What’s Behind the December Dip in Housing Affordability?

By

FirstAm Editor on February 27, 2017

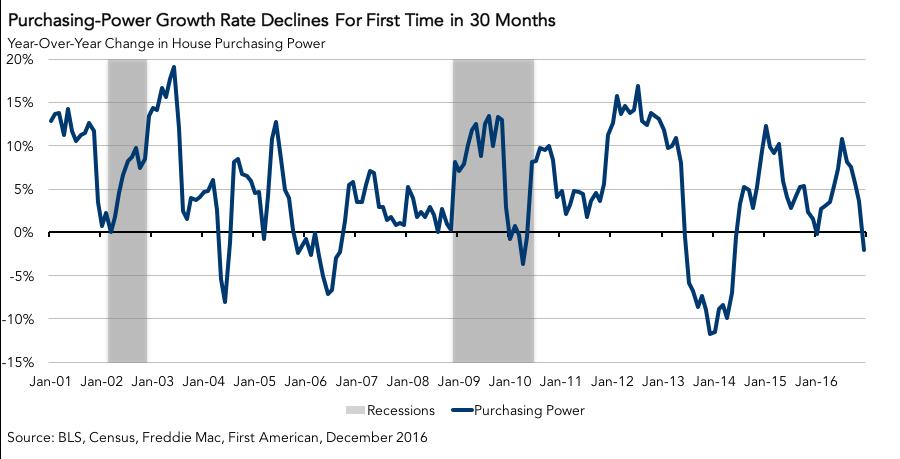

First American’s proprietary Real House Price Index (RHPI) looks at December 2016 data and includes analysis from First American Chief Economist Mark Fleming on the decline in affordability as consumer house-buying power dipped due to rising rates.

Read More ›

Market Composition Shift Accelerating Loan Application Defect Risk?

By

FirstAm Editor on February 24, 2017

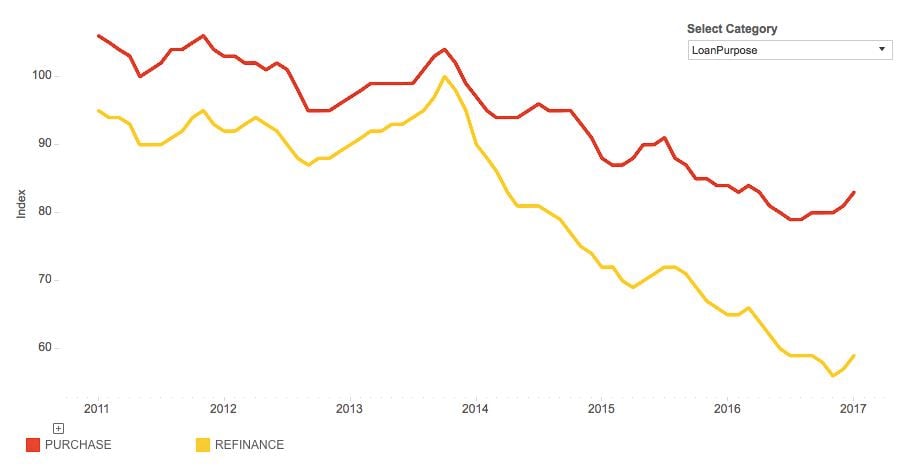

We’ve posted the January First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index increased 5.8 percent in January 2017 as compared with the previous month, and decreased 3.9 percent as compared to January ...

