How Does a Strong Economy Slow the Housing Market?

By

Mark Fleming on December 21, 2018

For the second consecutive month, all three key drivers of the Real House Price Index (RHPI), household income, mortgage rates, and the unadjusted house price index, increased compared with a year ago. The 30-year, fixed-rate mortgage and the unadjusted house price index increased by 0.9 percentage points and 7.3 percent respectively. Even though ...

Read More ›

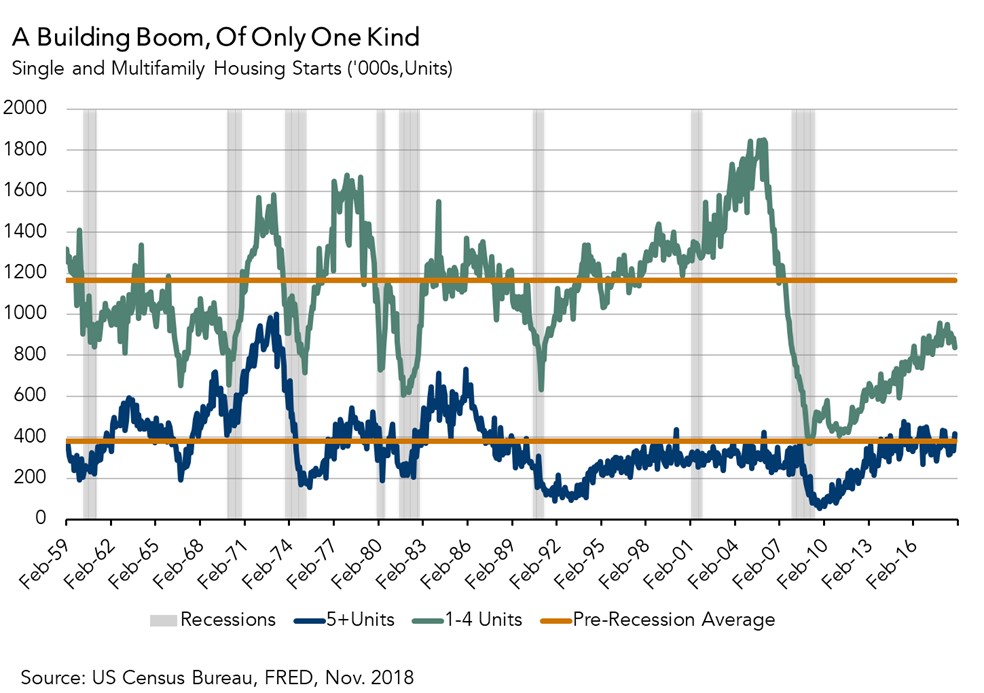

Will Homebuilders Deliver the Gift of More Housing Supply this Year?

By

Mark Fleming on December 19, 2018

Yesterday, the Census Bureau released its Residential Construction report for November. Housing completions decreased 3.9 percent compared with last November and continue to fall short of the number of new housing units necessary to keep pace with household formation. Housing starts also decreased 3.6 percent in November compared with a year ago. ...

