What Global Uncertainty Means for the Housing Market

By

Mark Fleming on January 10, 2020

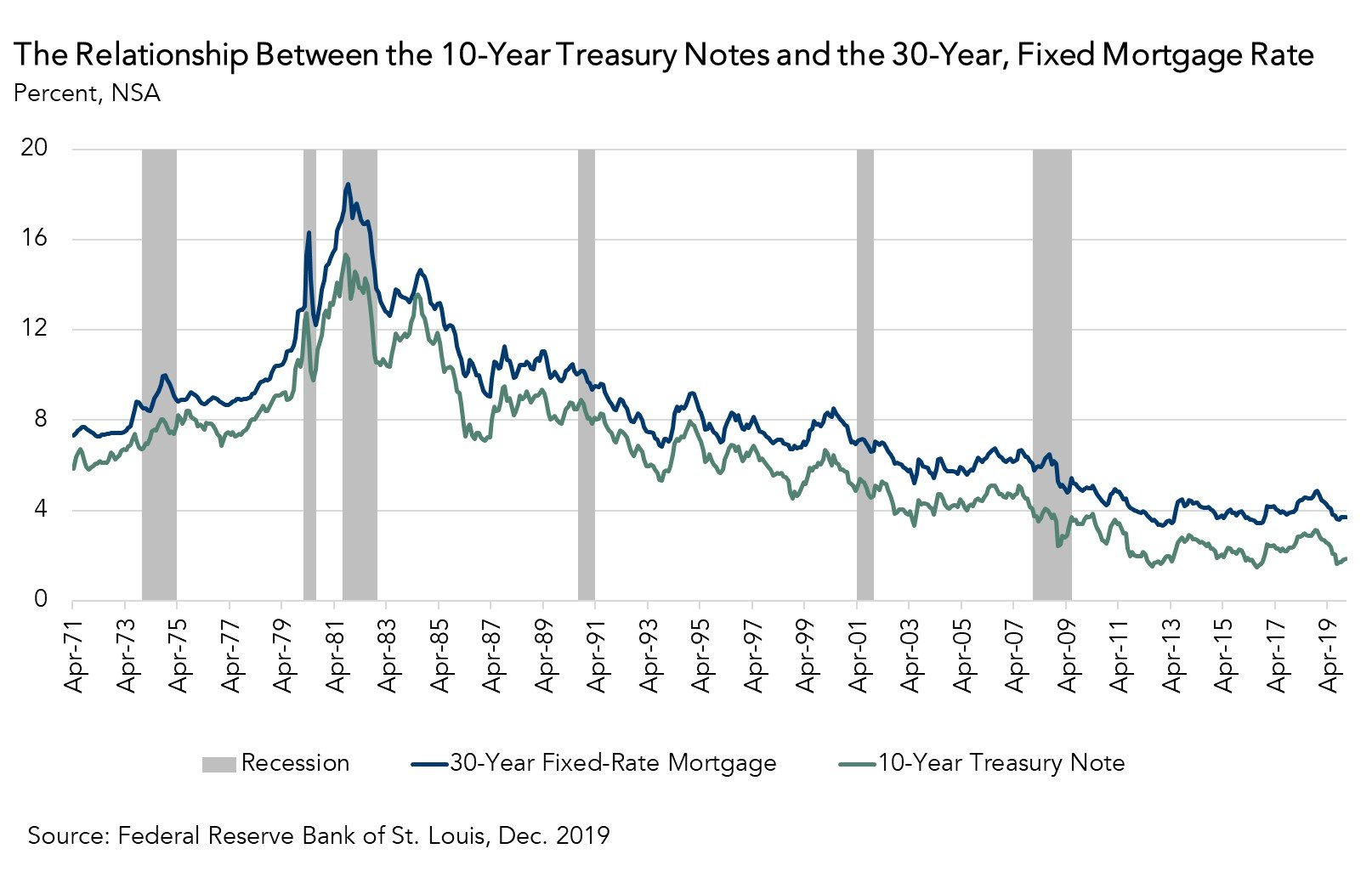

Global events and uncertainty, such as the conflict between the U.S. and Iran, clearly impacts geopolitical relations, but also impacts the U.S. economy, and more specifically, the U.S. housing market. How? Against a backdrop of uncertainty, investors worldwide look for a safe place to put their money. U.S. bonds, backed by the full faith and ...

