House Price Appreciation Poised to Accelerate as Pandemic Intensifies Housing Supply Shortage

By

Odeta Kushi on June 2, 2020

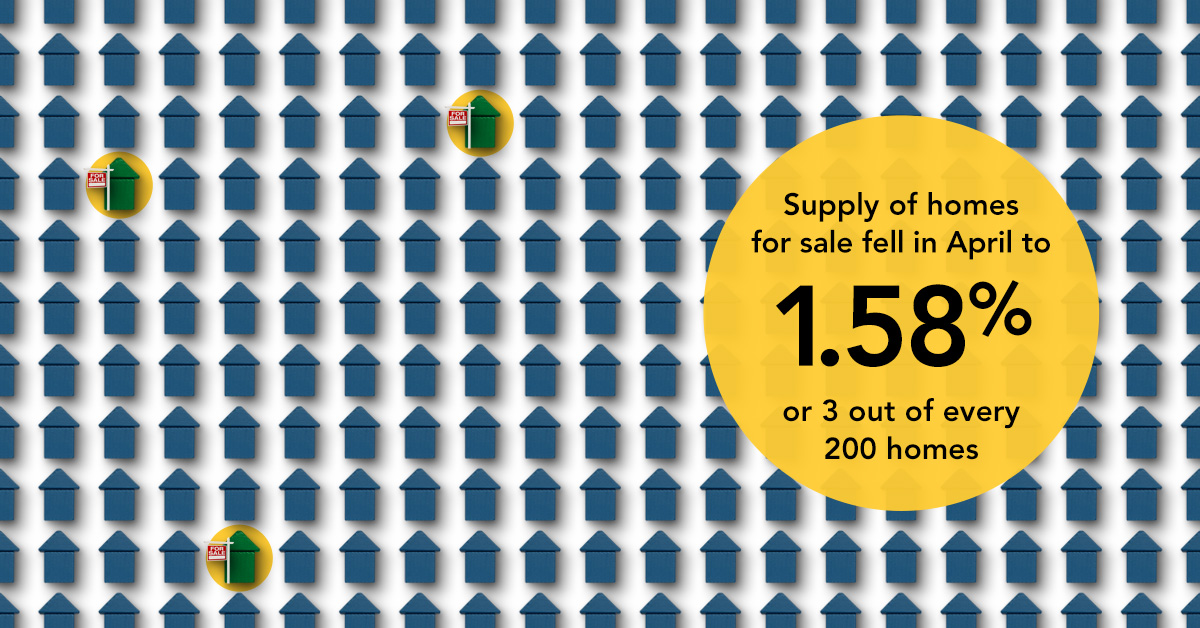

In April, pandemic-related pressure drove the supply of homes for sale to its lowest April supply level ever. Even in the years prior to the pandemic, the lack of housing supply for sale was a significant headwind to the housing market. A major reason for the lack of homes for sale is increasing tenure – the length of time a homeowner lives in ...

Read More ›

Interview with Yahoo! Finance: Existing-Home Sales Poised for Rebound in May Following April Plunge

By

FirstAm Editor on May 26, 2020

First American Chief Economist Mark Fleming was interviewed on Yahoo! Finance last week, explaining why the April existing-home sales numbers are likely the trough in this cycle and that signs point to a strong May rebound for the housing market.

