Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Housing Affordability Improved for Second Consecutive Month in December

By

Mark Fleming on February 28, 2023

While affordability has fallen 48 percent since December 2022, as measured by the Real House Price Index (RHPI), affordability has improved for two straight months. Nominal house price appreciation has slowed dramatically in response to dampened demand. Nationally, annual nominal house price growth peaked in March at 21 percent but has since ...

Read More ›

How Will Recent Uptick in Mortgage Rates Impact Spring Home-Buying?

By

Mark Fleming on February 22, 2023

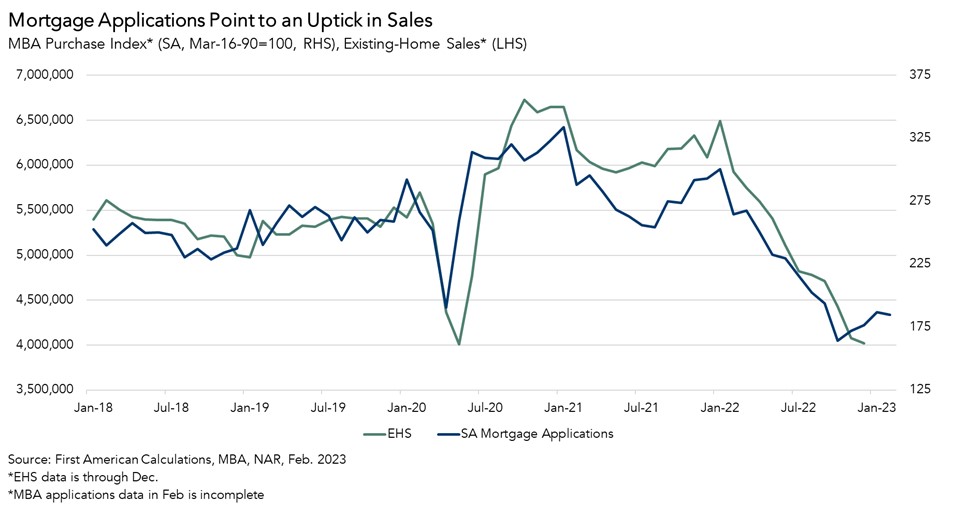

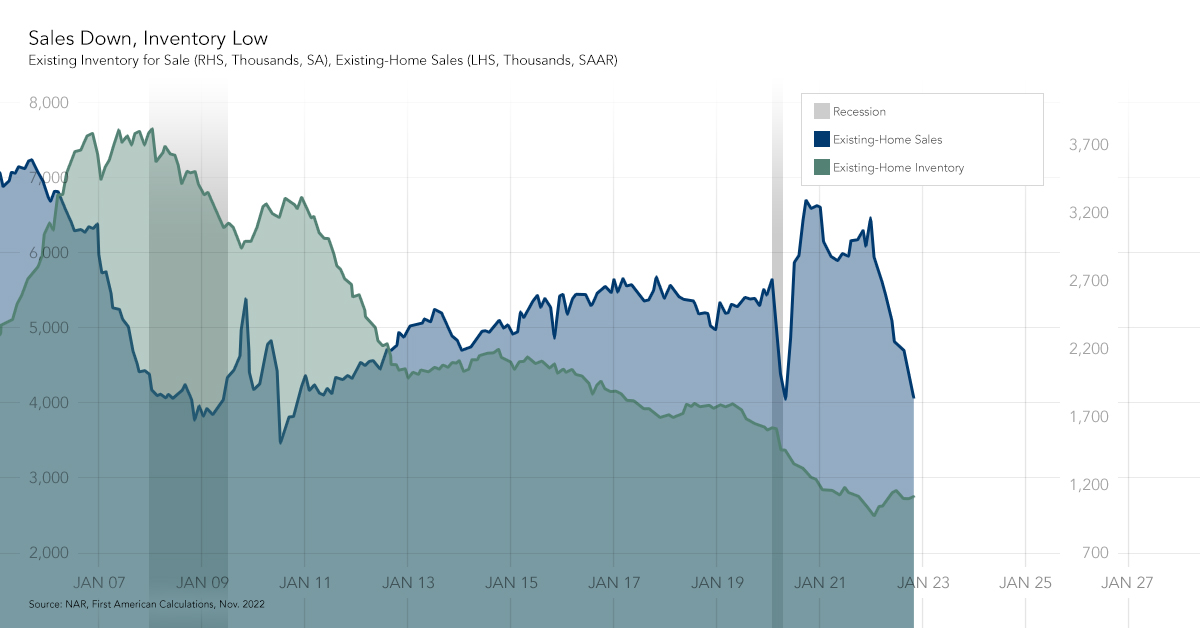

There’s no question that the housing market fell into a deep freeze in the second half of 2022. Excluding the early months of the pandemic, the pace of existing-home sales fell below 5 million seasonally adjusted sales for the first time since 2014. Yet, signs have emerged that sales activity may pick up in the months ahead. Purchase mortgage ...

