Market Potential Caught in the Crosswinds of Surging Demand and Tightening Inventory

By

Mark Fleming on May 23, 2017

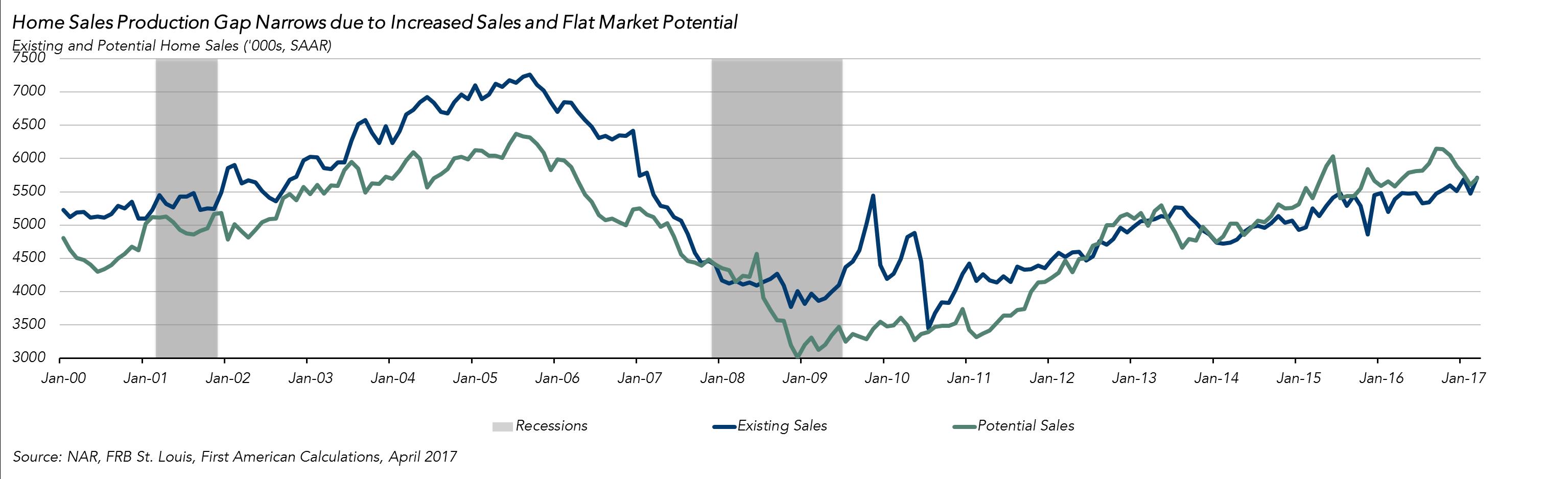

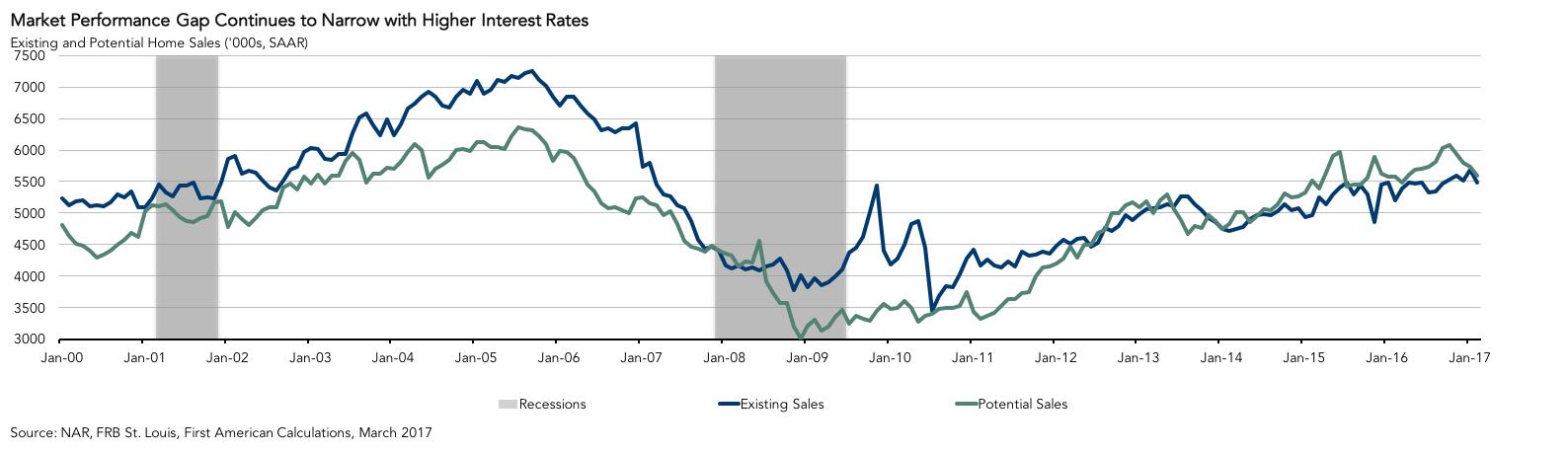

First American’s proprietary Potential Home Sales model looks at April 2017 data and includes analysis from First American Chief Economist Mark Fleming on how the real estate market is performing versus its potential.