Read More ›

Market Potential Continues Slide in January as Higher Rates Reduce Supply

By

Mark Fleming on February 21, 2017

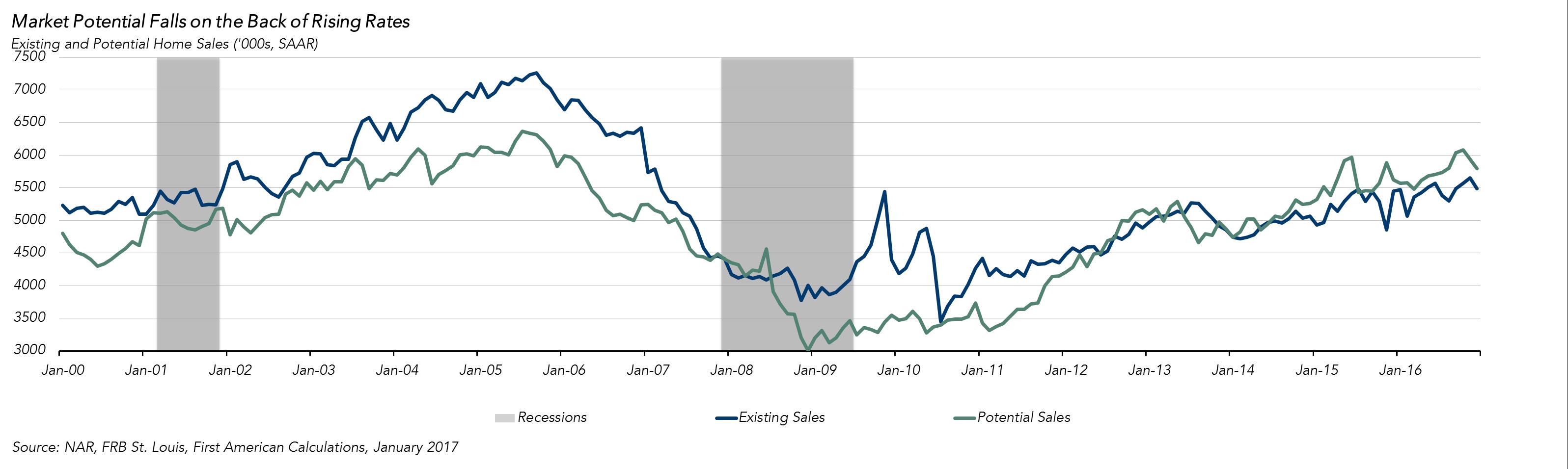

First American Chief Economist Mark Fleming shares his proprietary Potential Home Sales model with analysis of housing market trends in January 2017.

Read More ›

Money Matters Radio Interview – Does Marriage Matter to Homeownership?

By

FirstAm Editor on February 17, 2017

First American Chief Economist Mark Fleming is interviewed on Money Matters Radio in Boston and shares his perspective on the connection between marriage, declining homeownership rates, and Millennial home buying.

Read More ›

Is Love the Answer to Declining Homeownership?

By

Mark Fleming on February 13, 2017

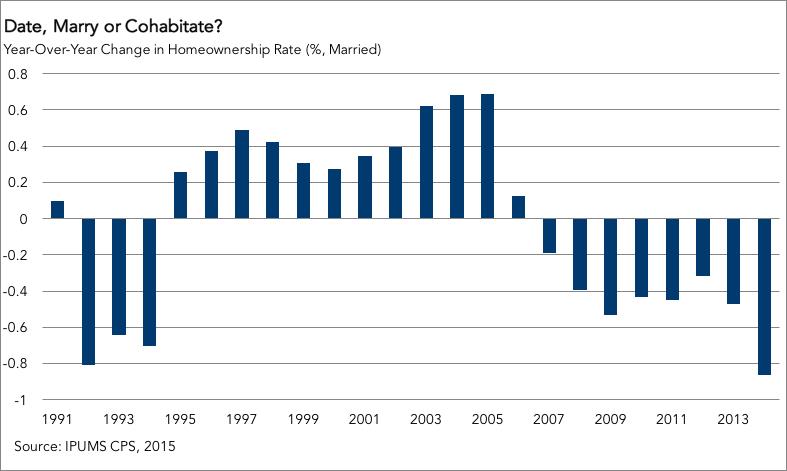

For Valentine’s Day, we pondered the question, could more love lead to an increase in homeownership? This is a serious question because marriage and homeownership, perhaps the two most enduring institutions of our society, have shaped the economic fortunes of many Americans.

Read More ›

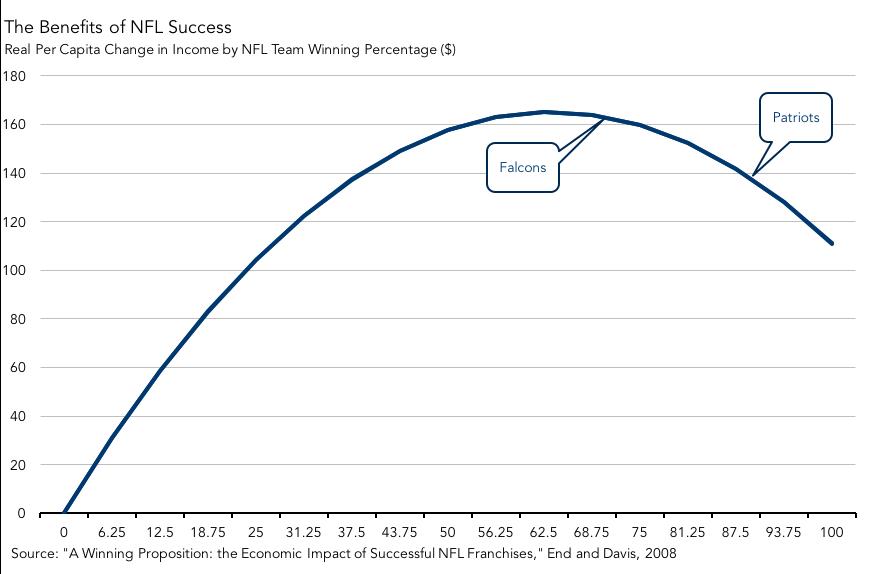

Just in Time for the Big Game: The Housing Benefit of Football Fandom

By

Mark Fleming on January 31, 2017

We all love our football, no more so than this weekend. But, it’s not just about cheering on your favorite team, guiltlessly eating wings, nachos or your favorite in-game football snack food, and gathering around that ever increasingly massive television (after all, it’s the second best time of the year to buy a television according to Consumer ...

Read More ›