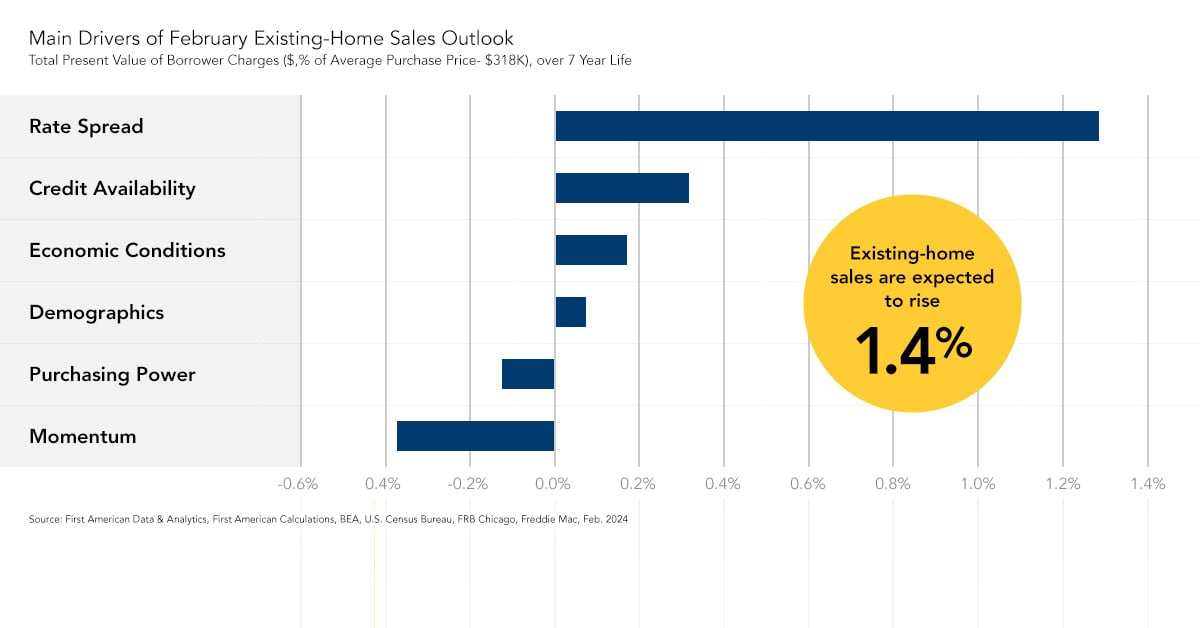

New Existing-Home Sales Outlook Report Projects February Uptick in Sales, Despite Rising Mortgage Rates

By

Mark Fleming on March 13, 2024

On average, nearly 40 percent of all existing-home sales in a year occur during the spring home-buying season between April and June. The warming weather and the end of the academic school year make for a more optimal time to move and fuel the seasonal increase in housing market activity. In the spring of 2023, home sales were lackluster. Housing ...

Read More ›

Interest Rates Federal Reserve Potential Home Sales Mortgage Rates

Will Falling Mortgage Rates Spark an Existing-Home Sales Rush to Close 2023?

By

Mark Fleming on December 18, 2023

In the month of October, existing-home sales hit the lowest level since 2010 as a result of the higher mortgage rate environment. Rising mortgage rates reduce affordability, all else held equal, for buyers and strengthen the rate lock-in effect for potential sellers. However, mortgage rates declined in November, igniting cautious optimism in the ...

Read More ›

The Blight, the Bright, and What Seems Just Right in 2024

By

Mark Fleming on November 21, 2023

The surge in mortgage rates from mid-2022 through 2023 triggered a housing recession, with the most pronounced impact felt in a steep decline in sales, while prices have remained relatively stable. Specifically, existing-home sales plunged to a more than 12-year low in September of this year. Rising mortgage rates have a dual impact on the housing ...

Read More ›

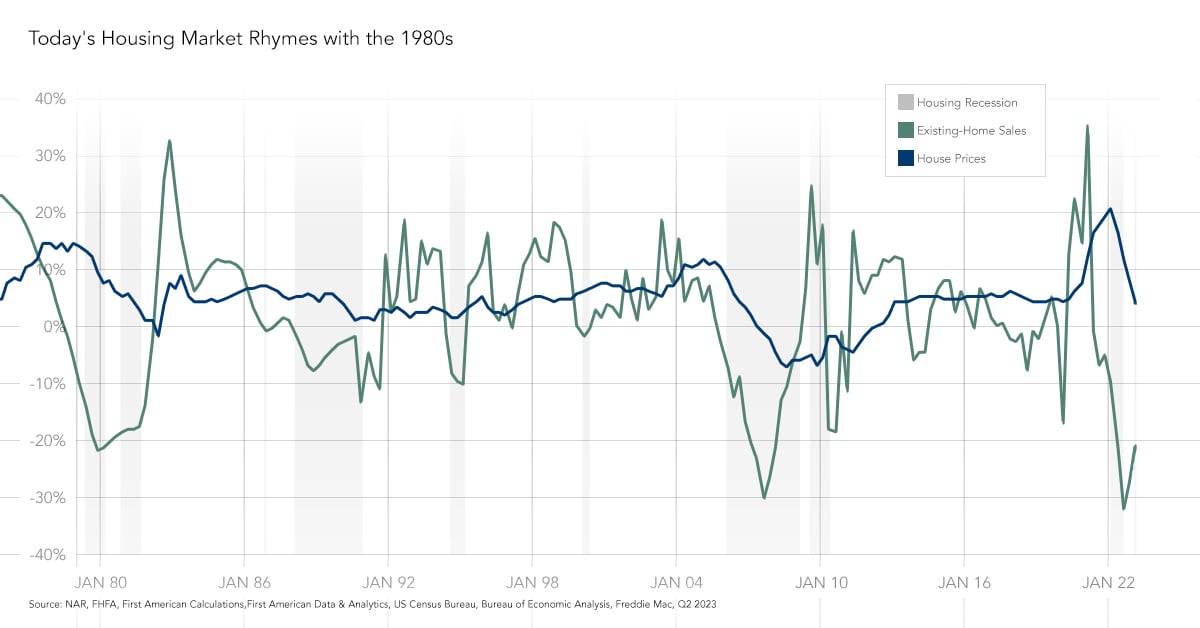

1980s Déjà Vu for the Housing Market

By

Mark Fleming on October 17, 2023

The average 30-year, fixed mortgage rate trended upward throughout September, approaching 8 percent in early October. Higher mortgage rates have a dual impact on the housing market – reducing affordability for buyers and strengthening the rate lock-in effect for potential sellers. The combination of reduced affordability and an even stronger rate ...

Read More ›

Return of the Housing Recession

By

Mark Fleming on September 18, 2023

Our Potential Home Sales Model, which measures what a healthy market for home sales should be based on the economic, demographic and housing market environments, decreased by 0.2 percent in August, and remains 3.4 percent lower than one year ago. While it seems that the steep decline in sales driven by the rapid rise in mortgage rates is behind ...

Read More ›

Housing Market Potential Increases, Despite Strengthening Rate Lock-In Effect

By

Mark Fleming on August 21, 2023

Our Potential Home Sales Model, which measures what a healthy market for home sales should be based on the economic, demographic and housing market environments, increased by 1 percent in July, but remains nearly 2 percent lower than one year ago. The yearly decline in market potential was the smallest since February 2022. The steep decline in ...

Read More ›