Read More ›

Does a Strong Sellers’ Market Mean Increased Loan Defect Risk?

By

FirstAm Editor on April 28, 2017

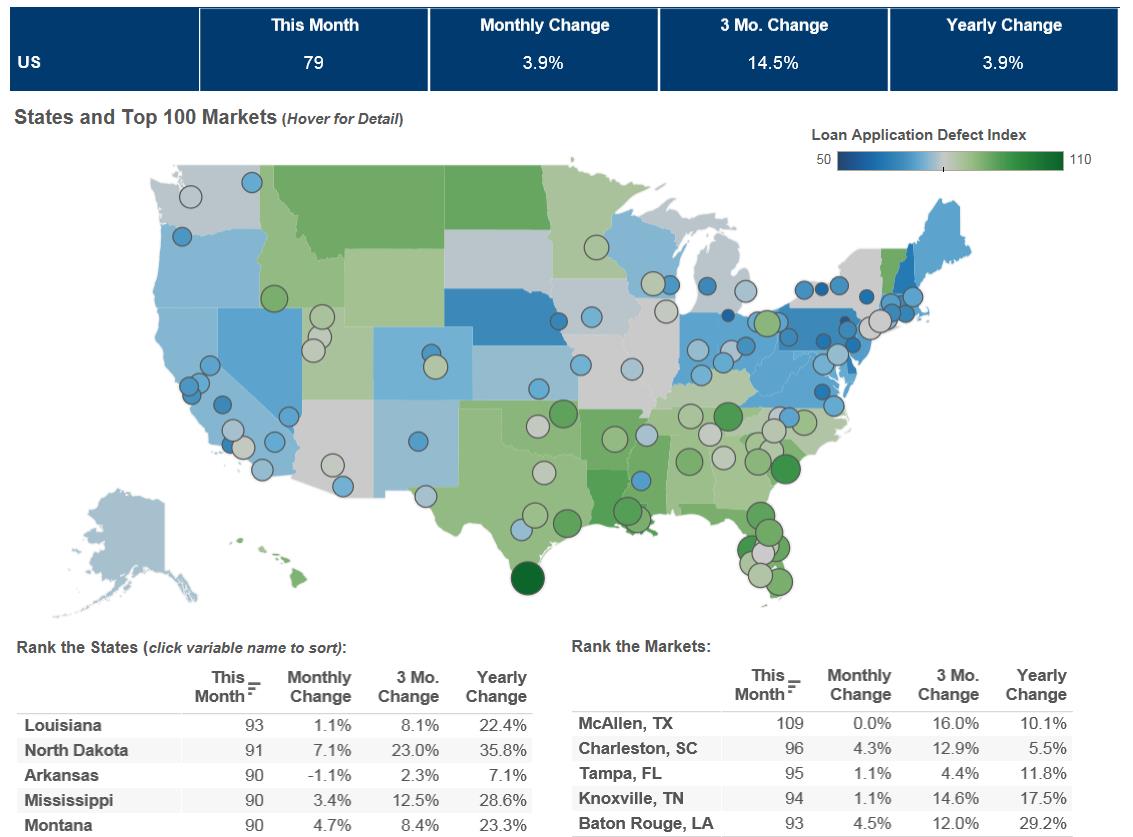

We’ve posted the March First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index increased 3.9 percent in March 2017 as compared with the previous month, and increased 3.9 percent as compared to March 2016. ...

