How Do Rapidly Rising Mortgage Rates Impact Affordability?

By

Mark Fleming on April 22, 2022

In February 2022, the Real House Price Index (RHPI) jumped up by nearly 31 percent. That’s the fastest growth in the more than 30-year history of the series. This rapid annual decline in affordability was driven by two factors: a 21.7 percent annual increase in nominal house prices and a nearly full percentage point increase in the 30-year, fixed ...

Read More ›

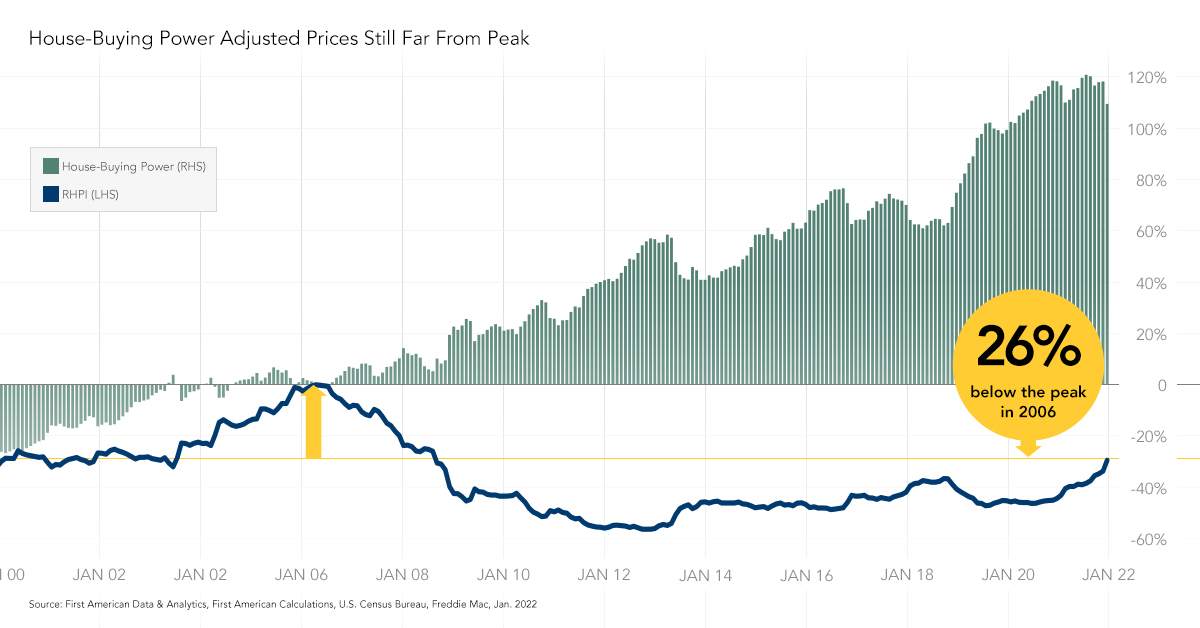

Is Affordability Worse Than the 2006 Housing Boom Peak?

By

Mark Fleming on March 29, 2022

In the first report with 2022 data, the Real House Price Index (RHPI) jumped up by nearly 27 percent, the fastest growth in the RHPI since 2004. This rapid annual decline in affordability was driven by a 21.7 percent annual increase in nominal house prices and a 0.7 percentage point increase in the 30-year, fixed mortgage rate compared with one ...

Read More ›

Will Rising Rates Bring Balance to the Housing Market?

By

Mark Fleming on February 23, 2022

In December 2021, the Real House Price Index (RHPI) increased 21.7 percent compared with December 2020, the highest annual growth rate since 2014. The record increase was driven by rising mortgage rates and rapid nominal house price appreciation, which make up two of the three drivers of the RHPI. The 30-year, fixed-rate mortgage and the ...

