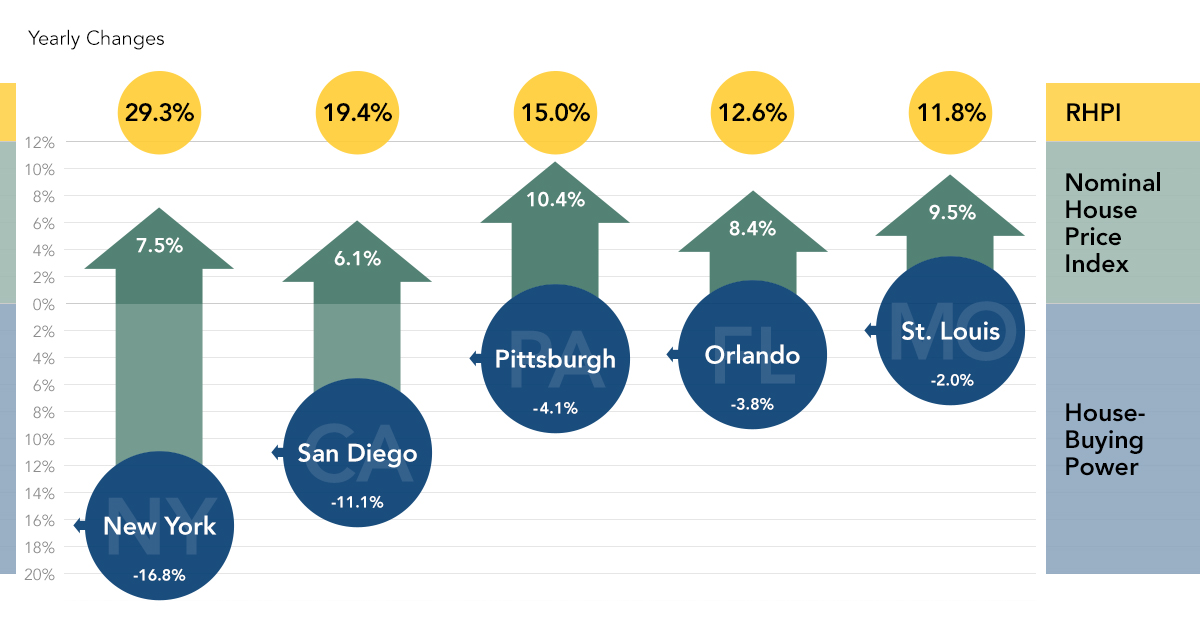

The Five Cities Where Affordability Declined the Most

By

Mark Fleming on November 23, 2020

Affordability declined month over month in September for the second month in a row, even as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability. The 30-year, fixed-rate mortgage fell by 0.05 percentage points and household income increased 0.2 percent ...

Read More ›

Interview with Yahoo! Finance: Explaining the Housing Market’s Resilience in the COVID-19 Era

By

FirstAm Editor on November 9, 2020

First American Deputy Chief Economist Odeta Kushi was interviewed on Yahoo! Finance earlier this month, discussing why the housing market is better positioned in this recession than it was heading into the Great Recession, and how low rates and millennials are driving demand.

Read More ›

Has the Affordability Boost From Falling Mortgage Rates Run its Course?

By

Mark Fleming on October 27, 2020

Throughout 2020, falling mortgage rates have been the strongest influence on housing affordability trends, even helping fuel the housing market’s impressive recovery and resilience to the continuing economic fallout from the coronavirus pandemic. Mortgage rates began declining in January 2020 and even dropped below 3 percent for the first time ...

