Recent Posts by Odeta Kushi

Where Is It Cheaper to Own a Home Than to Rent?

By

Odeta Kushi on April 10, 2020

As the coronavirus pandemic and its repercussions create challenges for all, it’s easy and important to focus on the day-to-day headlines and the information driving the news cycle at the moment. But, understanding long-term trends, even those that may be altered by the pandemic’s impacts, provides helpful insight into major decisions, like the ...

Read More ›

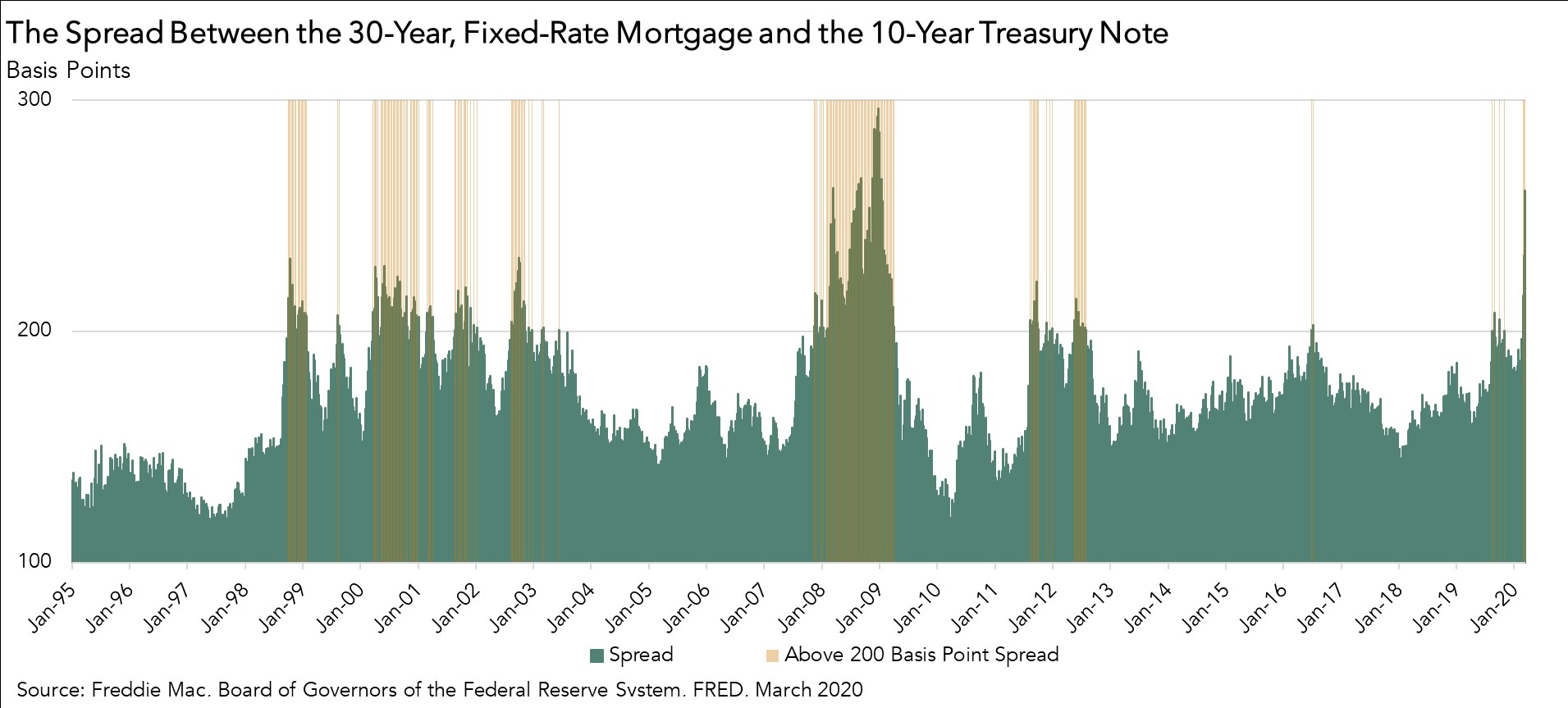

Are Negative Mortgage Rates on the Horizon?

By

Odeta Kushi on March 18, 2020

Given both emergency rate cuts of the Federal Reserve and the recent economic uncertainty due to the spread of the Coronavirus, the 10-year Treasury yield dropped to its lowest level in 150 years, according to Nobel Laureate Robert Shiller. For added perspective, that takes us back to the time of Ulysses S. Grant’s presidency. The 10-year Treasury ...

