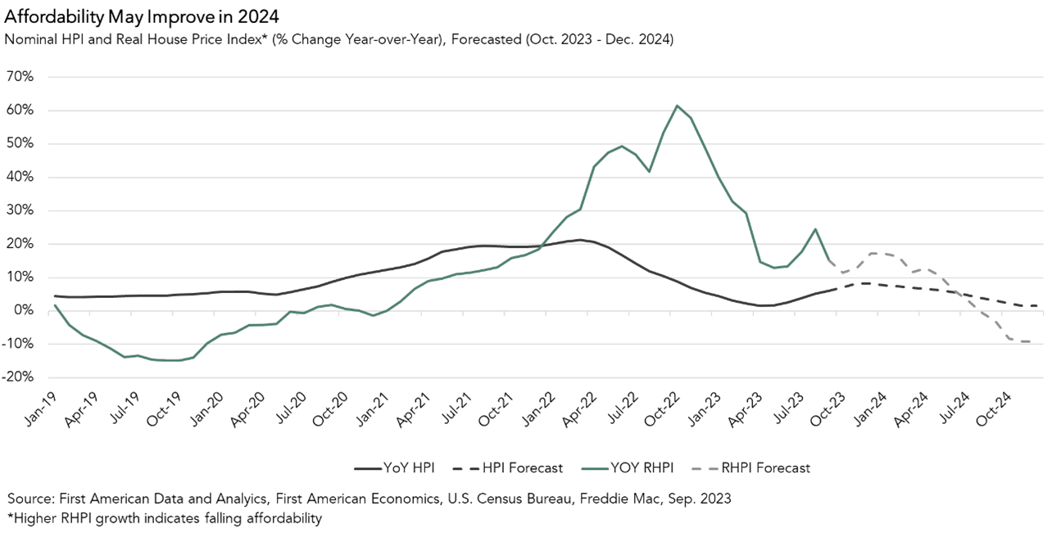

In September 2023, the Real House Price Index (RHPI) jumped up by 15 percent on an annual basis, dragging housing affordability to the lowest point in over three decades. Two factors drove the sharp annual decline in affordability – a 6.2 percent annual increase in nominal house prices, according to our First American Data & Analytics House Price Index, and a 1.1 percentage point increase in the 30-year, fixed mortgage rate compared with one year ago.

For home buyers, holding prices constant, the only way to mitigate the loss of affordability caused by higher mortgage rates is with an equivalent, if not greater, increase in household income. Even though household income increased 3.1 percent since September 2022 and boosted consumer house-buying power, it was not enough to offset the affordability loss from higher rates and rising nominal prices.

Looking ahead to 2024, what will happen to income, interest rates, house prices and affordability?

“In 2024, the housing market will not be pandemic hot, nor monetary-tightening cold, but it may not be quite right either.”

Income Growth Expected to Moderate:

The labor market continued to impress in September, as rising wages resulted in higher household income. Annual hourly wage growth increased by 4.3 percent compared with a year earlier, job growth remained steady, and the unemployment rate stayed low. The rise in wage growth contributed to a 3.1 percent year-over-year increase in median household income. Compared with September 2022, the rise in household income alone increased consumer house-buying power by approximately $11,000. The labor market faces a persistent labor shortage, putting upward pressure on wages, and therefore household income, but that shortage has narrowed from the peak of 2022, and will likely continue to narrow in 2024, which means the pace of wage growth will likely slow.

Mortgage Rates Projected to Retreat from 2023 Peaks:

Mortgage rates increased significantly in September compared to one year ago. The jump from 6.1 percent last September to 7.2 percent this September reduced house-buying power by nearly $38,000, holding income constant at its year-ago level. Combined with the gains from household income, the net effect on house-buying power was a decline of approximately $28,000 compared with September 2022. Average forecasts from the industry project that mortgage rates will end 2024 at approximately 6.6 percent, as inflation is expected to recede and the Federal Reserve is expected to stop its interest rate

hikes, which may boost consumer house-buying power.

Nominal House Prices Likely to Rise:

The housing market continues to suffer from an imbalance between housing supply and demand, which puts upward pressure on prices. As a result, annual nominal house price appreciation will likely continue to remain positive nationally, but return closer to the historical average of 3-to-4 percent, as the housing market adjusts to the reality of higher mortgage rates. The average of different industry forecasts suggests a 3.5 percent annual increase in nominal house price growth by the end of 2024.