Read More ›

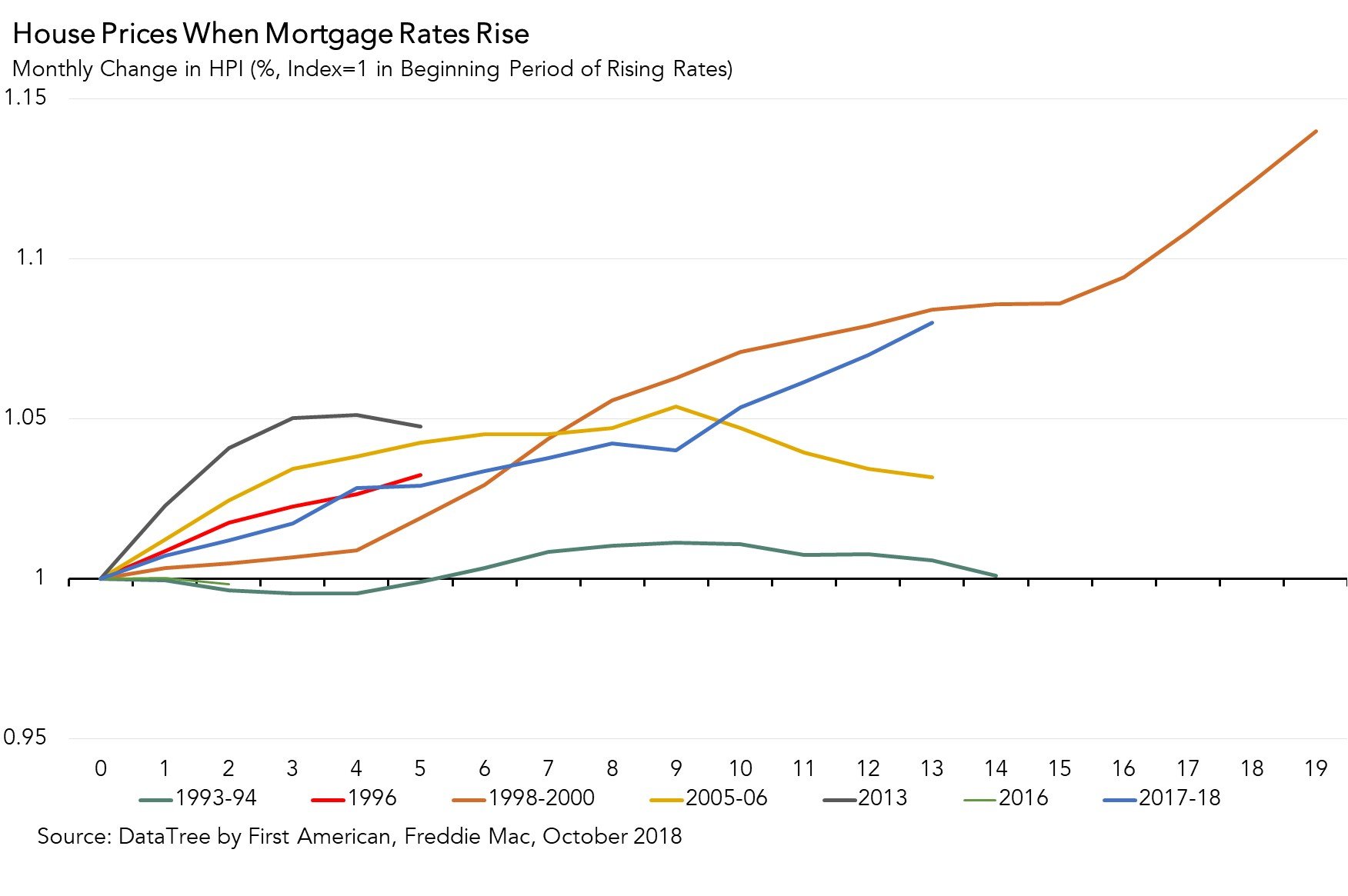

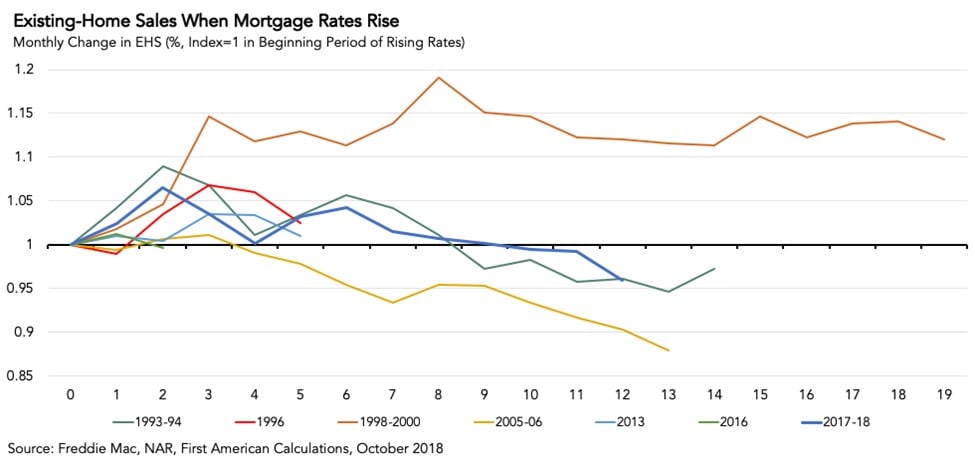

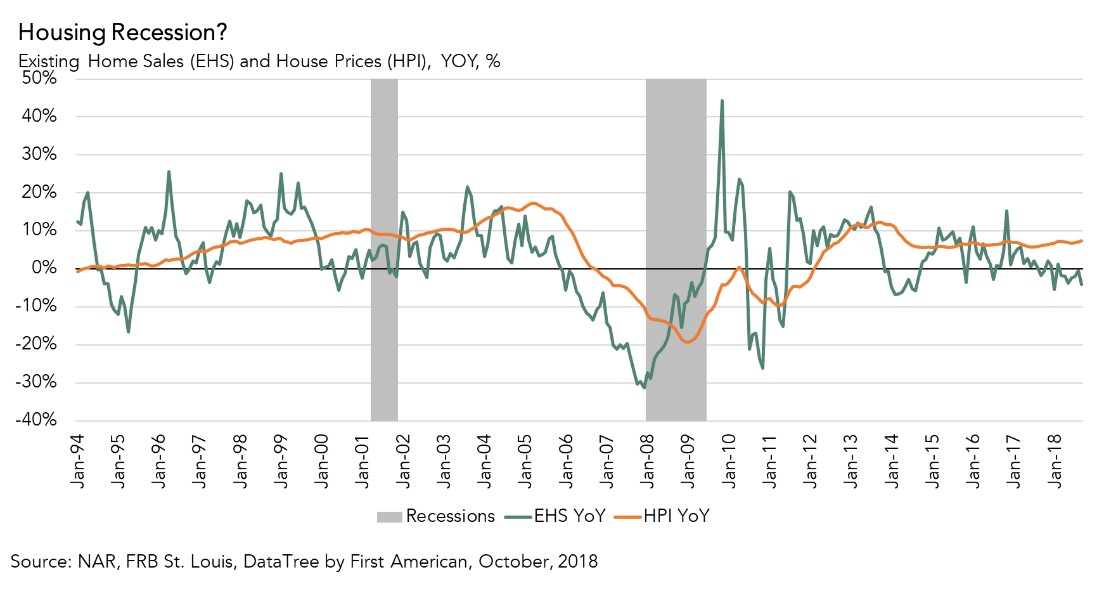

What Do Previous Rising Mortgage Rate Eras Tell Us About Today's Housing Market?

By

Mark Fleming on December 17, 2018

In November, the housing market underperformed its potential by 7.4 percent, marking 40 straight months the market remained below its potential, according to our Potential Homes Sales Model. Month over month, the gap between actual existing-home sales and the market potential for home sales narrowed by 1.2 percent, but the housing market still has ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

What Does an Inverted Yield Curve Mean for the Housing Market?

By

Mark Fleming on December 12, 2018

Last week, the yield curve inverted, meaning the yield on short-run Treasury bonds exceeded the yield on long-run Treasury bonds, which prompted increased speculation that a recession may be on the horizon. The speculation is rooted in the historical correlation between yield curve inversions and recessions, which have occasionally followed one to ...

