Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

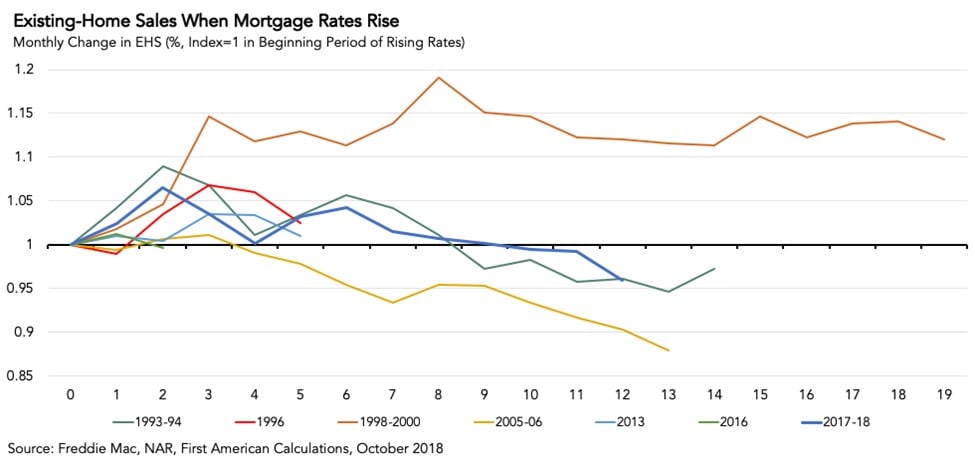

What Do Previous Rising Mortgage Rate Eras Tell Us About Today's Housing Market?

By

Mark Fleming on December 17, 2018

In November, the housing market underperformed its potential by 7.4 percent, marking 40 straight months the market remained below its potential, according to our Potential Homes Sales Model. Month over month, the gap between actual existing-home sales and the market potential for home sales narrowed by 1.2 percent, but the housing market still has ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

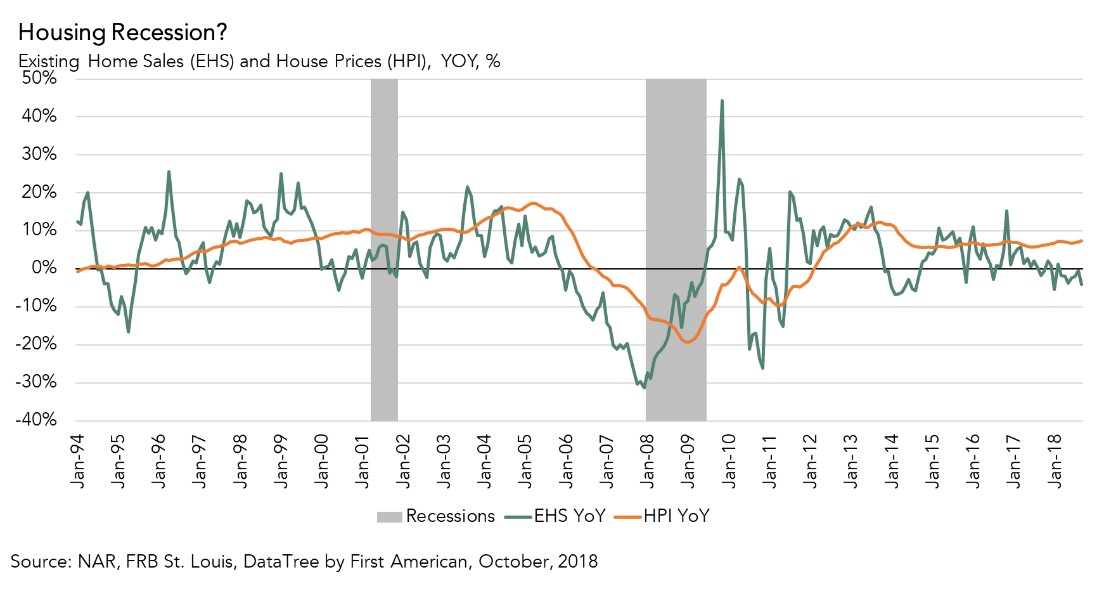

What Does an Inverted Yield Curve Mean for the Housing Market?

