Affordability Crunch Likely Unchanged Through End of the Year

By

Mark Fleming on July 3, 2024

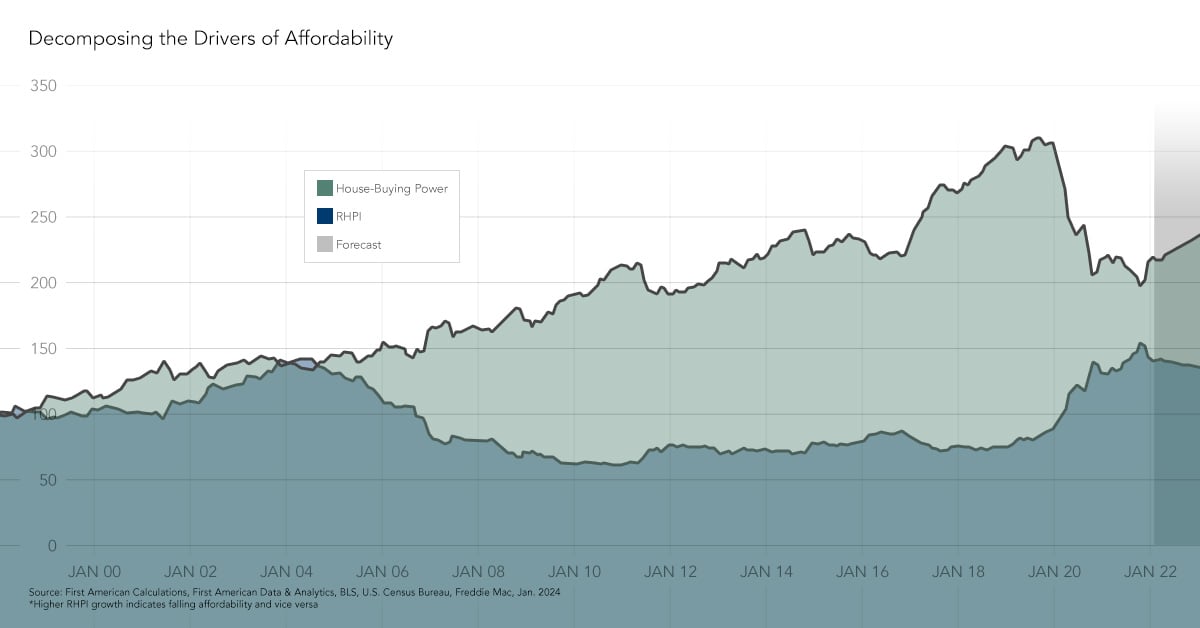

Apart from the fall of 2023, affordability in May reached its lowest level in over three decades. On a year-over-year basis, affordability declined by nearly 9 percent. Two factors drove the sharp annualized drop in affordability – a 5.9 percent annual increase in nominal house prices, according to our First American Data & Analytics House ...

Read More ›

Affordability Challenges Prompt a House Price Slowdown

By

Mark Fleming on May 28, 2024

Mortgage rates continued their spring surge in April 2024, rising to the highest level in five months and helping drag affordability down by 1.5 percent compared with March, according to the Real House Price Index (RHPI). On an annualized basis, affordability decreased by 9 percent. Two factors drove the year-over-year decline in affordability – a ...

Read More ›

An Overvalued Housing Market May Be Returning

By

Mark Fleming on April 29, 2024

In March 2024, mortgage rates increased and affordability fell modestly by 0.1 percent compared with February, according to the Real House Price Index (RHPI). On an annualized basis, affordability decreased by approximately 5 percent. Two factors drove the year-over-year decline in affordability – a 6.2 percent annual increase in nominal house ...

Read More ›

How “Higher for Longer” Impacts the Housing Market

By

Mark Fleming on March 22, 2024

In January 2024, mortgage rates declined and affordability improved by nearly 2 percent compared with December, according to the Real House Price Index (RHPI). However, on an annualized basis, affordability decreased by approximately 7 percent. Two factors drove the sharp annualized drop in affordability – a 7.1 percent annual increase in nominal ...

Read More ›

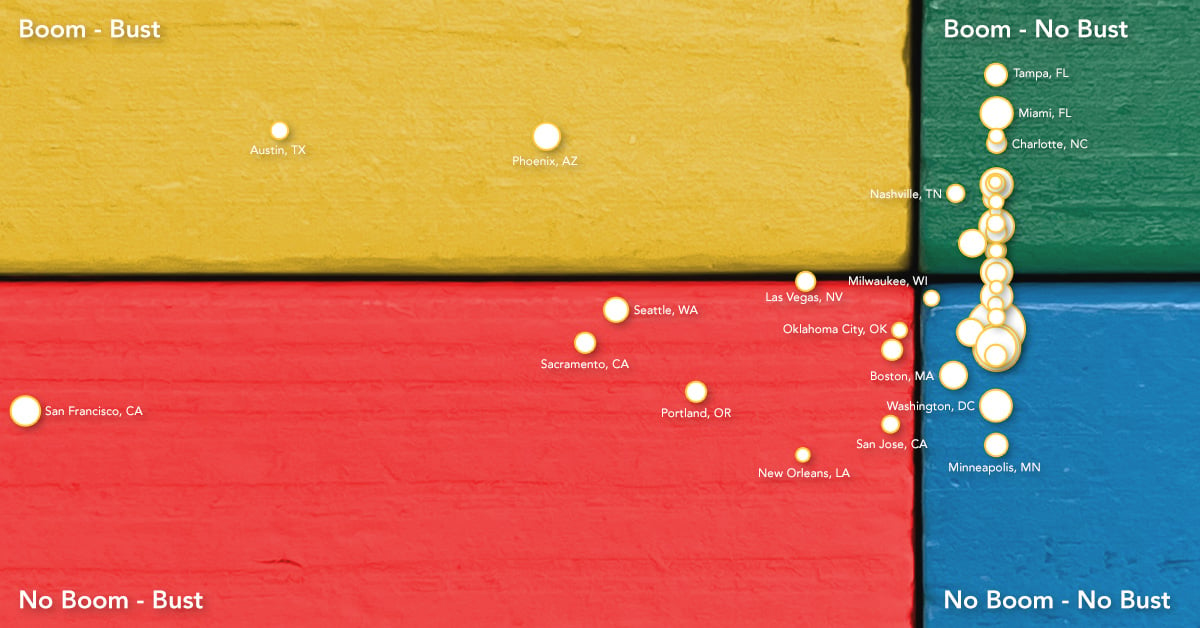

Revisiting Boom-Bust Markets After Recovery in House Price Growth

By

Mark Fleming on February 27, 2024

In December 2023, home buyers received a welcome holiday gift as mortgage rates fell and affordability improved by 6 percent over November, according to the Real House Price Index (RHPI). However, on an annualized basis, affordability decreased by nearly 9 percent. Two factors drove the sharp annualized drop in affordability – a 7.7 percent annual ...

Read More ›

House Prices Reach a New Peak, But Not Everywhere

By

Mark Fleming on January 23, 2024

In November 2023, the Real House Price Index (RHPI) leaped 11 percent on an annual basis. Affordability improved modestly on a monthly basis, as mortgage rates fell from the previous month. Two factors drove the sharp annual decline in affordability – a 7.7 percent annual increase in nominal house prices, according to our First American Data & ...

Read More ›

.jpg)