The Federal Open Market Committee (FOMC) meeting is just around the corner and a rate hike is almost certain, according to experts, which will trigger conversations about rising mortgage rates across the housing industry. While changes to the federal funds rate won’t necessarily spur further increases in mortgage rates, mortgage rates are expected to rise nonetheless.

"Changes in affordability depend on the tug-of-war between rising household income and inflation-driven pressure on mortgage rates."

Mortgages rates typically follow the same path as long-term bond yields, which are expected to increase due to inflation driven by healthy economic growth. This inflation-driven increase in long-term bond yields will, in turn, increase mortgage rates. Due in large part to the strong economy, the 30-year, fixed mortgage rate has increased 56-basis points over the past 12 months.

Five Percent Mortgage Rates Likely in 2019

Consensus among economists is that the 30-year, fixed mortgage rate will increase from its current rate of 4.53 percent to an average of 5 percent in 2019. Last week, we analyzed what a rate of 5.0 percent could mean for existing-home sales. The result? Home sales will continue to grow despite rising rates, due to the strength of economy. But, what will 5 percent mortgage rates mean for affordability?

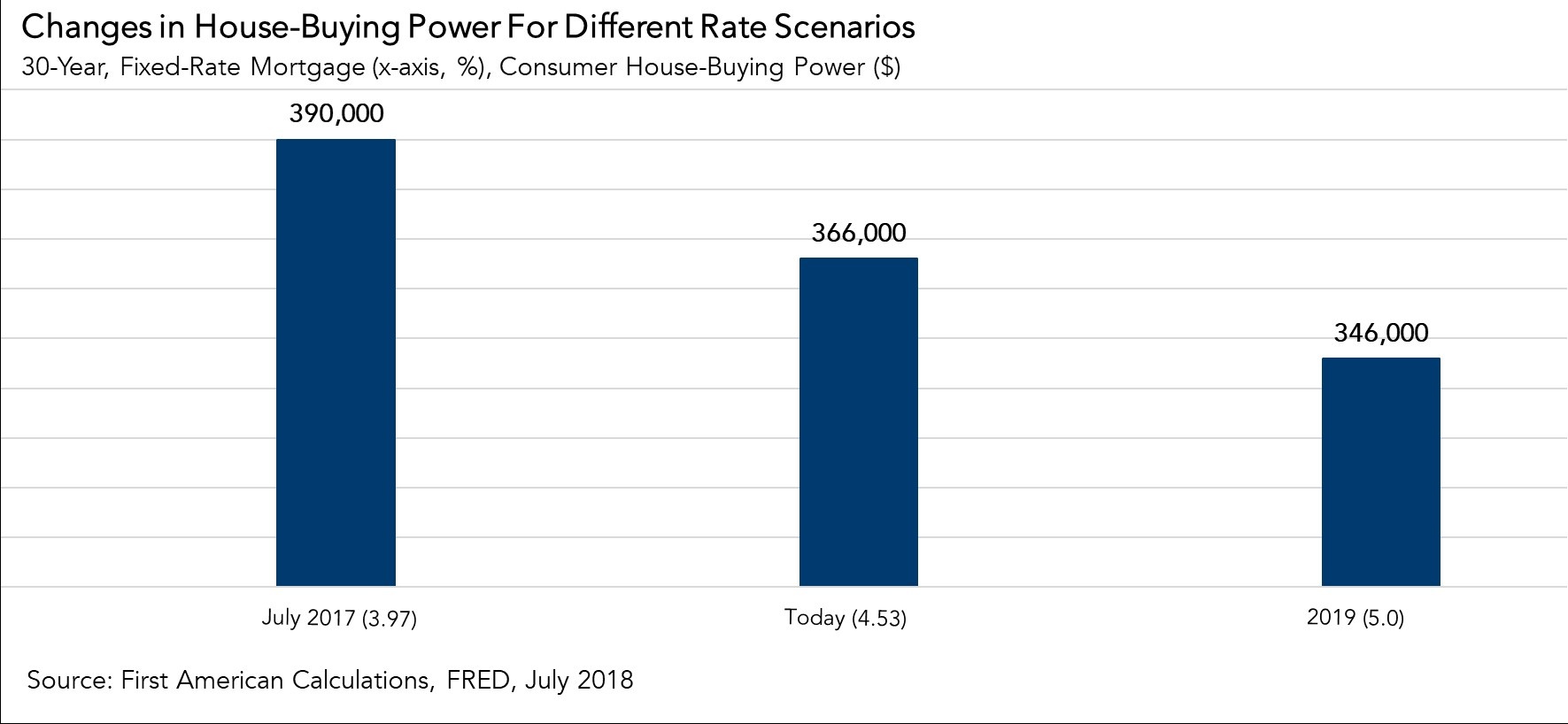

The First American Real House Price Index (RHPI) measures consumer house-buying power, how much one can buy based on household income and the 30-year, fixed-rate mortgage. Shifts in income and interest rates either increase or decrease consumer house-buying power or affordability. When incomes rise and/or mortgage rates fall, consumer house-buying power increases.

If the mortgage rate increased from its current level of 4.5 percent to the expected level of 5 percent, assuming a 5 percent down payment, and the July 2018 average household income of $64,000, we find that house-buying power falls a modest 5.5 percent, from $366,000 to $346,000. In this hypothetical 5 percent mortgage rate environment, consumer-house buying power would be 11 percent lower than it was in July 2017, when the 30-year, fixed mortgage rate was 3.97 percent.

Consumer House-Buying Power Remains 2.2 Times Greater than January 2000

It’s evident that rising mortgage rates have an impact on affordability. However, the root cause of higher inflation and, in turn, rising mortgage rates is surging wage growth. In fact, our estimate of average household income, based on Census and Bureau of Labor Statistics data, reached the highest level since 2000.

Average household incomes are 53 percent higher today than in January 2000. On the other hand, the 30-year, fixed mortgage rate remains near its historic low point. As a result, consumer house-buying power is still 2.2 times higher today than in January 2000. Changes in affordability depend on the tug-of-war between rising household income and inflation-driven pressure on mortgage rates.

For the full analysis on affordability, the top five states and markets with the greatest increases and decreases in real house prices, and more, please visit the Real House Price Index.

The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of October 29, 2018.

Sources: