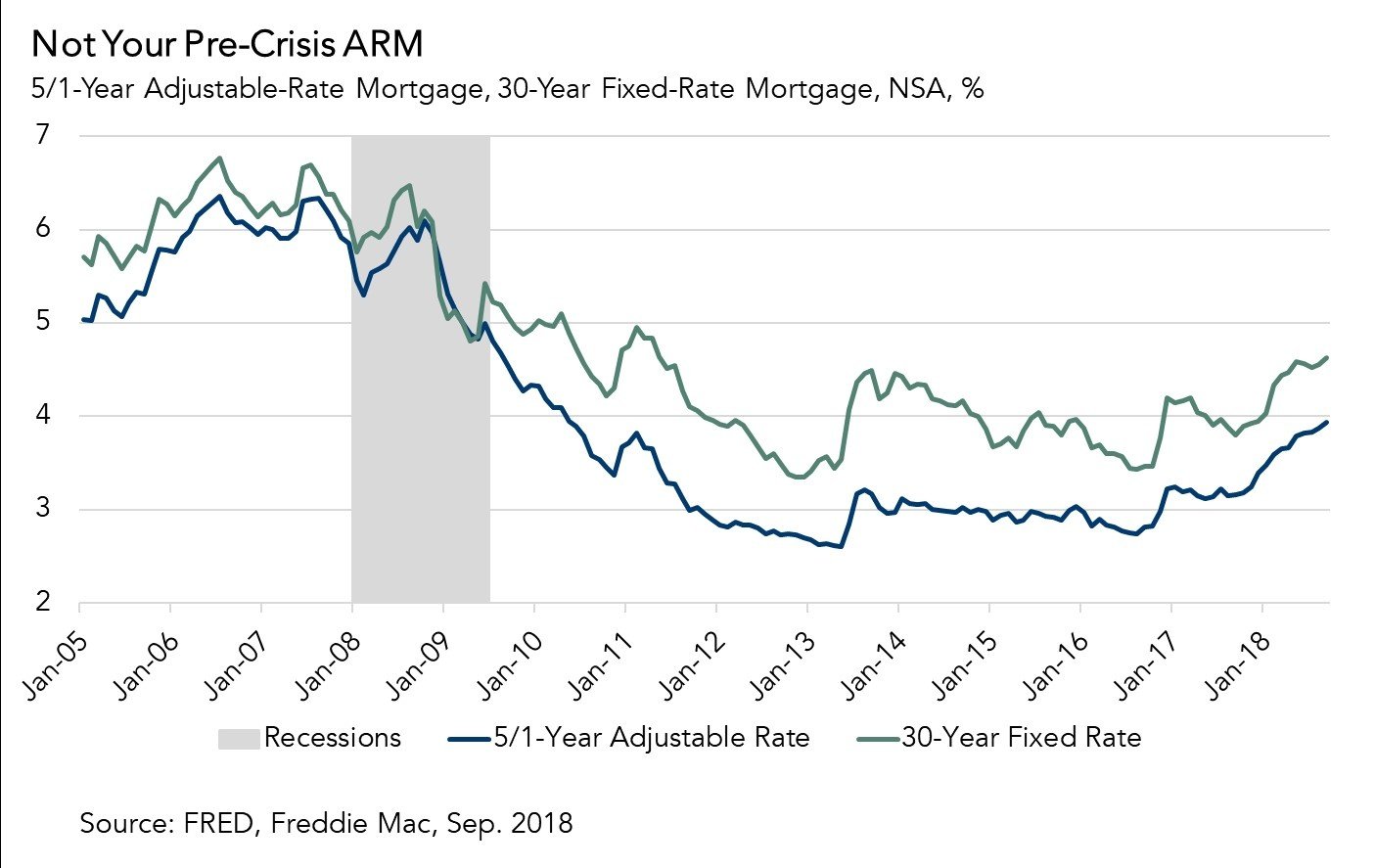

Why ARMs Today are Different

By

Odeta Kushi on October 10, 2018

Adjustable-rate mortgages (ARMs), a symbol of the housing market crash, are making a comeback, but their resurgence is not an indicator of a potential negative turn in the housing market. An ARM is a mortgage that typically has a 30-year repayment term, but the interest rate is fixed for the first few years of the loan. Once the fixed period ends, ...