Read More ›

Interest Rates Real House Price Index Federal Reserve Affordability

Why Our Economy Is Generating More Investment Growth in IP than IT

By

Odeta Kushi on October 16, 2019

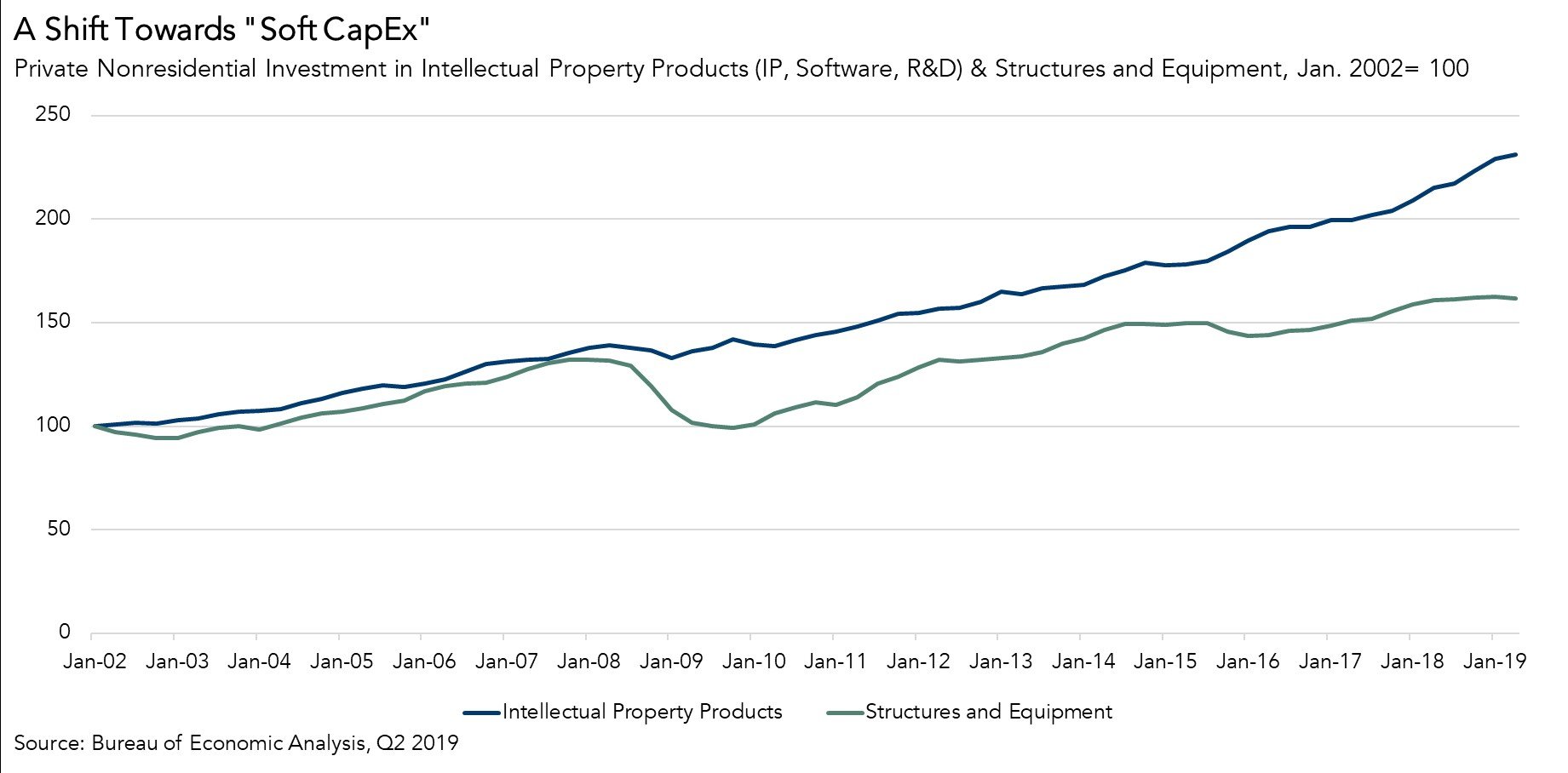

Important, but easy to overlook shifts in investment trends may be contributing to our current era of low interest rates. An excess supply of global savings relative to the demand for that money for investments is driving down interest rates, which can be thought of as the price of money. The neutral rate of interest, which is monitored by the ...