Read More ›

What’s Behind the Surge in Real House Prices?

By

FirstAm Editor on April 24, 2017

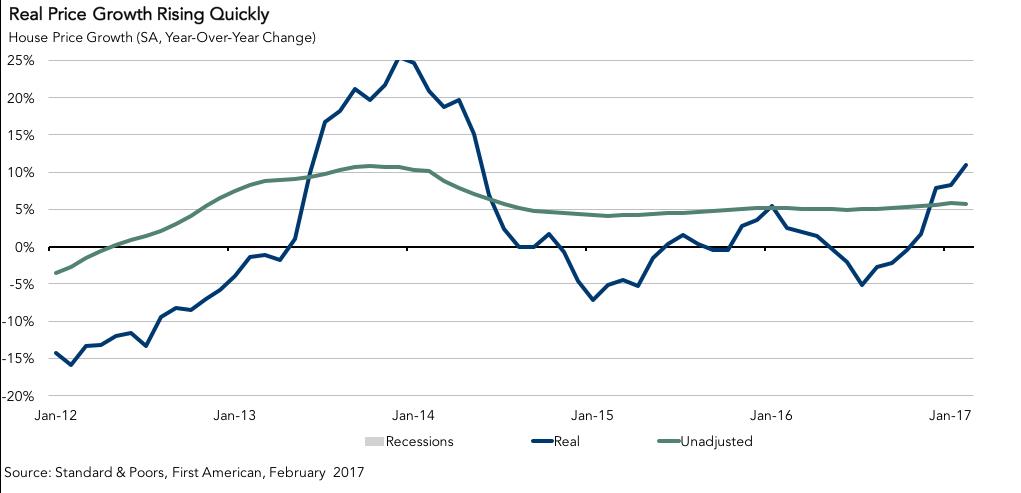

First American’s proprietary Real House Price Index (RHPI) looks at February 2017 data and includes analysis from First American Chief Economist Mark Fleming on the impact of under-supplied markets on real house prices.

Read More ›

Do Unexplained Homeownership Gaps Exist?