Not Too Hot, Not Too Cold, But Not Quite Right

Assuming that mortgage rates fall to 6.6 percent by the end of 2024, as the industry average predicts, household income grows at the pre-pandemic historical average of 2.9 percent due to a narrowing labor supply-demand gap and slowing labor market, and nominal house prices increase by 3.5 percent annually as the industry predicts, then affordability as measured by the RHPI will improve by a little over 5 percent. A more affordable housing market will be welcome news for buyers currently sitting on the sidelines. However, even at this level, affordability will remain more than 40 percent worse than in February 2022, just before the Fed started increasing rates. In 2024, the housing market will not be pandemic hot, nor monetary-tightening cold, but it may not be quite right either.

For more analysis of affordability, please visit the Real House Price Index. The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of December 26, 2023.

Sources:

September 2023 Real House Price Index Highlights

The First American Data & Analytics’ Real House Price Index (RHPI) showed that in September 2023:

- Real house prices increased 1.9 percent between August 2023 and September 2023.

- Real house prices increased 15.2 percent between September 2022 and September 2023.

- Consumer house-buying power, how much one can buy based on changes in income and mortgage rates, decreased 0.9 percent between August 2023 and September 2023, and decreased 7.9 percent year over year.

- Median household income has increased 3.1 percent since September 2022 and 86.4 percent since January 2000.

- Real house prices are 49.0 percent more expensive than in January 2000.

- Unadjusted house prices are now 56.2 percent above the housing boom peak in 2006, while real, house-buying power-adjusted house prices are 4.3 percent above their 2006 housing boom peak.

September 2023 Real House Price State Highlights

- The five states with the greatest year-over-year increase in the RHPI are: Alaska (+31.8 percent), Maine (+23.8 percent), West Virginia (+23.0 percent), Connecticut (+21.5 percent), and Delaware (+21.3 percent),

- There were no states with a year-over-year decrease in the RHPI.

September 2023 Real House Price Local Market Highlights

- Among the Core Based Statistical Areas (CBSAs) tracked by First American Data & Analytics, the five markets with the greatest year-over-year increase in the RHPI are: Boston (+22.5 percent), Cincinnati (+22.3 percent), San Diego (+22.1 percent), Hartford, Conn. (+21.9 percent), and Buffalo, N.Y. (+20.9 percent).

- Among the Core Based Statistical Areas (CBSAs) tracked by First American Data & Analytics, there was one market with a year-over-year decrease in the RHPI: Salt Lake City (-0.6 percent).

Next Release

The next release of the First American Data & Analytics’ Real House Price Index will take place the week of December 26, 2023.

About the First American Data & Analytics’ Real House Price Index

The traditional perspective on house prices is fixated on the actual prices and the changes in those prices, which overlooks what matters to potential buyers - their purchasing power, or how much they can afford to buy. First American Data & Analytics’ proprietary Real House Price Index (RHPI) adjusts prices for purchasing power by considering how income levels and interest rates influence the amount one can borrow.

The RHPI uses a weighted repeat-sales house price index that measures the price movements of single-family residential properties by time and across geographies, adjusted for the influence of income and interest rate changes on consumer house-buying power. The index is set to equal 100 in January 2000. Changing incomes and interest rates either increase or decrease consumer house-buying power. When incomes rise and mortgage rates fall, consumer house-buying power increases, acting as a deflator of increases in the house price level. For example, if the house price index increases by three percent, but the combination of rising incomes and falling mortgage rates increase consumer buying power over the same period by two percent, then the Real House Price index only increases by 1 percent. The Real House Price Index reflects changes in house prices, but also accounts for changes in consumer house-buying power.

Opinions, estimates, forecasts and other views contained in this page are those of First American’s Chief Economist, do not necessarily represent the views of First American or its management, should not be construed as indicating First American’s business prospects or expected results, and are subject to change without notice. Although the First American Economics team attempts to provide reliable, useful information, it does not guarantee that the information is accurate, current or suitable for any particular purpose. © 2023 by First American. Information from this page may be used with proper attribution.