Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Do Rising Rates Outweigh the Impact of the Strong Economy on Housing Market Potential?

By

Mark Fleming on November 19, 2018

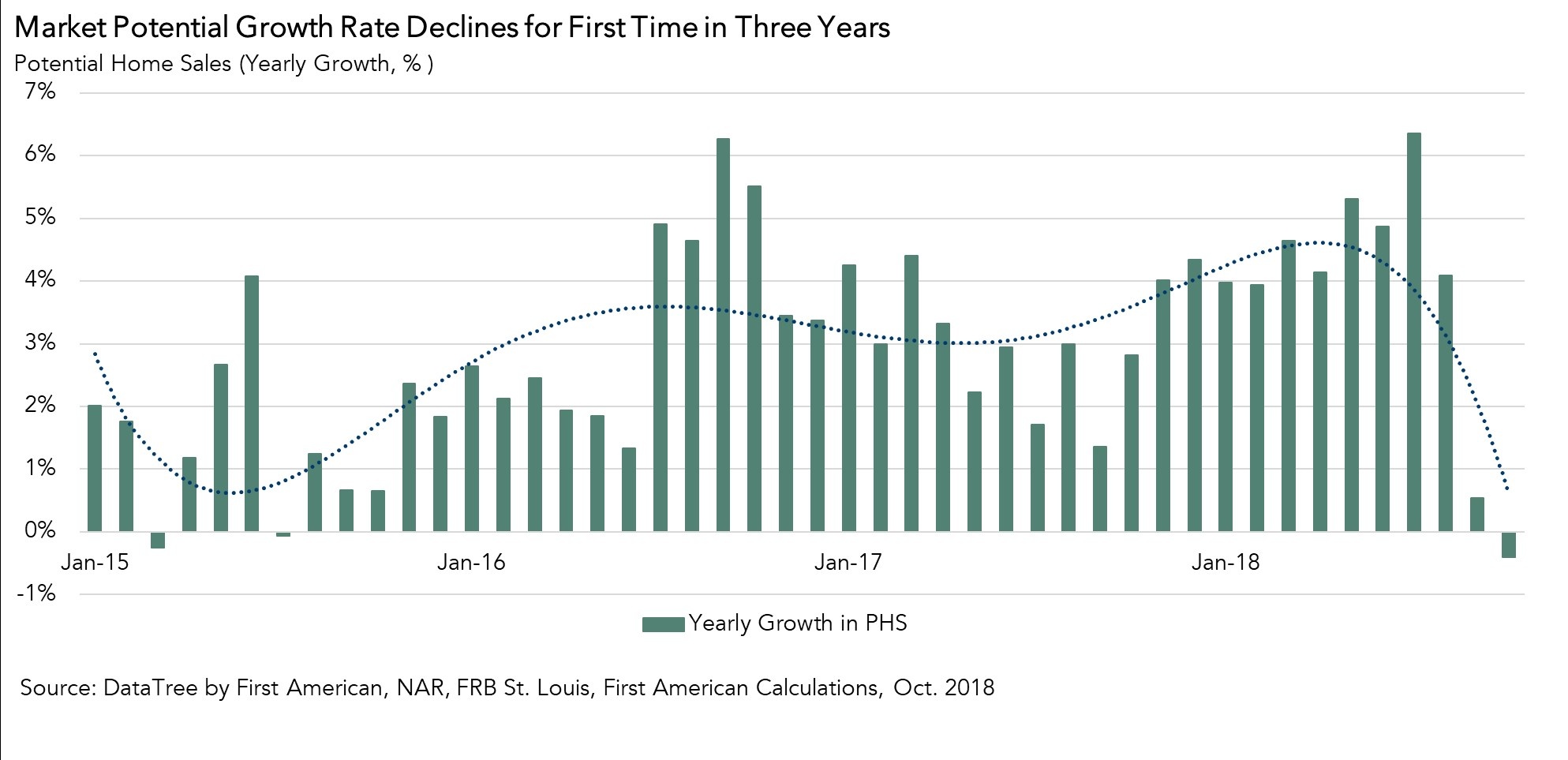

While the housing market continues to underperform its potential by 6.5 percent, the gap between actual existing home sales and the market potential for home sales narrowed by 1 percent in October compared with September, according to our Potential Homes Sales model. The housing market has the potential to support more than 391,000 additional home ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