Read More ›

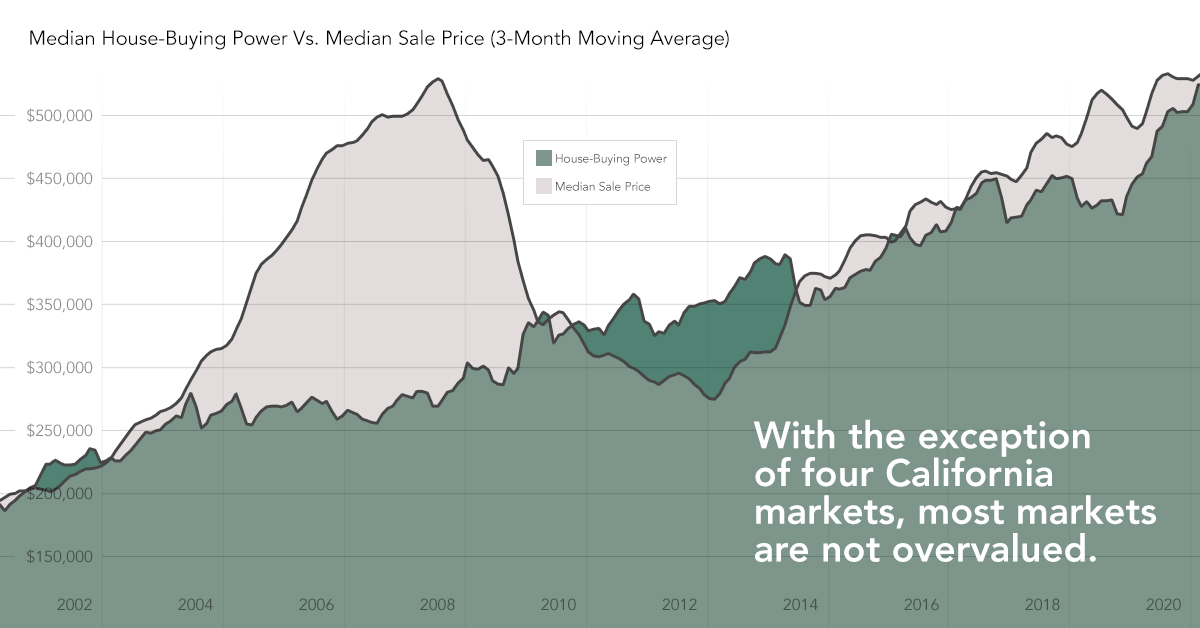

Why Housing Overvaluation is Not as Prevalent as Many Believe

By

Mark Fleming on May 22, 2020

In March, data began to reveal the depth of the impact from the pandemic on the housing market. The number of existing-home sales fell 8.5 percent relative to February, and the number of new listings continued to dwindle. While historically low mortgage rates make it more affordable for those with stable incomes to buy a home, tightening credit ...