Read More ›

Interview on CNBC: Discussing the impact of rising rates on affordability and home-buying demand

By

FirstAm Editor on October 5, 2018

First American Chief Economist Mark Fleming was interviewed on CNBC yesterday and discussed the impact of rising interest rates on affordability and home-buying demand.

Read More ›

Housing In The News Interest Rates Millennials Affordability

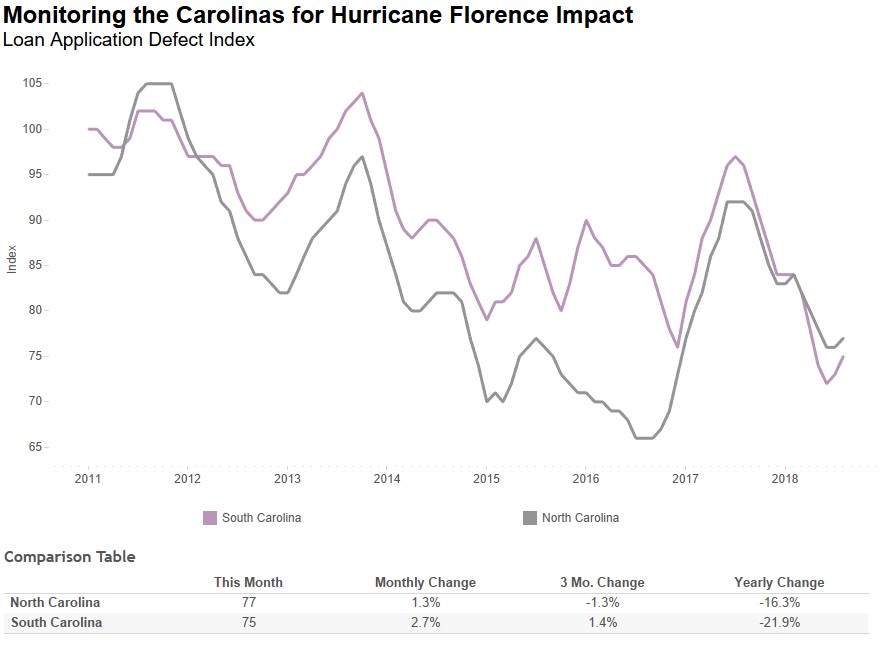

Do Hurricanes Influence Mortgage Fraud Risk?

By

Mark Fleming on September 26, 2018

Following seven straight months of declining defect risk, the Loan Application Defect Index for purchase transactions remained the same in August compared with the month before. Year over year, the Defect Index for purchase transactions decreased 13.2 percent as compared to August 2017. The Defect Index for refinance transactions is the same as ...

