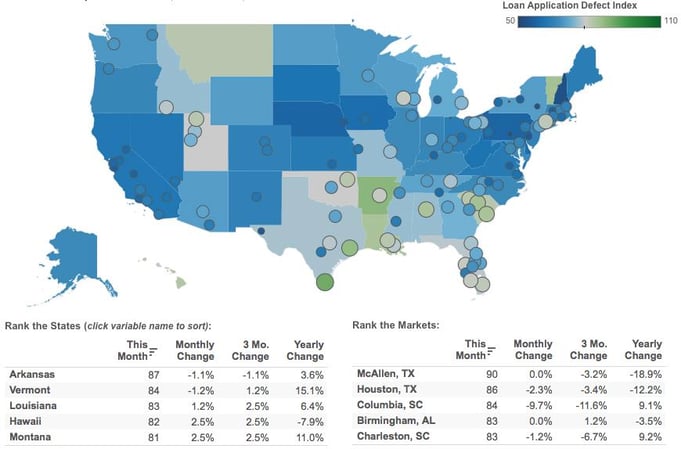

We’ve posted the October First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 1.4 percent in October as compared with September and decreased by 13.9 percent as compared to October 2015. The Defect Index is down 33.3 percent from the high point of risk in October 2013.

“Cotton states in the South are showing the highest levels of risk, compared to the northern rust-belt, where application and defect risk is currently the lowest.”

“Defect, fraud and misrepresentation risk can vary substantially by location. In fact, the most recent data is showing a growing division between the North and South,” said Mark Fleming, chief economist at First American. “Cotton states in the South are showing the highest levels of risk, compared to the northern rust-belt, where application and defect risk is currently the lowest.

“Defect risk is concentrating in the South, particularly in Arkansas and Louisiana, as well as in large markets in Texas and South Carolina,” said Fleming. “Comparatively, markets in the northeast states of New York, Pennsylvania, and Ohio have the least loan application defect and misrepresentation risk.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.