Read More ›

What is the Neutral Rate of Interest and How Does it Influence the Federal Reserve?

By

Mark Fleming on September 17, 2019

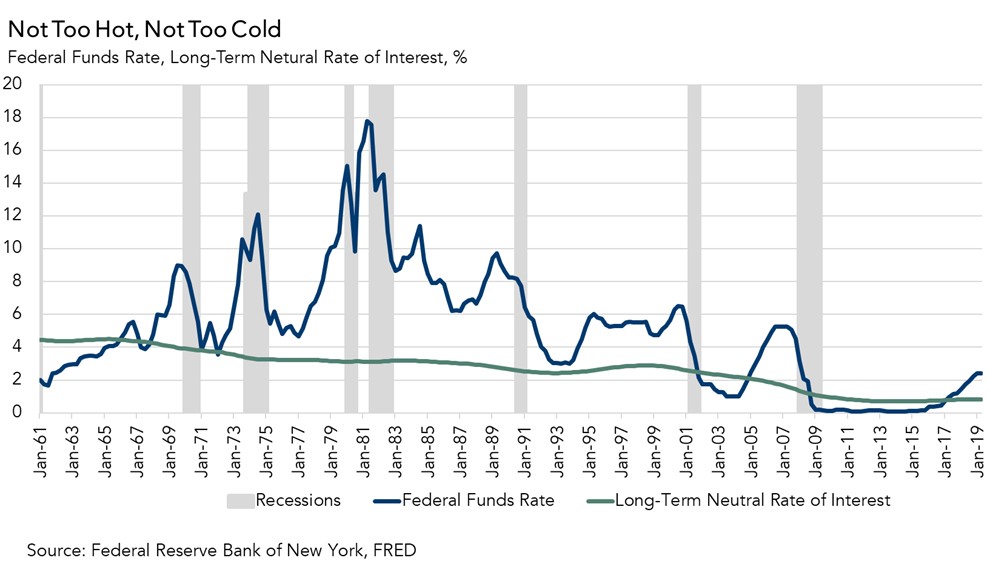

Many people understand the “natural rate of unemployment,” and if you don’t, you can probably guess what it is – the rate of unemployment when the labor market reaches equilibrium. What many people don’t know is that a similar concept exists in monetary policy.

Read More ›

Interview on FOXBusiness: Discussing the outlook for the U.S. economy, Federal Reserve policy and the state of the job market

By

FirstAm Editor on September 6, 2019

First American Chief Economist Mark Fleming was interviewed on FOXBusiness earlier this week and discussed the U.S. economy, Federal Reserve policy and the state of the job market.

Read More ›

Interviews on CNBC and Nightly Business Report: Discussing the Refinance Boom and Tailwinds Boosting the Housing Market

By

FirstAm Editor on September 3, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Deputy Chief Economist Odeta Kushi was interviewed on Nightly Business Report last week, where they discussed the refinance boom driven by low mortgage rates and the tailwinds boosting the housing market.

Read More ›

Housing In The News Interest Rates Federal Reserve Affordability

Interviews on CNBC and Bloomberg TV: Discussing the Impact of Historically Low Rates and the Outlook for the Housing Market and the Economy

By

FirstAm Editor on August 23, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Deputy Chief Economist Odeta Kushi on Bloomberg TV earlier this week and discussed the impact of historically low rates on the housing market, and what the Fed minutes indicate about the direction of rate policy and the economy.

Read More ›

Housing In The News Interest Rates Federal Reserve Affordability