Read More ›

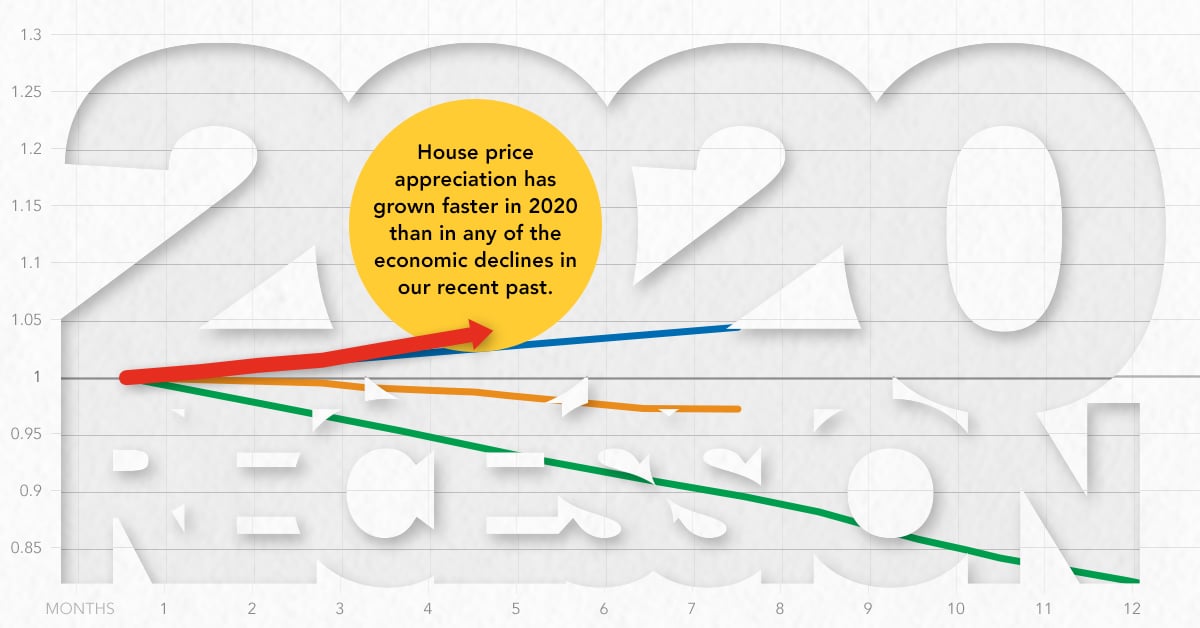

How Can Housing Affordability Improve During Periods of Economic Decline When House Prices Rise

By

Mark Fleming on September 28, 2020

Affordability improved in July as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability, outpacing the rise in nominal house price appreciation. The average 30-year, fixed mortgage rate fell by 0.75 percentage points and household income increased 5.5 ...

