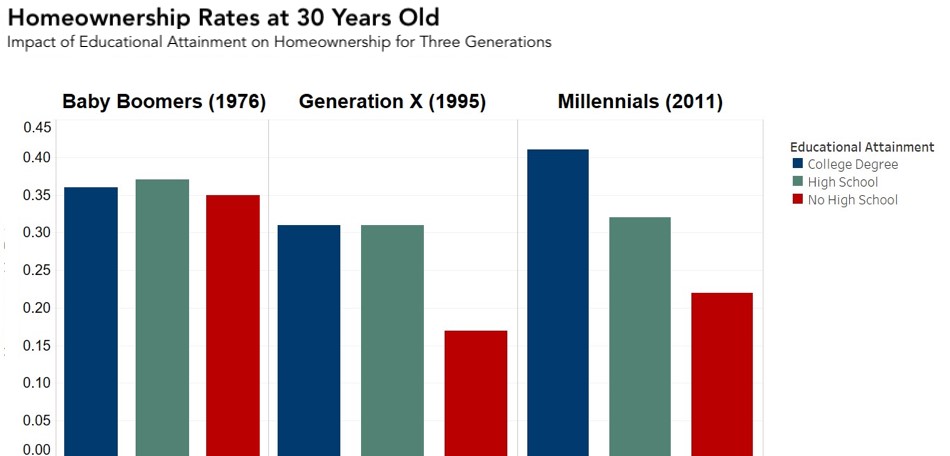

Why Education is the Best Investment for Homeownership

By

Mark Fleming on September 7, 2018

Whether students are beginning middle school or their last year of college, back-to-school season is here. Although many students may grimace when they hear “back to school,” they won’t regret pursuing a higher education as adults as they compete for well-paying jobs and one day, hopefully, buy a home.

Read More ›

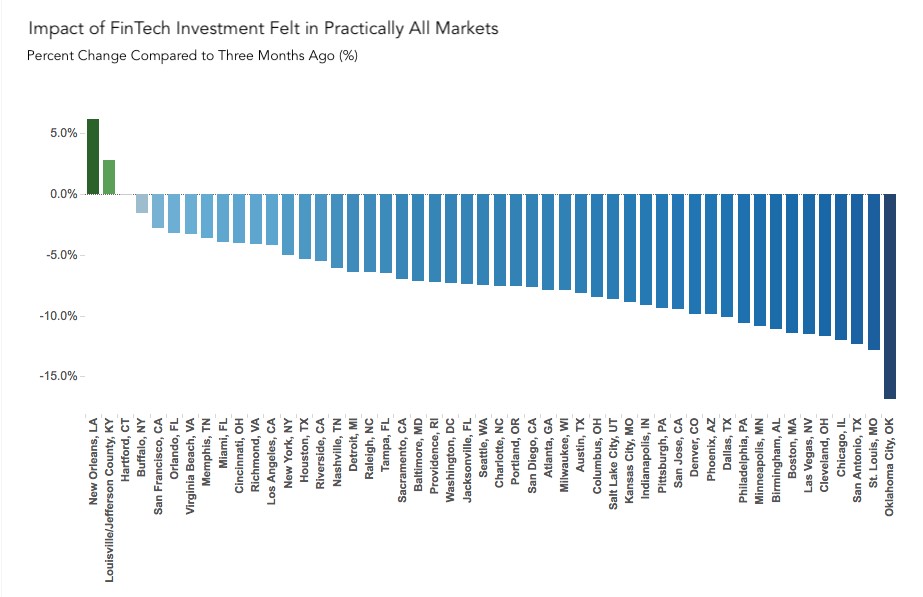

Impact of FinTech Investment Felt in Nearly All Markets

By

Mark Fleming on August 31, 2018

The Loan Application Defect Index for purchase transactions continued its downward trend, declining 1.3 percent in July compared with the month before, the seventh consecutive month defect risk in purchase transactions have fallen. Yet, is declining loan application misrepresentation, defect and fraud risk isolated to a few markets or is the trend ...