Read More ›

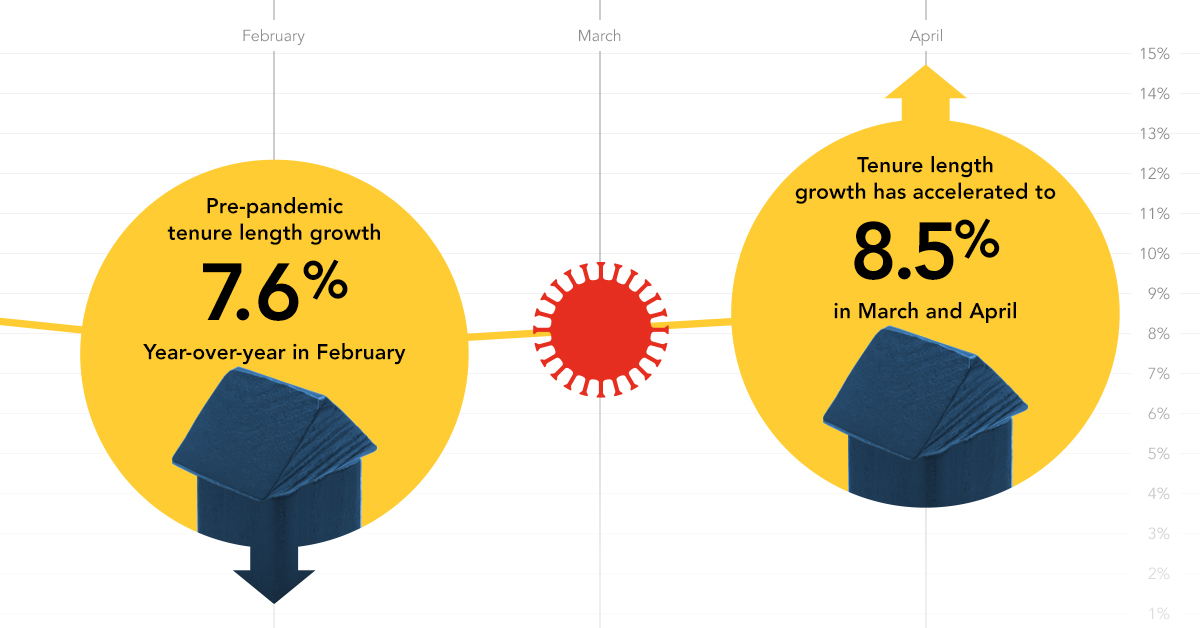

Why the Pandemic Has Worsened the Housing Supply Shortage

By

Mark Fleming on May 20, 2020

The coronavirus pandemic continued its historic assault on the domestic and global economy in April, and the housing market did not go unscathed. Typically, the hot spring home-buying season would be in full swing in April, but pandemic-related impacts, including shelter-in-place orders, the rapid surge in unemployment, and declining consumer ...