Why the Housing Market Can Thrive at 5 Percent Mortgage Rates

By

Mark Fleming on November 12, 2018

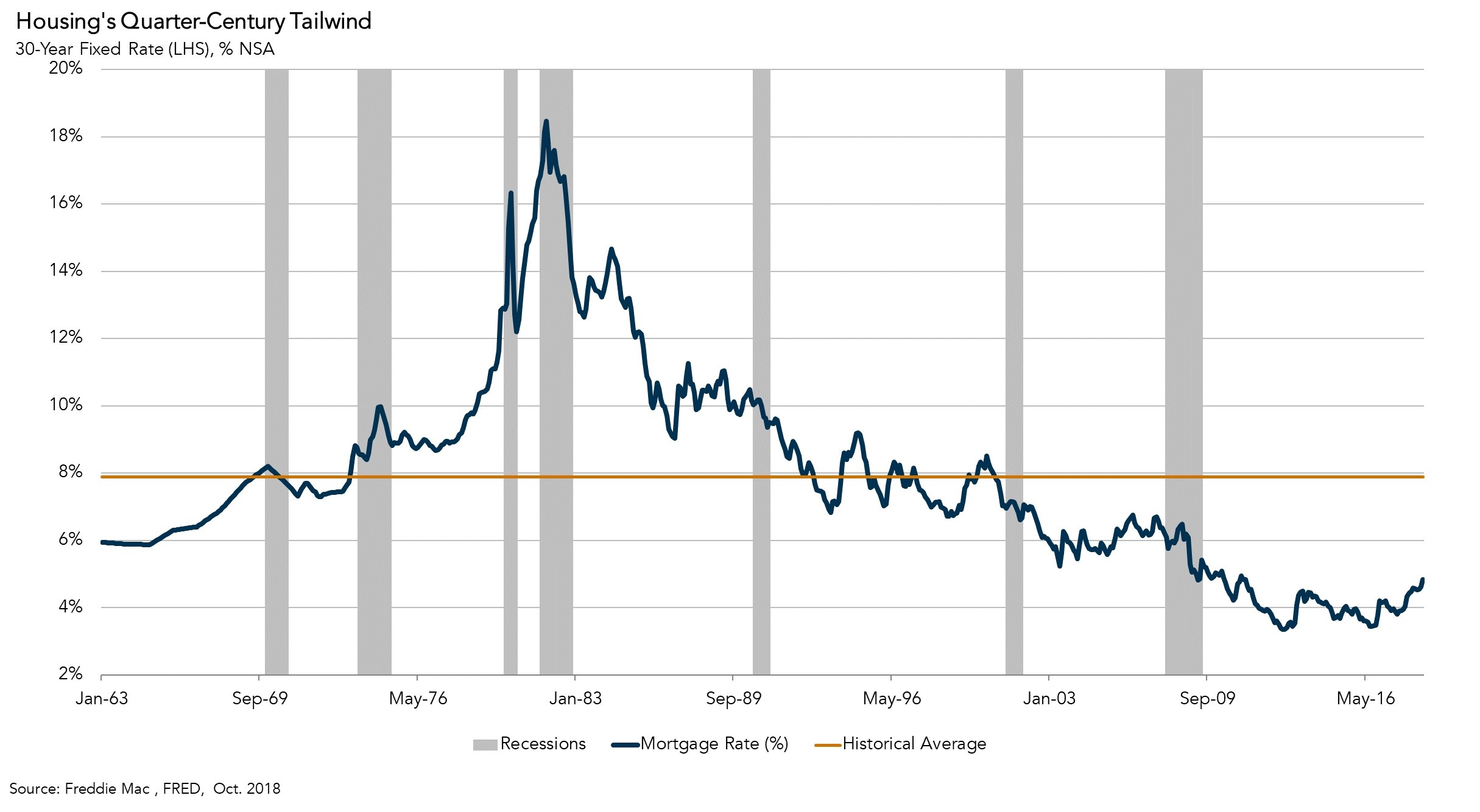

Last week, the 30-year, fixed mortgage rate hit a seven-and-a-half-year high of 4.86 percent. Most experts believe mortgage rates will continue to rise, reaching 5 percent in 2019.

