Quoted on Forbes.com: Rising Rates Can Increase Housing Demand

By

FirstAm Editor on June 7, 2018

First American Chief Economist Mark Fleming was quoted Tuesday in a feature article on Forbes.com, explaining how rising rates can increase housing demand.

Read More ›

Housing In The News Interest Rates Millennials Affordability

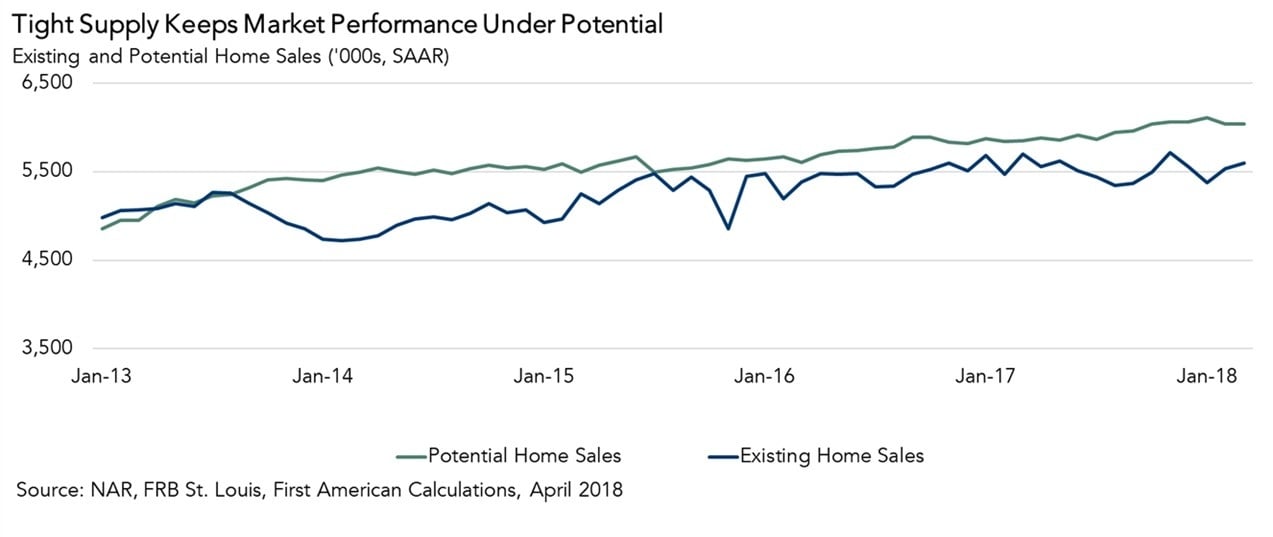

The Surprising Impact of Rising Rates on Market Potential

By

Mark Fleming on May 23, 2018

In April, the housing market continued to underperform its potential. Existing-home sales were 6.5 percent below the market’s potential for existing-home sales, according to our Potential Home Sales Model. Lack of supply remains the primary culprit. The inventory of homes for sale in most markets remains historically low, yet demand continues to ...

Read More ›

Interview on CNBC: Explaining the Link Between Rising Rates, Housing Supply and Affordability

By

FirstAm Editor on May 18, 2018

First American Chief Economist Mark Fleming was interviewed yesterday on CNBC and explained the link between rising rates, housing supply and affordability.

