It’s that time of year again. The time when we come together and celebrate the American tradition of giving thanks for the many blessings in our lives. Often we give thanks for having the basic necessities of life: food, health, water and shelter. While all of these things are vital to human existence, as a housing economist, I naturally tend to focus on shelter.

Homeownership is not just a symbol of the American Dream, but rather a real and impactful part of the economy. And many are afraid that this dream is fading as the homeownership rate hits half-century lows.

In a blog post last year, we illustrated how the positive effects of the housing market far exceed the mere buying and selling of homes. The data supporting this point has only strengthened since. Nearly 77 percent of people who responded to a recent survey agreed that homeownership was a part of achieving the American Dream. After owning a home, half of respondents selected going to college, getting married, and having children as other elements that are vital to the fulfillment of that dream. Another survey confirms this sentiment as it found that 94 percent of Millennials between the ages of 20-29 are planning to buy a home. In other words, the dream of homeownership is far from dead.

“The ideal of the American Dream and the goal of homeownership will exist as long as supporting higher educational attainment, economic mobility, and long-term national economic growth remain defining tenets of American policy.”

While it may not be a surprise that homeownership remains a priority, it may come as a surprise that Millennials have not been discouraged from this goal. Millennials are often referred to as a “renter generation,” because they have prioritized their education and tend to concentrate in metropolitan areas. They have, for now, chosen to share cramped apartment space with roommates over the commitment that comes with buying a home. But, the “American Dream” is not the mere act of owning a home, but rather an ethos or set of ideals which allows citizens the opportunity to pursue prosperity and upward mobility through hard work. In this context, homeownership is not just about shelter, but a primary vehicle for wealth creation for middle-class Americans.

Homeownership Builds Wealth Over Time

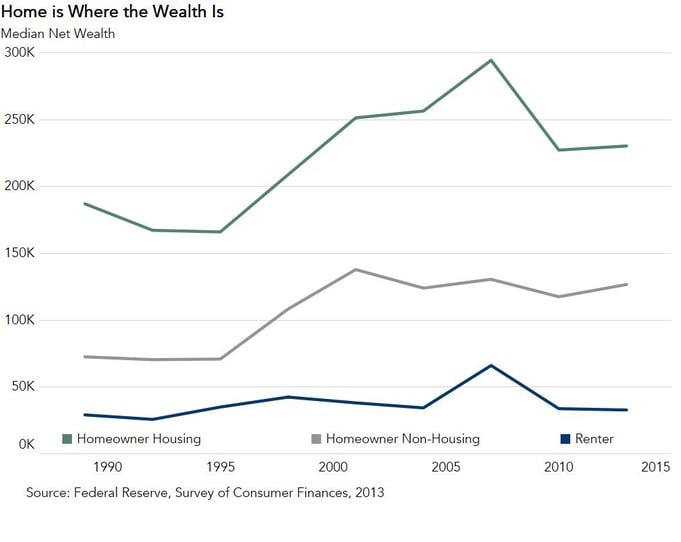

Homeownership is critical for wealth creation and upward mobility for the majority of low- and moderate-income households. The concept that owning a home is a financially savvy move is not new. Our parents knew it, and their parents before them knew it. But, this idea is especially relevant for the bottom 40 percent of households, based on the income distribution in the United States. In fact, of those in this cohort who are homeowners, three quarters of their wealth comes from their home. According to the 2007 Survey of Consumer Finances, 46 percent of aggregate household wealth is residential wealth. Even during the recovery from the Great Recession, the net worth of homeowners over time outpaced that of renters, who tend to accumulate very little wealth. As you might expect, homeowners are wealthier. In dollar terms, a typical homeowner’s net worth was $195,400, while that of renter’s was $5,400. The median wealth-to-earnings ratio for homeowners is almost 4, but a meager 0.21 for renters. Finally, homeowners hold a staggering 97.5 percent of aggregate household wealth in the United States.

Promoting homeownership is also a political priority. At our State of Homeownership leadership event last year, Representative Loretta Sanchez (D-Ca) spoke about the importance of furthering first-time home buyer demand because of homeownership’s proven ability to facilitate wealth creation.