Read More ›

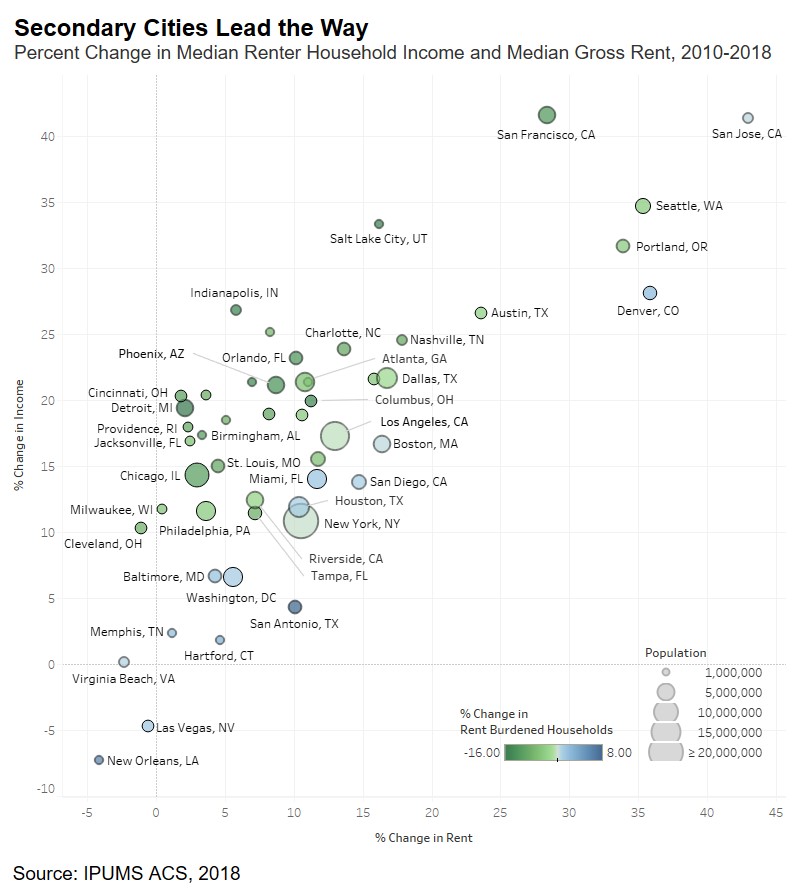

Where Rent-Burdened Households Declined the Most

By

Odeta Kushi on March 11, 2020

Beginning in 2011 and continuing through 2018, the share of rent-burdened households declined nationally – a trend reversal from the decade between 2000 and 2010. According to the Department of Housing and Urban Development, rent-burdened households spend over 30 percent of their income on rent. However, as the old adage goes, it’s all about ...

Read More ›

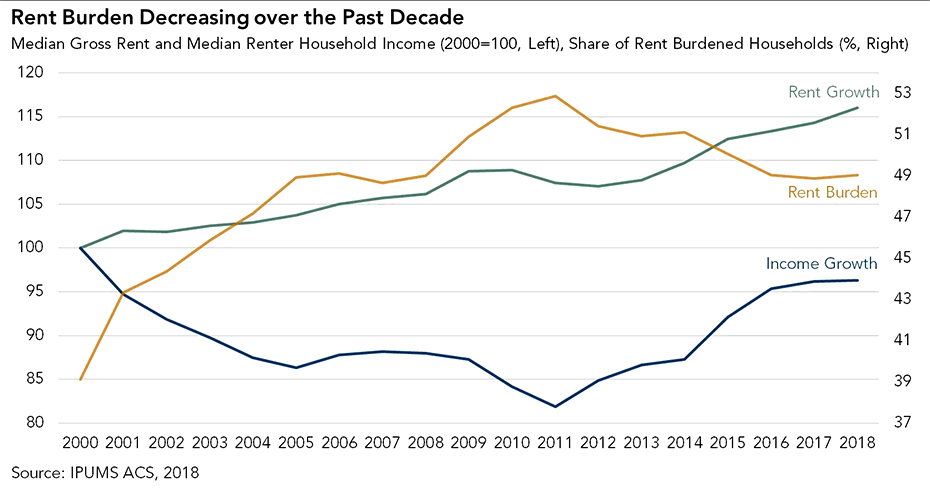

Why the Share of Rent-Burdened Households Has Declined in the Post-Recession Era

By

Odeta Kushi on March 2, 2020

After nearly 20 years of rising rents, renter affordability, or the lack thereof, is a hot topic in housing. The long-running increase in rents has fueled a rise in the share of rent-burdened households, defined by the Department of Housing and Urban Development (HUD) as households that spend over 30 percent of their income on rent.

