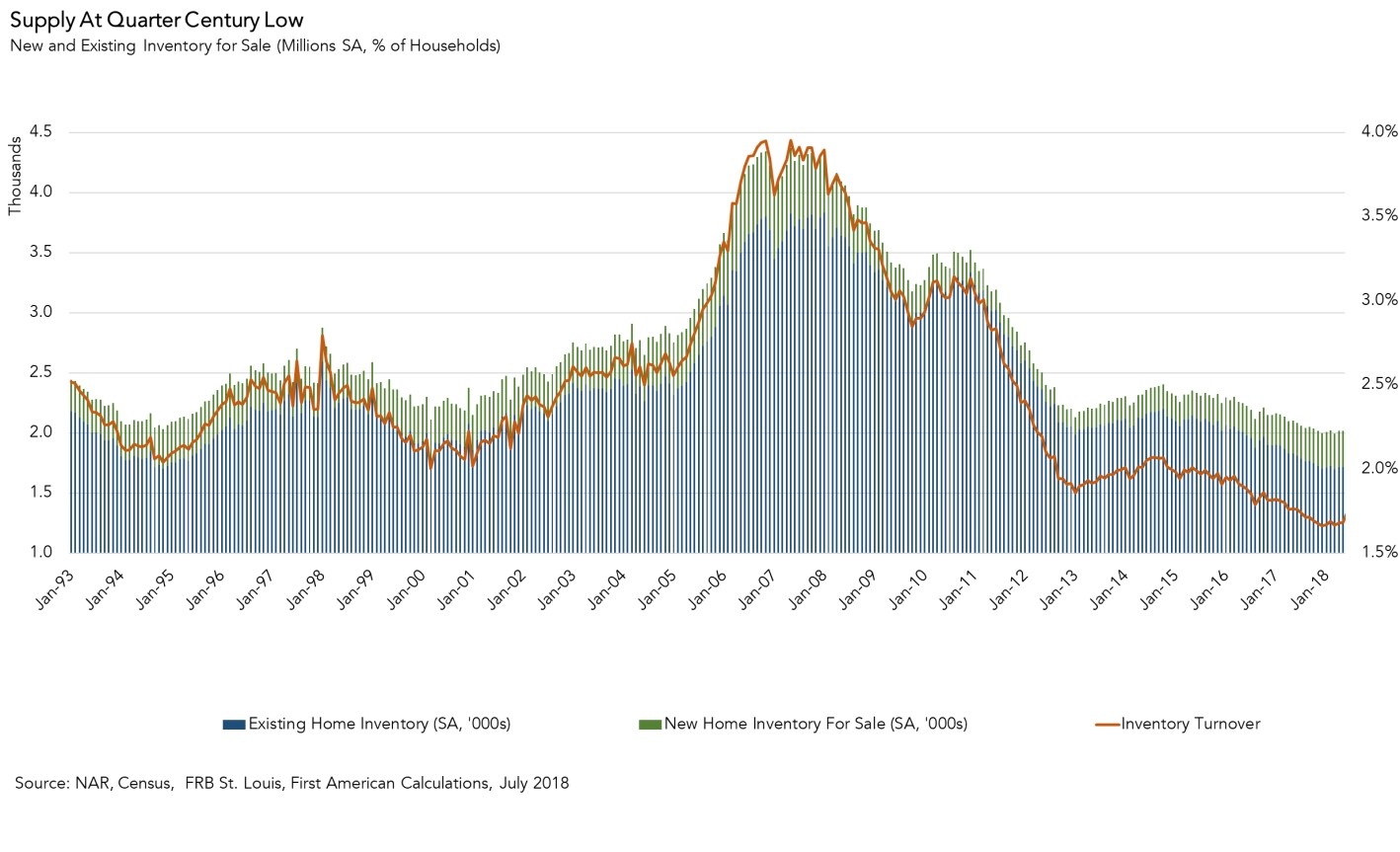

Does Rising Housing Inventory Signal the Beginning of a Buyer’s Market?