Read More ›

Housing In The News Interest Rates Millennials Affordability

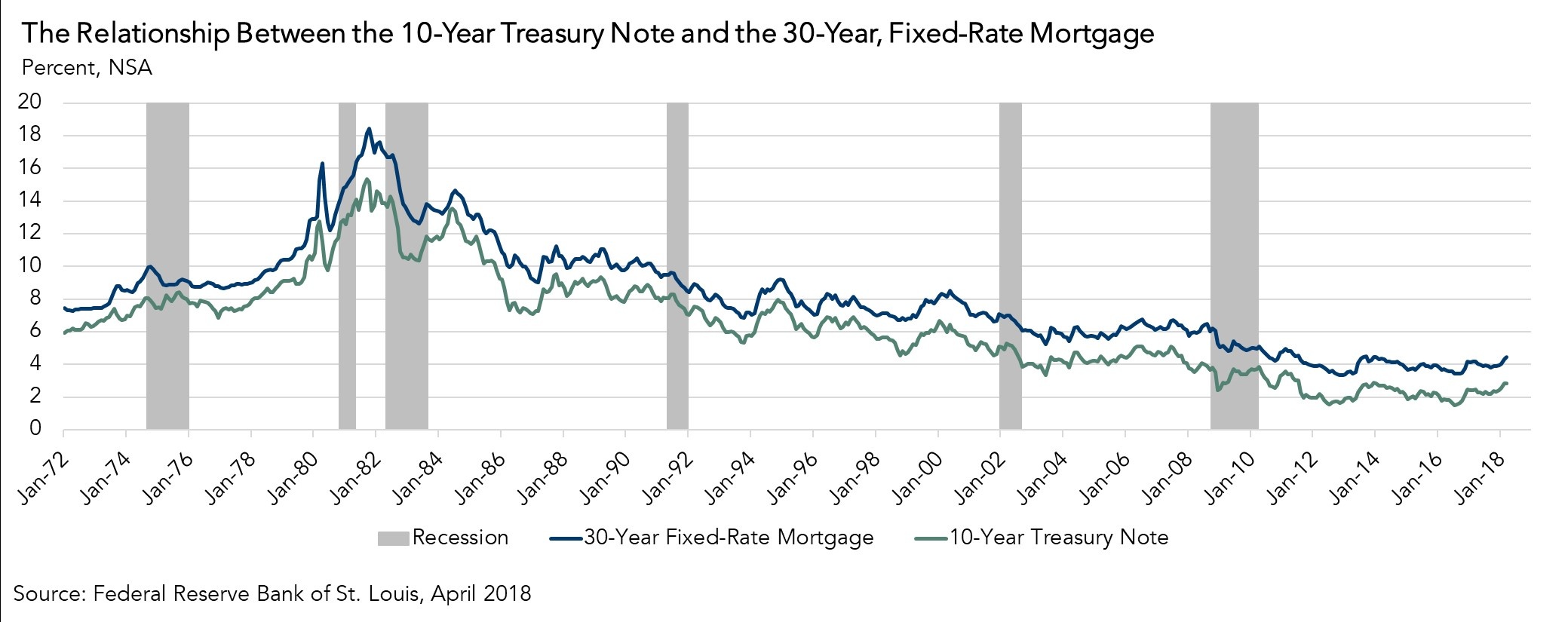

What Does the Change in the 10-Year Treasury Note Mean for Housing Affordability

By

Mark Fleming on May 7, 2018

At the May Federal Reserve (Fed) meeting last week, all eyes were on the 10-year Treasury yield. In late April, that yield topped 3 percent for the first time in more than four years. With yields on the rise, housing market participants expect this to mean higher interest rates from central banks. It’s often overlooked that the popular 30-year, ...

Read More ›

Housing Interest Rates Real House Price Index Federal Reserve Affordability

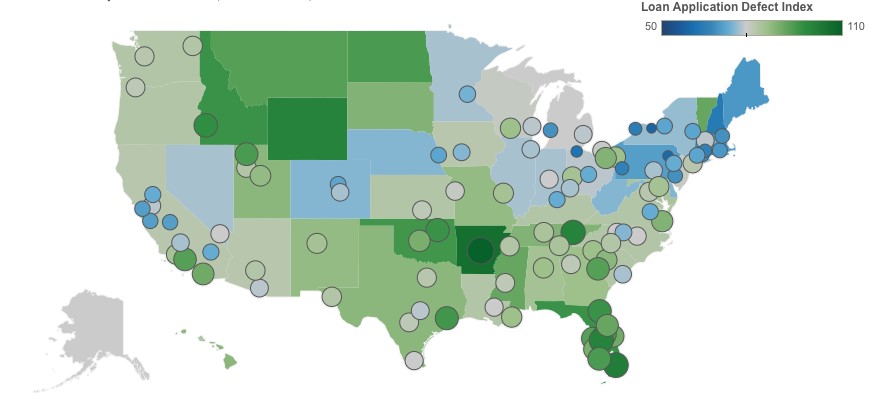

What Drives Loan Application Defect Risk at the Local Level?