Read More ›

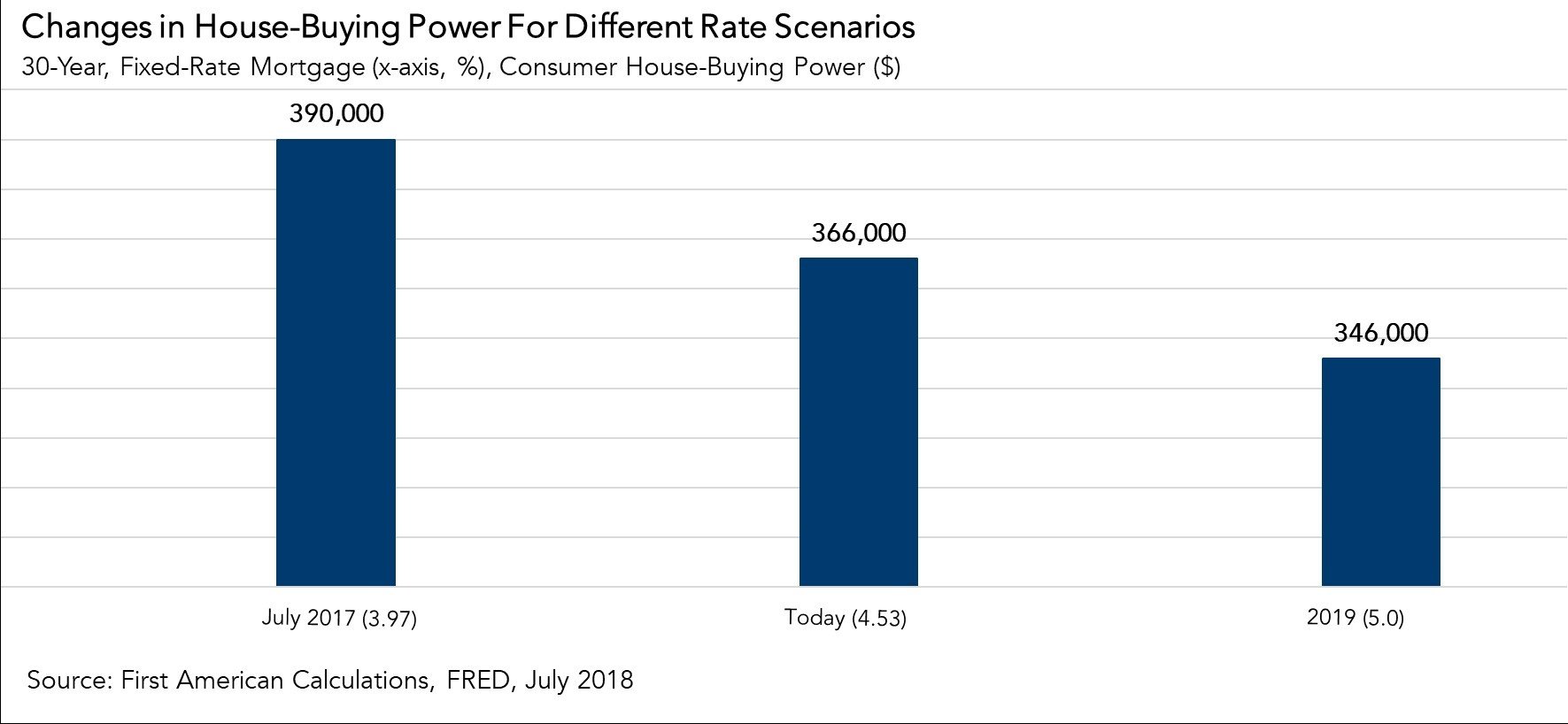

How Will Rising Mortgage Rates Impact Housing Affordability in 2019?

By

Mark Fleming on September 24, 2018

The Federal Open Market Committee (FOMC) meeting is just around the corner and a rate hike is almost certain, according to experts, which will trigger conversations about rising mortgage rates across the housing industry. While changes to the federal funds rate won’t necessarily spur further increases in mortgage rates, mortgage rates are expected ...

Read More ›

Interview on CNBC: Discussing the housing market’s potential shift toward a buyer’s market

By

FirstAm Editor on September 21, 2018

First American Chief Economist Mark Fleming was interviewed on CNBC earlier this week and discussed the housing market’s potential shift toward a buyer’s market and the challenges facing the market: affordability and interest rates.