By

Mark Fleming on April 20, 2017

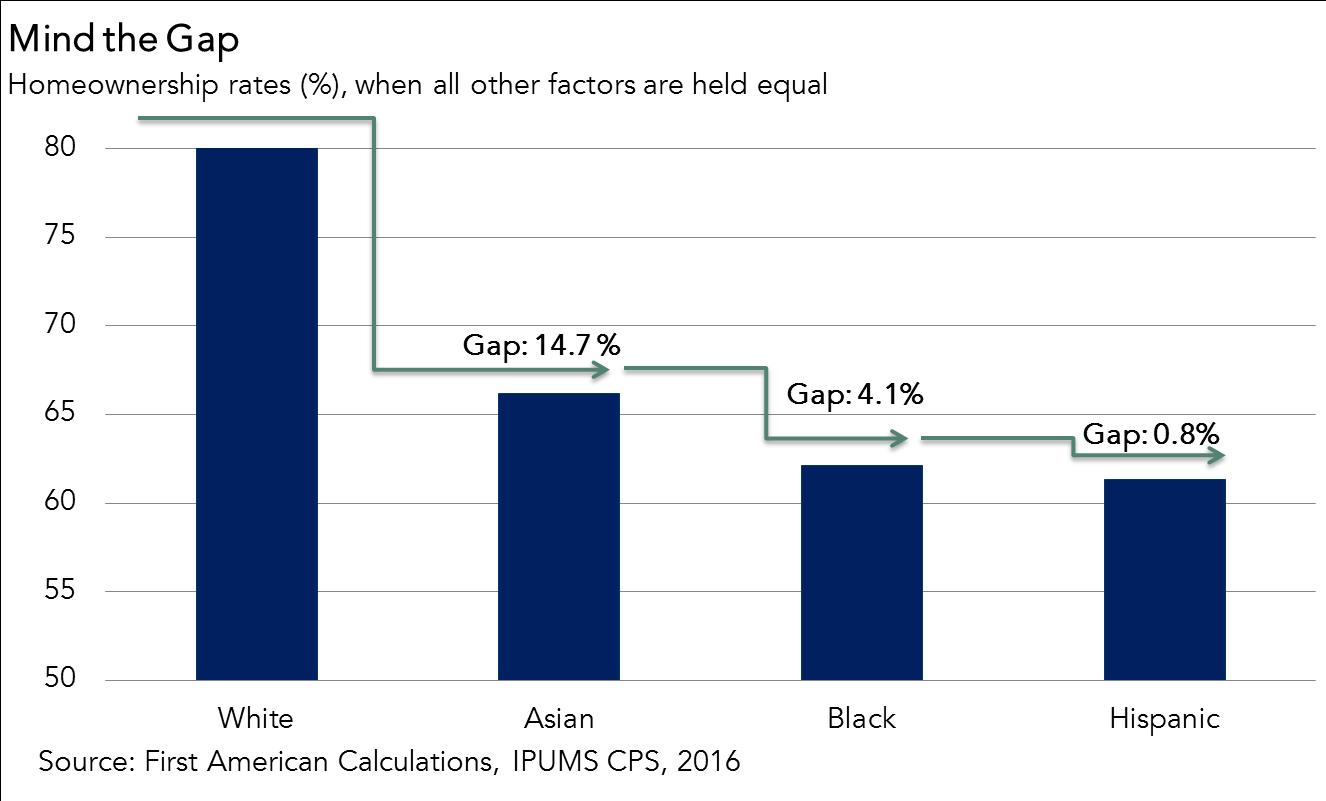

Homeownership is a goal shared among all people, regardless of race or ethnicity, and remains the main driver of wealth creation for the majority of households in the United States. That is why it is vital to understand the underlying characteristics that influence the probability of homeownership. Over the last several months, my research has ...

Read More ›

Market Potential Remains Flat, But Is Tight Inventory Relief on the Way?

By

Mark Fleming on April 19, 2017

First American’s proprietary Potential Home Sales model looks at March 2017 data and includes analysis from First American Chief Economist Mark Fleming on how the market is performing versus its potential.

Read More ›

The $1 Trillion Question for Housing in 2017

By

Mark Fleming on April 7, 2017

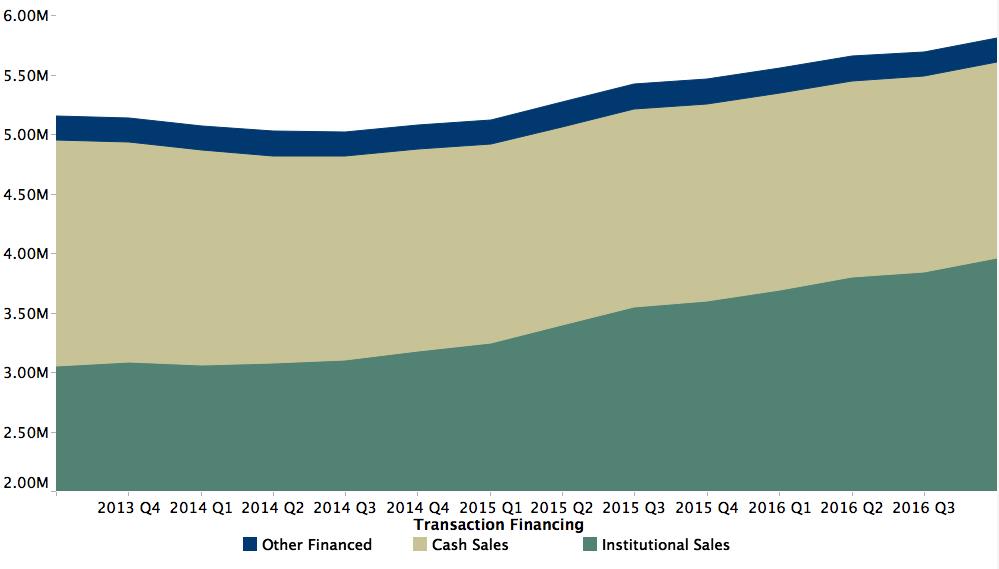

Last week, I helped present the results from the American Enterprise Institute (AEI)/First American National Housing Market Index, one of the most comprehensive analyses of the U.S. housing market. The results provide insight into the 2017 spring home buying market and shed light on housing’s $1 trillion question.

Read More ›