Sales Activity Driven by the Five Ds Amid Persistent Market Headwinds

By

Odeta Kushi on April 10, 2024

Our Existing-Home Sales Outlook Report ‘nowcasts’ existing-home sales based on the historical relationship between sales, demographic trends, house-buying power, and the prevailing financial and economic conditions. Based on our nowcast, we expect March existing-home sales to rise 1.7 percent compared with February, but remain approximately 16 ...

Read More ›

Interest Rates Federal Reserve Mortgage Rates Existing-Home Sales

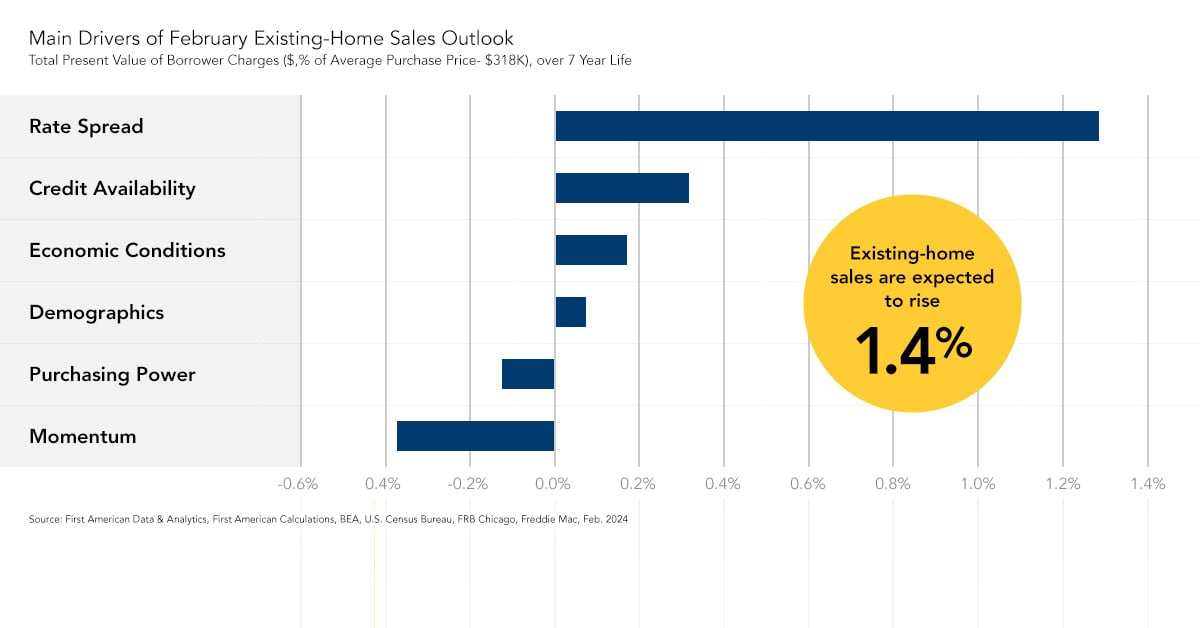

New Existing-Home Sales Outlook Report Projects February Uptick in Sales, Despite Rising Mortgage Rates

By

Mark Fleming on March 13, 2024

On average, nearly 40 percent of all existing-home sales in a year occur during the spring home-buying season between April and June. The warming weather and the end of the academic school year make for a more optimal time to move and fuel the seasonal increase in housing market activity. In the spring of 2023, home sales were lackluster. Housing ...

Read More ›

Interest Rates Federal Reserve Potential Home Sales Mortgage Rates

Will Falling Mortgage Rates Spark an Existing-Home Sales Rush to Close 2023?

By

Mark Fleming on December 18, 2023

In the month of October, existing-home sales hit the lowest level since 2010 as a result of the higher mortgage rate environment. Rising mortgage rates reduce affordability, all else held equal, for buyers and strengthen the rate lock-in effect for potential sellers. However, mortgage rates declined in November, igniting cautious optimism in the ...

Read More ›

The Blight, the Bright, and What Seems Just Right in 2024

By

Mark Fleming on November 21, 2023

The surge in mortgage rates from mid-2022 through 2023 triggered a housing recession, with the most pronounced impact felt in a steep decline in sales, while prices have remained relatively stable. Specifically, existing-home sales plunged to a more than 12-year low in September of this year. Rising mortgage rates have a dual impact on the housing ...

Read More ›