By

Mark Fleming on September 17, 2018

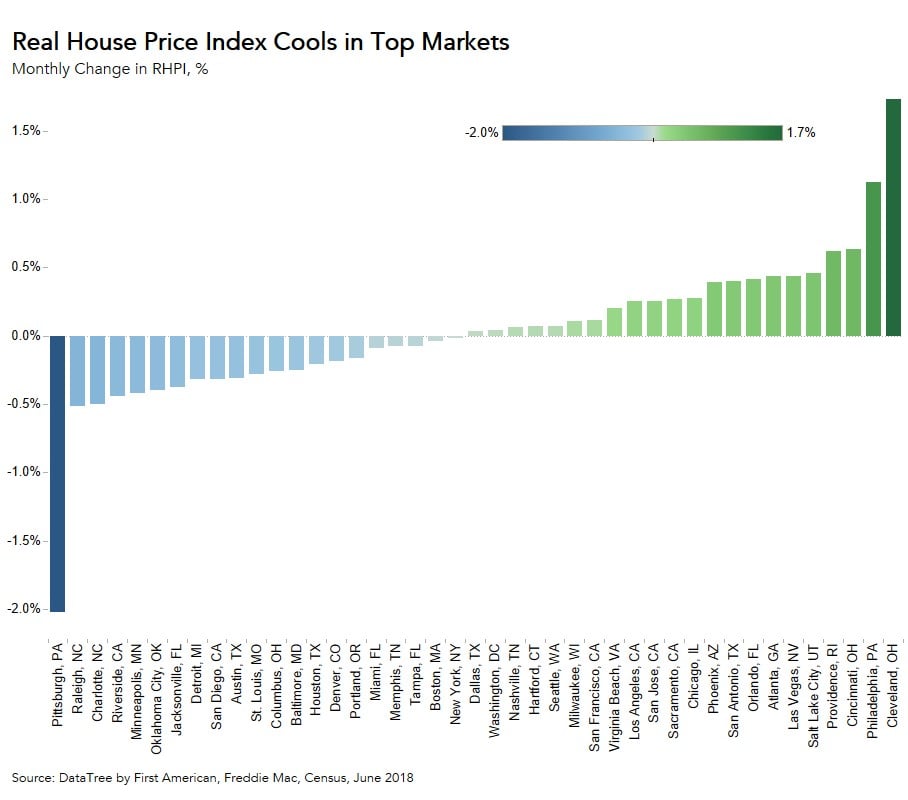

Last month, we noted in our latest Real House Price Index (RHPI) report that house price appreciation may be slowing. According to our RHPI, 21 cities experienced a monthly decline in their real, consumer house-buying power-adjusted price level. One reason for the price appreciation slowdown is that 21 of the 50 largest cities in the U.S. ...

Read More ›

Interest Rates Mortgages Real House Price Index Affordability Housing supply

Has House Price Appreciation Reached a Tipping Point?

By

Mark Fleming on August 27, 2018

House price appreciation remains on a tear, as unadjusted home prices nationwide increased by 7.3 percent compared with a year ago and are now 1.3 percent above the housing boom peak in 2006, according to DataTree by First American. The U.S. economy continues to perform well, as the current economic expansion reaches record levels, prompting some ...

Read More ›

Interviews on CNBC: Discussing rising mortgage rates, house price appreciation, millennial demand and lack of new home construction

By

FirstAm Editor on August 24, 2018

First American Chief Economist Mark Fleming was interviewed on CNBC earlier today as well as last Friday, August 17 and discussed how rising mortgage rates, house price appreciation, millennial demand and a lack of new homes may be squeezing affordability.

Read More ›

New Home Buying In The News Interest Rates Millennials Affordability Housing Starts

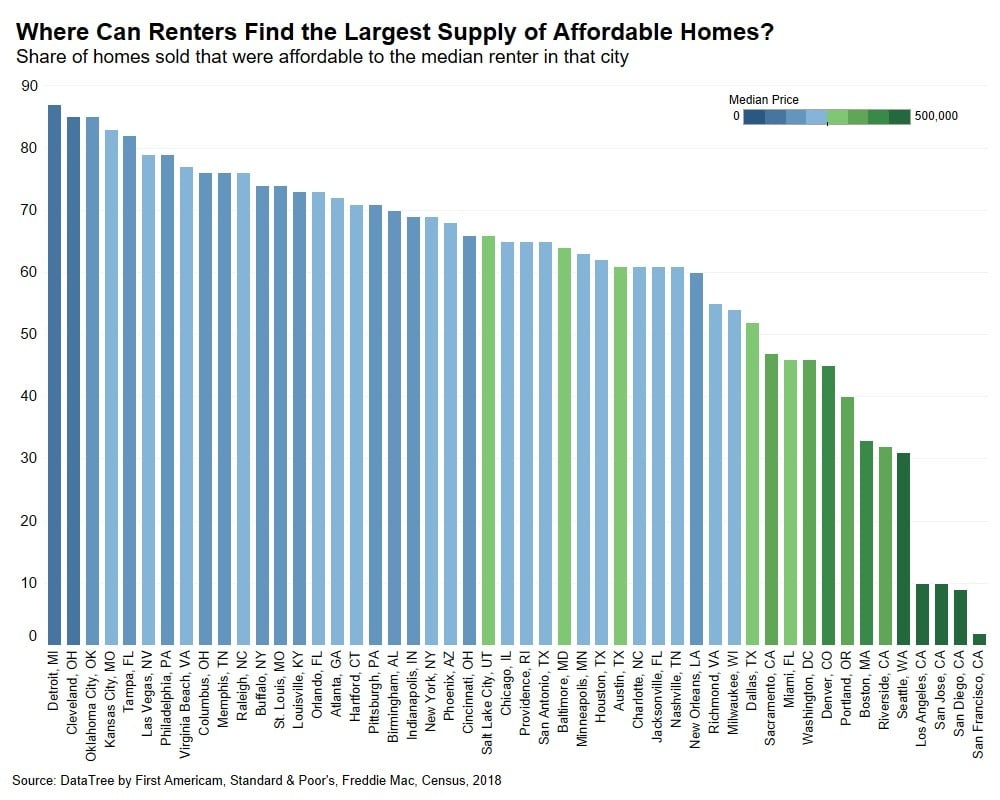

Where Can Renters Find Affordable Homes to Buy?

By

Odeta Kushi on August 20, 2018

Limited housing supply and growing millennial demand continue to drive home prices higher across the country. Even when adjusted for income growth and mortgage rates, prices are 11.4 percent higher than a year ago, according to our Real House Price Index. Unless income growth accelerates and begins to outpace house price appreciation, or housing ...

Read More ›