Read More ›

How Wage Growth Reduced the Sting of Rising Rates on Affordability

By

Mark Fleming on October 29, 2018

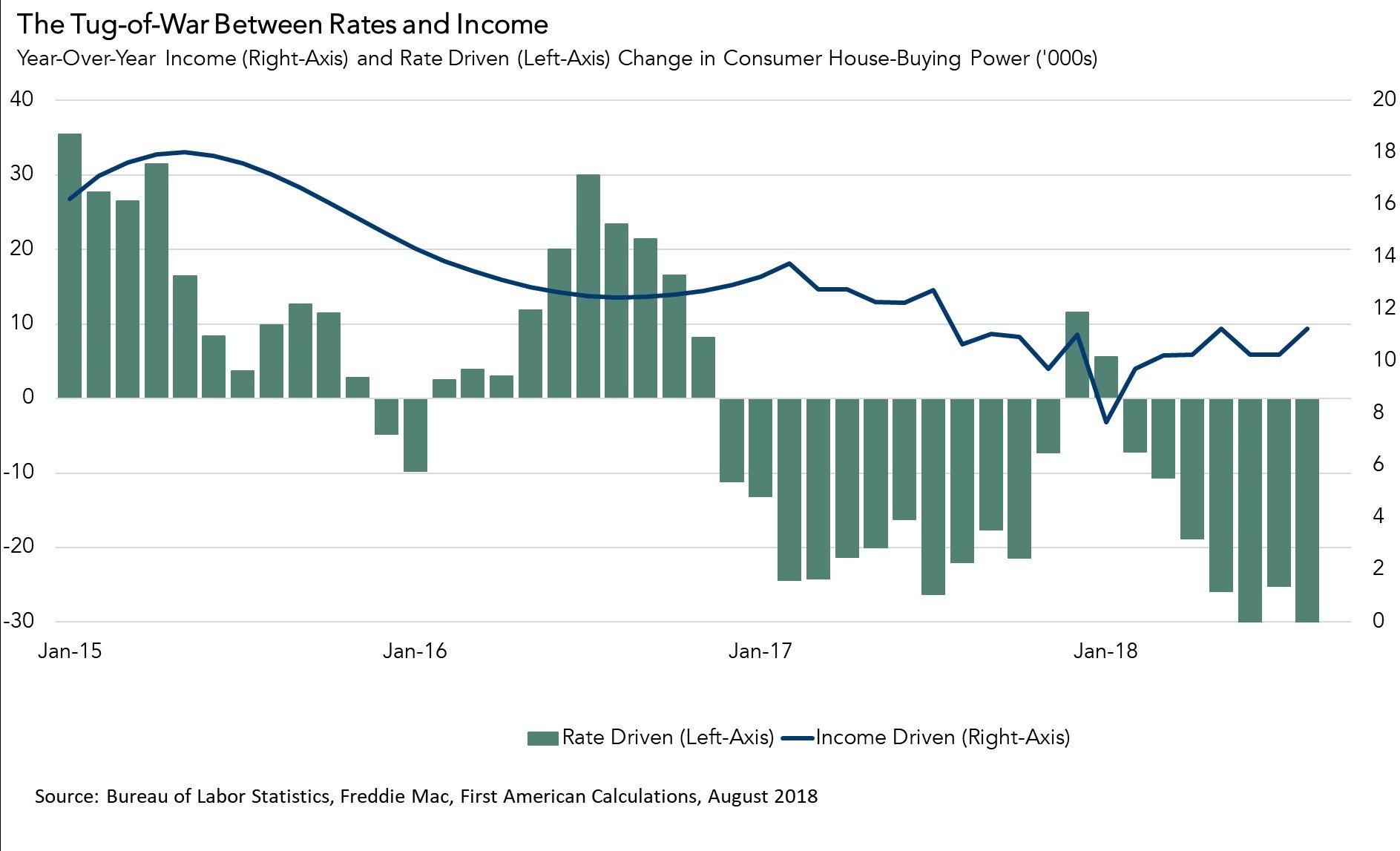

Understanding the dynamics that influence consumer house-buying power, how much home one can buy based on changes in income and interest rates, provides helpful perspective on the housing market. When incomes rise, consumer house-buying power increases. When mortgage rates or nominal house prices rise, consumer house-buying power declines. Our ...

Read More ›