Read More ›

How "Renter" Millennials Will Transform the Housing Market

By

Odeta Kushi on December 10, 2018

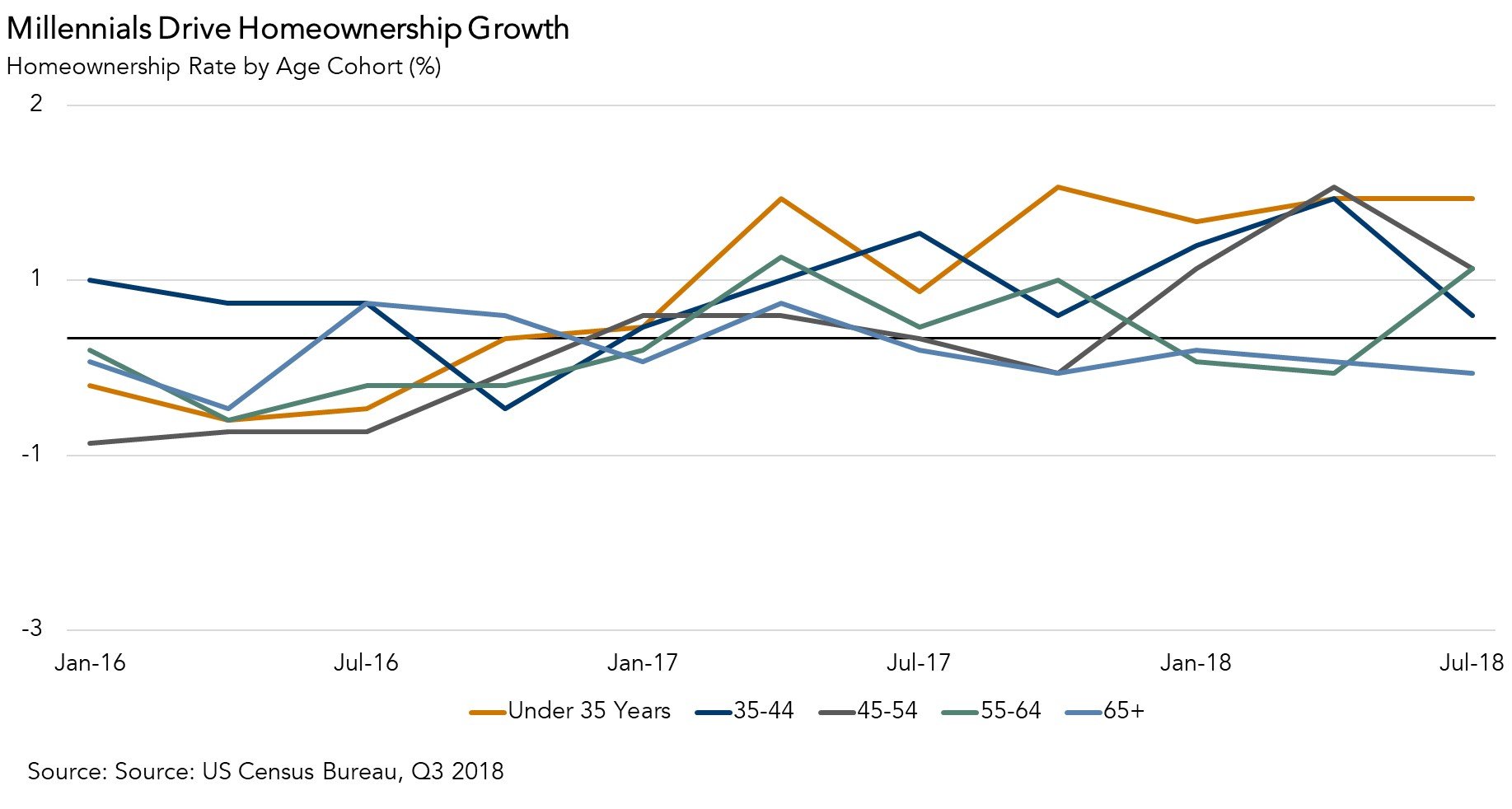

Millennial demand for homeownership was one of the biggest trends influencing the housing market in 2018. Households under 35 years old contributed the most to overall homeownership growth in the third quarter of 2018, with millennial homeownership rising 1.2 percentage points from last year. This trend shows no indication of reversing in 2019. In ...