Read More ›

Housing In The News Interest Rates Millennials Affordability

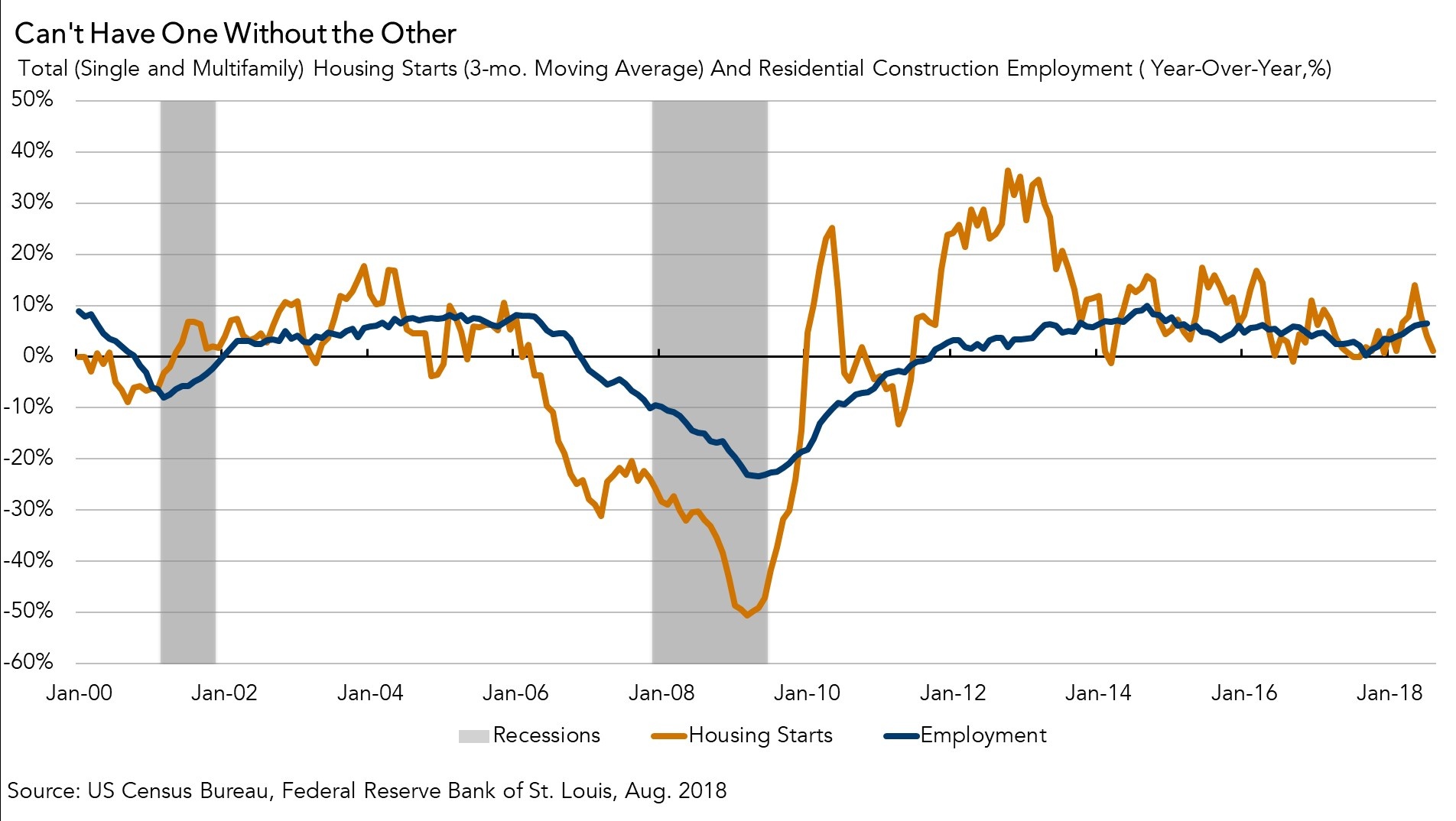

How Hurricane Florence May Impact the Housing Market

By

Mark Fleming on September 20, 2018

Yesterday’s Census Bureau report for August is an indication of strength for the housing market. While the number of permits issued, which can signal how much construction is in the pipeline, decreased by 5.5 percent, home building rose in August as housing starts increased 9.4 percent compared with a year ago. The growth in housing starts is ...

Read More ›