Read More ›

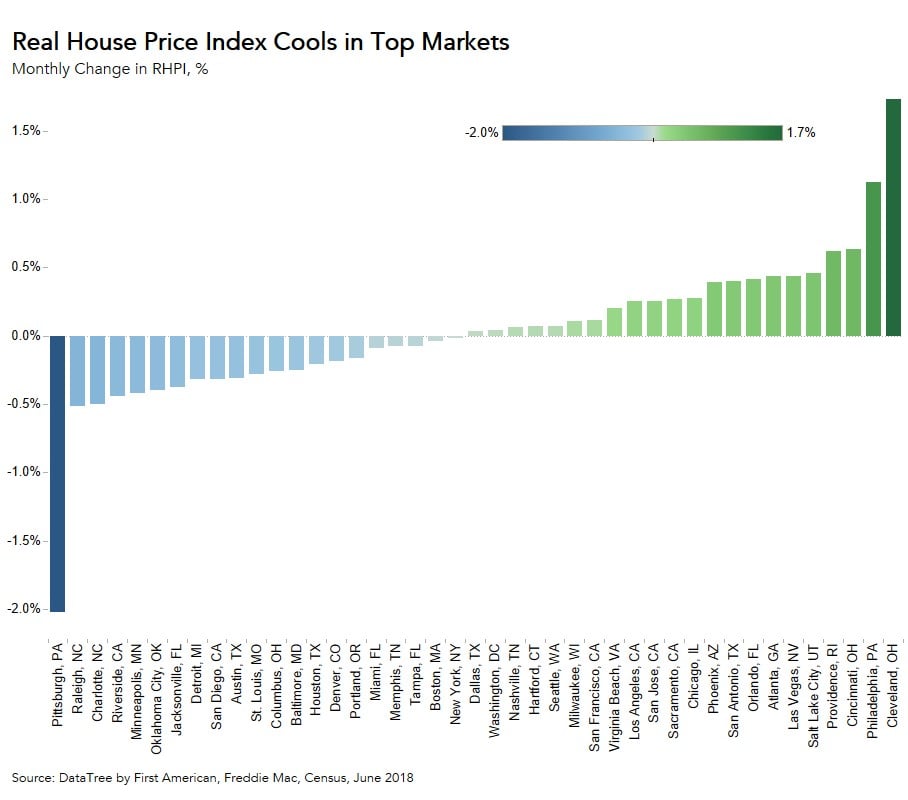

Has House Price Appreciation Reached a Tipping Point?

By

Mark Fleming on August 27, 2018

House price appreciation remains on a tear, as unadjusted home prices nationwide increased by 7.3 percent compared with a year ago and are now 1.3 percent above the housing boom peak in 2006, according to DataTree by First American. The U.S. economy continues to perform well, as the current economic expansion reaches record levels, prompting some ...

Read More ›

Interviews on CNBC: Discussing rising mortgage rates, house price appreciation, millennial demand and lack of new home construction

By

FirstAm Editor on August 24, 2018

First American Chief Economist Mark Fleming was interviewed on CNBC earlier today as well as last Friday, August 17 and discussed how rising mortgage rates, house price appreciation, millennial demand and a lack of new homes may be squeezing affordability.

Read More ›

New Home Buying In The News Interest Rates Millennials Affordability Housing Starts