Read More ›

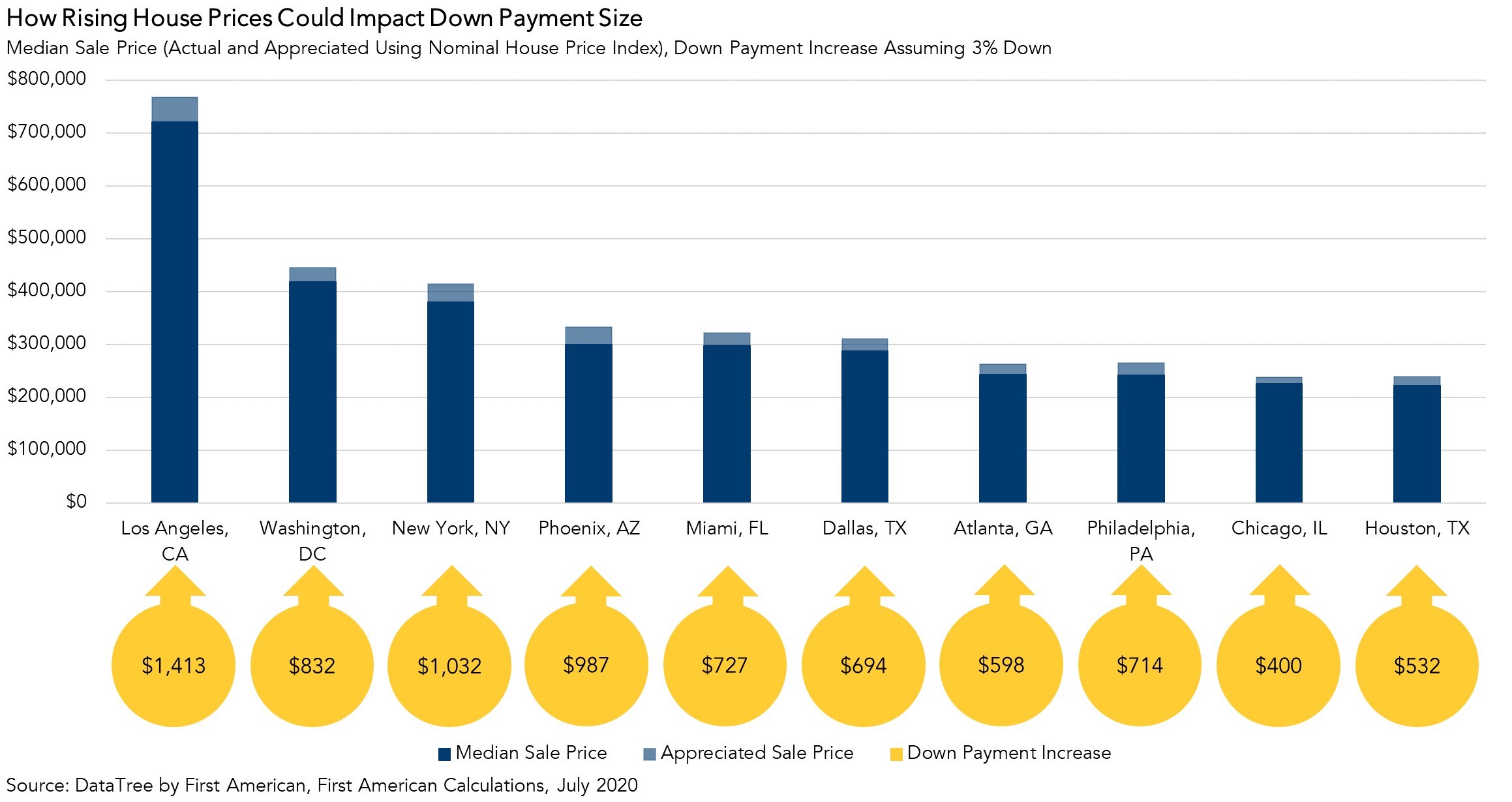

How Rising House Prices Could Impact Down Payment Size

By

Odeta Kushi on September 17, 2020

After hitting a low point in the spring, the housing market has rebounded strongly during the pandemic. Historically low mortgage rates have fueled demand and increased home buyers’ purchasing power amid an ongoing housing supply shortage. The widening imbalance between housing supply and demand has pushed house prices higher. Some now fear that ...

Read More ›

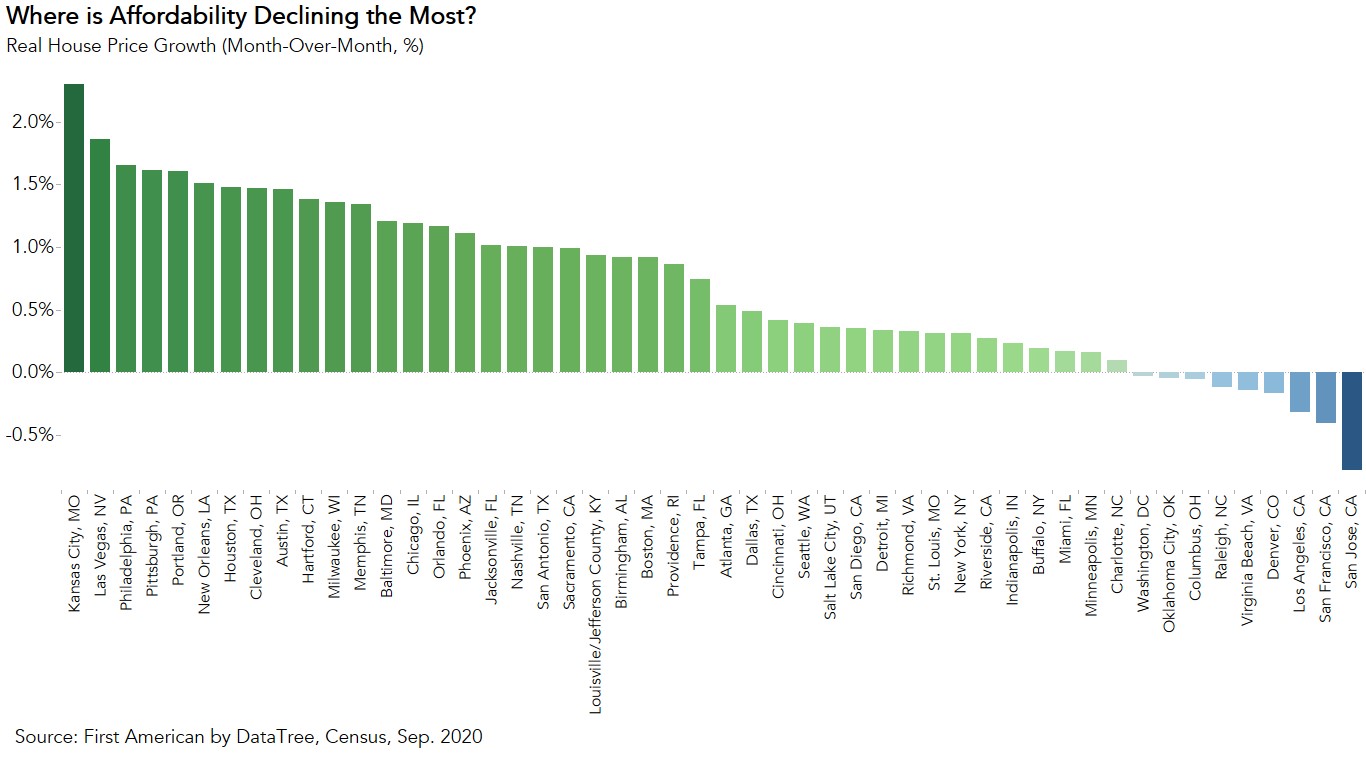

Where Housing Affordability is Declining the Most

By

Mark Fleming on August 24, 2020

The coronavirus pandemic continues to wreak havoc on global and domestic economies, yet housing has thus far managed an impressive V-shaped recovery. Housing’s strong rebound has been driven by several factors that existed before the coronavirus outbreak but have continued or even gained strength amid the pandemic. Mortgage rates are even lower ...

Read More ›