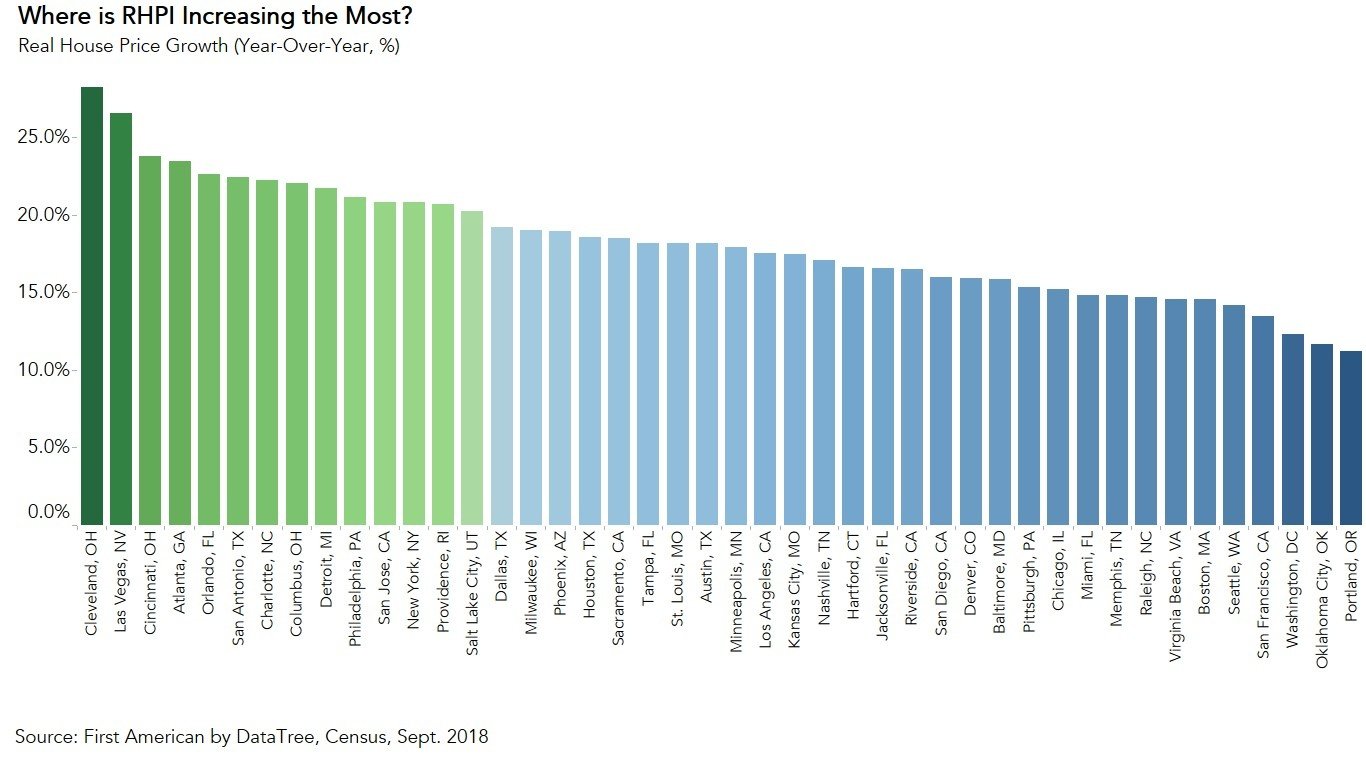

Why is Real House Price Appreciation Accelerating?

By

Mark Fleming on November 26, 2018

In September, all three of the key drivers of the Real House Price Index (RHPI), household income, mortgage rates, and an unadjusted house price index, increased compared with a year ago. When household income rises, consumer house-buying power increases. When mortgage rates and house prices increase, consumer house-buying power decreases. The ...

Read More ›

Interview on CNBC: Discussing the New Normal for the Housing Market

By

FirstAm Editor on November 23, 2018

First American Chief Economist Mark Fleming was interviewed on CNBC earlier this week and discussed the current dynamics at play in the housing market where rising mortgage rates have impacted both supply and demand.

Read More ›

Housing In The News Interest Rates Millennials Affordability

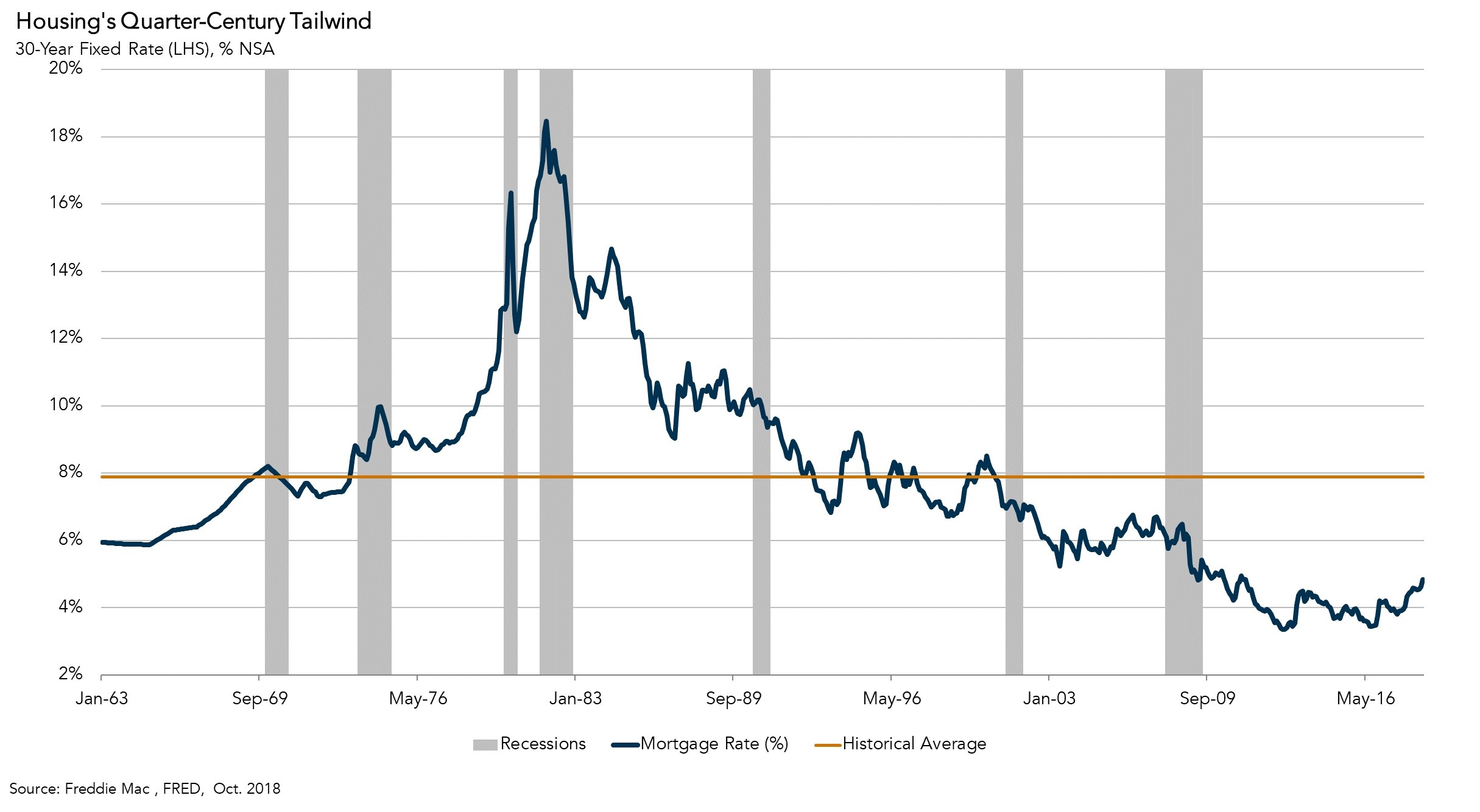

Why the Housing Market Can Thrive at 5 Percent Mortgage Rates

By

Mark Fleming on November 12, 2018

Last week, the 30-year, fixed mortgage rate hit a seven-and-a-half-year high of 4.86 percent. Most experts believe mortgage rates will continue to rise, reaching 5 percent in 2019.