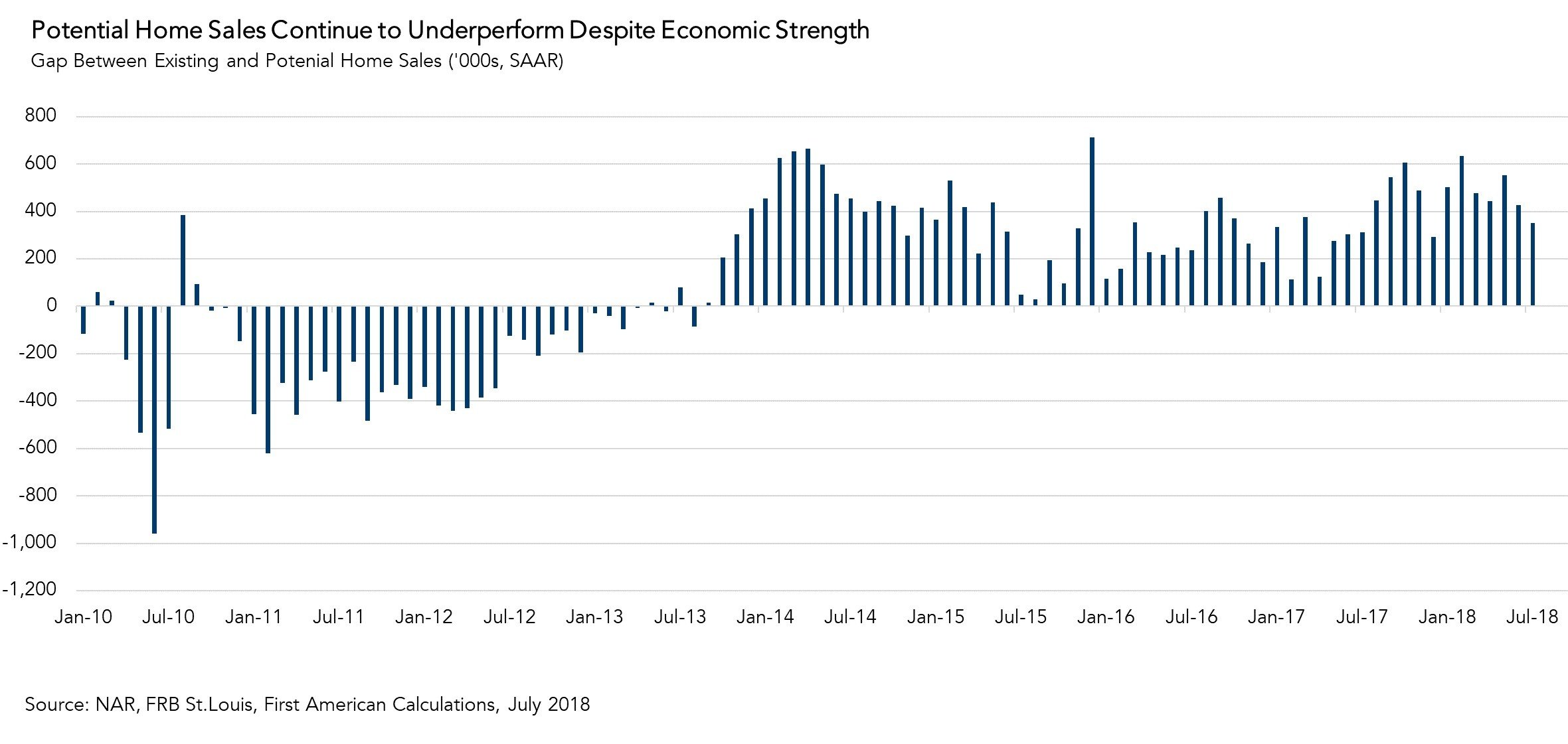

Why Hasn’t Economic Momentum Lifted Home Sales?

By

Mark Fleming on August 21, 2018

The U.S. economy remains on an impressive growth streak. Last month, the Commerce Department reported that the gross domestic product, the broadest measure of goods and services produced in the economy, grew at a 4.1 percent annualized rate in the second quarter, the strongest pace of growth since 2014. The economy has added jobs every month for ...

Read More ›

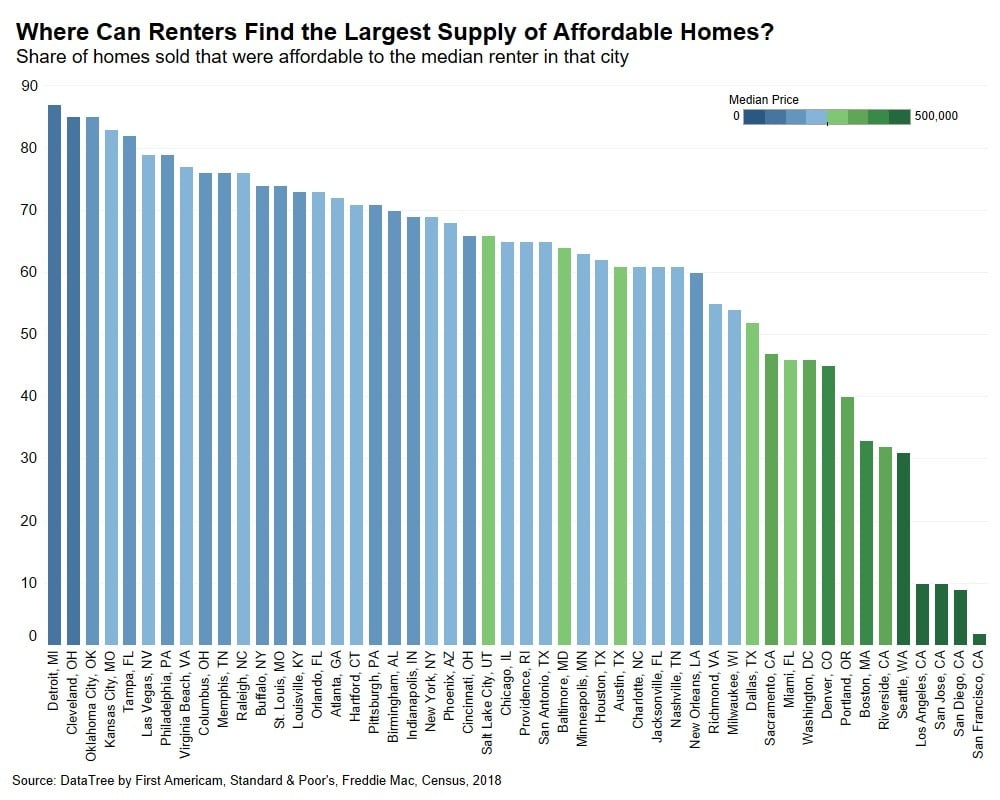

Where Can Renters Find Affordable Homes to Buy?

By

Odeta Kushi on August 20, 2018

Limited housing supply and growing millennial demand continue to drive home prices higher across the country. Even when adjusted for income growth and mortgage rates, prices are 11.4 percent higher than a year ago, according to our Real House Price Index. Unless income growth accelerates and begins to outpace house price appreciation, or housing ...

Read More ›