By

Mark Fleming on December 12, 2018

Last week, the yield curve inverted, meaning the yield on short-run Treasury bonds exceeded the yield on long-run Treasury bonds, which prompted increased speculation that a recession may be on the horizon. The speculation is rooted in the historical correlation between yield curve inversions and recessions, which have occasionally followed one to ...

Read More ›

Defect Risk Declines Nationally, But Future Increases Possible for Regions Impacted by Natural Disasters

By

Mark Fleming on December 3, 2018

For the second month in a row, the Loan Application Defect Index for purchase transactions increased in October compared with the previous month. Year over year, the Defect Index for purchase transactions decreased 8.9 percent compared with October 2017. The Defect Index for refinance transactions increased 1.4 percent compared with the previous ...

Read More ›

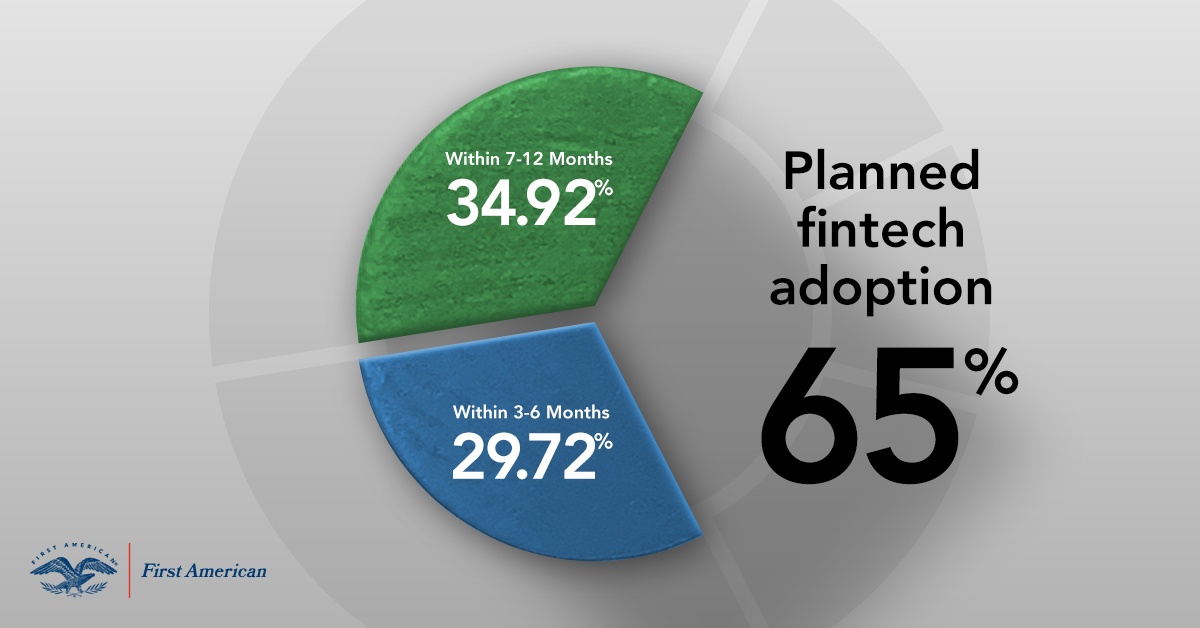

Will Fintech Adoption Among Real Estate Professionals Accelerate in 2019?

By

Mark Fleming on November 27, 2018

Throughout 2018, we’ve seen many trends that set the groundwork for the acceleration of financial technology (fintech) adoption. It has been a strong seller’s market across the top U.S. metropolitan areas. With inventory low and house prices at historic highs, prospective home buyers felt pressured to settle deals quickly before opportunities fade ...