So, how does homeownership so successfully drive wealth creation? Homeownership requires buyers to first save for a down payment. As a homeowner, you also build equity every month – the equity being the amount of money a homeowner can get if they sell their home minus the debt the homeowner owes on it. Each month, the mortgage payment acts like a forced savings plan by reducing the amount owed on the home. The monthly mortgage payment also increases equity, a benefit that renters do not have. Renters can only build similar wealth if they invest an amount equal to the initial down payment and invest an amount equal to the principal a homeowner pays off each month.

Furthermore, the value of the home changes over time, usually increasing over the long run. Figure 1 below illustrates that homeowners build equity wealth over time simply by being the asset owner. As homeowners move for a new job, or for a larger home, or for access to better schools for their children, the equity they have accumulated goes with them.

Renters, as non-homeowners, gain no wealth benefit as home prices rise – that wealth all accrues to the landlord. Homeownership, even for the lowest quintile of income earners, helps to facilitate additional non-housing savings. Over time, assuming their wages rise, the fixed payment for shelter becomes a lower burden and, therefore, homeowners are able to save in other ways that renters cannot.

Figure 1.

Educational Attainment and Homeownership

Educational Attainment and Homeownership

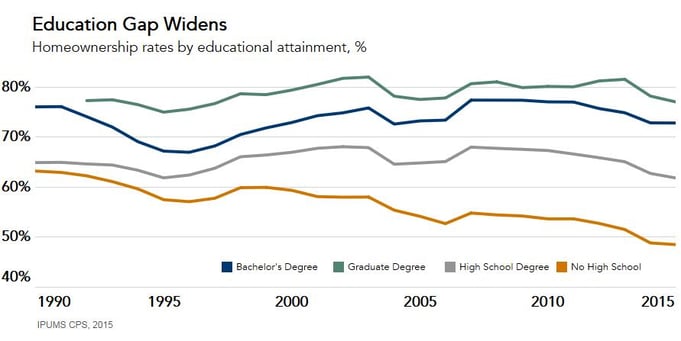

In our proprietary Homeownership Progress Index (HPRI), we discuss how increasing educational attainment is one of the most important factors for improving the long-run outlook for homeownership. In fact, since 1991, the share of households in which at least one member has a bachelor’s degree has increased 24 percent. This number is expected to increase further as Millennials continue to graduate from college and enter the workforce with improved prospects for higher-paying jobs.

It is certainly no coincidence that the states and cities with improving homeownership levels also have increasing rates of educational attainment and higher income levels. In fact, the relationship between the two has only grown in importance. The homeownership gap between those with a college education and those without has grown more than 11 percent since 1990 (see Figure 2 below). The good news is educational attainment is growing. So, it is reasonable to expect homeownership rates to grow as well. As more people achieve greater levels of education, they are able to generate higher income, and then use that higher income to buy homes.

Figure 2.

What Homeownership Means for the Economy

New home construction is a major catalyst for productivity, creating jobs for millions of Americans and generating tax revenues for all levels of government. Housing accounts for approximately 15 percent of the nation’s gross domestic product when you consider the economic impact of new construction of single-family and multi-family homes, the value of existing homes to owners, and remodeling. Studies by the National Association of Homebuilders (NAHB) show that, on average, building 100 single-family homes generates 297 jobs, $28 million in wages and business income, and $11.1 million in taxes. New home construction spurs job creation in a variety of occupations and industries: electricians, plumbers, carpenters, real estate agents, furniture industries, and more. In fact, the housing market downturn contributed to a loss of more than 11.5 million jobs in manufacturing, transportation and engineering. This is in addition to the more than 2 million jobs lost in residential construction. The economic impact of homeownership on a national, state, and local scale is broad-based and powerful.

Owning a home also plays a role in providing social stability and financial security. It is a major component of the U.S. economy and significant contributor to the upward mobility of its citizens. The ideal of the American Dream and the goal of homeownership will exist as long as supporting higher educational attainment, economic mobility, and long-term national economic growth remain defining tenets of American policy.”

Odeta Kushi contributed to this blog post.