Thankful for Homeownership: A Look at Generational Trends

By

Sam Williamson on November 26, 2024

Key Points: The homeownership rate for millennials has consistently lagged behind previous generations by as much as 7 percentage points – despite higher education levels and similar incomes. Despite these setbacks, millennials have narrowed the gap as they near middle age, catching up to Gen X at age 38, and closing the gap more quickly than Gen ...

Read More ›

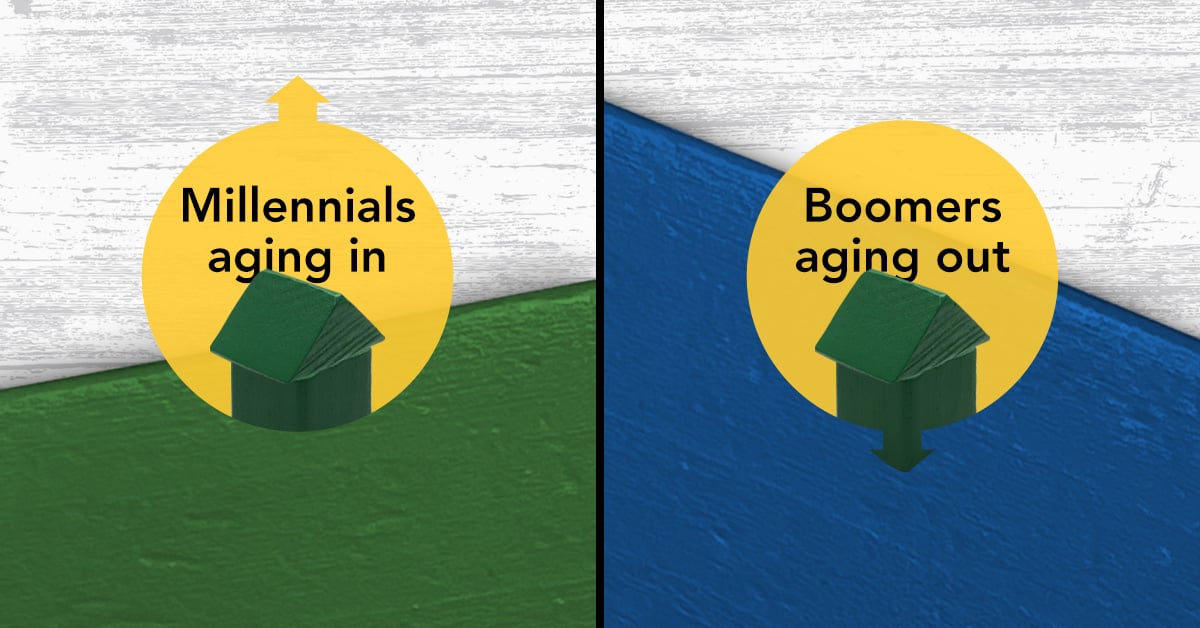

When Boomers and Millennials Collide: Tectonic Shifts in Demographics are Coming

By

Ksenia Potapov on October 6, 2023

Demographic trends are a fundamental driver of housing demand and supply and analyzing them can help us anticipate how many people will need housing, as well as roughly when, where and what kind of housing. During the pandemic, the peak of millennial demand for homeownership coincided with record-low mortgage rates and a shortage of homes for ...

Read More ›

Millennials, Walking Around Like They Own the Place

By

Ksenia Potapov on June 22, 2023

Amid the roller coaster housing market of the past few years, National Homeownership Month presents an opportunity to examine a fundamental driver of homeownership and housing demand—demographics. In fact, there’s one generation in particular that will remain a driving force of homeownership demand for years to come—the millennials.

Read More ›

Why Educated Millennials Still Hold the Key to Future Homeownership Demand

By

Odeta Kushi on October 10, 2022

The fall usually marks the beginning of the school year, seasonally cooler weather and a seasonally cooler housing market. But, this year, the housing market’s typical autumn slowdown is more pronounced as rapidly rising interest rates discourage buyers and sellers from entering the market. The housing market is not immune to business cycles, and ...

Read More ›

Millennials Continued to Drive Homeownership Demand in 2021

By

Odeta Kushi on July 6, 2022

In 2022, National Homeownership Month arrived in June as the housing market adjusts to higher mortgage rates amid still strong nominal house price appreciation, which have resulted in a significant decline in house-buying power. The housing boom of 2020 and 2021 was the exception, not the rule. Record-low mortgage rates, the ability to work from ...

Read More ›

Housing Millennials Homeownership Progress Index Homeownership

What’s the Outlook for the Housing Market in 2022?

By

Odeta Kushi on December 20, 2021

At first glance, the outlook for the 2022 housing market is a familiar one – strong millennial demand for homes constrained by an ongoing, historic housing supply shortage. This supply-demand imbalance generated the record house price appreciation seen in 2021 and, given this dynamic shows few signs of changing, we expect house price appreciation ...

Read More ›