Read More ›

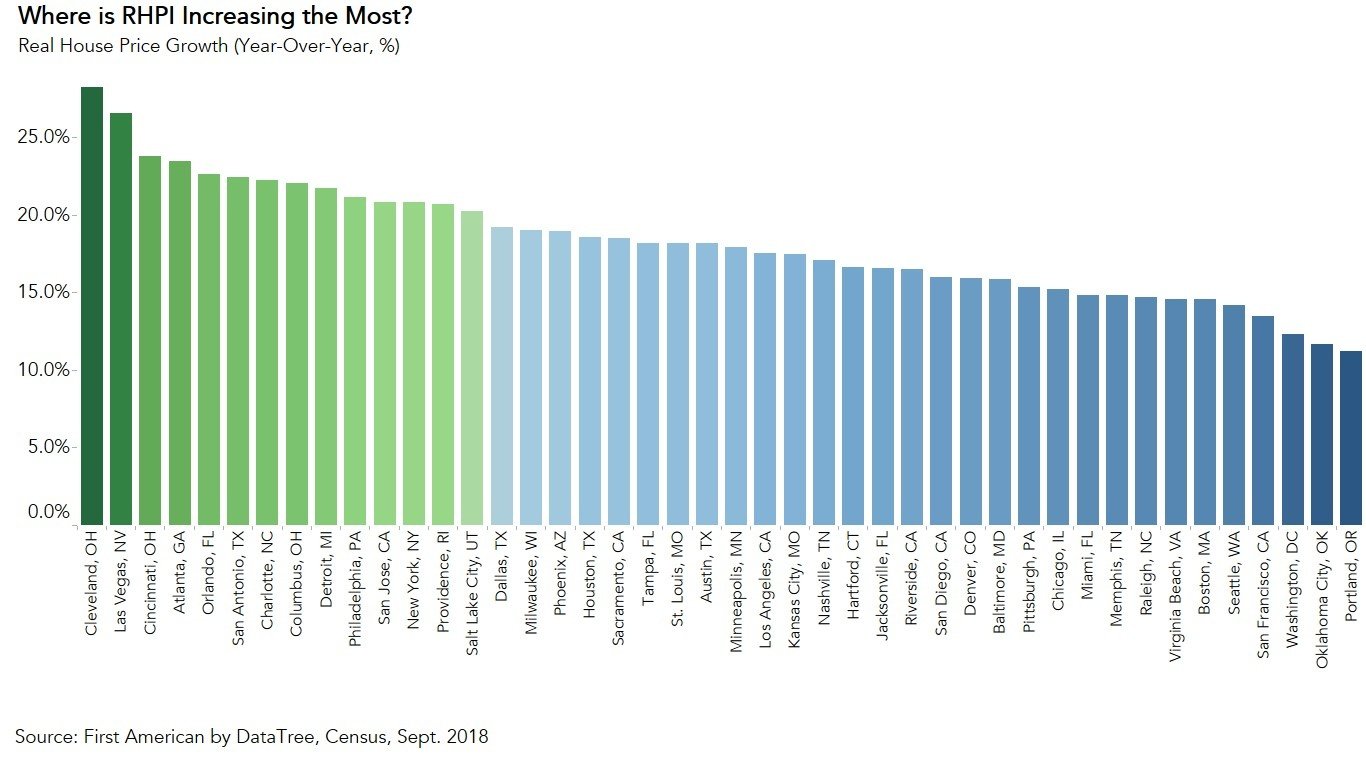

Why is Real House Price Appreciation Accelerating?

By

Mark Fleming on November 26, 2018

In September, all three of the key drivers of the Real House Price Index (RHPI), household income, mortgage rates, and an unadjusted house price index, increased compared with a year ago. When household income rises, consumer house-buying power increases. When mortgage rates and house prices increase, consumer house-buying power decreases. The ...