What Can Hurricane Irma Teach Us About Defect Risk Trends Following Hurricanes Florence and Michael?

By

Mark Fleming on October 26, 2018

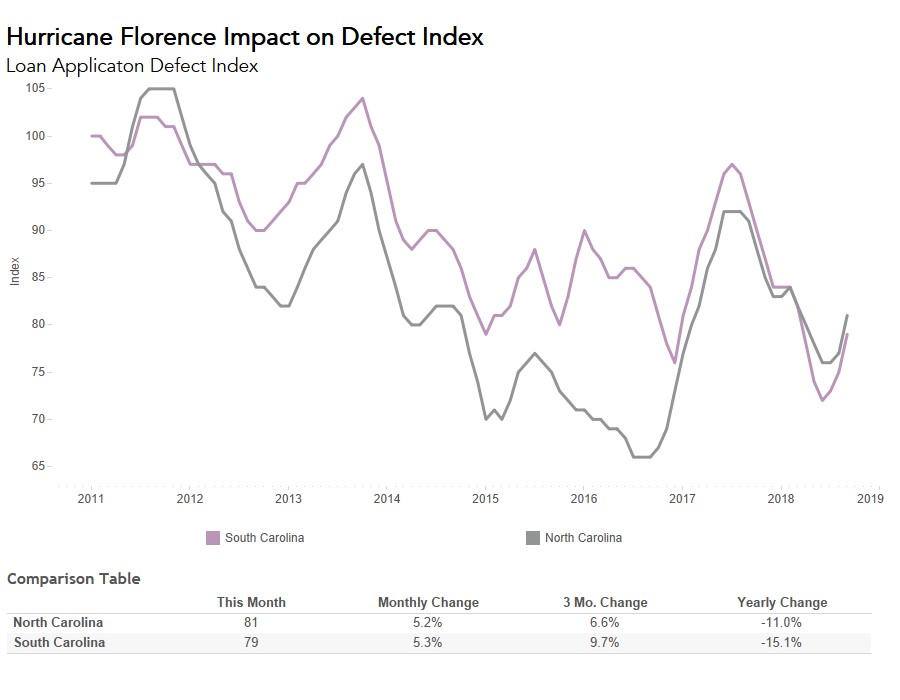

For the first time in eight months, the Loan Application Defect Index for purchase transactions increased compared with the month before, rising 1.3 percent in September over August. Year over year, the Defect Index for purchase transactions decreased 11.1 percent. The Defect Index for refinance transactions also increased by 1.4 percent compared ...

Read More ›

What Recent Hurricanes Mean For Future Housing Supply?

