Limited housing supply and growing millennial demand continue to drive home prices higher across the country. Even when adjusted for income growth and mortgage rates, prices are 11.4 percent higher than a year ago, according to our Real House Price Index. Unless income growth accelerates and begins to outpace house price appreciation, or housing supply surges, prices will likely continue to rise in the coming year, which may be discouraging to renters looking to buy a home.

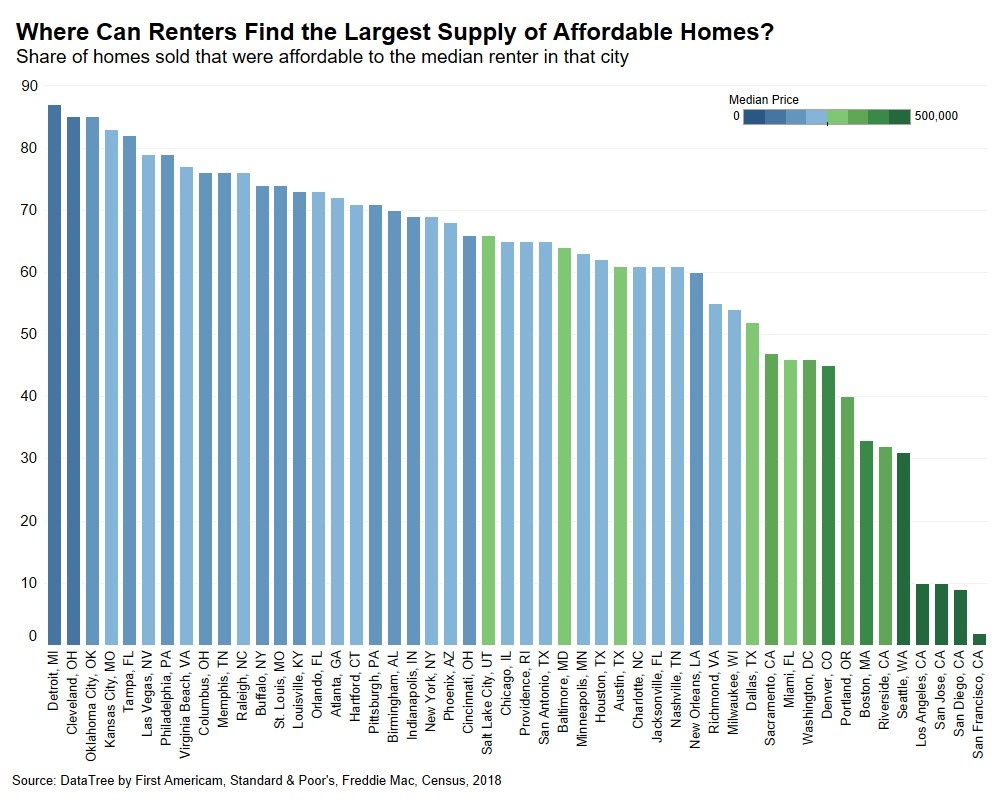

“If you are looking to buy your first house and not break the bank, perhaps consider Detroit, Cleveland or Oklahoma City – cities that offer a greater supply of affordable homes for median renters.”

Nationally, Renter Affordability Is High, But What About the Top 50 Cities?

The good news is buying a house is not as impossible as it seems. Nationally, renter housing affordability, or how much one can buy based on median household income, remains high. We examined the top 50 cities against the median renter’s house-buying power to provide a more nuanced look.

A renter’s house-buying power is based on the prevailing 30-year, fixed mortgage rate, and assumes a 5 percent down payment, and that one-third of pre-tax income is used for the mortgage. We then use the renter’s house-buying power to see what share of the homes for sale the renter could afford to buy. As a measure of affordability, the higher the share of homes for sale that renters can afford to buy, the more affordable the market.

Detroit Ranks First, San Francisco Last for Renter Housing Affordability

In 2017, the most affordable city among the largest 50 cities for median renters looking to buy a home was Detroit. The median renter, with an income of $43,643 and house-buying power of $265,000, could afford 87 percent of the homes sold in the Motor City. Move that same renter with the same income and house-buying power to San Francisco, and the renter could afford less than 1 percent of homes sold. Detroit’s high housing affordability can be attributed to less demand and excess supply. It has one of the highest home vacancy rates in the U.S.

Conversely, San Francisco is the least affordable city in this analysis, where the median house price in 2017 was $1.24 million, 456 percent above the national median house price of $223,000. The median renter in San Francisco, with an income of $65,764 and a house-buying power of approximately $400,000, could only afford 2 percent of the homes sold in the city. One reason for the low affordability in the Bay Area is the strength of the technology-driven labor market, which has generated a large concentration of highly paid employees competing for limited housing supply.

Top 10 Cities with the Largest Supply of Affordable Homes to Buy

- Detroit

- Cleveland

- Oklahoma City

- Kansas City, Mo.

- Tampa Bay, Fla.

- Las Vegas

- Philadelphia

- Virginia Beach, Va.

- Columbus, Oh.

- Memphis, Tenn.

More than half of all mortgage loans originated by the government sponsored enterprises (Fannie Mae and Freddie Mac) are now for first-time home buyers – most likely millennials. Many millennials are gravitating toward less affordable cities, such as San Francisco, Los Angeles and Boston. Yet, there are alternatives. If you are looking to buy your first house and not break the bank, perhaps consider Detroit, Cleveland or Oklahoma City – cities that offer a greater supply of affordable homes for median renters.

Data Sources

Katherine Hayden contributed to this post.