What is the Connection Between Higher Mortgage Rates and Defect, Fraud and Misrepresentation Risk?

By

Mark Fleming on March 24, 2017

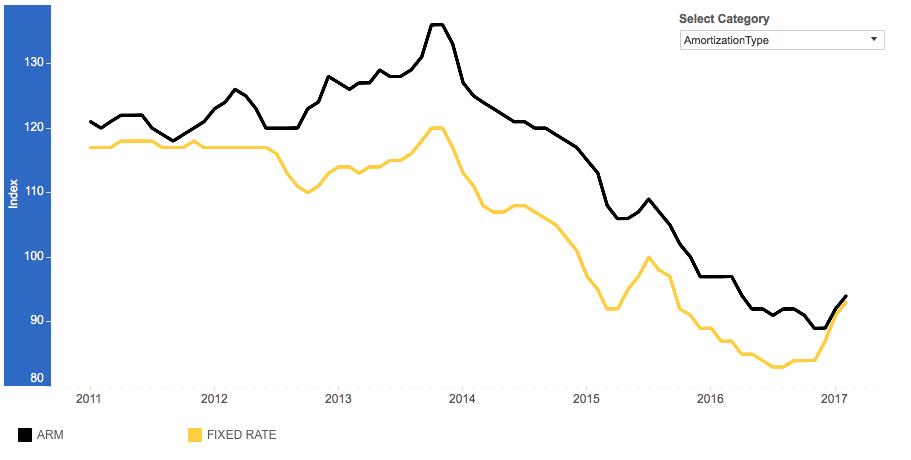

We’ve posted the February First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications.

Read More ›

Rising Rates Outweigh Influence of Economic Momentum on Market Potential

By

Mark Fleming on March 21, 2017

February 2017 Potential Home Sales

Read More ›

Can you Spring Break into Homeownership?

By

Mark Fleming on March 16, 2017

Spring break is fast approaching, that playful time of year when beach cities are inundated with college students and tourists. As housing economists, spring break is exciting because it coincides with the beginning of the spring home buying season! While we may not seem to have much in common with the college crowd, there is an underlying ...

Read More ›

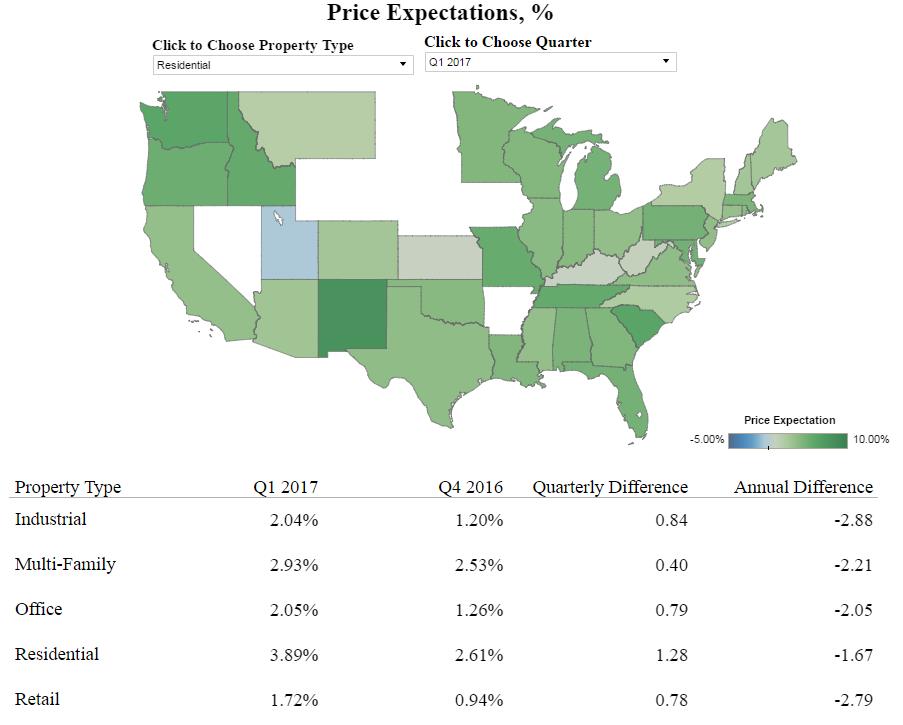

Improved Real Estate Outlook Suggests Strong Spring Market

By

FirstAm Editor on March 14, 2017

We invite you to browse the first quarter 2017 First American Real Estate Sentiment Index, which is based on a quarterly survey of independent title agents and other real estate professionals, providing a unique gauge on the real estate market using the crowd-sourced wisdom and expertise of real estate experts.