Read More ›

Defect Risk Declines Nationally, But Future Increases Possible for Regions Impacted by Natural Disasters

By

Mark Fleming on December 3, 2018

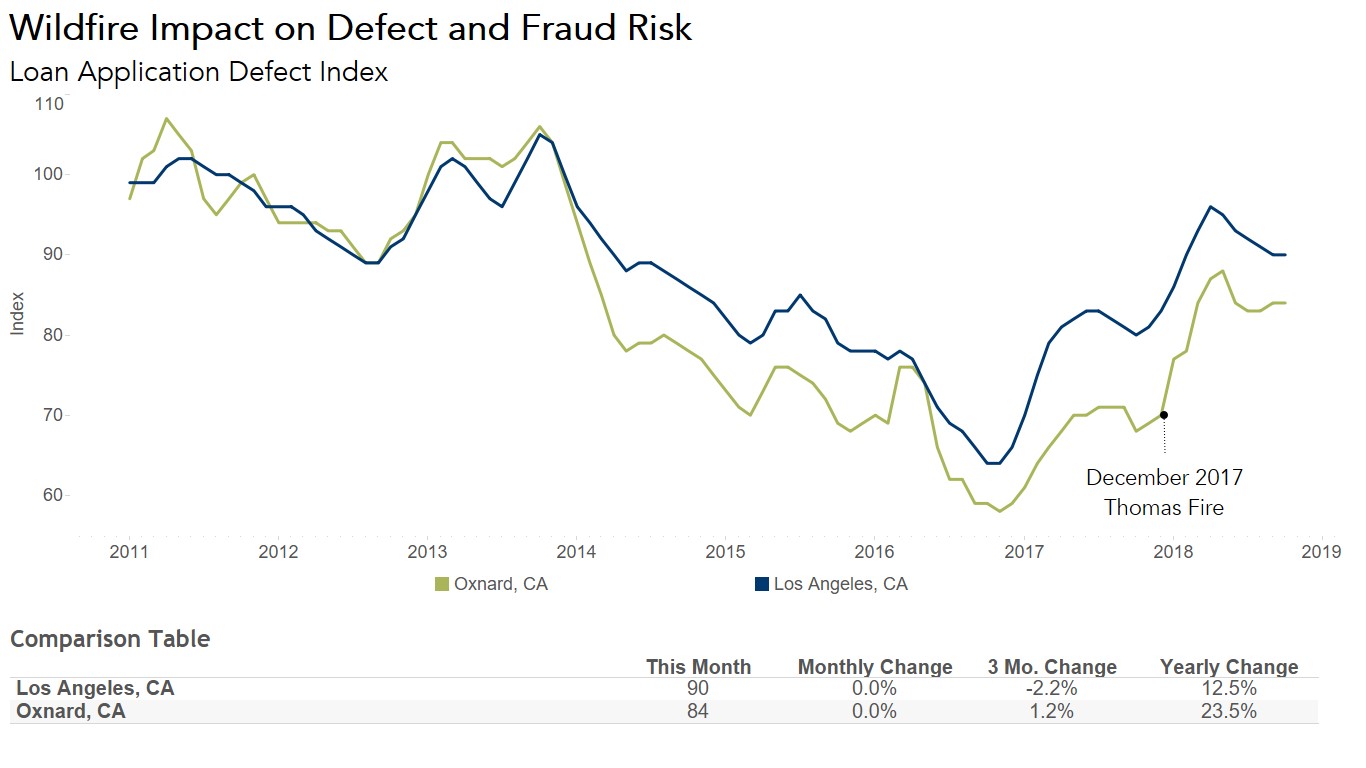

For the second month in a row, the Loan Application Defect Index for purchase transactions increased in October compared with the previous month. Year over year, the Defect Index for purchase transactions decreased 8.9 percent compared with October 2017. The Defect Index for refinance transactions increased 1.4 percent compared with the previous ...

Read More ›