Read More ›

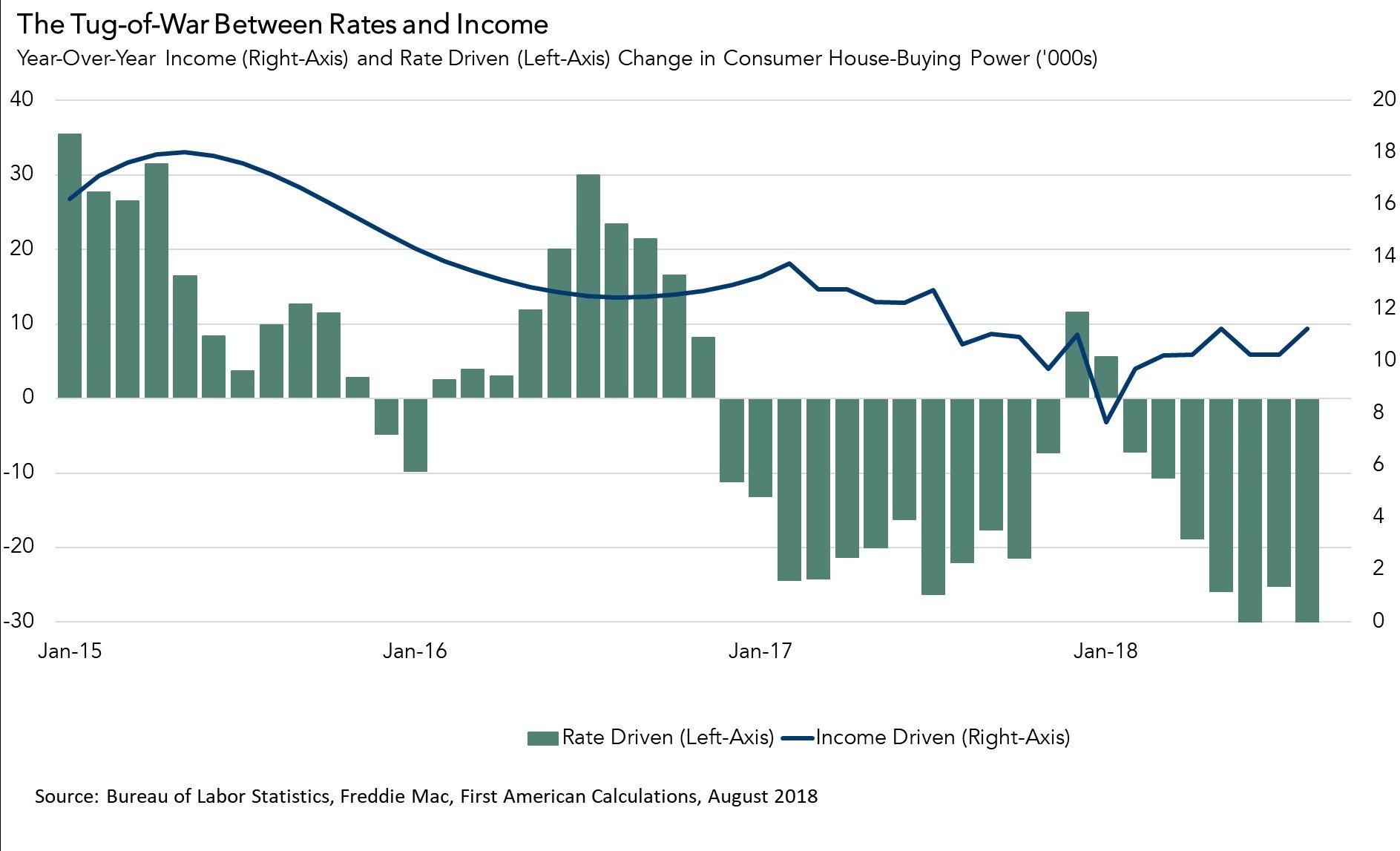

How Wage Growth Reduced the Sting of Rising Rates on Affordability

By

Mark Fleming on October 29, 2018

Understanding the dynamics that influence consumer house-buying power, how much home one can buy based on changes in income and interest rates, provides helpful perspective on the housing market. When incomes rise, consumer house-buying power increases. When mortgage rates or nominal house prices rise, consumer house-buying power declines. Our ...