Read More ›

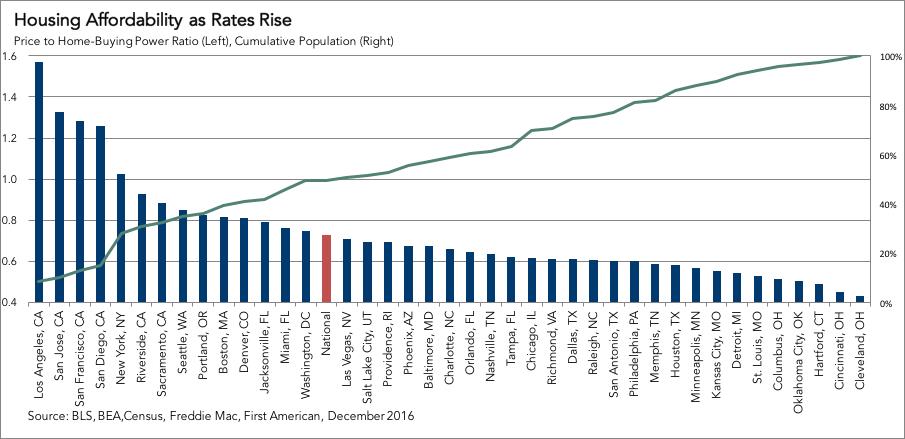

Top 5 Most and Least Affordable Housing Markets Amid Higher Rates

By

Mark Fleming on March 13, 2017

Recent economic data and comments by members of the Federal Open Market Committee (FOMC) all suggest that the chance of a rate increase this week after the FOMC meets is substantially higher than it was just a few weeks ago. Now that we are most likely in a rising rate environment, what does it mean for housing affordability?

Read More ›

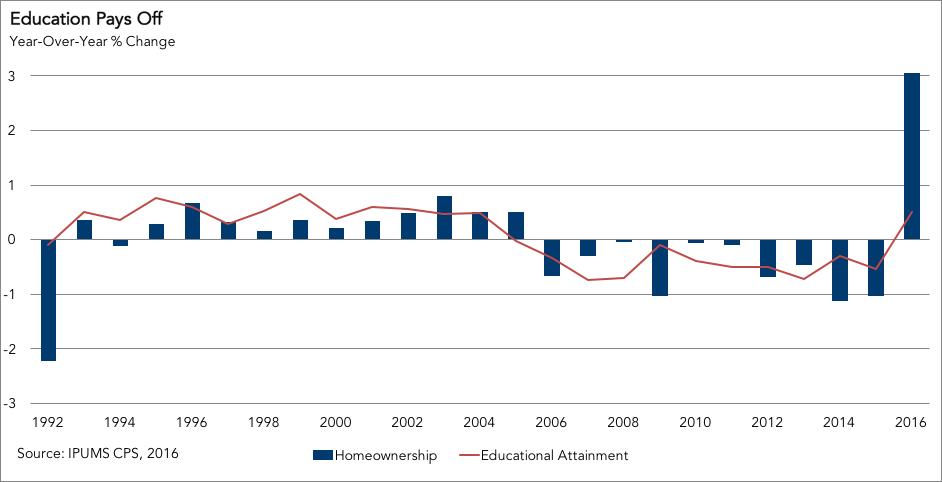

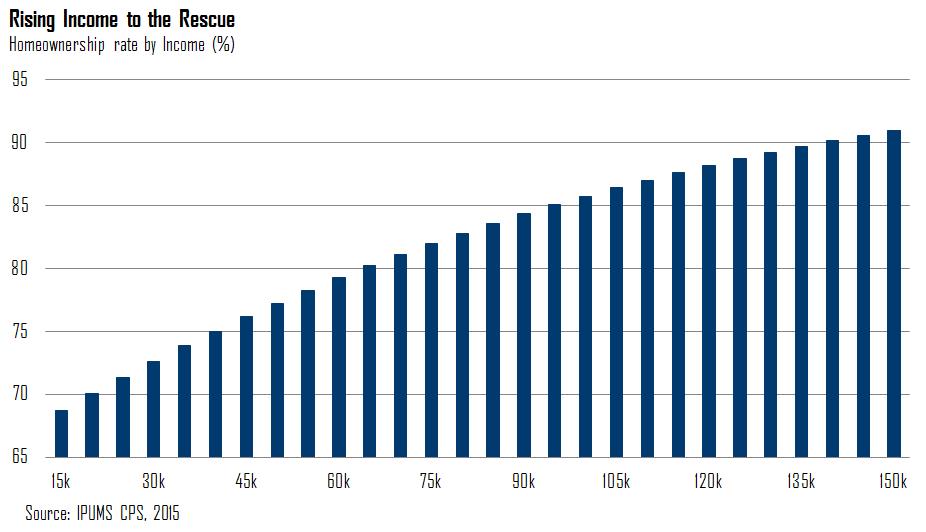

Two Trends Poised to Trigger Potential Surge in Homeownership Demand this Spring

By

Mark Fleming on March 2, 2017

The spring home-buying season is right around the corner. As we reflect back on the spring of last year, it becomes clear that we were spoiled in 2016 with mortgage rates well below 4 percent at the beginning spring, and flirting with record lows at 3.4 percent in the summer. This year began with mortgage rates at 4.25 percent, and concern ...

Read More ›