By

Mark Fleming on October 19, 2018

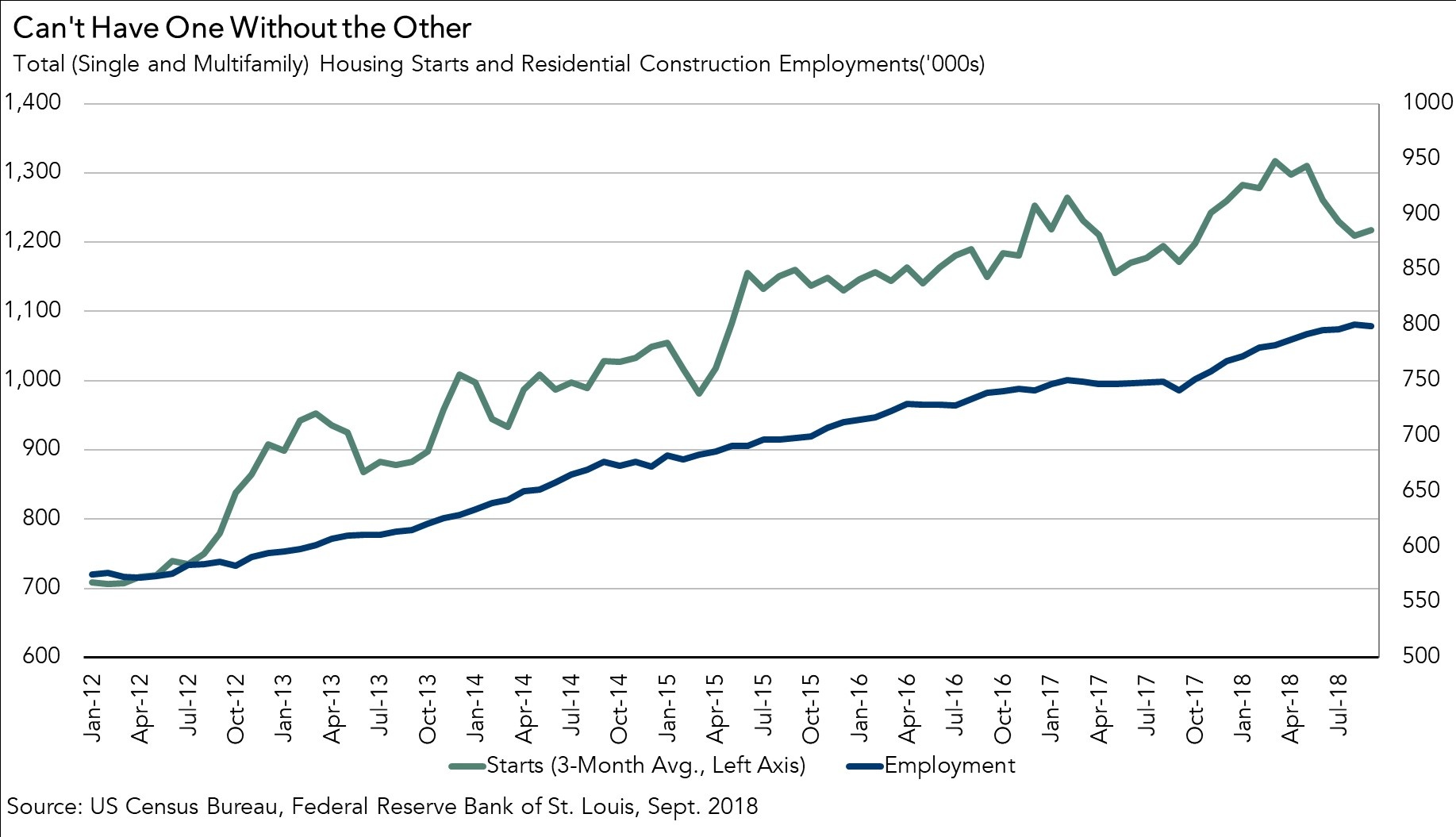

Wednesday’s Census Bureau report on new residential construction data for September sends a mixed message to the housing market. Current home buyers received a lift as completions jumped 7.0 percent compared to September of last year, which is additional new net supply added to the housing stock. The continued year-over-year growth in completions ...

