Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Seasonal Demand Drives Resurgent House Price Growth and Decline in Affordability

By

Mark Fleming on May 31, 2023

In March, housing affordability declined, snapping a four-month streak of increasing affordability. The decline in March occurred as two of the three key drivers of the Real House Price Index (RHPI), nominal house prices and mortgage rates, moved higher, decreasing house-buying power by 2.7 percent and dragging affordability down relative to one ...

Read More ›

Two Dynamics Locking Existing Homeowners into their Homes

By

Mark Fleming on May 17, 2023

The housing market remains sluggish heading into the spring home-buying season. While mortgage rates have retreated from recent peaks, they remain elevated compared with one year ago. Higher mortgage rates have a dual impact on sales – pricing out buyers who lose purchasing power and keeping some potential sellers rate-locked in. There are plenty ...

Read More ›

Why Declining House Prices and Softening Labor Market Will Not Trigger a Foreclosure Tsunami

By

Mark Fleming on April 21, 2023

Affordability has now improved for four straight months, yet remains down 32 percent since February 2022, according to the Real House Price Index (RHPI). Recently falling mortgage rates have overpowered the affordability-dampening effects of higher nominal house prices. Nominal house price appreciation has slowed dramatically in response to ...

Read More ›

Will there be a Residential Real Estate Credit Crunch?

By

Mark Fleming on April 18, 2023

The housing market has faced its fair share of headwinds leading up to this year’s spring home-buying season. While mortgage rates have retreated from recent highs, they remain elevated compared with one year ago, and house prices, while down from the peak, also remain elevated. All while housing supply remains historically and unseasonably low. ...

Read More ›

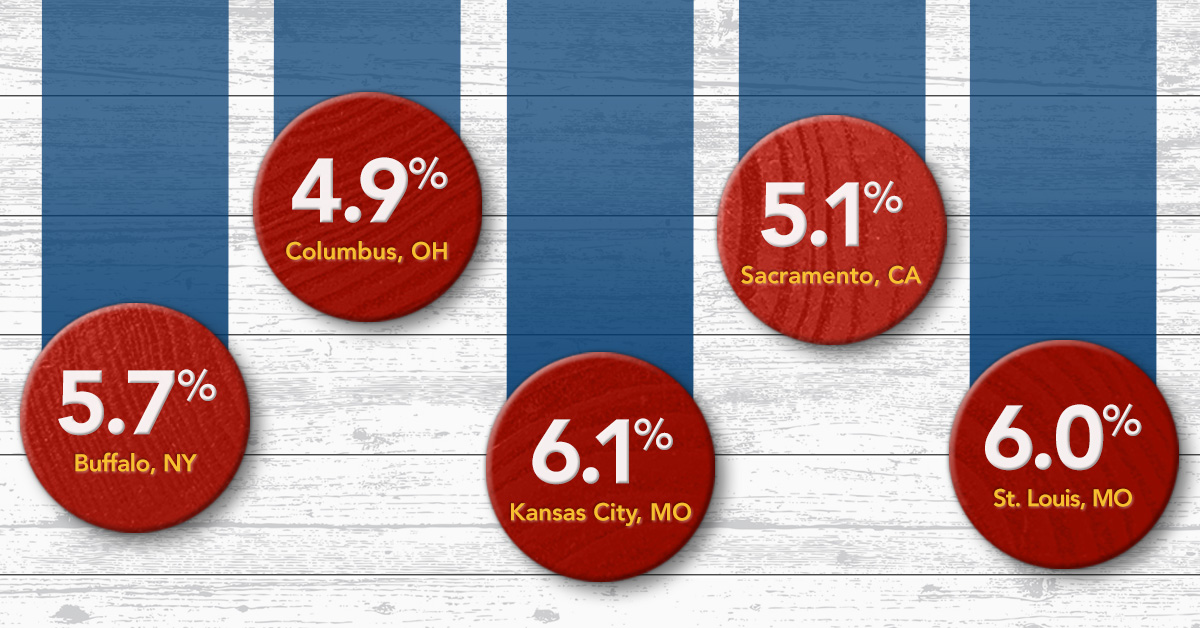

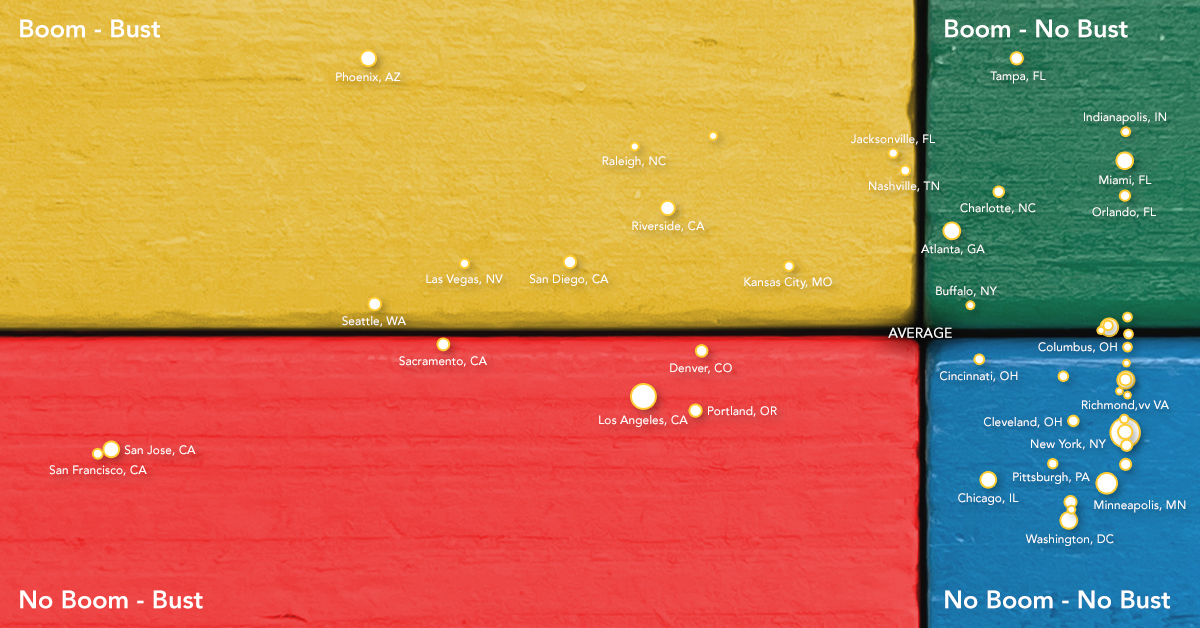

What Makes a Boom-Bust Market?

By

Mark Fleming on March 30, 2023

Affordability has now improved for three straight months, yet remains down 39 percent since January 2022, according to the Real House Price Index (RHPI). Nominal house price appreciation has slowed dramatically in response to dampened demand. Nationally, annual nominal house price growth peaked in March 2022 at 21 percent, but has since ...

Read More ›

Why Home Buyers May Find More Opportunities with New Homes this Spring

By

Mark Fleming on March 21, 2023

The spring season is typically the busiest time of the year for the housing market. According to data from First America Data & Analytics, historically approximately 36 percent of existing-home sales for the year occur from March through June. The housing market’s seasonal pattern is driven by factors such as weather, holidays and the ...

Read More ›