Read More ›

House Prices Declining Fastest in Overvalued Markets

By

Mark Fleming on January 31, 2023

In November 2022, the Real House Price Index (RHPI) increased by 60 percent on an annual basis. This rapid annual decline in affordability was driven by two factors -- a 7.6 percent annual increase in nominal house prices and a 3.7 percentage point increase in the average 30-year, fixed mortgage rate compared with one year ago. Even though ...

Read More ›

Why Housing Market Potential Increased for the Second Straight Month

By

Mark Fleming on January 20, 2023

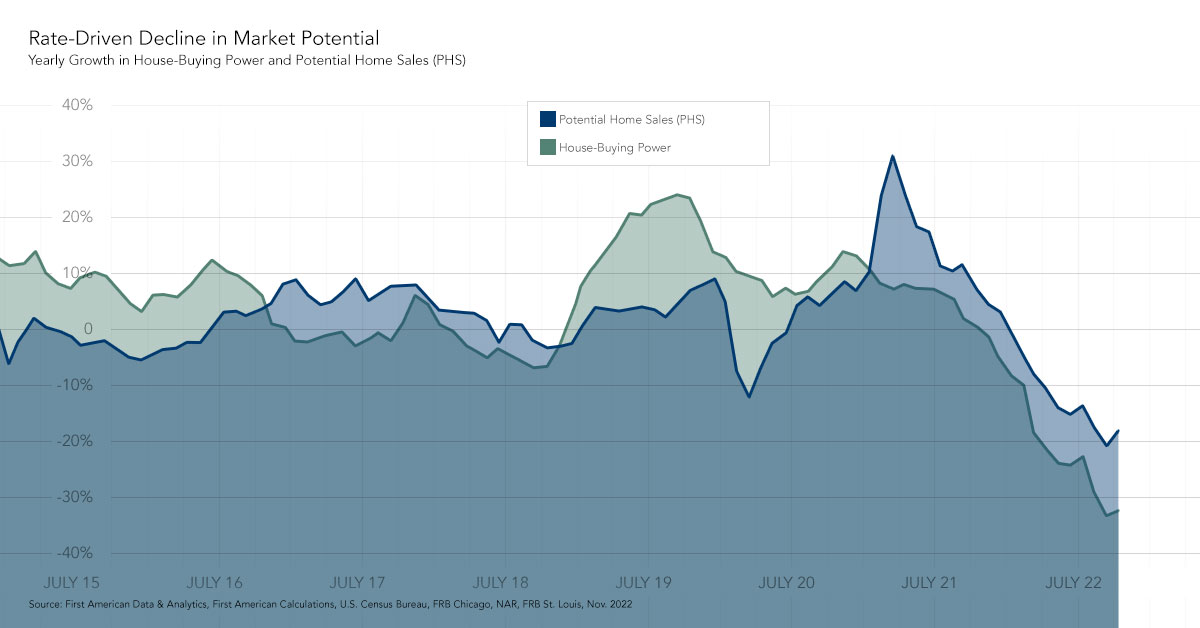

Housing market potential closed 2022 on a two-month upswing, increasing by 3.0 percent relative to November. Despite the second consecutive month-over-month uptick, housing market potential remained down 17 percent compared with December of last year, a decline of 1,065,000 potential existing-home sales. The steep annual decline in market ...

Read More ›

Why Housing Affordability May Rebound in 2023

By

Mark Fleming on December 26, 2022

Affordability continued to suffer in October 2022, as the Real House Price Index (RHPI) jumped up by 68 percent on an annual basis. This rapid annual decline in affordability was driven by a 12 percent annual increase in nominal house prices and a 3.8 percentage point increase in the average 30-year, fixed mortgage rate compared with one year ago. ...

Read More ›

The Case for Optimism for Housing Market Potential in 2023

By

Mark Fleming on December 20, 2022

Housing market potential in 2023 will remain largely dependent on the path of mortgage rates, which will be heavily influenced by inflation. In November 2022, housing market potential increased by 2.5 percent relative to October, boosted by a slight month-over-month decline in mortgage rates. Even with the modest monthly increase in housing market ...

Read More ›

.jpg)

.jpg)