Read More ›

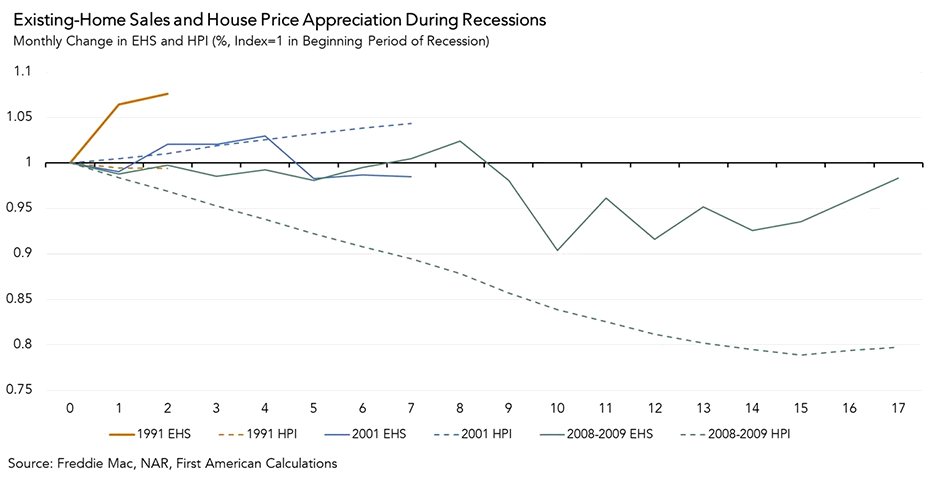

Why Today’s Housing Market May Be a Recession Buster

By

Odeta Kushi on February 4, 2020

In the third quarter of 2019, the United States reached its longest economic expansion in history, which caused some people to wonder whether we were overdue for a correction. Additionally, global uncertainty resulted in a flight to safety of U.S. Treasury bonds, prompting the dreaded inversion of the yield curve. When that happened, we discussed ...

Read More ›

Where Lower-Income Renters Can Pursue the Dream of Homeownership

By

Odeta Kushi on December 12, 2019

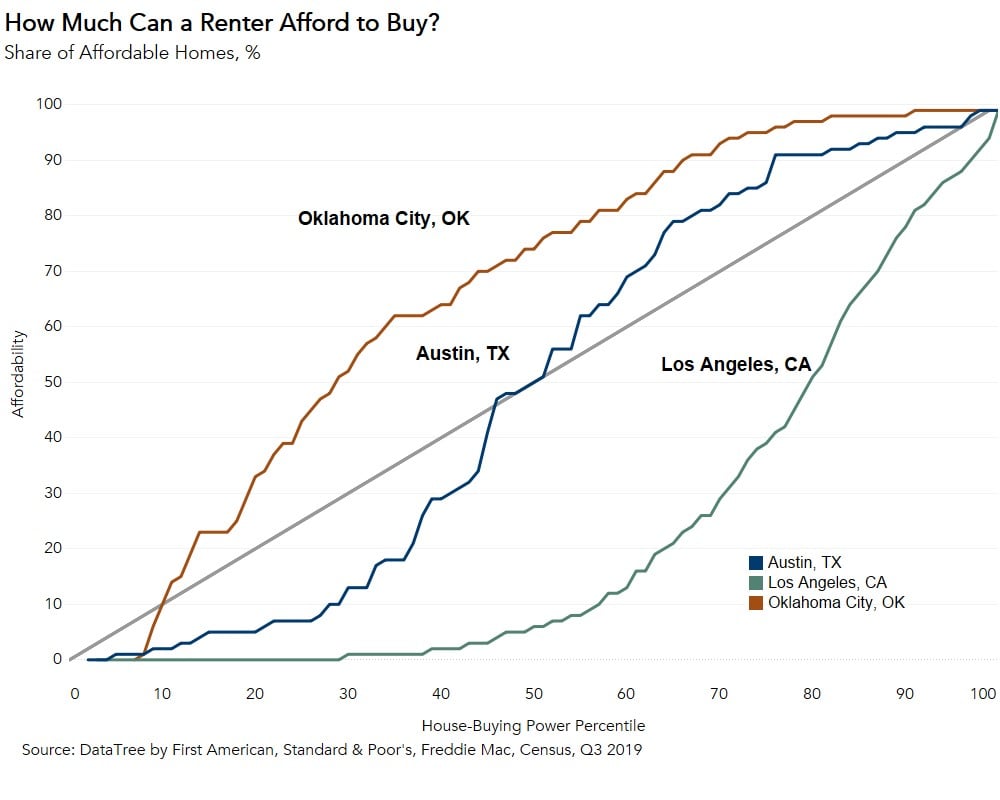

In 2019, the growth in consumer house-buying power outpaced house price appreciation for the median renter trying to buy the median priced home. But, there are many renters with household incomes below the median income in their cities. We can measure affordability for all renter households based on their household income and the share of homes ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report