Read More ›

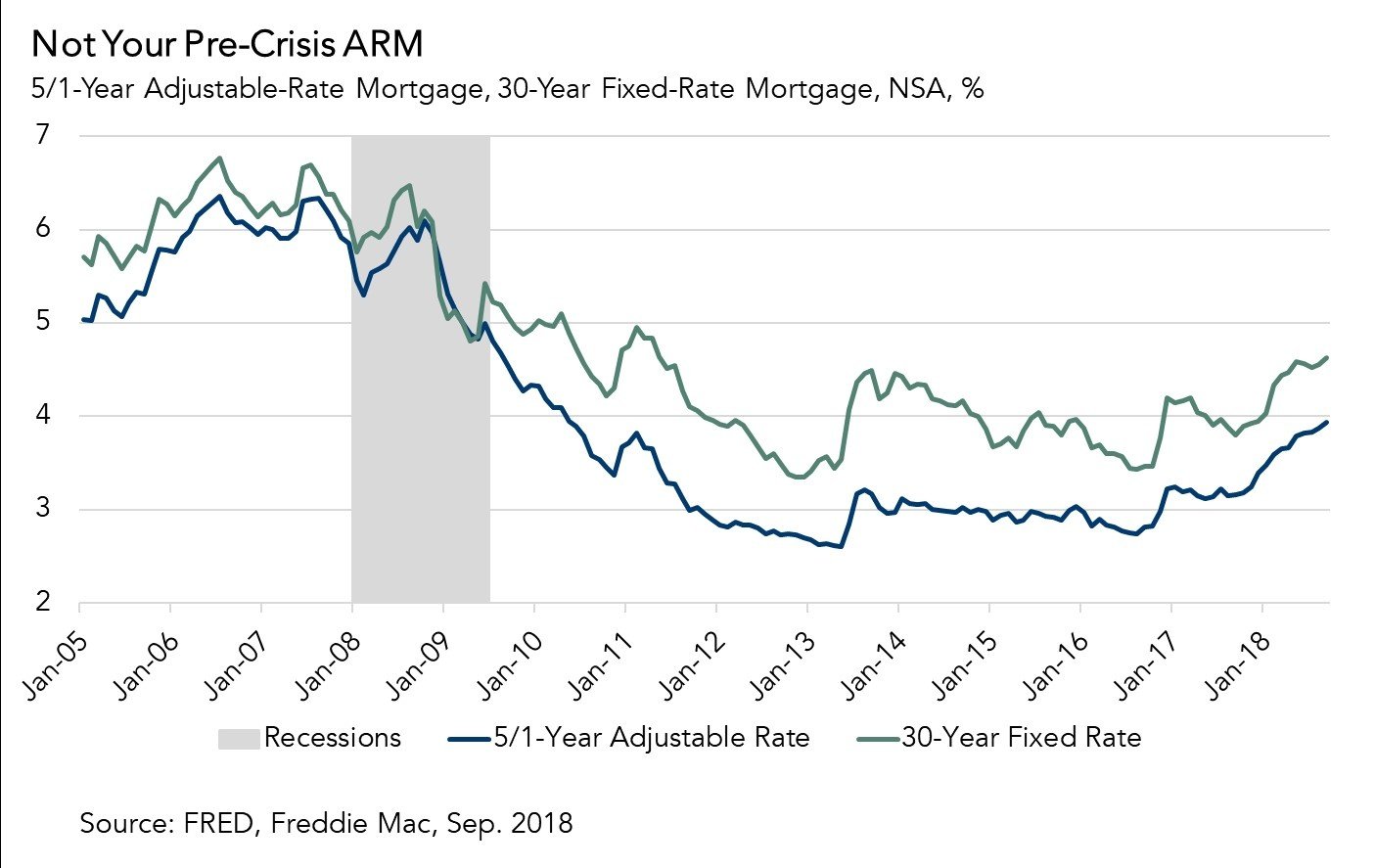

Why ARMs Today are Different

By

Odeta Kushi on October 10, 2018

Adjustable-rate mortgages (ARMs), a symbol of the housing market crash, are making a comeback, but their resurgence is not an indicator of a potential negative turn in the housing market. An ARM is a mortgage that typically has a 30-year repayment term, but the interest rate is fixed for the first few years of the loan. Once the fixed period ends, ...

Read More ›

Interview on CNBC: Discussing the impact of rising rates on affordability and home-buying demand

By

FirstAm Editor on October 5, 2018

First American Chief Economist Mark Fleming was interviewed on CNBC yesterday and discussed the impact of rising interest rates on affordability and home-buying demand.

Read More ›

Housing In The News Interest Rates Millennials Affordability