Affordability has now improved for three straight months, yet remains down 39 percent since January 2022, according to the Real House Price Index (RHPI). Nominal house price appreciation has slowed dramatically in response to dampened demand. Nationally, annual nominal house price growth peaked in March 2022 at 21 percent, but has since decelerated by nearly 17 percentage points to 4.4 percent in January. The pandemic-era boom in house prices was broad-based, with house prices increasing by an average of approximately 42 percent from pre-pandemic to peak in the 10 markets now experiencing the lowest annual price growth. Now, as house prices adjust to the reality of higher mortgage rates, it’s becoming clear that the pace of adjustment will vary significantly by market.

“Price declines will continue across many markets, but those declines would have to be substantial to erase all the equity gains accumulated by homeowners over the last few years.”

What Factors Determine Boom and Bust Markets?

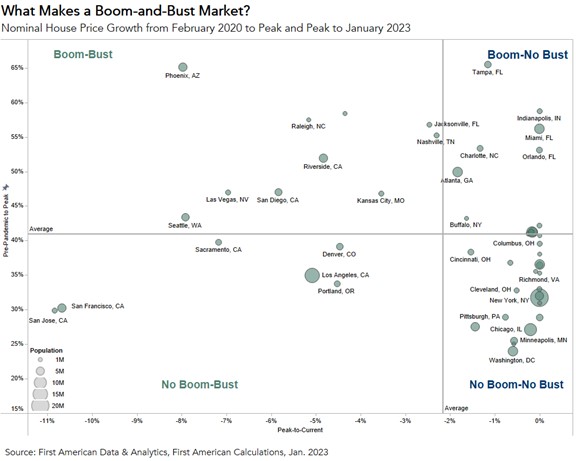

The ongoing adjustment in house prices is broad-based as well, with nominal house prices declining in January from their recent peaks in 35 of the top 50 markets we track, but also varies significantly by market. In some markets, house prices have declined from recent peaks by double-digits, while house prices in other markets have yet to decline. Of course, repeat-sales price indices, such as the one used in this analysis are based on closed sales prices, which are a lagging indicator of price changes in the housing market because the contracts for these closed sales were set months earlier. Even so, a pattern emerges that allows us to separate markets into four categories[1]: boom-bust; boom-no bust; no boom-bust; and no boom-no bust.

- Boom-Bust: An example of a boom-bust market is Phoenix. House prices increased 65 percent from February 2020 to the peak in May of 2022, but have since declined by nearly 8 percent. Phoenix is emblematic of the expression -- the higher they rise, the harder they fall. Demand skyrocketed, partially because of significant net-in migration to Phoenix over the course of the pandemic. Of the top 50 markets we track, Phoenix experienced the fourth highest growth in population from 2020 to 2021. Additionally, according to our calculations using data from First American Data & Analytics, more than 30 percent of all residential home sales in Phoenix in the summer of 2022 were investor purchases of residential homes as rental properties, indicating heightened investor demand. However, the share of investor purchases has declined significantly since then. The swift pullback in demand due to declining affordability is dragging down house prices.

- Boom-No Bust: Miami is an example of a boom-no bust market. In fact, house prices have yet to decline in Miami. Since the start of the pandemic, Miami house prices have increased by over 56 percent. John Burns Real Estate Consulting national survey results from February indicate that the southern Florida housing market is holding up better than most of the country, in part, because of the prevalence of cash buyers, who are not deterred by rising mortgage rates, making demand more resilient.

- No Boom-Bust: The example of a no boom-bust market is San Jose, Calif. In San Jose, house prices increased 30 percent from February 2020 until the peak in April 2022 and have since declined by 11 percent from the peak. While San Jose prices have declined the most from peak among the markets tracked, it was in the bottom 10 markets for pre-pandemic-to-peak growth. Many of the markets with the largest price declines from peak, such as San Jose and San Francisco are also considered “overvalued” markets, meaning the median existing-home sale price exceeded house-buying power in these markets pre-bust. For San Jose in January, the housing market was still overvalued by $549,000. These larger coastal markets have long been among the most expensive, so when mortgage rates nearly doubled in a year, the pullback in demand in these already expensive markets was more pronounced.