Read More ›

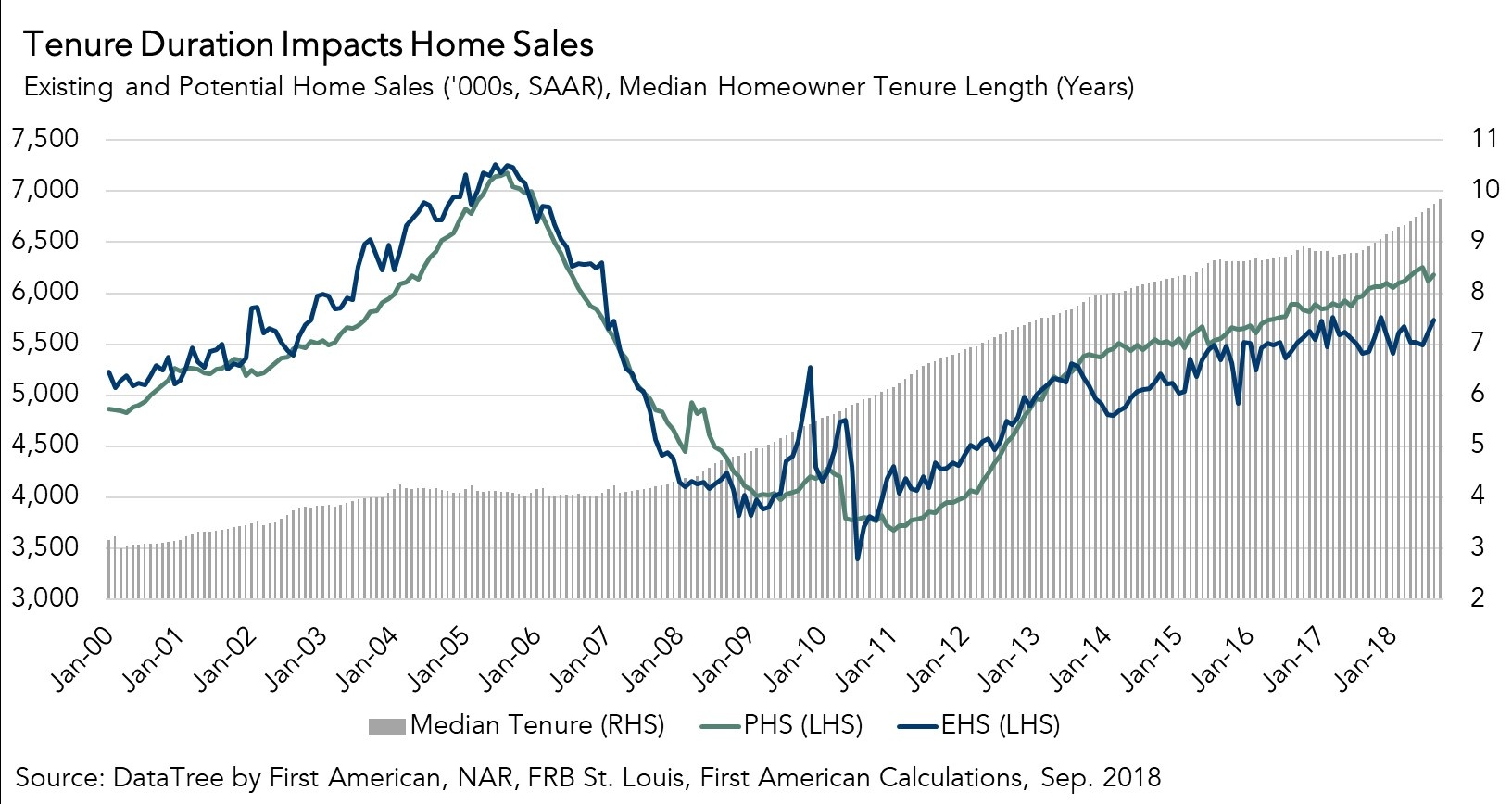

Why Homeowners Staying in their Homes Dampens the Housing Market

By

Mark Fleming on October 18, 2018

While the housing market continues to underperform its potential by 7.2 percent, the gap between actual existing home sales and the market potential for home sales narrowed by 1 percent in September compared with August, according to our Potential Homes Sales model. However, even though the performance gap narrowed a bit, the housing market still ...

Read More ›