By

Mark Fleming on April 27, 2018

A common adage about real estate is that it’s local. The dynamics of one housing market can be very different from another depending on the local economy and access to natural amenities, like mountains or water. The levels of loan application defect, fraud and misrepresentation risk vary greatly based on local conditions as well. In fact, ...

Read More ›

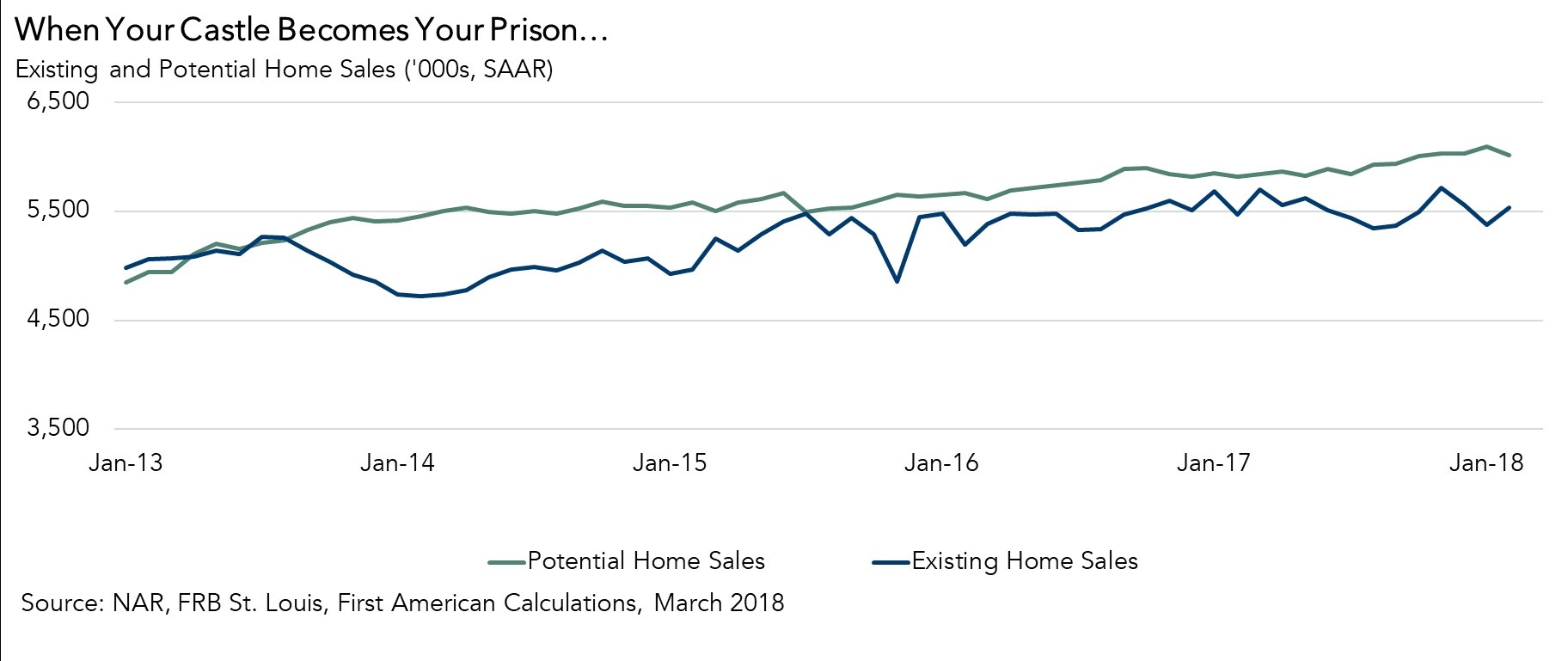

The Market Dynamics Fueling the Great Housing Shortage

By

Mark Fleming on April 20, 2018

In March, the housing market continued to underperform its potential. Actual existing home sales are 4.5 percent below the market potential for home sales, according to our Potential Home Sales model. The lack of supply is the primary culprit. The inventory of homes for sale in most markets remains historically tight, yet demand continues to rise ...

Read More ›