Read More ›

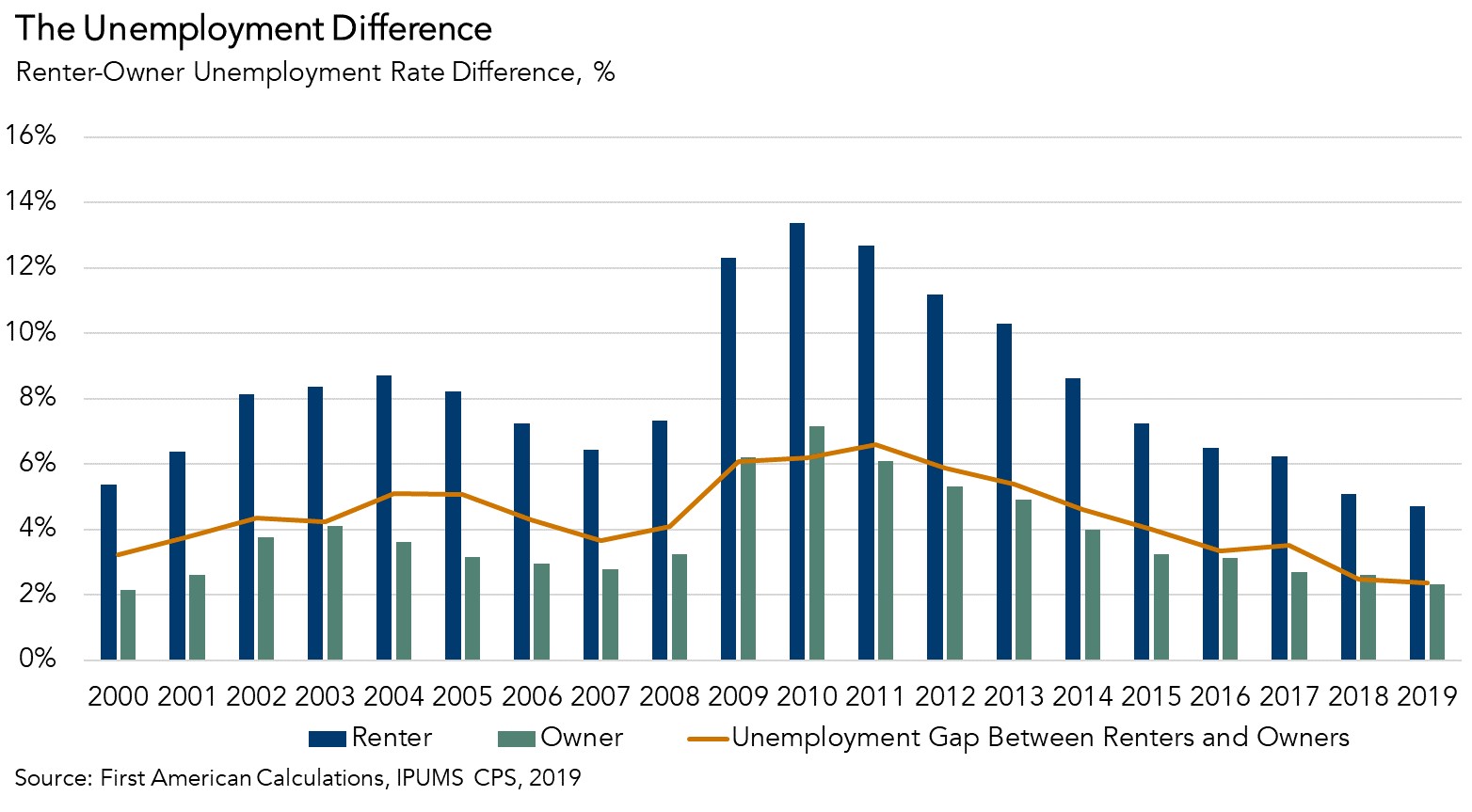

What a Service Sector-Driven Recession Means for Homeownership Demand

By

Odeta Kushi on May 14, 2020

The shutdown of large discretionary consumption segments of the U.S. economy, with the intent to slow and prevent the spread of COVID-19, has triggered one of the fastest contractions in U.S. economic activity ever observed. As a result, millions of Americans have filed for jobless benefits and the unemployment rate rose to 14.7 percent in April, ...

Read More ›

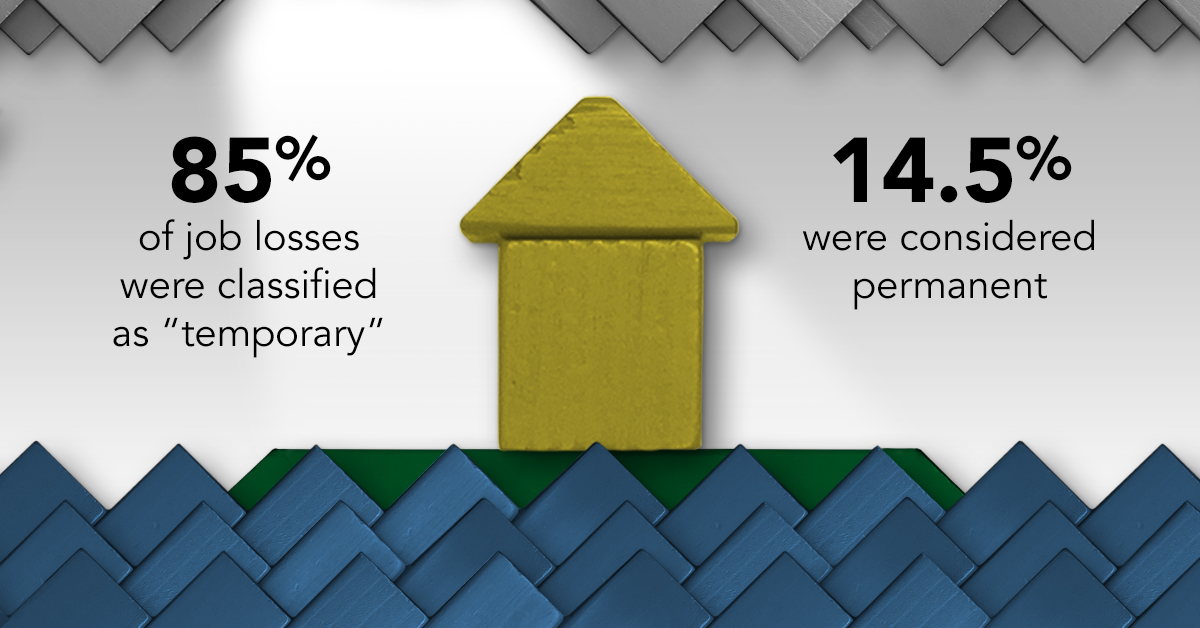

Why the Labor Market May Recover Faster than Previous Recessions

By

Odeta Kushi on May 6, 2020

The coronavirus pandemic continues to significantly impact the domestic and global economy. Weekly unemployment claims in April have broken records and consumer confidence has declined with the worsening economic conditions. More than 18 percent of the labor force has claimed unemployment in the past six weeks. Less than two months ago, the ...

Read More ›