Read More ›

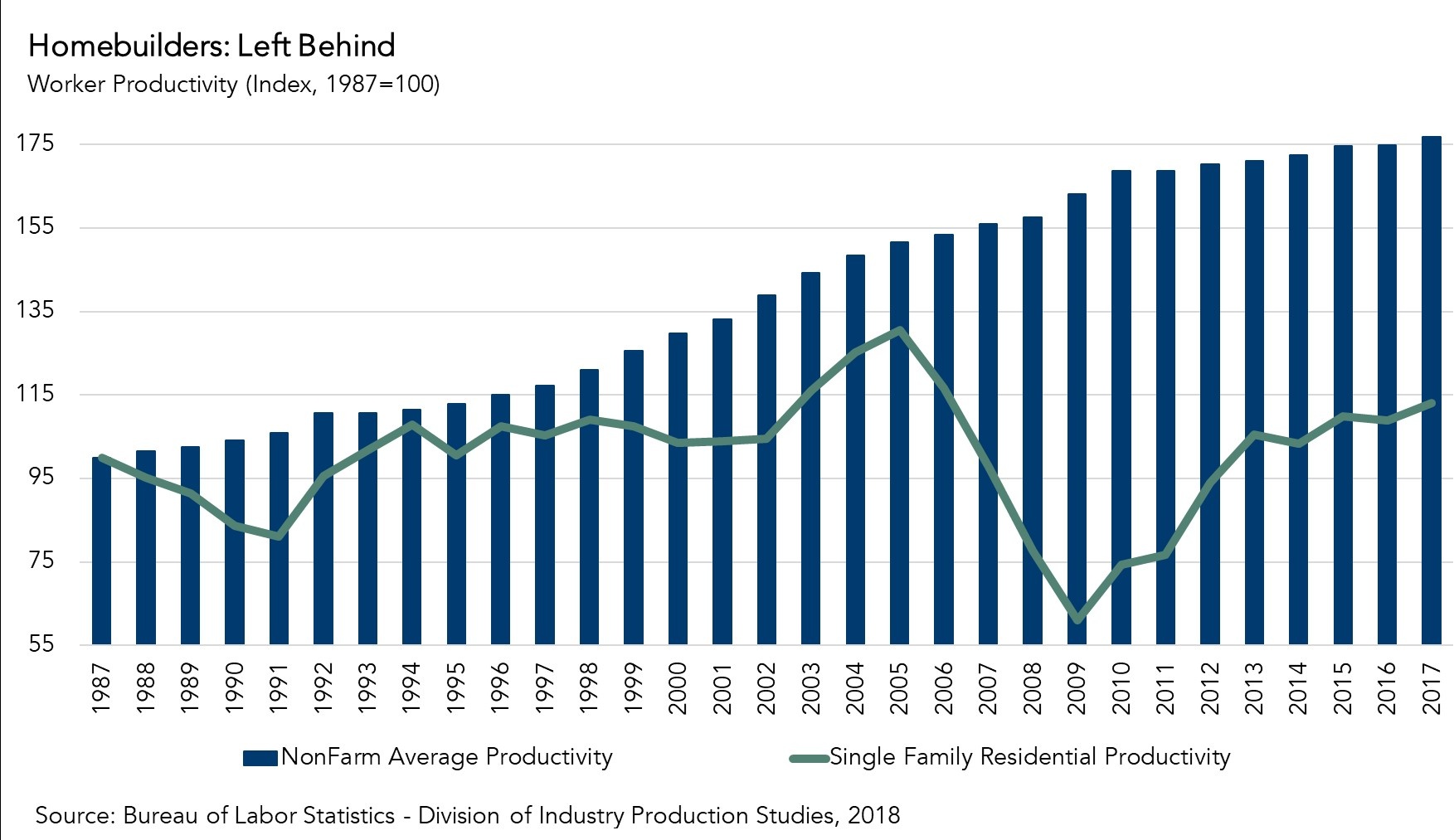

Can Homebuilders Increase Productivity to Help Close Gap Between Housing Supply and Demand?

By

Mark Fleming on November 21, 2018

Yesterday’s Census Bureau report for October indicated that we are falling short of adding homes to the market in the short-term, as completions decreased 6.5 percent compared with October of last year.

Read More ›