Read More ›

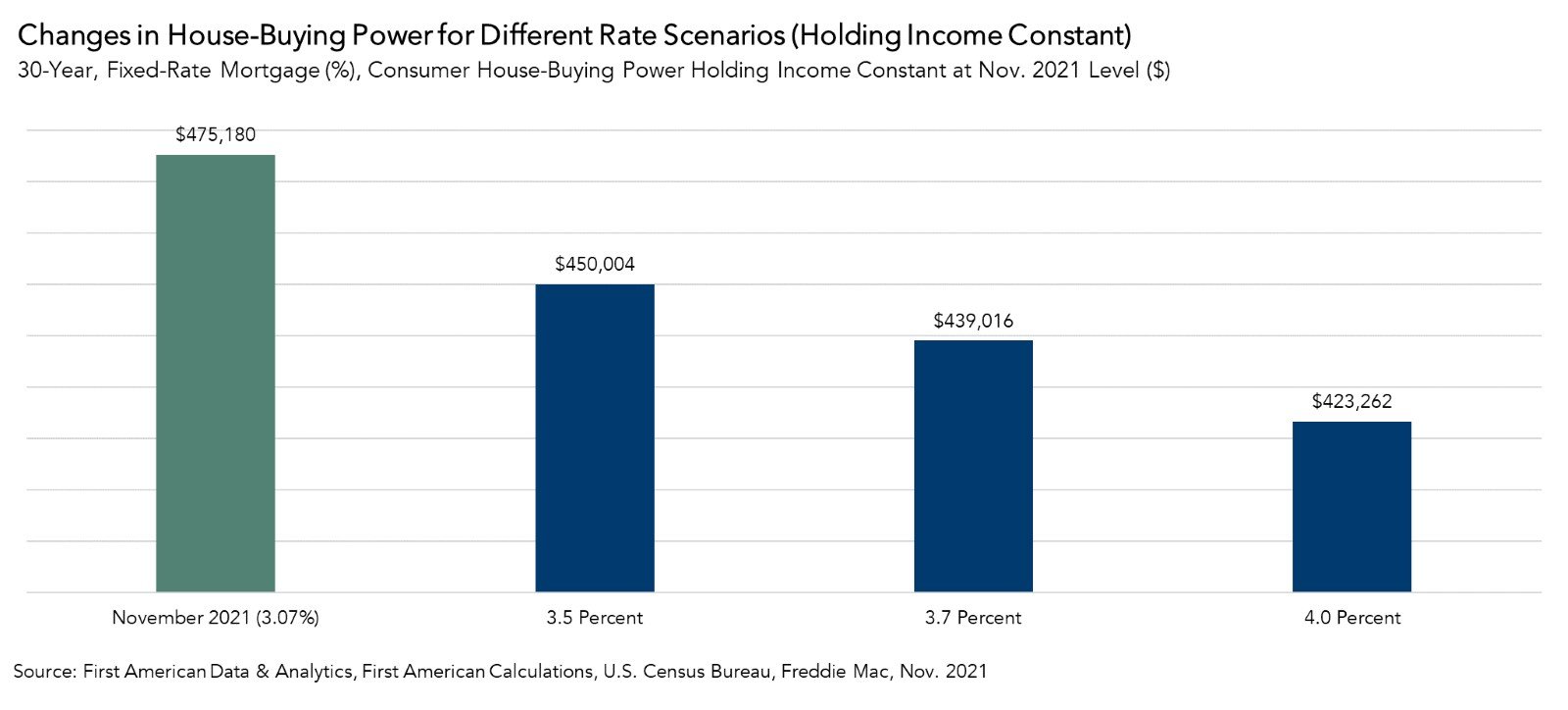

How Will Rising Mortgage Rates Impact Spring Home-Buying?

By

Mark Fleming on January 24, 2022

In November, year-over-year nominal house price appreciation reached 21.5 percent, the sixth consecutive month it has set a new record. According to our Real House Price Index (RHPI) - which measures housing affordability based on changes in income, interest rates and nominal house prices - affordability declined 21.0 percent compared with a year ...

Read More ›

Affordability Falls to its Lowest Level Since 2008

By

Mark Fleming on December 27, 2021

Affordability sank to its lowest level since 2008 in October, as two of the three key drivers of the Real House Price Index (RHPI) swung in favor of reduced affordability relative to one year ago. Higher mortgage rates and record year-over-year nominal house price growth triggered a nearly 20 percent jump in the RHPI (rising RHPI values indicate ...

Read More ›

What’s the Outlook for the Housing Market in 2022?

By

Odeta Kushi on December 20, 2021

At first glance, the outlook for the 2022 housing market is a familiar one – strong millennial demand for homes constrained by an ongoing, historic housing supply shortage. This supply-demand imbalance generated the record house price appreciation seen in 2021 and, given this dynamic shows few signs of changing, we expect house price appreciation ...

Read More ›