- No Boom-No Bust: New York is an example of a no boom-no bust market. The pre-pandemic-to-peak growth rate in New York was nearly 32 percent, muted compared with other top markets. House prices have not yet declined in New York, in part because there was less of a boom during the pandemic, as many residents flocked to the suburbs from the density of the city. Not as fast of a rise, not as hard of a fall.

Prices Declines May Continue, But Equity Buffers Remain

While prices declines will likely continue across the top 50 markets, there is one trend that bodes well for all markets – much of the homeowner equity gained during the pandemic remains. As the housing market rebalances, price declines will continue across many markets, but those declines would have to be substantial to erase all of the equity gains accumulated by homeowners during the pandemic boom.

For more analysis of affordability, please visit the Real House Price Index. The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of April 17, 2023.

[1] If a market is above the average rate of nominal house price from 2020 until the peak, then it is considered a pandemic “boom” market. If a market is below the average rate of growth from peak-to-January 2023, then that is considered a bust market. The average pre-pandemic to peak growth rate was 41 percent, while the average peak-to-current growth was -2 percent.

Sources:

January 2023 Real House Price Index Highlights

The First American Real House Price Index (RHPI) showed that in January 2023:

- Real house prices decreased 0.9 percent between December 2022 and January 2023.

- Real house prices increased 38.8 percent between January 2022 and January 2023.

- Consumer house-buying power, how much one can buy based on changes in income and interest rates, increased 1.3 percent between December 2022 and January 2023, and decreased 24.8 percent year over year.

- Median household income has increased 4.1 percent since January 2022 and 80.3 percent since January 2000.

- Real house prices are 32.8 percent more expensive than in January 2000.

- Unadjusted house prices are now 48 percent above the housing boom peak in 2006, while real, house-buying power-adjusted house prices are 7.1 percent below their 2006 housing boom peak.

January 2023 Real House Price State Highlights

- The five states with the greatest year-over-year increase in the RHPI are: Vermont (+52.8 percent), Alabama (+49.4 percent), Maryland (+48.2 percent), New Hampshire (+47.8 percent), and Florida (+47.4).

- There were no states with a year-over-year decrease in the RHPI.

January 2023 Real House Price Local Market Highlights

- Among the Core Based Statistical Areas (CBSAs) tracked by First American, the five markets with the greatest year-over-year increase in the RHPI are: Miami (+59.5 percent), Indianapolis (+57.0 percent), Orlando, Fla. (+49.1 percent), Baltimore (+47.1 percent), Jacksonville, Fla. (+46.5 percent).

- Among the Core Based Statistical Areas (CBSAs) tracked by First American, there were no markets with a year-over-year decrease in the RHPI.

About the First American Real House Price Index

The traditional perspective on house prices is fixated on the actual prices and the changes in those prices, which overlooks what matters to potential buyers - their purchasing power, or how much they can afford to buy. First American’s proprietary Real House Price Index (RHPI) adjusts prices for purchasing power by considering how income levels and interest rates influence the amount one can borrow.

The RHPI uses a weighted repeat-sales house price index that measures the price movements of single-family residential properties by time and across geographies, adjusted for the influence of income and interest rate changes on consumer house-buying power. The index is set to equal 100 in January 2000. Changing incomes and interest rates either increase or decrease consumer house-buying power. When incomes rise and mortgage rates fall, consumer house-buying power increases, acting as a deflator of increases in the house price level. For example, if the house price index increases by three percent, but the combination of rising incomes and falling mortgage rates increase consumer buying power over the same period by two percent, then the Real House Price index only increases by 1 percent. The Real House Price Index reflects changes in house prices, but also accounts for changes in consumer house-buying power.

Disclaimer

Opinions, estimates, forecasts and other views contained in this page are those of First American’s Chief Economist, do not necessarily represent the views of First American or its management, should not be construed as indicating First American’s business prospects or expected results, and are subject to change without notice. Although the First American Economics team attempts to provide reliable, useful information, it does not guarantee that the information is accurate, current or suitable for any particular purpose. © 2023 by First American. Information from this page may be used with proper attribution.