In the month of October, existing-home sales hit the lowest level since 2010 as a result of the higher mortgage rate environment. Rising mortgage rates reduce affordability, all else held equal, for buyers and strengthen the rate lock-in effect for potential sellers. However, mortgage rates declined in November, igniting cautious optimism in the industry. In fact, our Potential Home Sales Model, which measures what a healthy market for home sales should be based on the economic, demographic and housing market environments, increased by 1.3 percent in November – that’s the highest monthly growth since December 2022. The question remains: will the recent decline in mortgage rates translate into growth in existing-home sales?

“The road back to a market that is not too hot, not too cold, but just right will be a slow one, but recent mortgage applications data indicates a thaw in the housing market is upon us.”

Lower Mortgage Rates Drive the Market Forward

The average 30-year, fixed mortgage rate declined to 7.4 percent in November from a recent peak of 7.6 percent in October. The nearly 0.2 percentage-point monthly decline in mortgage rates combined with a 0.3 percent increase in median household income fueled a 2 percent ($6,500) month-over-month increase in house-buying power. Mortgage rates have fallen further in December to approximately 7 percent. Holding median household income constant at its November level, a 0.4 percentage point decline in the average 30-year, fixed mortgage rate boosts house-buying power by approximately $13,000.

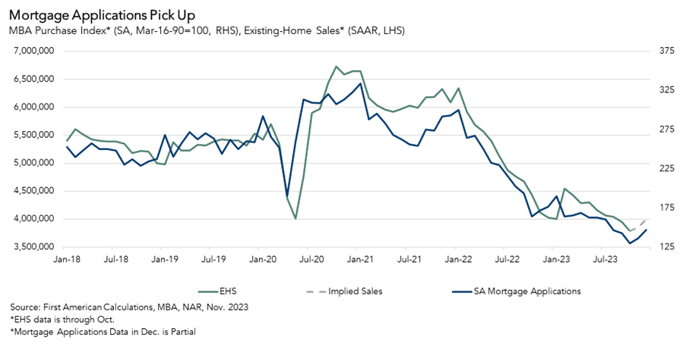

One way to project whether lower mortgage rates will result in a boost in sales is by tracking mortgage applications. Most home buyers purchase a home with a mortgage, and filling out a purchase mortgage application is an early step in the home-buying process. An increase in purchase mortgage applications, therefore, precedes an uptick in home sales as these applications reflect growing demand in the market.

According to purchase mortgage application data from the Mortgage Bankers Association (MBA), average mortgage applications in the month of November increased 5 percent compared with October. Additionally, data from the first two weeks of December indicates a nearly 8 percent increase from November. A simple analysis based on the historical relationship between mortgage applications and existing-home sales indicates that home sales should accelerate and approach 4 million seasonally adjusted annualized sales (SAAR) as 2023 comes to a close.

What’s Next?

Existing-home sales of 4 million SAAR is still low from a historical perspective, but it represents a move in the right direction. Heading into 2024, existing-home sales may continue to drift higher if mortgage rates fall further or stabilize. However, it’s unlikely that existing-home sales will increase dramatically, as the bulk of existing homeowners will remain rate locked-in, even if rates drift closer to 6 percent. The road back to a market that is not too hot, not too cold, but just right will be a slow one, but recent mortgage applications data indicates a thaw in the housing market is upon us.

November 2023 Potential Home Sales

For the month of November, First American Data & Analytics updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales increased to a 5.30 million seasonally adjusted annualized rate (SAAR), a 1.3 percent month-over-month increase.

- This represents a 52.1 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales increased 1.5 percent compared with a year ago, a gain of 80,000 (SAAR) sales.

- Currently, potential existing-home sales is 1,486,400 (SAAR), or 21.9 percent, below the peak of market potential, which occurred in April 2006.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the First American Data & Analytics Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what a healthy market for home sales should be based on the economic, demographic and housing market environments.

About the First American Data & Analytics Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction.

Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.